Accurately verifying a prospective tenant’s income and employment is an important step for property owners, property managers, and the tenant screening services they rely on.

In the property rental market, verifying an applicant’s income and employment is a critical part of the tenant application process.

Among other benefits, it’s a reliable way for rental property owners and managers to prevent application fraud and ensure prospective renters can actually keep up with the monthly rent.

Below, we dive into how tenant income and employment verifications work, how they help screeners calculate more accurate rent-to-income ratios and make smarter business decisions, and how emerging property management technologies are making them easier than ever to carry out.

What is tenant income verification?

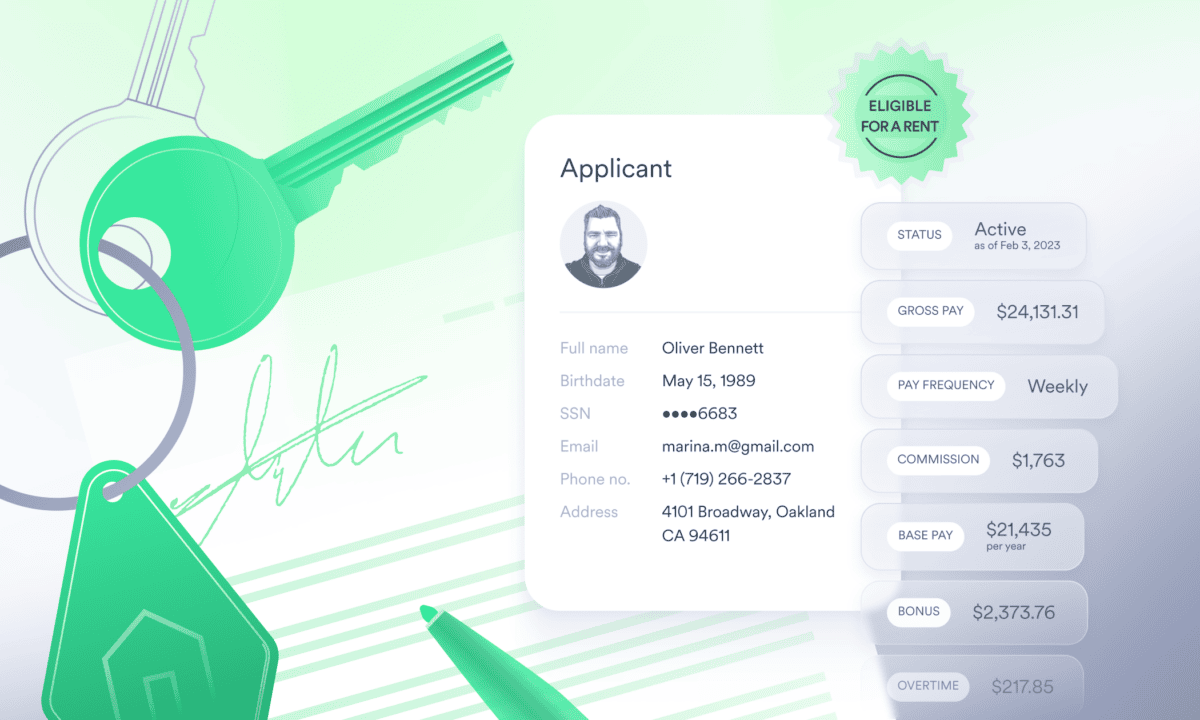

Tenant income verification is the process of confirming that the income and employment information a potential tenant has entered on their rental application is accurate and up to date. This is typically carried out by the property owner or manager or by a tenant screening service they have contracted to help them complete tenant background checks.

Income verifications can take a number of different forms. Property managers might look at an applicant’s bank statements, tax forms, or even testimonials from previous landlords to paint a basic picture of their financial health and general earnings.

In ideal cases, they can use innovative technologies to connect directly to a tenant’s payroll account and pull comprehensive income and employment data straight from the system of record.

Why are tenant income verifications important?

At the most fundamental level, income and employment verifications protect property owners and managers against financial and legal risk—but they also offer protections for tenants themselves.

Benefits for property owners and managers

Unlike other financial screening methods like credit checks—which only surface an applicant’s credit report and show how they’ve accumulated and repaid debt over time—income verifications can disclose how much money they are currently earning on a regular basis.

