The first half of 2025 brought no shortage of challenges to the industries we serve. In mortgage lending, loan origination volumes remain low across most markets; meanwhile, the pressure for faster and more reliable verification of income and employment in tenant screening continues to grow as concerns about fraud mount.

These are just two examples of how external forces are making efficient, reliable verifications more critical than ever. In environments like these, every inefficiency becomes magnified, every friction point adds cost, and every manual process becomes a competitive disadvantage.

But through it all, our customers continued to build—and so did we, because this is precisely the context where thoughtful innovation matters most.

During the first half of this year, we’ve continued to enhance the verification experience by deepening integrations, removing friction, and launching new products.

Here’s what we’ve accomplished so far.

New integrations that keep the flow moving

Whether it’s a loan origination system, a point-of-sale platform, or a background check solution, flow matters. The fastest path to a decision is one without handoffs. That’s why we’ve focused heavily on building deeper, more interoperable integrations—so we can meet operators where they work.

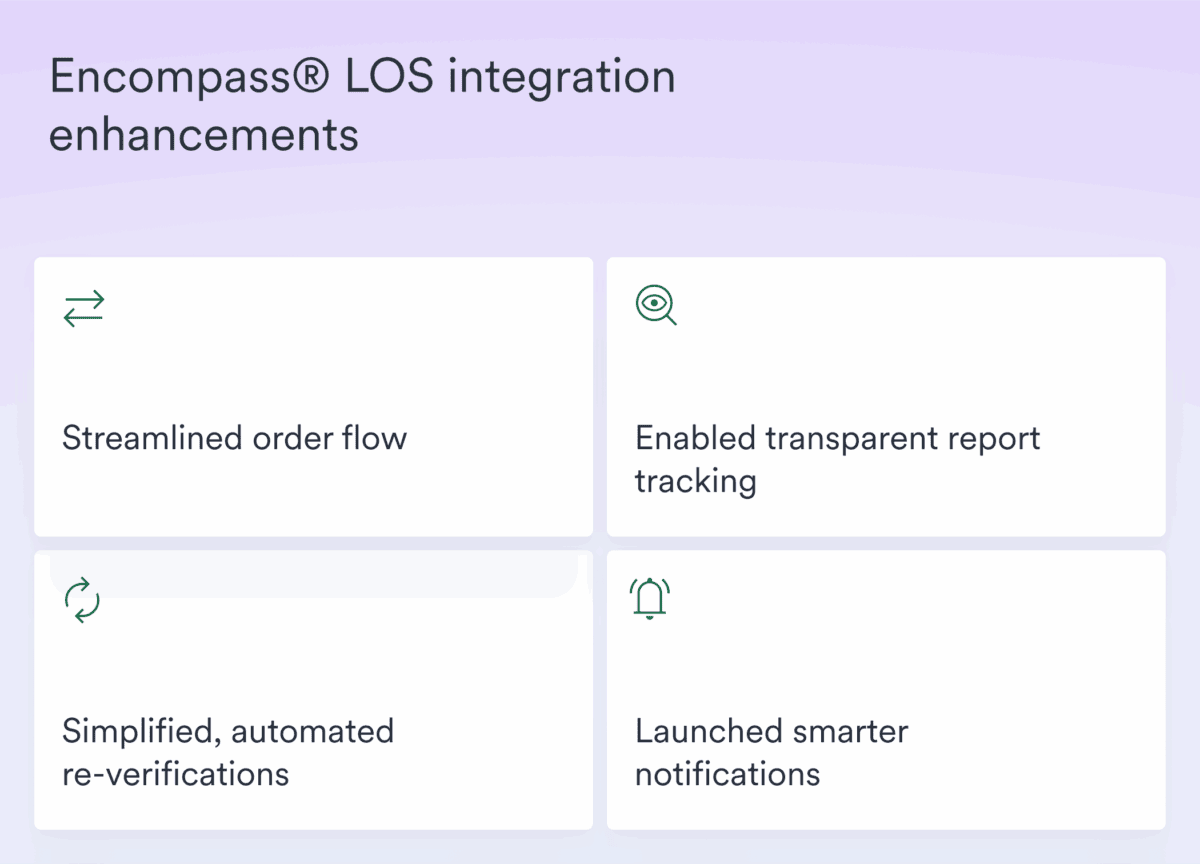

For example, we’ve made significant enhancements to our Encompass® LOS integration:

- Streamlined order flow

- Enabled transparent report tracking

- Simplified, automated re-verifications

- Launched smarter notifications

Together, these updates improve visibility, save time, and ensure clean handoffs from application through close.

