A Letter From Our Founder & CEO

On the heels of a strategic investment round with participation from Mastercard, Bain Capital Ventures, Checkr, Rockefeller Asset Management and SignalFire, Shmulik Fishman highlights our continued focus on being the top verification platform.

When we set out to build Argyle, we had a clear goal: empower consumers to share their data, and in doing so, unlock faster, fairer financial decisions for everyone.

That goal hasn’t changed. But the platform—and the opportunity ahead of us—has grown in extraordinary ways.

Today, I’m thrilled to share a strategic investment round that included new participation from Mastercard alongside continued support from current investors: Bain Capital Ventures, Checkr, Rockefeller Asset Management and SignalFire.

This marks an exciting new chapter for Argyle—one that reinforces our mission and accelerates our path forward.

A platform built to serve

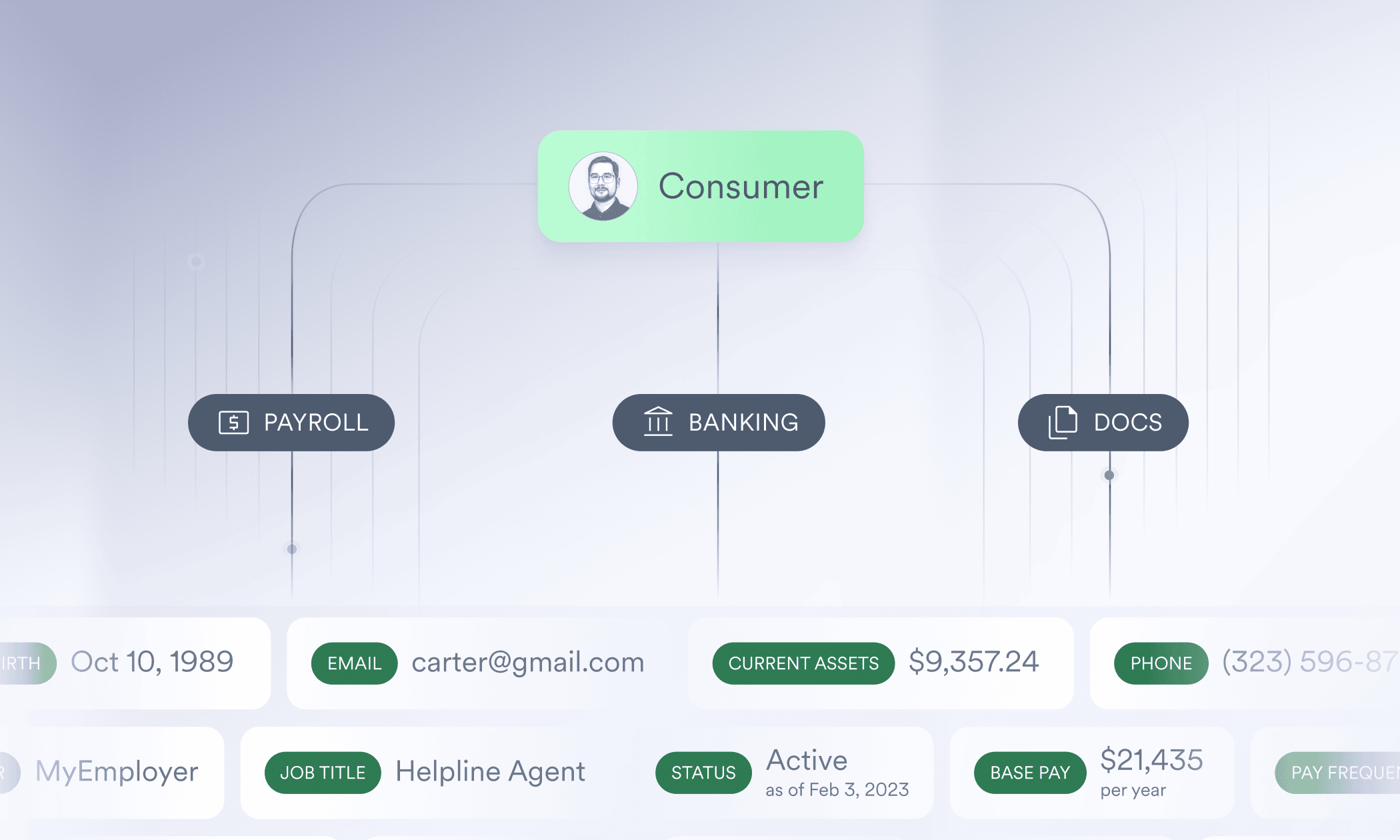

Over the past year, we’ve transformed from a payroll-focused solution into a comprehensive, consumer-permissioned verification platform.

Today, Argyle supports key industries including mortgage, personal lending, tenant screening, background checks, government benefits, and the gig economy.

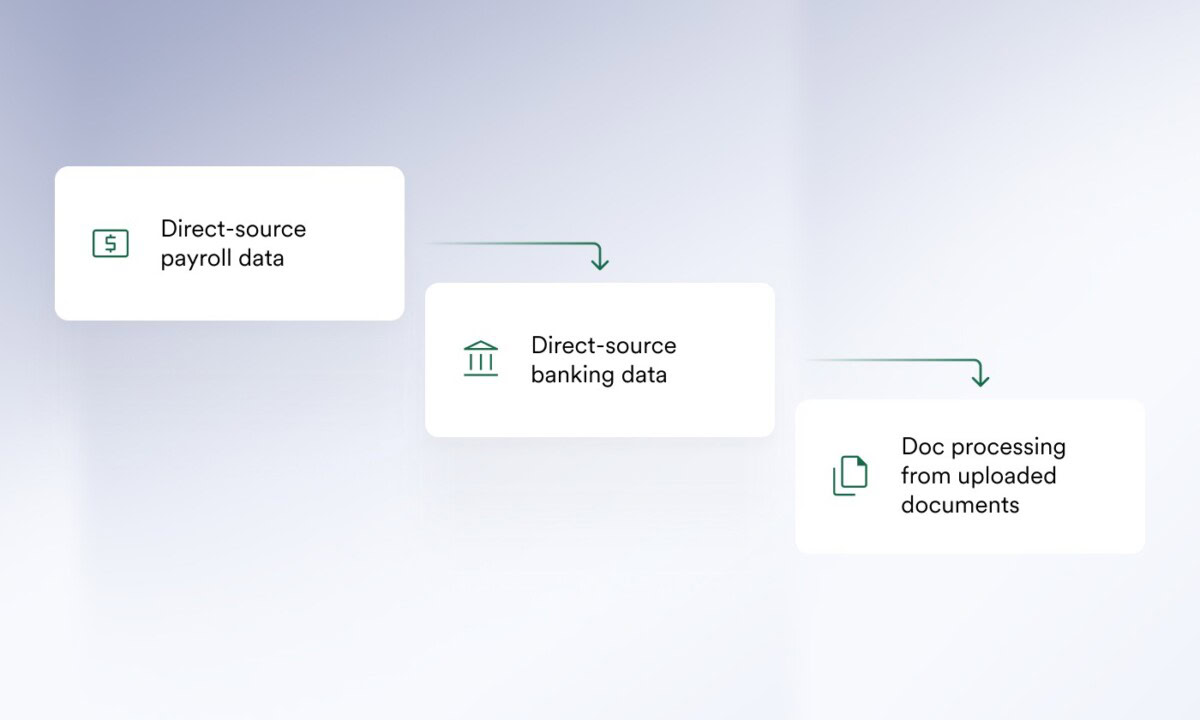

By leveraging direct-source data, Argyle enables customers—from lenders to screeners—to verify income, employment, and assets with greater speed and accuracy. Our unified waterfall brings together the data needed in a single platform:

- Direct-source payroll data

- Direct-source banking data

- Doc processing from uploaded documents

Everything is delivered through a streamlined experience, backed by GSE-compliant reports and unmatched customer support.

