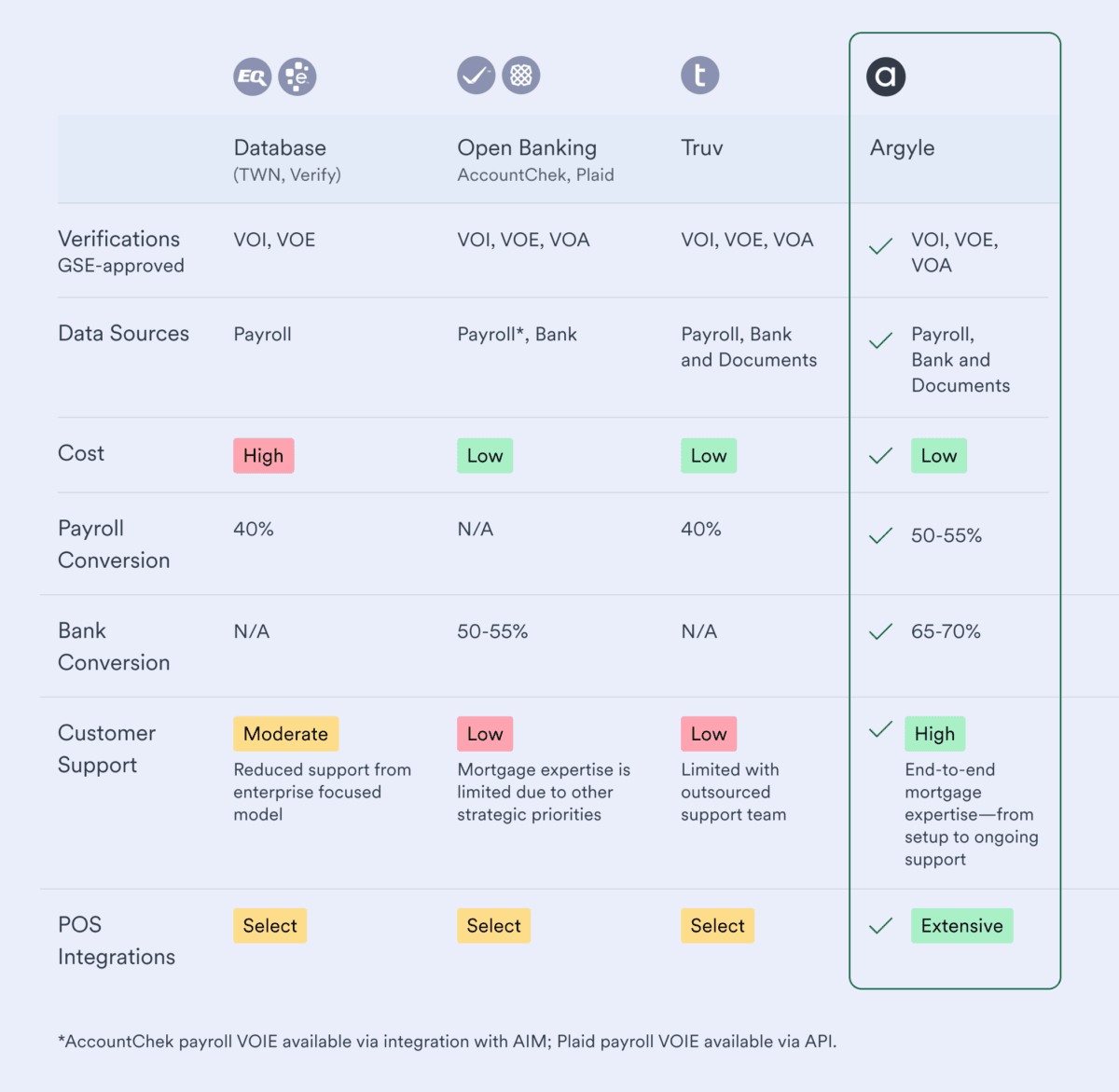

How Argyle stacks up against other verification providers on the market

In today’s high-stakes mortgage environment, verification of income, employment, and assets has never been more essential. Mortgage lenders are under increasing pressure to move faster, reduce costs, and take more steps to mitigate fraud, all while providing borrowers with a frictionless experience. That means navigating a crowded market and picking the right partner to handle critical verification processes.