One standout example is our fully embedded VOIE integration between nCino and Encompass. This connection allows income and employment data to be transferred directly from the borrower application to underwriting and closing, with no manual intervention, no duplicate data entry, and no risk of duplicate orders. This delivers faster workflows, clearer audit trails, and a better experience for borrowers and lending teams.

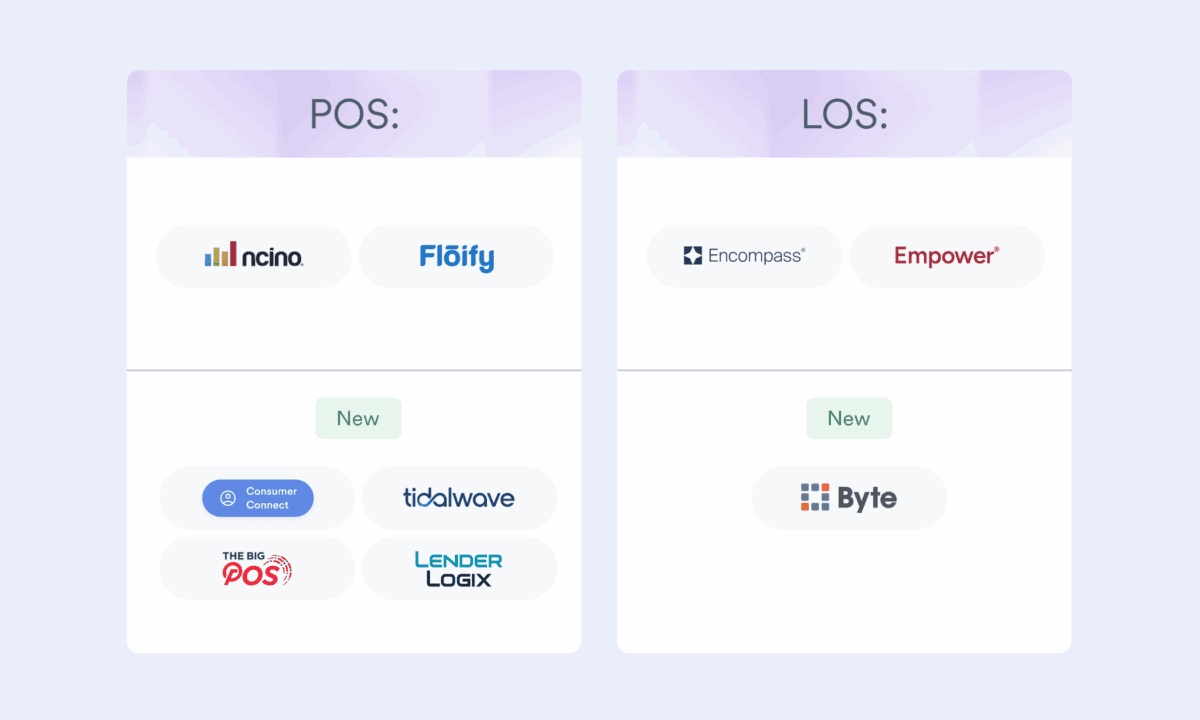

We also expanded our LOS and POS integrations to bring Argyle to more platforms across more stages of the origination lifecycle:

- POS:

- Current: nCino, Floify

- NEW: Consumer Connect, Tidalwave, The BIG Point of Sale, LenderLogix

- LOS:

- Current: Encompass, Empower

- NEW: Byte

In apartment rental and background screening, integrations like our new connection with TazWorks extend Argyle’s reach into existing workflows to streamline income and employment verification.

That brings our total supported integrations to nine—and growing. But more importantly, it brings us closer to the experience our customers want: verifications that fit smoothly into their workflows.