We’ve expanded our POS and LOS integrations (9 and counting), helped more lenders automate manual processes, and delivered the tools needed to make smarter, faster decisions.

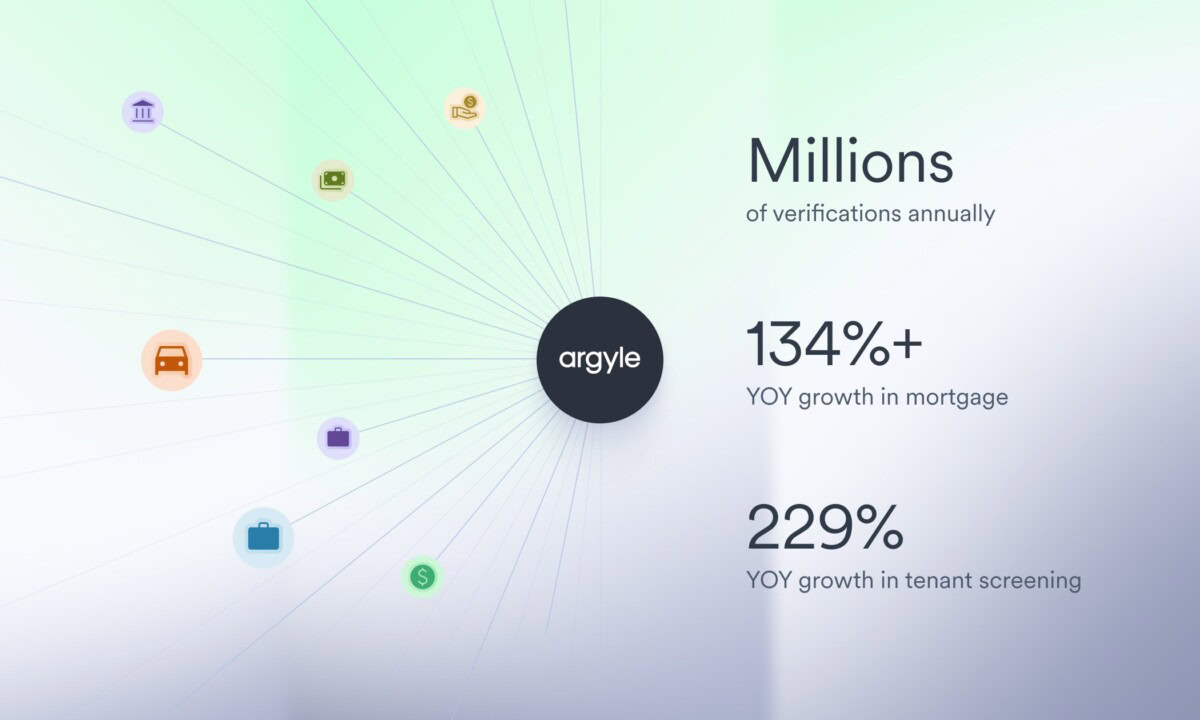

The results speak for themselves:

- Millions of verifications annually—with volume continuing to grow

- 134%+ YOY growth in mortgage—despite an industry-wide decline in loan volume

- 229% YOY growth in tenant screening—as screening providers seek lower fraud risk and better applicant experiences

A signal of confidence

This momentum hasn’t gone unnoticed.

We’re proud to announce an extension of our Series C funding, with continued participation from all of our existing investors. Every one of them chose to double down—and that means the world to us.

And we’re equally proud to partner with Mastercard on asset verifications. Together, we’ll bring unmatched waterfall options, innovation, and support to the verifications industry.

It’s a powerful combination: Argyle Direct Connect + Mastercard Data Connect. A better, more complete way to verify with direct-source data.

Eyes forward

With this capital, we’re not just funding growth—we’re laying the foundation for long-term sustainability. This extension puts us on a clear path to achieving free cash flow in 2026.

But beyond the numbers, what drives us is impact. We’re reshaping how verifications get done—making them more efficient for providers, less burdensome for applicants, and more inclusive for those historically left out.

We’re poised for even greater impact.

And we’re grateful to have you on the journey with us.