The right verification solution can dramatically accelerate close times, reduce fallout, lower operational costs, and increase conversion rates. The wrong one creates bottlenecks, drains hours and budgets, and introduces unnecessary risk.

At Argyle, we hear from hundreds of mortgage lenders who are rethinking their verification workflows and reevaluating their tech stacks. And one question comes up time and again: How does Argyle compare to other providers on the market like The Work Number (TWN), Experian Verify, AccountChek, Plaid, and Truv?

This post offers a definitive answer.

A crowded and fractured field

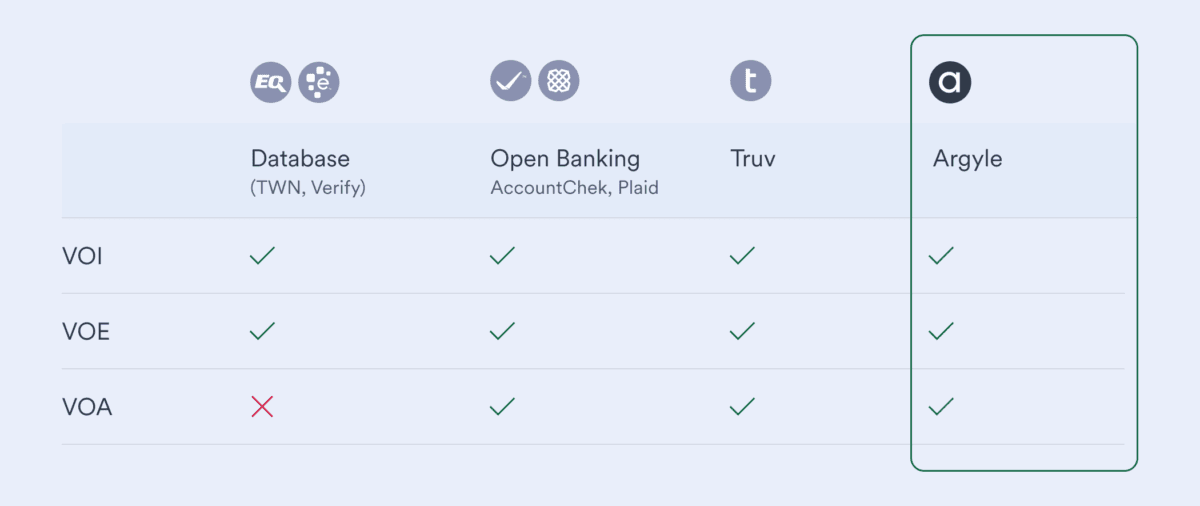

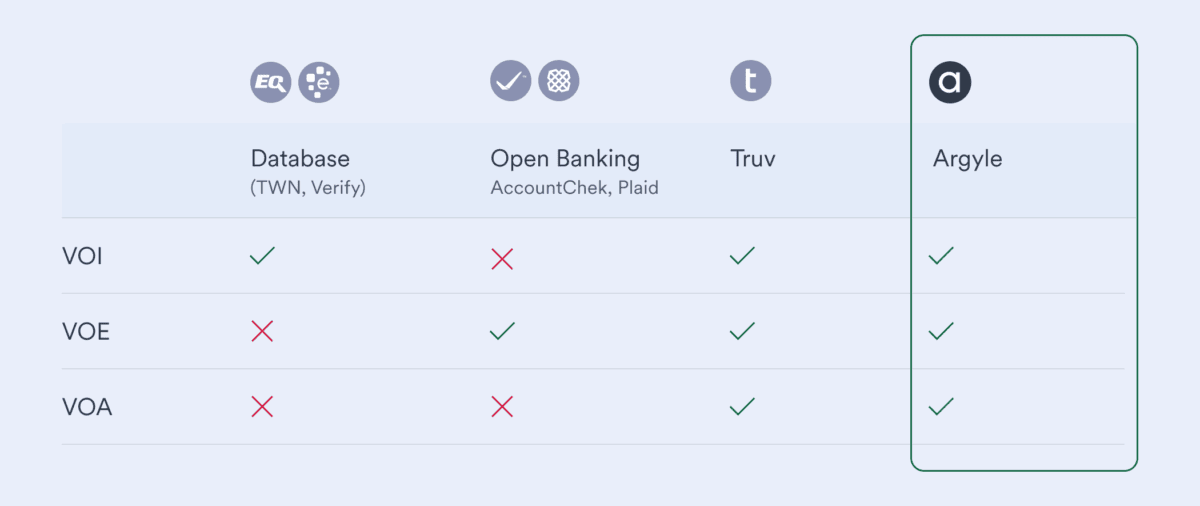

Many mortgage lenders still rely on a patchwork of different vendors and systems to cover verifications of income (VOI), employment (VOE), and assets (VOA), along with document uploads. The result is a fragmented verification waterfall, disjointed workflows, inflated costs, and a lack of centralized customer support.

The truth is, few verification platforms were designed to do it all. Most focus on or excel at only a particular piece of the verification puzzle:

- Database solutions like The Work Number (TWN) from Equifax and Experian Verify use static, employer-reported records to provide VOI and VOE, but not VOA, limiting their overall breadth and utility.

- Open banking solutions like AccountChek and Plaid connect directly to consumers’ bank accounts—and, while they cover the full range of VOI, VOE, and VOA, they aren’t able to access complete payroll details or accurately authenticate documents.

