The difference comes down to cost, coverage, and applicant experience

For decades, verification of income and employment has been dominated by Equifax’s The Work Number (TWN). In that time, the cost of using The Work Number has skyrocketed, and concerns over monopolistic practices have mounted. According to a 2024 class-action antitrust lawsuit, The Work Number’s per-transaction price has increased 272% since 2012—jumping from $17.85 to $66.45. In some cases, the price is even higher. In a recent survey, nearly 20% of respondents reported paying over $200 for The Work Number on a per-use basis.

For organizations processing thousands of verifications annually—whether mortgage lenders, personal lenders, tenant screeners, background check providers, or government benefits administrators—The Work Number is a significant line item that keeps growing.

But here’s what many organizations don’t realize: You have options. And those options can fundamentally change your cost structure, your ability to accurately verify more segments of the workforce, and the experience you deliver to consumers.

The monopoly problem

The Work Number’s pricing trajectory isn’t an accident. It’s possible because the company has long controlled access to essential income and employment data.

Recent legal challenges have exposed the mechanics of this control. As mortgage lenders First Financial Lending and Greystone Mortgage alleged in their 2024 lawsuit, The Work Number maintains its market position through exclusive multi-year data agreements with major payroll providers like ADP, Paychex, and Intuit.

For a long time, these agreements effectively prevented competitors from accessing the data needed to offer viable alternatives. Without competitive pressure, The Work Number has been able to raise prices unchecked, and its parent company, Equifax, has profited handsomely.

Meanwhile, among organizations that rely on The Work Number’s verification services, the outcome is far less favorable:

- Government benefit administrators operating under tight budget constraints are in crisis. States administering SNAP, Medicaid, TANF, and other programs need accurate verification, but not at prices that consume an outsized portion of already-strained budgets.

- For lenders, escalating verification costs directly impact profitability. When verification expenses rise faster than loan volumes, margins shrink.

- For tenant screeners and background check providers processing high application volumes, the cumulative cost creates pressure to either raise fees or absorb the expense.

The effect on customer experience

Cost isn’t the only problem with legacy verification models. There’s also the question of how consumers experience The Work Number and whether they even know a verification is happening.

The Work Number operates on a buy-and-sell model: Employers and payroll providers sell income and employment data to Equifax, which then resells it to third parties. Applicants often have no idea their information is being traded this way, much less who’s accessing it or for what purpose.

This lack of transparency has consequences. Consumers increasingly prioritize knowing how their data is used and who has access to it. They want control, and The Work Number’s legacy model wasn’t built for this expectation.

