New data reveals a continued reliance on manual checks despite the operational and CX benefits of automated verification platforms.

Thanks to rapid technological developments, the mortgage lending process has improved significantly in recent years. Automated verification of income and employment (VOIE) tools are now more advanced, widely available, and easier to implement.

Yet, something surprising is happening: manual verifications are increasing.

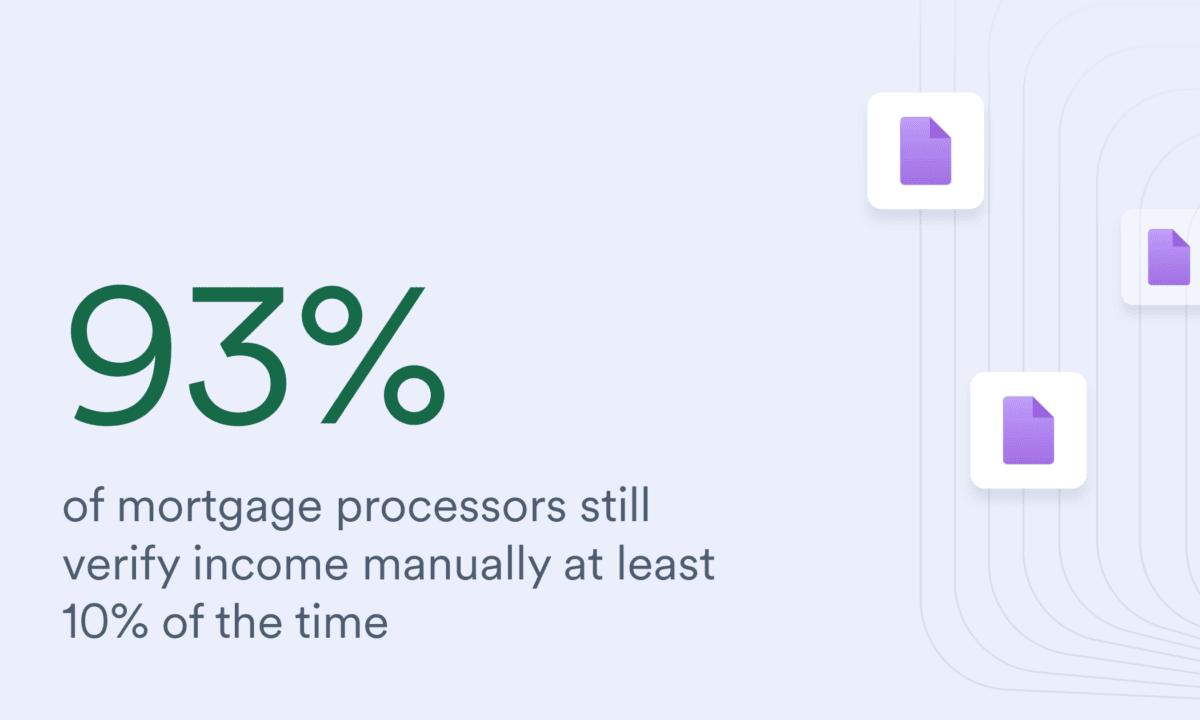

According to our report, The State of Income & Employment Verifications 2025, 93% of mortgage processors still verify income manually at least 10% of the time. Meanwhile, more than one-third of processors report a growing dependence on manual methods.

Why is this happening, and what does it mean for lenders?