That makes income verifications a much better indicator of what an applicant can actively afford and how likely they are to be able to submit rent payments on time.

This offers several immediate advantages for property owners and managers:

- Stronger fraud prevention

Property managers can also use income verifications to protect against cases of application fraud, which are growing more common year over year.

With rapid advances in generative artificial intelligence (GenAI), it’s becoming easier than ever for applicants to misrepresent their income and falsify their financial documents in a highly convincing way—including fake paystubs, bank statements, and employment letters.

According to the NMHC survey above, a vast majority of property owners, managers, and developers (93%) encountered at least one attempt at application fraud in 2023 alone.

Letting fraud go unchecked doesn’t just damage a property manager’s reputation and potentially land them in legal hot water; it can also impact a property owner’s bottom line. Applicants who misrepresent their income are also far more likely to end up in nonpayment and eviction, leading to millions of dollars in lost rental revenue.

Verifying that an applicant’s self-reported income matches their records means property managers can thwart these deceptive practices before they become a problem.

- Reduced risk of nonpayment

By properly vetting applicants’ income and employment, property managers can ensure they’re only approving financially stable tenants. That means they’ll see fewer instances of delayed or missing rent payments and a lower overall volume of bad debt.

This is an urgent need. According to a recent survey from the National Multifamily Housing Council (NMHC), rates of nonpayment have increased to crisis levels and are continuing to rise.

In fact, the NMHC survey revealed that property owners, managers, and developers were forced to write off an average of nearly $4.2 million in bad debt in the last year alone.

- Fewer evictions

Cases of ongoing nonpayment often lead to pricey and time-consuming evictions.

Between legal fees, property turnover costs, and lost income opportunities due to empty units, evictions can easily cost property owners thousands of dollars for each ousted tenant, putting a big dent in their revenue.

Eviction processes can also drag on for several months, eating up time that could be spent on more profitable business initiatives.

Ensuring approved tenants can keep up with rent payments through effective income verifications means property owners and managers can avoid these significant hassles and expenses.

- More responsible tenants

If tenants know their income and employment information will be verified, they have more incentive to be open and upfront about their finances, leading to more honest and transparent transactions.

Tenants with reliably stable finances are also more likely to properly maintain their home, leading to fewer instances of intentional and unintentional property damage.

- Smooth rental application processes

Verifying a prospective tenant’s income early in the application process means property owners can quickly and accurately assess an applicant’s ability to pay rent and make smarter, faster decisions.

Ultimately, they can spend less time vetting unqualified applicants and more time on the high-impact business projects they care about.

Benefits for tenants

Income verifications don’t just help property owners. They also give tenants a chance to start a rental relationship off on the right foot and establish a strong financial trajectory that sets them up for success.

Among other benefits, income verifications can help tenants:

- Demonstrate financial stability

Income verifications help prove to property owners and managers that a tenant is fiscally responsible and able to keep up with their financial obligations, building a more solid and trustful housing relationship—and potentially earning tenants some good will if there are any hiccups down the line.

- Increase chances of housing approval

Offering up hard evidence of sufficient income means property managers can more easily approve a tenant’s rental application and allow them to move into their new housing faster.

- Avoid unaffordable situations

It’s not just in property managers’ best interest to ensure a tenant can pay their rent on time and in full. Tenants themselves should also prioritize making smart, affordable housing choices—so they don’t find themselves over their heads financially, facing eviction and racking up bad debt that can damage their reputation, lifestyle, or credit score.

- Build a positive rental history

Finally, a history of bad rental relationships and evictions can put a tenant in a bad place when it comes to securing the housing they need. Conversely, a history of happy landlords and accurate, on-time payments—backed by effective income verifications—put them in the best possible position to win glowing testimonials and future approvals.

In short, proper income verifications help remove risk and worry from the rental application process, so both property managers and tenants can move with confidence.

How to verify tenant income and employment

There are a number of different methods that can be used to verify tenant income and employment, each with its own relative strengths and drawbacks. But a few common tasks are almost always involved.

Collecting proof of income documents

Generally, prospective tenants must show proof of income by providing property management with income verification documents.

