Carrying out effective income and employment verifications is an essential part of reducing risk for landlords and property managers.

One of the most important parts of owning or managing a rental property is receiving accurate, on-time rent payments from tenants.

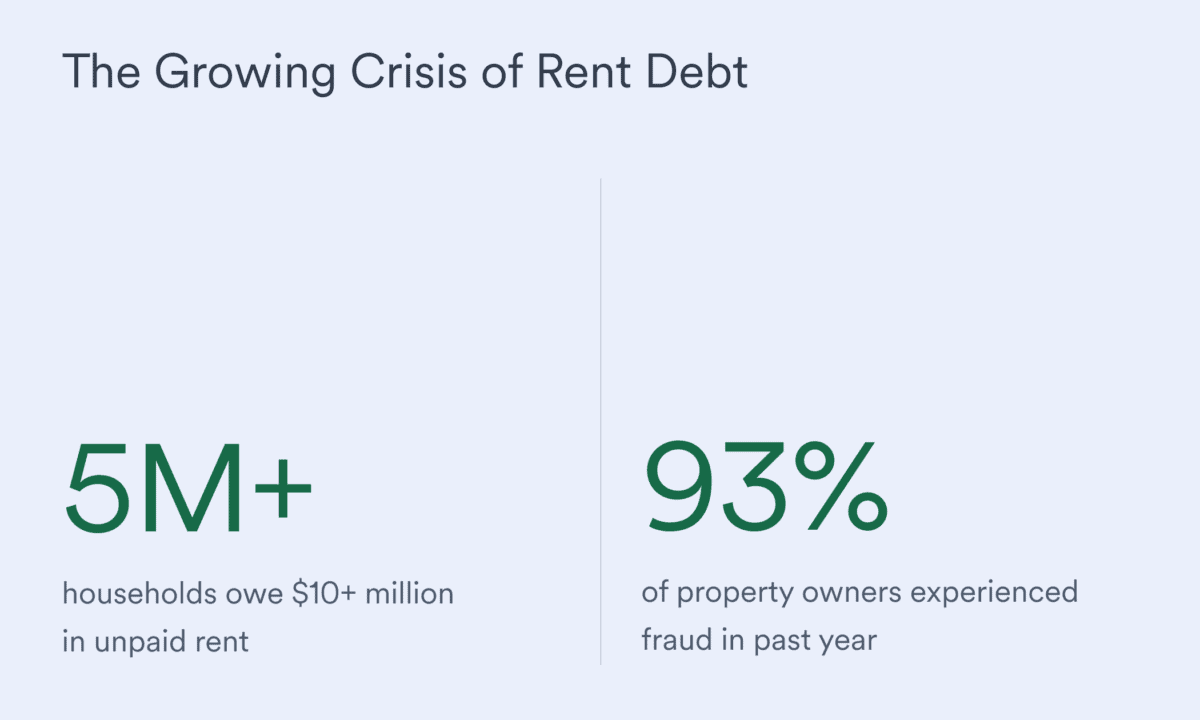

Unfortunately, the National Equity Atlas is currently measuring rent debt at crisis levels, with over five million households owing over $10 billion in unpaid rent. What’s more, rental application fraud is rampant; in the last year alone, 93% of property owners, developers, and managers had applicants misrepresent their income or falsify their financial documents. Ultimately, these fraudulent applications were far more likely to lead to nonpayment, eviction, and bad debt.

Facing such stark challenges, property managers—and the tenant screening services they rely on for answers—need a simple, seamless way to assess whether prospective tenants can actually afford their monthly rent.

Screening services routinely complete background checks as part of the tenant screening process, and they often turn to an applicant’s credit score/credit report, bank statements, tax returns, or even previous landlords’ references to build out a risk profile. But while these sources do provide valuable information, they can’t prove that a potential renter is actively and steadily employed—and they certainly can’t provide the granular monthly income data needed to calculate a precise rent-to-income ratio (RTI ratio).

To really reduce their risk of nonpayment and fraud, tenant screeners need to know how to verify tenant income and employment quickly and accurately.

There are two ways they can accomplish this. They can verify the traditional way—through manual methods and physical documents—or by leveraging direct-source, real-time data technologies that automate the verification process from end to end.