Product releases and updates that remove friction

The year hasn’t only been about expanding integrations; Our work has included enhancing the experience and expanding our verification platform. In the first half of the year, we introduced several enhancements:

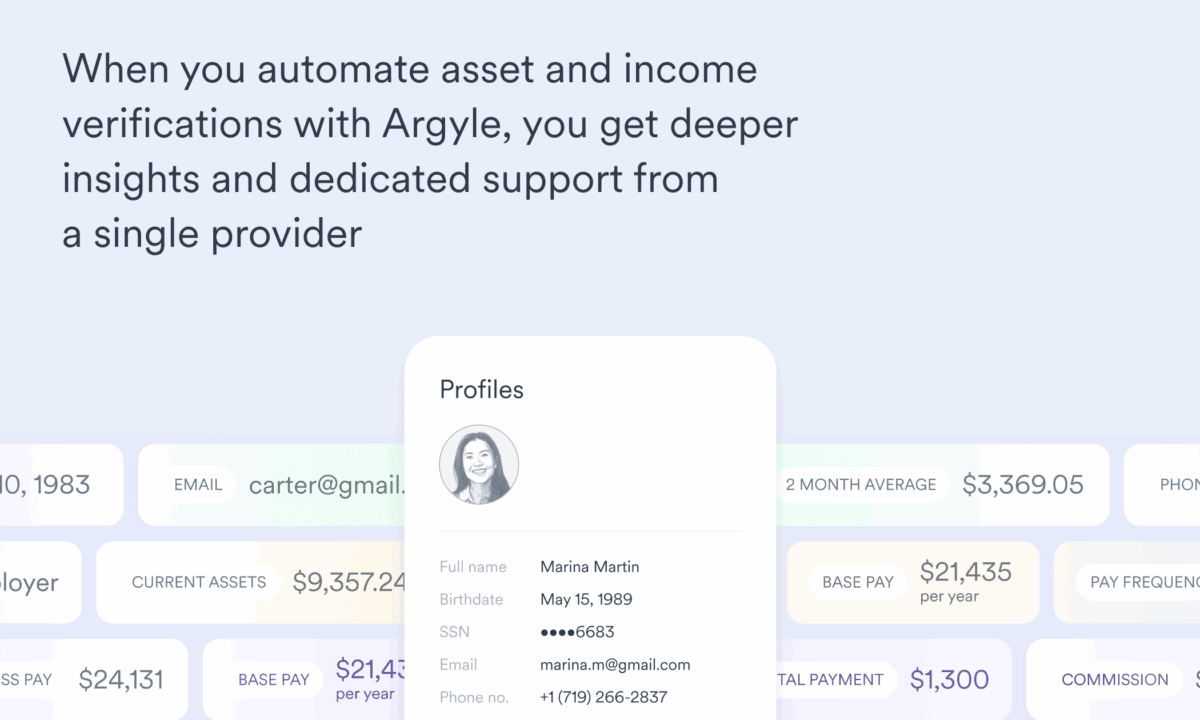

Verification of Assets (VOA)

One of our most significant announcements this year is the launch of asset verifications. With VOA, Argyle becomes a single-source provider for consumer-permissioned verifications. Powered by Mastercard’s open finance technology, the verification of assets enables lenders to confirm borrowers’ balances, cash-to-close, and cash-flow history alongside income and employment.

This means Argyle customers can now access the data they need from a single provider:

- Access banking transaction data from 11,000+ financial institutions

- Access payroll data from 90% of the U.S. workforce

- Fall back to document uploads when connections aren’t available

VOA is also GSE-compliant, making it easier for lenders to adopt without disrupting compliance standards.

The result is a more comprehensive and streamlined verification workflow that supports various asset verification use cases, including mortgage underwriting, personal lending, and tenant screening. It’s especially valuable when cash flow, rental payments, and account history matter as much as employment status and gross pay.

Doc VOI (coming soon)

Direct connections to payroll and banking remain the gold standard for speed and accuracy, but some consumers want a fallback option. That’s why we have developed Doc VOI, a new GSE-compliant report option utilizing uploaded income documentation (such as paystubs or W-2s) when direct access is unavailable.