This typically includes evidence of:

- Regular or steady income, like a recent paystub

- Total annual income, like a W-2 form, the previous year’s tax return from the IRS, or other tax documents

- Active employment status, like an employment verification letter, employment offer letter, or other statement from an applicant’s employer

- Benefits earnings, like a Social Security benefits statement, unemployment statement, or workers’ compensation letter

- Other sources of income, like court-ordered payments from alimony or child support

These documents can either be submitted in physical form or scanned and sent as digital files. In either case, the income and employment information they contain then needs to be extracted and entered into whatever system is being used to capture tenant data, like an internal form or spreadsheet.

Alternatively, if a property manager or tenant screening service is using advanced technology to automate income and employment verifications, these documents can be generated in real time with the direct-source data from the applicant’s payroll system. More on that below.

Calculating rent-to-income ratio

A rent-to-income ratio (or RTI ratio) measures how much of a renter’s income would be spent on specified rent payments. Property owners and managers use RTI ratios to determine whether a prospective tenant can afford the cost of their monthly rent.

A tenant’s RTI ratio is calculated by dividing the monthly cost of their desired rental property by their gross monthly income and working the result into a percentage. The higher the percentage, the less disposable income a tenant will have for other life expenses after paying their rent.

Conventional guidelines suggest that a prospective tenant’s RTI ratio should remain under 30% for a rental to work, but higher numbers may be expected in areas with a steeper cost of living like New York City and San Francisco.

Confirming income and employment details

If applicants submit their own proof of income documents, screeners will want to check the data they contain for accuracy and to guard against document fraud.

They can either do this themselves, by contacting an applicant’s source(s) of income, or by partnering with verification solutions—like direct payroll connections—that can pull pre-verified income and employment data fields directly from the system of record.

Manual versus automated verification processes

The verification tasks above can either be carried out via traditional means—that is, manually by a property manager’s in-house team—or automated through a third-party digital platform.

Predictably, automated verification processes tend to be more efficient, cost-effective, and accurate, while also optimizing the application experience on both sides. Let’s dive deeper into the comparison.

Pain points of manual verifications

With manual verification processes, properties must ask applicants to submit their own documents, process their income and employment data by hand, contact employers or other parties to corroborate the details, and then follow up to correct any mistakes or oversights.

Those painstaking steps can introduce several significant issues, including:

- Inefficiencies and delays that can last for days, weeks, or months, depending on how long it takes for applicants and their employers to provide answers

- Elevated costs as labor expenses and operational resources pile up and rental properties remain empty

- Incomplete or inaccurate data as human errors occur and important data points are potentially incorrect or missing

- Heightened risk of fraud as convincing, GenAI-altered documents go unspotted by human eyes and easily slip through the cracks

- Limited insights into applicants’ finances, leading to flawed business decisions

- A poor applicant experience due to a friction-filled, time-consuming application process and slow housing decisions

Advantages of automated verifications

Automated verification solutions can resolve many of these obstacles by guaranteeing accuracy, speeding up application decisions, and allowing property managers to fill vacancies quickly and confidently.

Luckily, various tech-powered platforms have developed in recent years to make end-to-end automation possible. They do this by connecting screeners directly to the systems that tenants use to manage their finances, so they can instantly access up-to-date, verified data.

Among other benefits, this leads to:

- Efficient workflows that pull financial data in real-time, so property managers can make faster decisions and spend less time on manual paperwork

- High-quality, accurate data that comes straight from the source, meaning it’s an exact, one-to-one representation of what’s in an applicant’s financial records

- Mitigated risk since data flows along an uninterrupted pipeline, blocking opportunities for human error or fraud

- Seamless experiences since prospective renters aren’t asked to track down and send their own financial documents

Common tenant income verification challenges

Aside from the inefficiencies, costs, and risks of manual processes, tenant income verifications can present a number of unique challenges if not conducted effectively.

Some of these challenges include:

- Accounting for alternative sources of income that don’t come from traditional, full-time employment and aren’t typically reported on a standard W-2. This could include wages from freelancing, self-employment, or the gig economy that don’t follow a regular pattern.