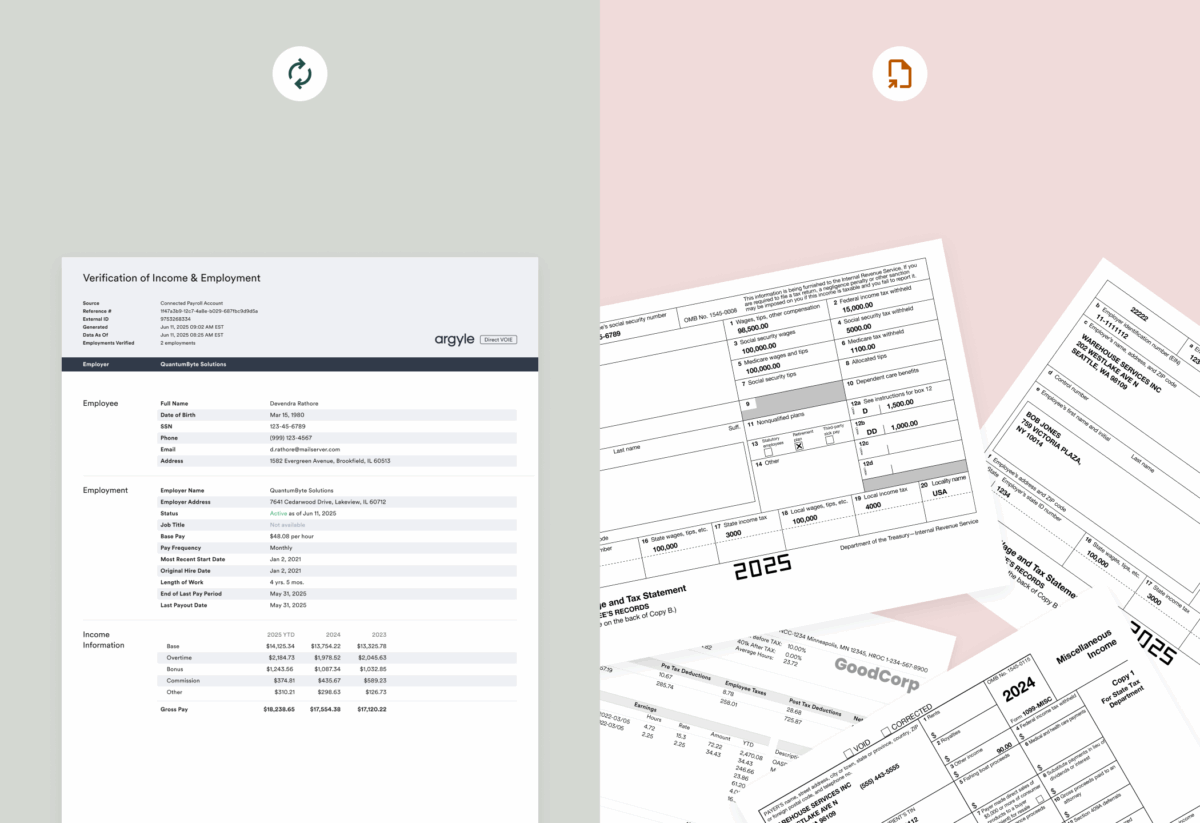

What’s more, many organizations require income documentation like paystubs, W-2s, and 1099s, but The Work Number only delivers verification reports. In many cases, consumers are still on the hook for tracking down and supplying these documents, which adds friction and delays to application processes.

How consumer-permissioned verification changes everything

Argyle takes a fundamentally different approach. Instead of purchasing consumer data from employers and aggregating it in a database for resale, Argyle connects directly to the system of record with the consumer’s explicit permission. When someone applies for a loan, rental property, job, or government benefit, they can choose to grant direct access to their payroll or bank account via Argyle. Then, in minutes, you receive verified, real-time data.

This isn’t just a technical difference. It changes the economics and the experience.

