In financial services, even the most tech-forward solutions succeed not despite human involvement, but because of it.

There’s an interesting paradox playing out right now in financial technology. As digital products and services grow more sophisticated, human relationships are only becoming more critical to their success.

Verifications are a prime example. It’s natural to think that, as verification processes are automated from end to end through reliable, direct-source data, the need for hands-on human support might diminish. But the reality is exactly the opposite. In the high-touch industries served by verification solutions—like mortgage lending, personal finance, and tenant screenings—trust isn’t just important. It’s everything. The key is finding verification platforms that offer both unparalleled efficiency and a best-in-class customer success team.

In this post, we’ll explore why the most successful solutions in finance today are those that combine cutting-edge technology with exceptional human expertise, along with how customer success has evolved from a basic support function to a full strategic imperative.

The trust factor in financial services

Consider what happens when a service provider—like a lender, property manager, or screening company—adopts a verification solution. They’re not just experimenting with a new tech product. They’re fundamentally changing the way they handle applications, evaluate critical financial information, and make important business decisions that can dramatically affect both their bottom line and consumers’ lives.

In other words, implementing a new tech solution is far from a simple rollout. It’s a dynamic transformation that touches everyone from internal operations and compliance teams to applicants themselves. And while the technology itself may be groundbreaking (we certainly think ours is), its effectiveness often hinges on how well it’s understood, implemented, and optimized by the people who actually deploy it.

That’s where customer success becomes not only valuable, but indispensable.

Why high-tech demands high-touch

Financial services operate first and foremost on relationships. Consumers choosing a potential lender or landlord aren’t making a solely transactional decision. They’re choosing a partner for one of the biggest decisions of their life. Similarly, when service providers choose a verification platform, they’re not just buying software. They’re investing in a partnership that will shape thousands of future experiences.

As a result, advances in technology don’t eliminate the need for human connection—they amplify it. Here are some of the top reasons why:

More complex problems require more nuanced solutions

Every service provider has unique workflows, including specific rules, regulations, and compliance requirements. No amount of automation can fully anticipate the intricacies of integrating a verification platform into their existing software—like their point of sale (POS) or loan origination system (LOS)—while maintaining compliance with evolving standards.

Experienced customer success managers (CSMs) are invaluable in making it all come together. They understand not only the technology, but also the industry context. They’ve seen similar challenges before. And, once they get to know a business’s particular needs, they can identify which solutions will actually work and which seem good in theory but will fall flat once deployed.