Let’s take a closer look at each approach, how it impacts tenant screeners’ operations, and what it means for the application experience.

The traditional way: manual verifications

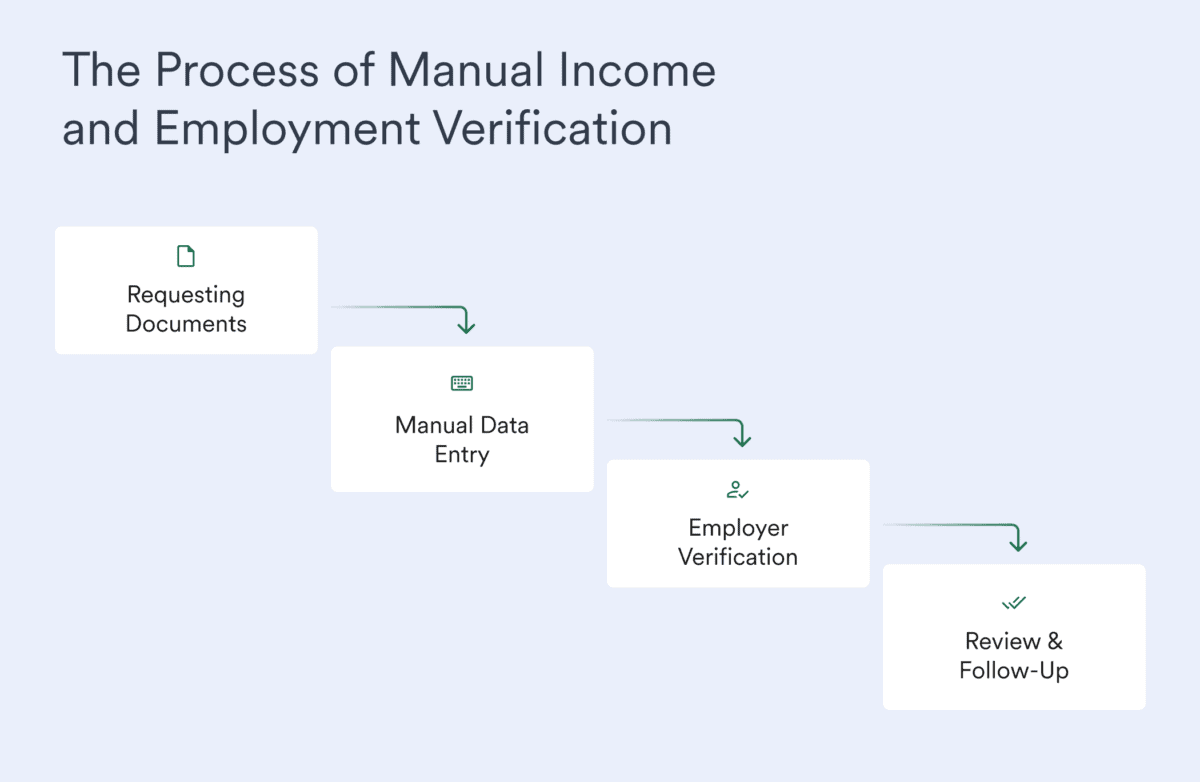

Tenant screeners verifying income and employment manually must typically run through a number of different steps. These generally include:

- Asking an applicant to submit documents that provide proof of income (like a recent paystub), total earnings (like W-2 forms or other tax documents), and active employment (like an employment verification letter or offer letter)

- Extracting and processing the applicant’s income and employment information by hand—like copying it into an internal spreadsheet or form

- Contacting the applicant’s employer(s) via phone or email to verify that their income and employment information is accurate and to fill in any missing data fields

- Reviewing all files and records to check for mistakes, oversights, or inconsistencies—and then following up with the applicant or their employer to correct them

Of course, with a lengthier application process, the information in an applicant’s documents will grow stale and outdated. That could require screeners to repeat these steps later on to make sure the data they have and present is accurate and up to date.

Drawbacks of manual verifications

Manual verification processes don’t just involve a lot of work, they can also negatively impact a screener’s business operations.