- Payroll data aggregators like Truv are newer entrants that combine different data sources but often fall short on execution, offering fewer integrations and lower conversion rates for mortgage-specific workflows.

By contrast, Argyle offers a single, comprehensive platform that supports every major verification type, including VOI, VOE, VOA, and any combination of the three. It’s a unified approach that isn’t just more elegant, but also more effective.

To explain why, let’s take a closer look at how Argyle measures up against each verification provider and approach across the categories that matter most in mortgage.

Data sources

Mortgage lenders need to be able to verify a range of information as they assess a borrower’s financial health, from income histories and direct deposits to tax statements. That’s why Argyle built its verification waterfall to pull from a full range of data sources:

- Direct payroll connections draw income and employment data straight from the system of record—a borrower’s employer or payroll provider account. Argyle’s extensive network covers 90%+ of the U.S. workforce, including traditional, self-employed, gig, and federal workers.

- Direct bank connections via Finicity pull asset, transaction, and deposit data straight from borrowers’ financial institutions, covering 95% of all direct deposit accounts.

- OCR-processed document uploads allow borrowers to instantly submit W-2s, paystubs, 1099s, and other proof-of-income documents in edge cases where direct connections cannot be established.

This multi-source approach gives Argyle a significant leg up over more siloed tools. In head-to-head comparisons, Argyle supports the full range of GSE-approved verifications, while other providers often require costly add-ons or third-party integrations to fill key gaps.