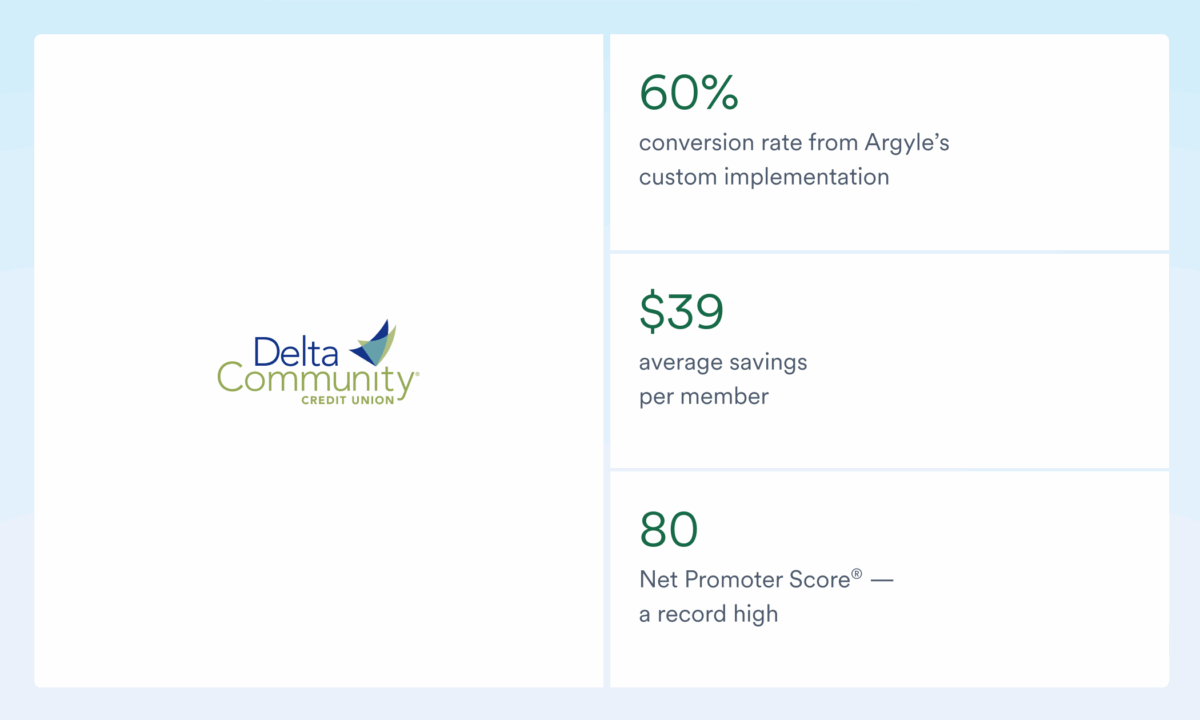

Partnership in practice: As an example, Argyle’s agile team built a custom implementation plan to meet Delta Community Credit Union’s distinctive needs—resulting in over 60% conversion rates, $39 average savings per member, and a record-high Net Promoter Score® of 80.

Speed is important, but balance is vital

In today’s fast-moving market, service providers can’t afford lengthy implementation cycles. Consumers increasingly expect quick decisions, and competition is fierce. At the same time, rushing to deploy new technology without proper onboarding and support is a recipe for disaster.

The best customer success teams know how to balance speed with diligence and attention to detail. They’ve architected implementation processes that get providers up and running quickly while ensuring nothing falls through the cracks.

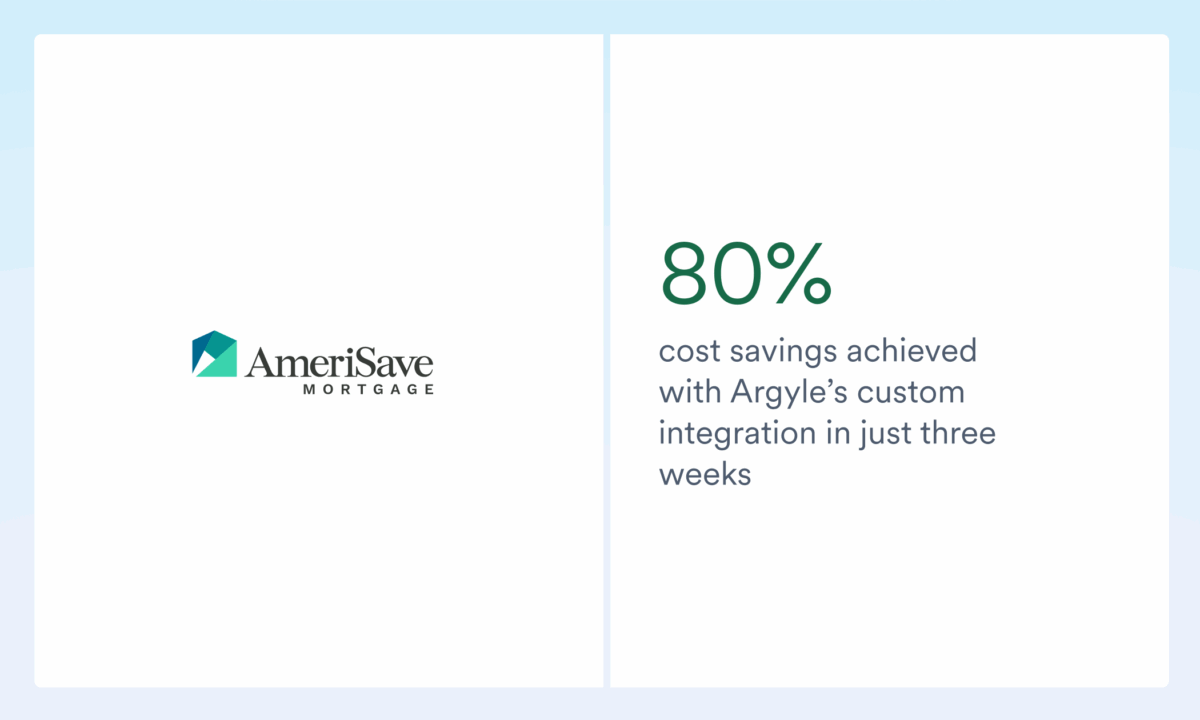

Partnership in practice: What does true collaboration look like? Working together, Argyle’s team was able to get AmeriSave live with a custom integration in just three weeks, unlocking 80% cost savings compared to their previous verification solution.