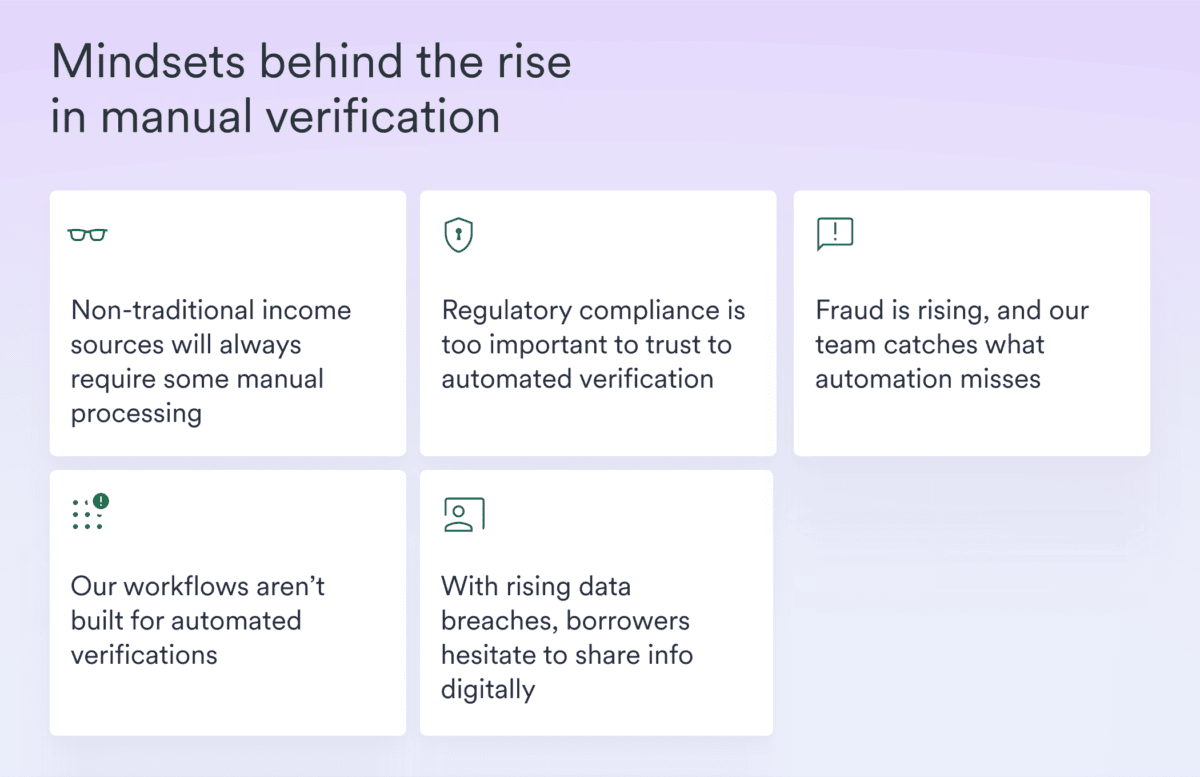

Below, we unpack five lingering mindsets behind this rise in manual verification and share how forward-looking lenders can address them.

1. “Non-traditional income sources will always require some manual processing.”

What’s happening: The makeup of the U.S. workforce is quickly evolving, creating verification challenges for traditional systems. Many borrowers now have mixed income sources, combining W-2 income with gig work, consulting, or other non-traditional earnings. This creates verification complexity even for those with traditional primary employment.

Why it matters: When legacy tools and traditional verification databases can’t accommodate a particular verification need, loan processors turn to manual document collection. This slows approvals or leads to application abandonment or rejection because the process doesn’t fit their employment type.

The better way: Argyle covers 90% of the U.S. workforce through direct-source payroll connections to not only 96% of the Fortune 1000 but also nontraditional income sources like gig platforms and government payroll and benefits systems. This ensures even borrowers with complex income situations can be verified without manual processing. In edge cases where direct connection is unavailable, our Doc Processing fallback option allows OCR-based document upload, digitizing files for automated analysis, and further reducing the need for manual verification.

Digging deeper: Today, a growing percentage of the workforce relies on non-traditional employment types. Verification systems must evolve so these workers don’t fall through the cracks. Expanded coverage capabilities not only benefit edge cases, they also offer a more inclusive approach to lending, empowering loan processors to approve a broader range of qualified applicants.

Want to better understand the current landscape of income and employment verifications and what it means for your lending process? Get the full report for insights, challenges, and actionable solutions. Download your free report.

2. “Regulatory compliance is too important to trust to automated verification.”

What’s happening: Many lenders, facing increased scrutiny from regulators and investors, turn to manual processes out of an abundance of caution, erring on the side of caution to reduce perceived risk.

Why it matters: Manual reviews are time-consuming and complex to audit. They may feel safer and more accurate, but can increase risk through inconsistency and human error. Plus, manual steps introduce friction that leads to mortgage application abandonment.