The cost advantage

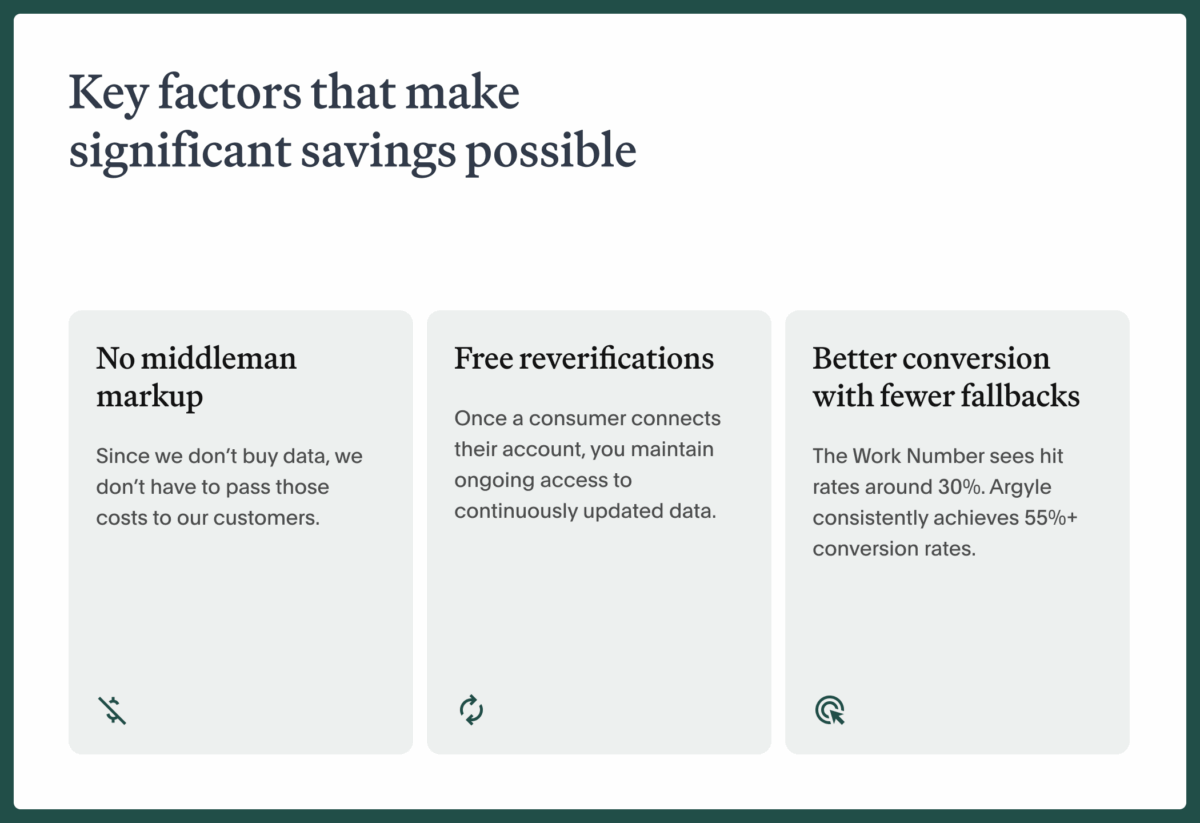

Whether you’re a lender, tenant screener, background check provider, or government benefit administrator, you can save up to 80-90% on verifications through Argyle compared to The Work Number. Three factors make such significant savings possible:

- No middleman markup. Since we don’t buy data, we don’t have to pass those costs to our customers.

- Free reverifications. Once a consumer connects their account, you maintain ongoing access to continuously updated data. For organizations that need to reverify frequently, like mortgage lenders and benefits administrators, this alone can save hundreds of thousands of dollars annually.

- Better conversion means fewer fallbacks. The Work Number sees hit rates around 30%. Argyle consistently achieves 55%+ conversion rates. Higher success rates mean fewer expensive manual verifications and less time spent chasing documentation.

These savings flow directly to your bottom line or can be reinvested in better technology, faster service, or expanded operations.

Better coverage

Beyond cost savings, Argyle delivers meaningfully broader coverage of the U.S. workforce, which translates to fewer failed verifications and less manual work for your team.

The Work Number’s database model inherently limits who it can cover. Because it relies on employers and payroll providers selling data into its system, coverage gaps are inevitable. Workers whose employers haven’t partnered with Equifax simply don’t appear in the database. This creates systematic blind spots that disproportionately affect certain populations.

Argyle’s direct-connection approach solves this problem. By connecting directly to payroll systems and platforms with consumer permission, Argyle covers 90% of the U.S. workforce—including populations The Work Number struggles to verify, including federal employees and gig workers.

In turn, Argyle offers more expansive and accurate income transparency, affording lenders and tenant screeners a better understanding of applicant risk and government benefit administrators a more accurate picture of income eligibility and work requirements. It also means more applicants can be properly verified digitally, without having to rely on manual fallbacks.

A superior experience

Consent-based verification solutions like Argyle also lend themselves to superior experiences in two fundamental ways:

First, consumers know exactly what’s happening and actively participate in the process. When someone connects their payroll account through Argyle, they:

- See what data will be shared

- Understand who will receive it and for what purpose

- Control how long access remains active

- Can revoke access at any time

This transparency builds trust. Instead of discovering months later that their employer sold their income data to a credit bureau, consumers make an informed choice.

Second, the Argyle process is also faster and easier. No hunting for paystubs, waiting for HR to respond to verification requests, or uploading documents. Just a few clicks to connect their payroll account, and verification happens automatically. For consumers, this means:

- Loan applications that move forward without documentation delays

- Rental applications that don’t require printing and manually scanning months of paystubs

- Benefit applications that process more quickly with less back-and-forth

- Background checks that can be completed without employer phone calls

And in competitive markets like lending and tenant and background screening, a smoother verification process can mean fewer customer dropoffs and churns.