Continuous optimization drives ROI

At Argyle, we’ve helped hundreds of lenders and other service providers streamline their workflows, including some of the largest in North America. And we’ve learned that the real value of a verification platform—as with any tech solution—isn’t realized on day one. It comes from continuous refinement: adjusting workflows, identifying new use cases, and optimizing conversion rates. Equally important is helping our customers scale successfully, moving from initial pilot programs to full deployment with clarity and confidence.

This kind of optimization doesn’t happen on its own. It requires ongoing collaboration between the tech vendor and the business customer, with success teams translating performance data and feedback into actionable improvements.

And it’s not just about the technology itself. Argyle’s team works directly with the people who actually use our platform, including loan officers, tenant screeners, and other front-line staff—providing the training, tips, scripts, customer videos, and other hands-on support they need to make Argyle an effective part of their daily workflows so they can deliver exceptional experiences.

Partnership in practice: Argyle is constantly making improvements in response to customer needs—including updates to ALCOVA’s LOS, Encompass® by ICE Mortgage Technology®, which have unlocked higher conversion rates, greater savings, and more frequent relief from reps and warrants.

“Argyle focuses on being the best at what it does. Its continuous investment in refining the platform and incorporating customer feedback shows a real commitment to making VOIE as straightforward and effective as possible.” – Kelly Good, Director of Strategic Initiatives at ALCOVA Mortgage

Argyle’s approach: platform plus partnership

At Argyle, we’ve built our customer success philosophy around a simple truth: great technology is just the beginning. What turns that offering into business value is the human expertise behind it.

It’s one reason why we recently launched “Behind Every Connection,” a campaign dedicated to showcasing the real people who power our platform. Led by Shelby Bohannon—Argyle’s VP of Customer Success and one of Mortgage Banker Magazine’s 2025 Powerful Women of Mortgage Banking—our CSMs bring more than technical know-how to the table. They bring a wealth of industry experience, problem-solving skills, and a genuine commitment to helping every customer thrive.

In practice, that means:

- Strategic guidance

Argyle’s customer success managers don’t just answer questions or troubleshoot basic issues. They proactively identify opportunities for improvement and growth, share best practices from across our customer base, and help service providers stay ahead of critical market changes and trends.

- Industry-specific expertise

Each vertical we serve at Argyle—from mortgage and personal lending to tenant screening—has its own specific requirements, regulations, and rhythms. Our CSMs specialize in the areas they serve, and each customer gets their own dedicated customer support representative, ensuring every interaction comes with deep domain experience and highly personalized attention.

- Continuous partnership

We measure our success by that of our customers. That’s why our team stays engaged long after implementation and launch, helping service providers adapt to new regulations, expand into new use cases, and continuously improve their verification processes.

Maintaining human intelligence in an AI world

As AI continues to reshape financial services, some worry about the human element getting lost in the mix. We see it differently. When done right, AI and automation free up humans to focus on what they do best: building relationships, solving complex problems, and providing levels of judgement and empathy that no algorithm can fully replicate.

In financial services, where every decision carries weight and makes or breaks an applicant’s dreams, a human touch can make all the difference. Technology can verify income in seconds, but it takes human expertise to ensure that verification fits seamlessly into a provider’s workflow, meets all compliance requirements, and results in a positive customer experience.

Looking ahead: the evolution of customer success

The future of fintech isn’t about choosing between automated digital solutions and high-touch human support. It’s about combining them in increasingly sophisticated ways. As verification platforms become more powerful, their customer success teams will become even more strategic, focusing on optimization, innovation, and partnership rather than basic support.

At Argyle, we’re already seeing this evolution. Our CSMs aren’t just supporting our platform; they’re helping shape the future of financial services, one partnership at a time. Behind every verification, every approved application, and every satisfied consumer, there’s more than just technology—there’s a team of dedicated professionals helping you succeed.

Meet our award-winning CS team

Want to learn more about how Argyle’s industry-leading customer success team can transform your verification waterfall? Schedule a consultation with one of our industry experts today.