- Accessing income and employment details beyond the basics, including work hours and shift-level data that can show whether an applicant is regularly and consistently working

- Handling and storing sensitive data in a safe and responsible way, especially with regard to applicants’ personal finances and income and employment information

- Navigating complex compliance requirements around consumer data privacy standards, security protocols, fair housing laws, and tenant rights. This becomes especially difficult given the rapidly evolving regulatory landscape of the real estate and housing industries.

The good news is that many of these challenges can be easily overcome by applying the right technology and working with the right data sources.

Leveraging property management technology

Today, many property owners and managers leverage innovative property management technology (or proptech) to transform every aspect of running a rental property—from digitizing rent collection and tenant communications to scheduling maintenance requests and optimizing energy usage from smart thermostats and lighting systems.

Among the most important players in the proptech ecosystem are tenant screening services—especially ones that offer fully automated income and employment verifications.

Not only can these services streamline verification flows, they can also deliver exceptionally detailed datasets and bake essential processes like regulatory compliance into every workflow. And they are only growing stronger as tools like GenAI, machine learning models, and predictive analytics continue to progress.

Comparing data sources

While tech-forward screening services and automated verification flows offer definite advantages, not all of these solutions are created equal. How effective a solution is largely depends on the source and quality of its data.

For example, some tenant screening services turn to open banking solutions, which allow them to connect to an applicant’s bank account and get an instant, automated view of their cash flow, deposit patterns, and spending behaviors.

These strengths aside, banking data has some critical gaps when it comes to verifying a tenant’s income and employment.

For one thing, it only shows past income that has already been deposited; it has no way of showing whether an applicant is currently employed, whether they’re currently earning income, or whether that income is being routed to any other destinations or accounts. Moreover, banking data doesn’t offer any access to proof of income documents like paystubs and W-2s, which still need to be collected from the applicants themselves.

For those reasons, connections to the original source of an applicant’s income and employment data—their employer or payroll provider account—offer a much stronger approach.

The gold standard: direct payroll connections

Direct payroll connections link a tenant’s employer or payroll provider account, so properties can tap into accurate, up-to-date income and employer data in real time.

This not only gives them access to an applicant’s current and ongoing employment activity, it equips them with a holistic view of their gross income, including granular details like bonus and commission amounts, tax withholdings, pay distribution settings, and the total number of shifts and hours worked. The best platforms also offer instant access to proof of income documents like paystubs and W-2s.

As with any technology, it’s important to pick the right data provider when implementing direct payroll connections for tenant screenings.

Argyle’s industry-leading Income & Employment Verification solution sets a high bar for comparison. Among other values, Argyle offers:

- Automated, ongoing access to an applicant’s income and employment data, with verifications returned in a matter of seconds

- Access to continually refreshed proof of income documents and tax forms like paystubs and W-2s

- Coverage of over 90% of the U.S. workforce, including hard-to-reach groups like gig workers, freelancers, and self-employed individuals and frequently unreported income sources like unemployment benefits and social security income

- 170+ data fields, including gross income details and comprehensive employment reports, presented in a standardized format with a 95%+ completeness rate

- The highest-converting data network on the market, yielding an average conversion rate over 55%

- Fully consumer-permissioned data sharing carried out with applicants’ explicit, fully informed consent

- A smooth, two-step connection process. Applicants simply select their employer or payroll provider from Argyle’s data network and log in with the same credentials they use any time they review their paychecks.

They can also choose to manually upload their documents and have them automatically scanned and processed through Ocrolus’s optical character recognition (OCR)

The bottom line? Direct payroll connections are undoubtedly the soundest option for screeners looking to optimize their tenant income and employment verifications. And within that innovative market, Argyle offers the highest-quality, top-performing data solution that gets results.

Summing up

Tenant income and employment verifications are an essential step for property owners, property managers, and tenant screening services looking to optimize their operations.

By following a few best practices—like working with top tech partners, leaning on direct-source income and employment data, and automating the entire verification process through real-time payroll connections—screeners can feel confident they’re leveraging the best possible insights and making the best possible decisions for their business and for their tenants.

Turn tenant incomes into business outcomes

Want to learn more about the value of direct-source income and employment data?

Reach out to Argyle’s team to schedule a call, or register for a free account to explore our fully automated Income & Employment Verification solution first-hand.