Additional benefits

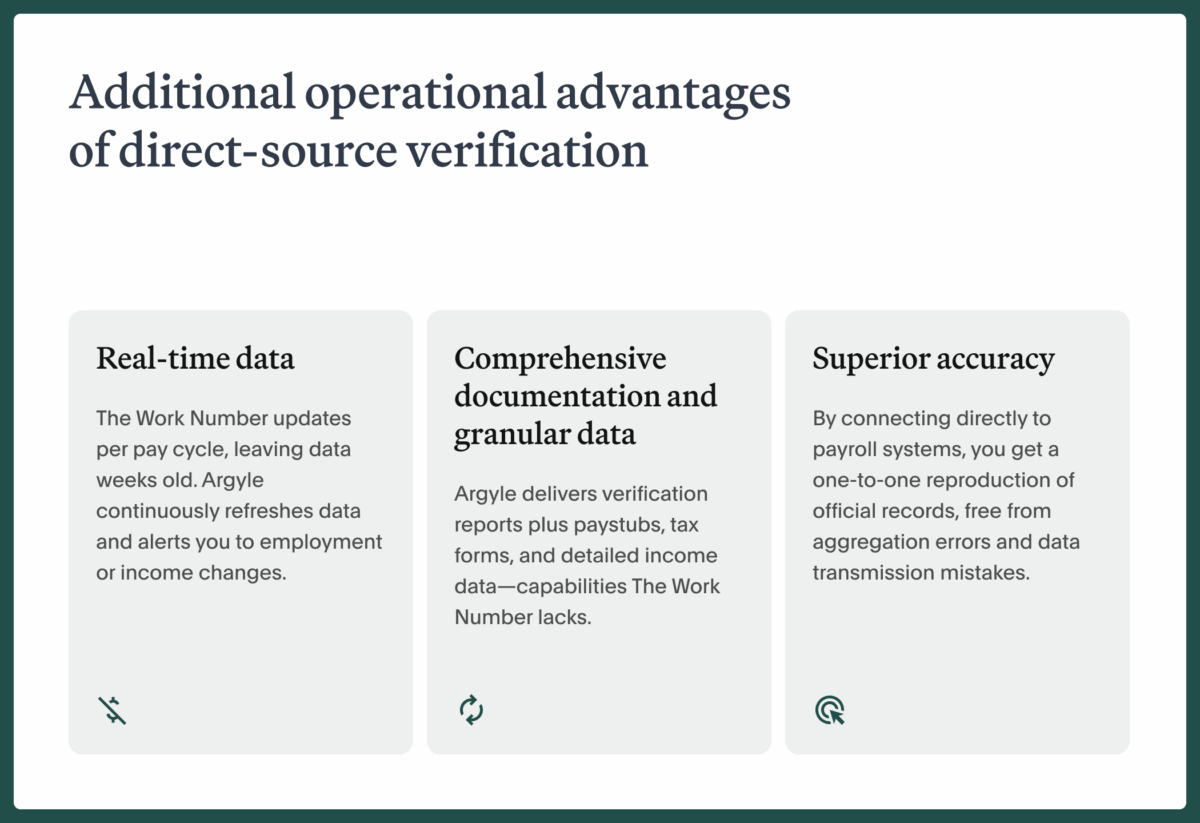

Direct-source, consumer-permissioned verification models like Argyle also deliver additional operational advantages:

- Real-time data. The Work Number updates data every pay cycle, meaning information could be weeks old. Argyle provides continuously refreshed data with automatic alerts when employment or income status changes. You’re never making decisions based on outdated information.

- Comprehensive documentation and granular data. In addition to delivering verification reports, Argyle automatically retrieves paystubs, W-2s, 1099s, and dozens of fields of data—from job titles and hire dates to detailed gross-pay breakdowns including base pay, bonuses, and commissions. The Work Number can’t say the same.

- Superior accuracy. By connecting directly to payroll systems, you get a one-to-one reproduction of official records, free from aggregation errors and data transmission mistakes.

What this means for your organization

If you’re a lender, you can reduce the amount of money it takes to produce a loan while closing loans faster. As an approved Fannie Mae and Freddie Mac vendor, Argyle also helps mortgage lenders meet GSE requirements without the premium pricing of legacy databases.

If you’re a government agency, you can manage rising caseloads and new work requirements without proportional cost increases. Save on verifications while delivering a more dignified applicant experience and maintaining strict accuracy standards.

If you’re a tenant screener, you can combat the rental fraud crisis (which costs property owners an average of $4.2 million annually) while reducing per-application costs and accelerating lease-ups.

You have a choice

The Work Number has been the default verification provider for decades. But there are other options that cost less, cover more of the workforce, and respect consumer privacy.

If you’re ready to explore what direct-source verification could mean for your organization—both in terms of cost savings and improved experience—reach out to our team. We’ll show you exactly how much you could save and how quickly you could implement a better solution.