Among other obstacles, manual verification processes tend to involve:

- Inefficiency

Since manual verification tasks are carried out by hand, they can take days, weeks, or even months to complete—especially if an applicant can’t track down a recent paystub or their employer is difficult to reach. - High costs

More data collection and processing time generally means more money spent on labor expenses and operational resources, tanking overall NOI. Moreover, every day an application approval is delayed is a missed opportunity for a property owner to collect rent and grow their revenue. - Human errors

People inevitably make mistakes, especially when handling large volumes of data entry by hand. Even small inconsistencies can have big consequences when it comes to real estate transactions—including applicants being needlessly denied housing and property owners losing time, money, and income. With new regulatory standards coming into play, errors can also land tenant screeners in hot water. - Static data

One-off documents and phone calls provide a limited, one-time view of an applicant’s income and employment. If an applicant loses their job or experiences a drop in income prior to move-in, a screener or property manager will be none the wiser. - Elevated risk of fraud

It’s difficult to know exactly where a physical or scanned paystub originated, leaving plenty of opportunity for it to be altered or falsified—especially with the wide availability of advanced AI tools that can convincingly mimic official documents with ease. - Poor experience

Manual processes aren’t just tiresome for tenant screening services and property managers, they also put the burden on renters to dig up and send their own financial documents. When faced with this added friction, some prospective renters may just walk away from an application altogether, leaving a property manager in the lurch.

The importance of a reliable data source

To offset some of these operational challenges, some screeners turn to open banking solutions like Plaid. These platforms can connect them to an applicant’s bank account and provide them with real-time banking data that offers a glimpse into a prospective tenant’s financial health.

While open banking solutions do automate some of the data collection process and grant insights into an applicant’s cash flow and spending habits, they have significant shortcomings when it comes to verifying income and employment.

For example, banking data can only show the net income an applicant has deposited in the past—not the gross income they’re actively making now. It doesn’t reveal whether an applicant is currently employed, where else their wages may be distributed, or—especially if they’re employed in a nontraditional, gig economy role—whether they pick up regular work shifts and are earning money consistently. Most importantly, banking data does not include access to proof of income and employment documents like paystubs and W-2s, meaning screeners still need to collect these materials directly from the applicant.

To paint a true picture of an applicant’s income and employment status, screeners need to turn directly to the source of record: their payroll account.

The automated way: direct payroll connections

In recent years, tech-powered platforms have emerged to automate the tenant verification process from end to end and equip screeners with live payroll connections that pull income and employment data straight from the source of record.

They do this by connecting screeners directly with a tenant’s payroll account, so they can access accurate, pre-verified data in real time.

