You’re building solutions that serve gig workers. But getting the data you need from gig platforms to power your products is either draining your team’s bandwidth or proving impossible.

Trusted by

problem

The challenges you’re facing

Earnings fluctuate due to variable work availability and hours, making income verification difficult.

In the absence of standard paystubs, gig workers have 1099s that reflect annual earnings but lack real-time, granular data.

Gig workers often have multiple income streams from various platforms, each with different reporting standards.

BENEFIT

The Argyle solution

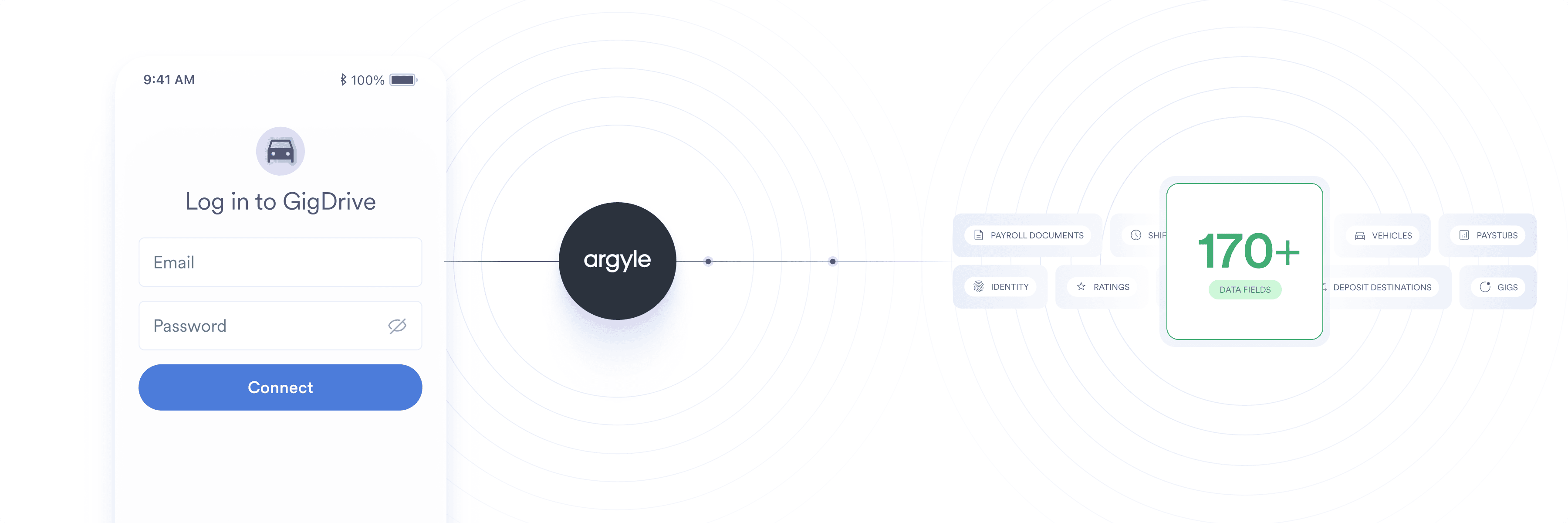

Argyle provides direct connections to dozens of gig platforms, giving you granular, permissioned access to gig workers’ shift-level income and employment data, so you can build amazing experiences.

Eliminate the need for uploads, manual data inputs, and reviews.

Confirm gig workers’ identity, employment history, and earnings in seconds.

Gain visibility into past and present rideshare and delivery activity.

Know if and when a vehicle is being used for commercial or personal reasons.

Catch the cash flow data other providers miss.

Fast-track your roadmap

When gig workers connect your application directly to their gig platform accounts via Argyle, it unlocks a critical dataset that makes a range of use cases possible.

KEY FEATURES

Why product and engineering teams building gig solutions love Argyle

Gig platforms

Data fields

Data on demand

why Argyle

Find out why product and engineering teams trust Argyle to power their platforms

Broader coverage

Higher conversion rate

Better quality

Blog

Learn more about Argyle

Ready to see what Argyle can do for you?

Get in touch to learn more about our verification solutions for the mortgage, personal lending, background check, and tenant screening industries, and more.

Contact sales