The better way: Today’s automated verification platforms are built with compliance in mind. Argyle, for instance, delivers reports that meet Fannie Mae’s Day 1 Certainty® and Freddie Mac’s AIM program requirements. That means lenders can get relief from representations and warranties and reduce their loan buyback risk without the paperwork or delays of manual verifications.

A smarter approach to risk: Regulatory pressure doesn’t have to mean more manual work. Digital tools offer clearer audit trails, more consistent and standardized workflows, and faster issue resolution than paper-based processes. Lenders can meet their oversight obligations with approved platforms and streamline the borrower experience.

3. “Fraud is rising, and we trust our processing team to catch things automated verifications might miss.”

What’s happening: CoreLogic’s Mortgage Application Fraud Risk Index rose 8.3% in 2024, underscoring how real and rising the threat has become. And fraudsters are becoming more advanced. AI-generated paystubs and carefully edited PDFs are common, leading many lenders to resort to manual scrutiny. But the truth is, human reviewers aren’t equipped to spot most income document fraud.

Why it matters: Even experienced loan processors miss the majority of fraud indicators. Studies show that over 90% of document fraud can slip past a manual review. The financial consequences are high. Every $1 lost to fraud costs mortgage lenders $4.20.

The better way: The best income and employment verification platforms, including Argyle, connect directly to payroll and income sources, making it nearly impossible to falsify income information. With the help of automated VOIE platforms, mortgage processors can remove fraud risk before it enters the system.

Outcome-based approach: Lenders often underestimate the time and money spent on fraud remediation. Preventing fraud from the outset—rather than addressing it retroactively—yields significant ROI and peace of mind.

4. “Our workflows aren’t built for automated verifications.”

What’s happening: Many lenders rely on legacy tech stacks incompatible with modern automation tools. Instead of reconfiguring their systems, they stick with manual processing.

Why it matters: Loan origination costs have skyrocketed, increasing 35% over the past few years. Resistance to integration delays automation, which means missed opportunities for faster processes and lower costs. Also, consumers rank a lender’s reputation for customer experience as the top factor in their selection process. Falling behind on automation can turn a streamlined mortgage application into a frustrating, time-consuming one.

The better way: The best VOIE platforms offer flexibility, so lenders can automate where it matters most and expand as needed. Argyle’s multiple integration options include connection via top LOS and POS systems. With Argyle’s POS/LOS interoperability, lenders can pass VOIE reports and documentation seamlessly between platforms, streamlining workflows and reducing manual effort.

Ease of adoption: With prebuilt integrations and dedicated onboarding support, automated verification platforms are built to work within existing environments, not against them.

5. “As data breaches become more common, borrowers are hesitant to share personal information digitally.”

What’s happening: Some borrowers resist sharing sensitive payroll or financial data through unfamiliar digital platforms. When applicants decline to connect directly to payroll systems, processors revert to manual verifications.

Why it matters: While this may sound like a technology issue, it’s actually a trust issue. If borrowers aren’t comfortable with the process, they’re less likely to opt into automation.

The better way: Through our consumer-facing interface, Argyle Link, borrowers encounter clear consent flows and privacy assurances that help build trust. Verification with Argyle Link is often embedded directly into the application experience, creating a seamless and secure process. We further enforce that trust with Argyle Passport—a command center for all of a borrower’s payroll connections—so they can be confident in their long-term control over their data.

Turning friction into trust: Borrowers are more likely to use automated verification when the request comes from a trusted lender brand and includes transparency around how their data is used. Providing a secure, branded experience and communicating how it helps speed up their loan makes all the difference.

From Rising Manual Rates Comes Opportunity

Rising manual verifications may seem to represent a step backward, but they signal that outdated systems, limited coverage, and borrower hesitation remain barriers to full-scale automation. They also signal an opportunity for change.

Lenders who embrace direct-source verification enjoy more than speed. They gain better borrower experiences, stronger fraud defenses, and clearer paths to compliance. The tools exist. The demand is apparent. Lenders should take action now to achieve faster closings, lower costs, and more confident lending decisions at every stage.

For a closer look at what’s driving the shift to manual verification and how mortgage lenders can confidently move forward with automated verification, read Argyle’s State of Income & Employment Verifications 2025.