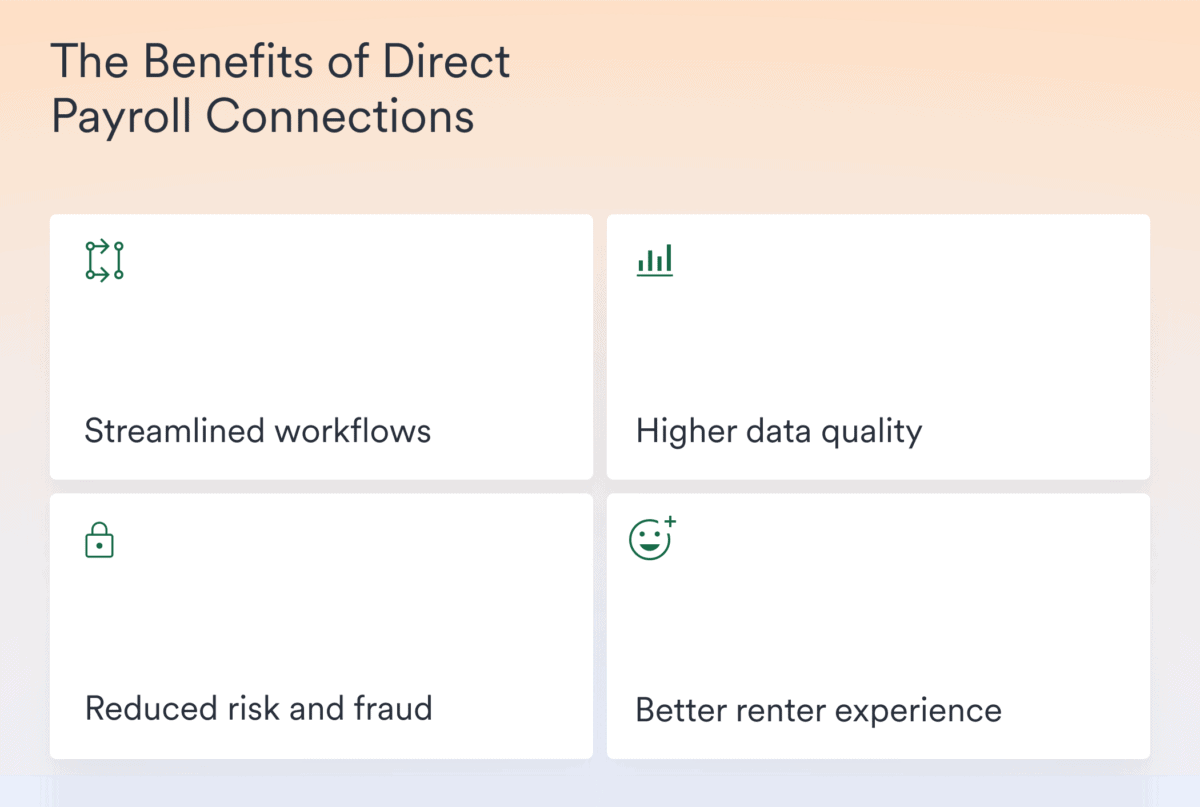

This has several immediate benefits:

- Streamlined workflows

Once a payroll account is connected, screeners get instant, automated access to a tenant’s income and employment data, allowing them to quickly process applications and calculate RTI ratios. - Higher data quality

Since data comes straight from the source, it is an exact one-to-one reflection of what is in a tenant’s payroll records, guaranteeing greater accuracy.

Direct-source payroll connections can also pull more income and employment fields than what is typically available on a paystub or W-2. That means tenant screeners can often work with more complete data sets—including granular details like bonus and commission amounts, shifts and hours worked, and tax withholdings. - Reduced risk and fraud

With a direct pipeline, there’s no middleman, meaning there’s no opportunity for would-be fraudsters to forge their financial documents or alter their data. There’s also no opportunity for unintentional human error.

More accurate information also means deeper insights and smarter business decisions, fewer instances of nonpayment and eviction, and more seamless compliance with industry and regulatory requirements. - Better renter experience

A fully automated verification process with direct-source data means prospective renters aren’t on the hook to provide their own documents. Plus, they won’t be denied housing opportunities based on incorrect, faulty data that’s beyond their control.

Picking the right income and employment data provider

When selecting a platform to automate tenant income and employment verifications, it’s important for screeners to consider valuable criteria like coverage, conversion rates, efficiency, data breadth and quality, security standards, and customer service.