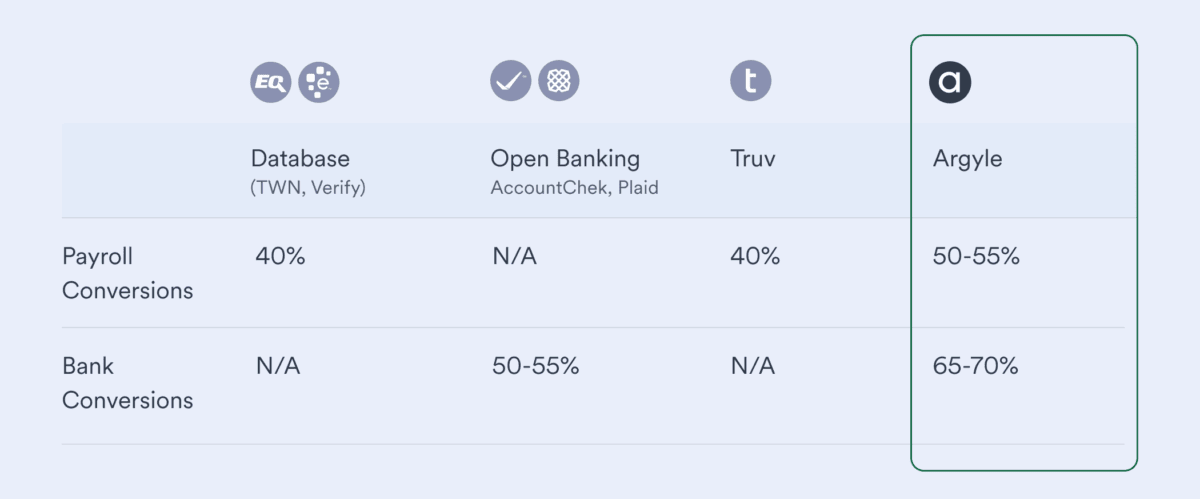

Conversion rates

Coverage is one thing, but conversion is quite another. What ultimately matters is not only how many borrowers can be reached, but how many successfully complete a verification.

This is where Argyle shines. Thanks to frictionless experiences, including intelligent routing, single sign-on (SSO) and passwordless logins, and integrated password-reset flows, Argyle effectively converts:

- 50 to 55% of all payroll verifications

- 65 to 70% of all bank verifications

These numbers represent real performance, not just theoretical potential. In contrast, TWN and Truv typically convert around 40% of payroll verification attempts, while open banking solutions convert around 50 to 55% of bank-related verifications.

Of course, more conversions mean fewer fallbacks, fewer manual reviews and interventions, and ultimately a faster path to close.

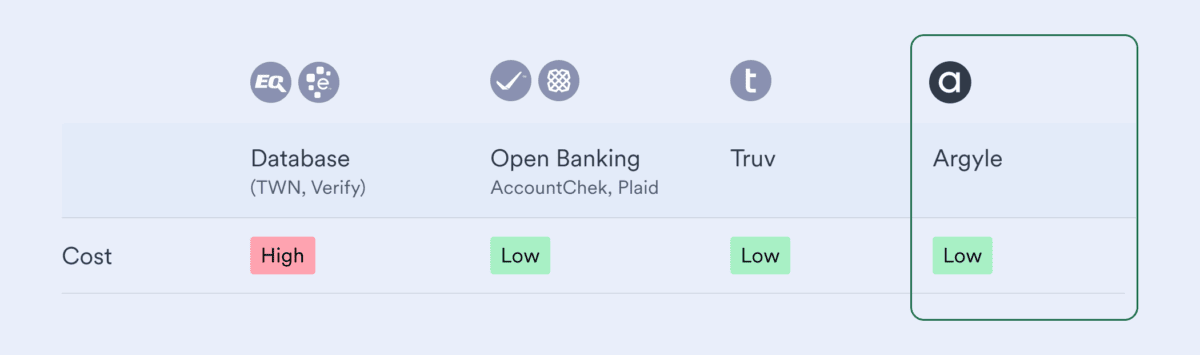

Cost

Verification tools can be expensive. Between steep per-transaction fees and limited data reuse, TWN’s model especially can burden lenders with higher-than-anticipated costs, with some paying over $200 per verification.

Argyle takes a different approach with usage-based pricing and continuous access to verified data—meaning no extra charge for reverifications. As a result, mortgage lenders using Argyle experience significant cost savings. Alcova, for instance, saves 88% on its verification process with Argyle, while Lake Michigan Credit Union saves $100 per loan.