Currently available for early access for API customers, Doc VOI enables:

- An additional fallback option for uploaded documents when direct connections aren’t available

- Automated document classification and parsing, reducing manual work, verification costs, and improving loan conversion

- Rep and warrant (R&W) relief with Freddie Mac’s AIM Check

Argyle Link

Argyle Link is the front-end experience consumers use to connect their employer or payroll provider. With a straightforward and intuitive experience, more users complete the flow, and our customers get the verified data they need faster.

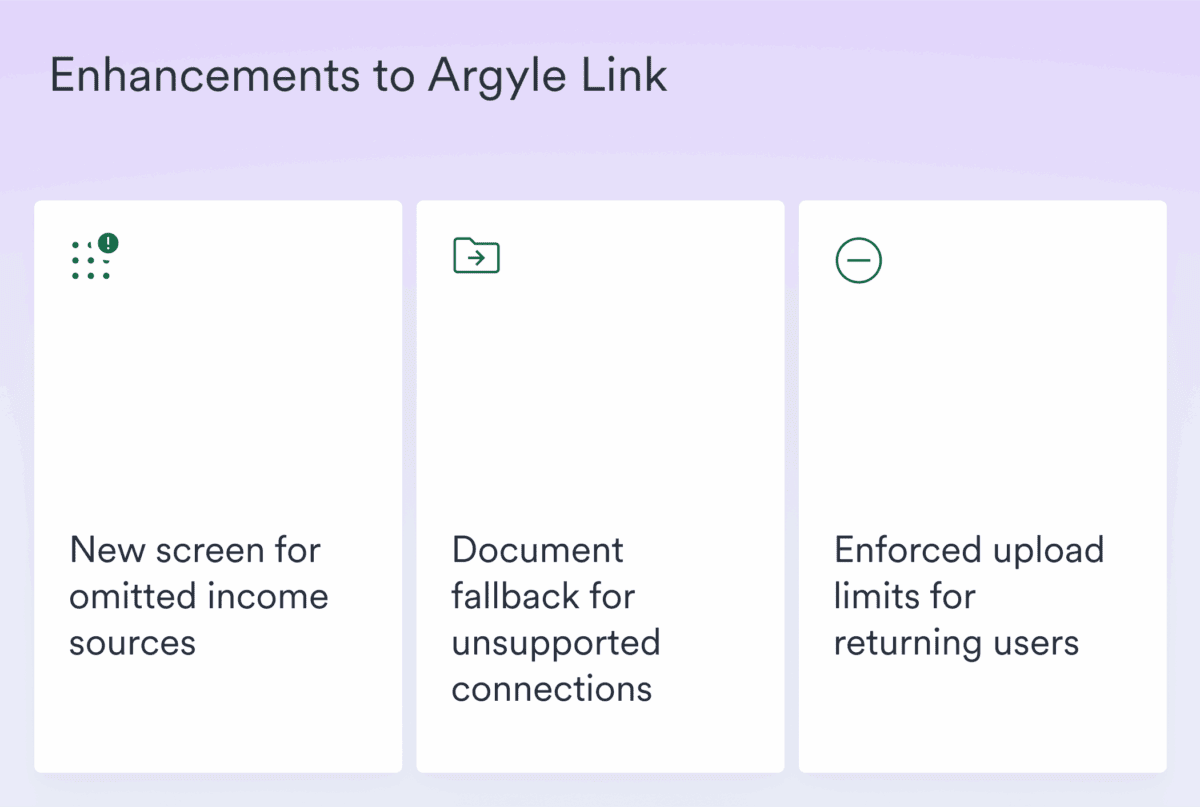

Here are a few of the enhancements to Argyle Link we launched:

- New screen for omitted income sources

Consumers now see income providers that were previously filtered out, with a clear message explaining why those connections aren’t currently supported. This eliminates guesswork and builds trust early in the process.

- Document fallback for unsupported connections

If an applicant can’t find their employer or payroll provider in Argyle Link, fallback is now automatically enabled, allowing them to upload supporting documents instead.

- Enforced upload limits for returning users

To avoid over-submission and data clutter, we now enforce document upload caps for returning applicants. They can still delete and re-upload documents, but the experience stays clean and consistent.