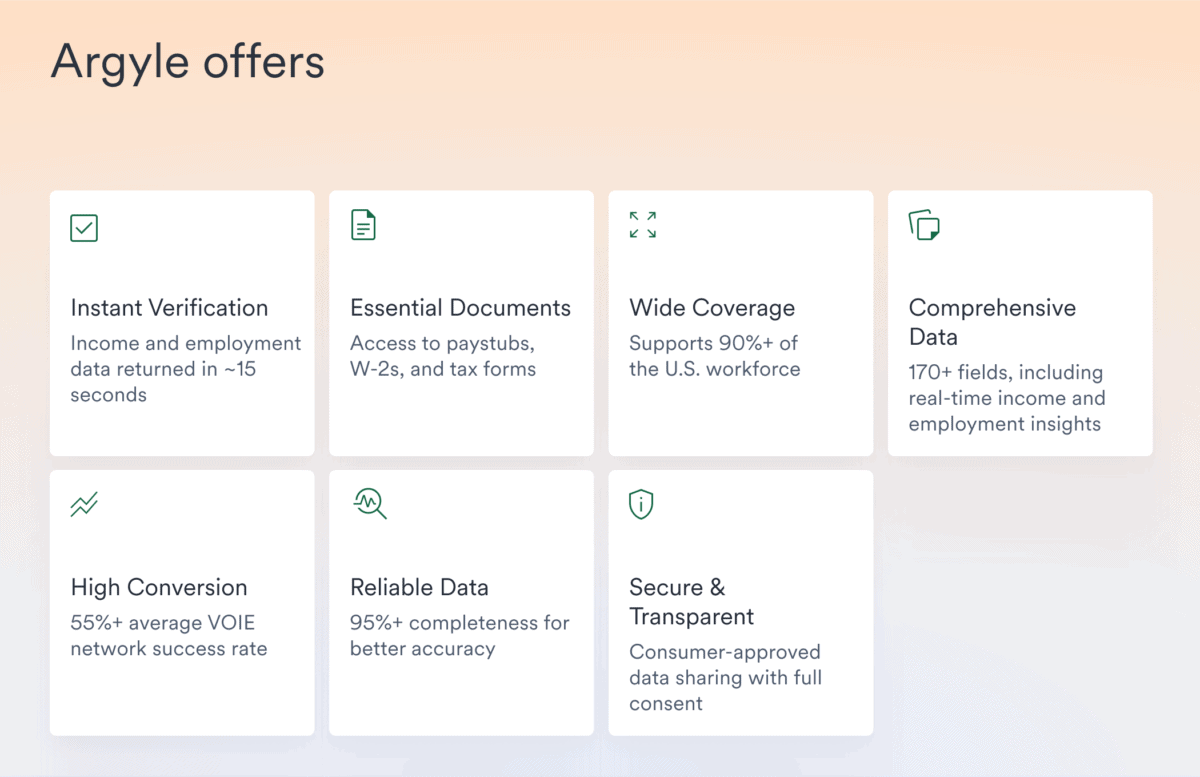

- Instant, ongoing access to income and employment data, with verifications returned in an average of 15 seconds

- Access to essential proof of income documents and tax forms like paystubs and W-2s

- Broad coverage of over 90% of the U.S. workforce

- 170+ data fields, including real-time gross income details, as well as insights into a tenant’s employment activity

- The highest-converting VOIE network, with an average conversion rate of over 55%

- Better data quality, with 95%+ completeness rates

- Consumer-permissioned data sharing that is carried out only with applicants’ explicit, informed consent

In an already innovative market, Argyle represents the gold standard for accurate, fully automated income and employment verifications that optimize the rental application process.

Key takeaway

The bottom line? Income and employment verifications are critical for tenant screeners who want to protect property owners and managers against nonpayment and fraud.

While manual verifications had their place in the past, automated verifications through direct payroll connections and real-time income and employment data are the way of the future—and the only way forward for tenant screeners looking to take their operations to the next level.

Want to learn more about how to verify tenant income and employment?

Reach out to our team to get your questions answered, and discover how fully automated, real-time income and employment verifications can transform your business.

FAQs

- How do automated income verifications work?

Different VOIE platforms automate income and employment verifications in different ways.

Argyle’s process is simple and straightforward. Applicants select their employer or payroll provider from Argyle’s comprehensive data network and log in using the same credentials they use any time they engage in routine tasks like reviewing their paychecks or requesting time off work.

From there, screeners are automatically connected to the tenant’s income and employment data and documents.

- How does real-time income data differ from banking data when it comes to tenant verifications?

Income data and banking data overlap in some ways; for one, they both provide insights into a prospective tenant’s financial health.

That said, while banking data offers a view of an applicant’s cash flow and spending habits, it can’t tell you their employment status or job title. It also can’t tell you the total income an applicant is actively making—especially if much of it disappears into withholdings, deductions, and other distribution methods before it ever hits their bank account. Those critical details are often what a tenant screener needs to calculate an effective rent-to-income ratio.

You can learn about the differences between income and banking data in greater detail by reading through this blog post.

- Can automated VOIE platforms like Argyle verify any income source?

Argyle can verify any source of full-time, part-time, gig, or self-employment income that is reported through:

- Employer platforms, whether from an enterprise or small business

- Payroll provider platforms

- Government platforms

- Benefit platforms (like Social Security income)

- Gig platforms (like Uber or Instacart)

That includes freelancers and self-employed individuals, among other types of workers.If an applicant can’t locate an employer or payroll provider in our network, they can also take advantage of Argyle’s Document Upload feature to post their proof of income documents and have them automatically scanned and processed through Ocrolus’s optical character recognition (OCR) service.