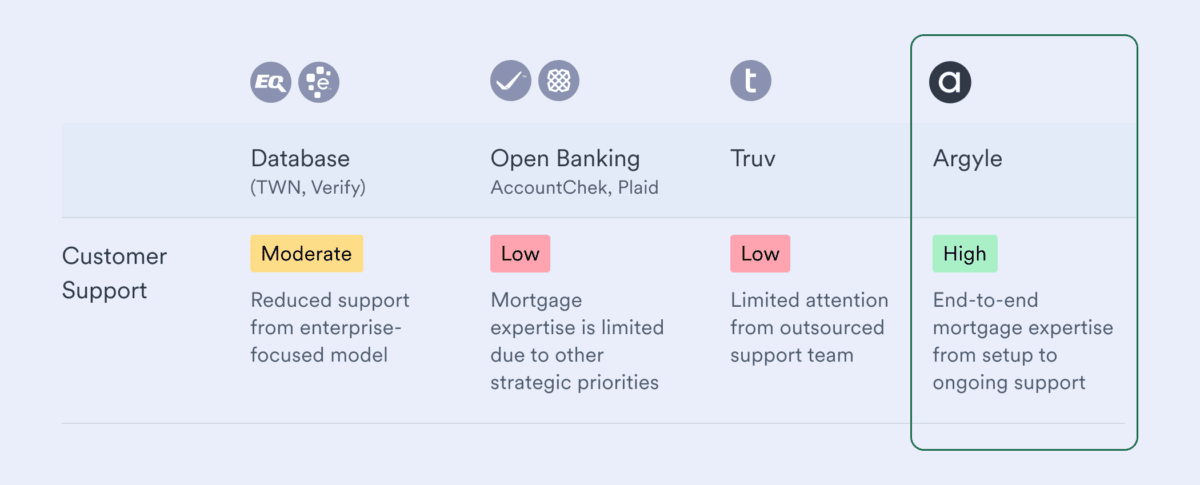

Customer support

When it comes to mortgage verifications, specialized customer support is often limited to onboarding or outsourced altogether.

Argyle takes a more involved approach. Lenders aren’t left to interpret documentation alone or chase down generic help desk tickets. Instead, Argyle pairs every customer with a dedicated success manager—someone who understands mortgage workflows and can help teams solve real operational challenges, not just technical ones.

What sets Argyle apart isn’t just availability; it’s relevance. Our team includes mortgage subject matter experts with decades of experience in origination, underwriting, and loan operations, plus an advisory board that features some of the industry’s most respected voices. That means the support you get is grounded in your world, rather than in abstract best practices.

As one Argyle customer put it: “This is a team that truly understands lenders. It’s not just about the cost-effectiveness and excellent product—it’s about the people behind it.” – Magesh Sarma, Chief Information and Strategy Officer at AmeriSave

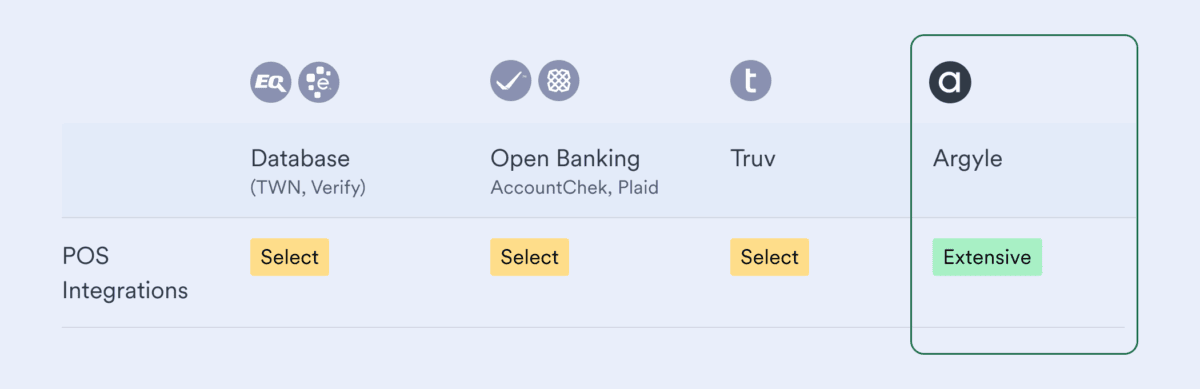

Integrations

Argyle integrates seamlessly with both point-of-sale (POS) and loan origination systems (LOS), embedding verifications directly into existing borrower workflows.

Argyle’s platform already works with popular platforms like nCino’s Mortgage Suite, Encompass® Consumer Connect™, Encompass® LOS, The BIG Point of Sale™, Tidalwave, and LenderLogix, with many more integrations available and in the works.

With three new POS integrations launched just in the last month, Argyle is committed to meeting lenders where they already work and building where they need it most.

A side-by-side comparison

The conclusion? Whether you’re looking to reduce per-loan costs, improve pull-through rates, or finally unify your verification workflows, Argyle is the only partner that excels across the board.

No handoffs. No data silos. No sticker shock. Just a single source of truth for income, employment, and asset data, delivered with the performance, experience, and support today’s lenders need.

See why leading mortgage lenders choose Argyle

Talk to our team to learn how Argyle can streamline your verification process—or request a demo to see our platform in action.