Education and training that drive long-term success

We are committed to helping our customers maximize the benefits of the Argyle platform. That’s why we launched Argyle Academy, a guided learning hub with tailored video courses, role-specific tutorials, and ongoing best practice content. Argyle Academy provides teams with on-demand access to training and support, so customers can adopt new features, optimize performance throughout the entire verification lifecycle, and onboard effortlessly.

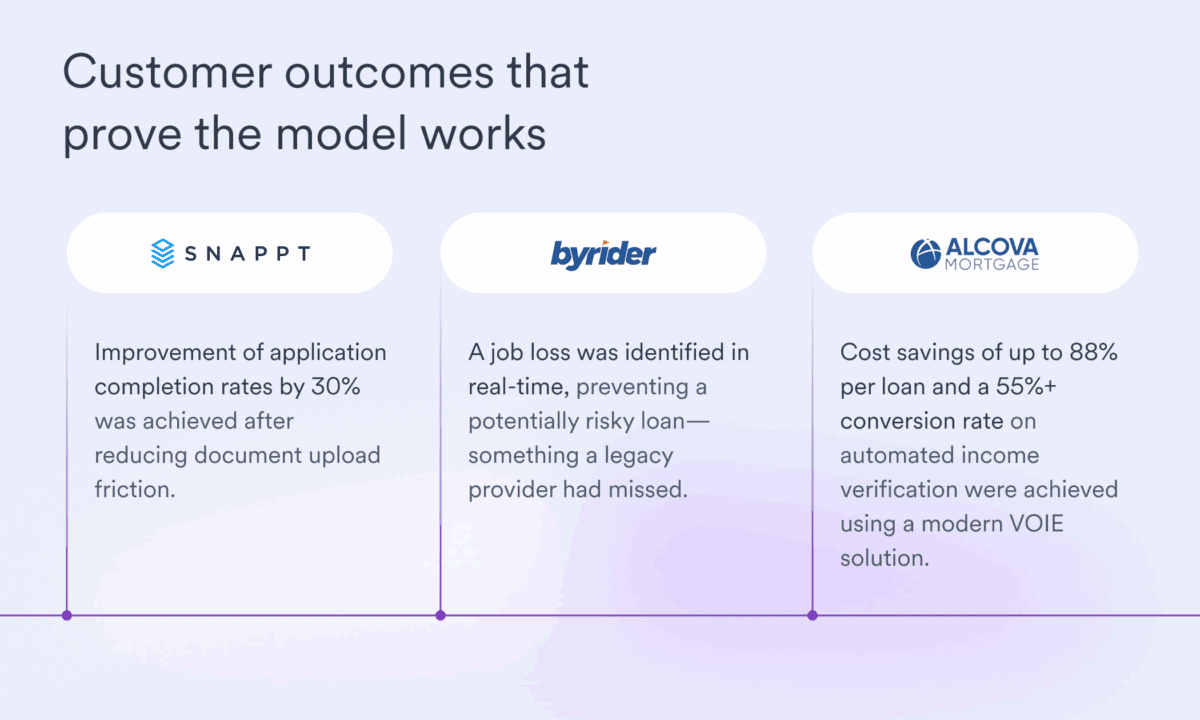

Customer outcomes that prove the model works

Backed by our growing customer success and solutions teams, we’re helping our customers activate faster, solve problems earlier, and unlock more value with less lift.

The results speak for themselves. Here are just a few new examples from 2025 year-to-date:

- Snappt improved application completion rates by 30% after reducing document upload friction with Argyle.

- Byrider identified a job loss in real-time that a legacy provider had missed, which prevented a potentially risky loan.

- ALCOVA Mortgage achieved cost savings of up to 88% per loan and a 55%+ conversion rate on automated income verification by using Argyle’s VOIE solution.

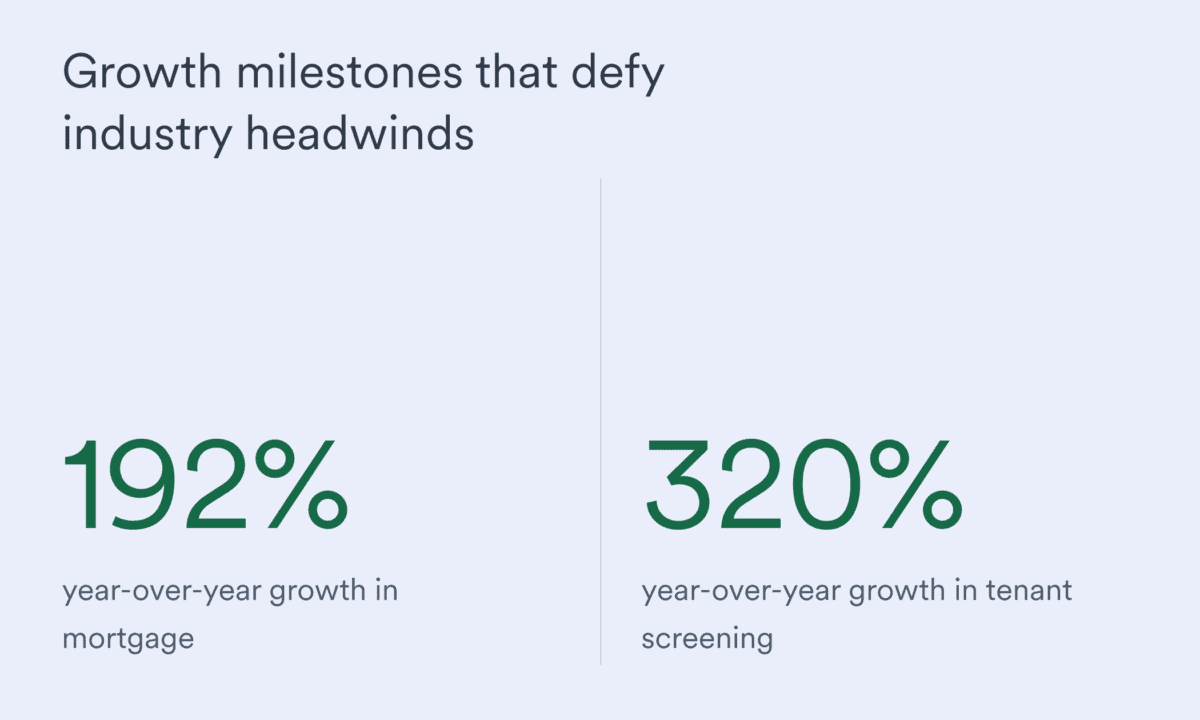

Growth milestones that defy industry headwinds

Even in a down market where volume is down and pressure is up, Argyle continues to show strong growth. In the first half of 2025, we saw:

- 192% year-over-year growth in mortgage, even as origination volumes across the industry continued to decline

- 320% year-over-year growth in tenant screening, as screeners look for lower fraud risk, better applicant experiences, and more reliable data

This momentum is a signal that direct-source, consumer-permissioned verifications are becoming the new standard, and the market is shifting toward faster, more embedded, and more reliable decision-making processes.

Industry recognition that validates the mission

We don’t build for awards, but we do see them as validation that what we’re building is working, and that it’s helping customers solve critical verification challenges.

This year, Argyle was recognized across multiple corners of the industry:

- Named a 2025 Game Changer

- Awarded ICE Gold Status

- Honored with Inman’s Best of Finance Award

- Won the 2025 Connections Award

- Named a Tech100 Winner by HousingWire

- Recognized by Forbes as one of America’s Best Startup Employers

And Daniel Esquibel, who leads our go-to-market strategy for mortgage, was named a HousingWire Rising Star.

Each of these is a testament to the work our team puts in every day and to the partners who continually push us to improve.

A bright future

The second half of the year won’t be about reinvention. It will be about expansion and delivering even more value through the systems our customers already use.

We’ll build on what’s working. We’ll expand our coverage network, strengthen fallback workflows, and embed Argyle more fully into the systems where decisions are made. We’ll continue to make verifications fast, easier, and more cost-effective.

Consumer-permissioned data is fast becoming the new standard for verification, unlocking faster, more accurate, and more transparent decision-making. Argyle is proud to support organizations that are embracing this shift and to lead the industry forward.