Improve your portfolio performance with deeper insights into borrowers’ income and employment.

Recent data shows delinquency rates are increasing across some lending categories. According to the Mortgage Bankers Association, for instance, the delinquency rate among all mortgage loans reached 4.04% in Q1 2025, up 6 basis points from the previous quarter and 10 basis points year-over-year.

On the bright side, unsecured personal loan delinquencies were down in the beginning of 2025 compared to the same time last year. But U.S. macroeconomic factors, including the likelihood of subpar economic growth, persistent inflationary pressures, and higher consumer debt, could mean a reversal of this positive trend in the coming months.

The good news? Direct-source income and employment verification solutions via payroll connections are making it easier to identify borrowers’ ability to meet their financial obligations.

The problem with other verification methods

The more you know about a borrower upfront, the better. And increasingly, lenders are finding that tapping into direct-source, consumer-permissioned income, employment verifications via payroll connections does just that. They get a much fuller and more reliable picture of potential borrowers’ creditworthiness than verification databases like The Work Number or a borrower’s banking data alone can offer.

The reason is two-fold:

- Data accuracy—Verification databases suffer from a latency problem. Because they obtain income and employment data from payroll companies and employers in the form of static data transfers, the data they report on is often weeks old or more by the time a lender buys a report. This can cause lenders to be unaware of more recent job or income status changes, resulting in erroneous credit approvals that put the loan at increased risk of delinquency and default.

2. Data completeness—If a lender is relying on banking data alone to verify income and employment, then they are missing out on key data points that allow for an accurate calculation of debt-to-income ratio, including gross income. They could also be missing important income sources. Many gig platforms, for example, pay out earnings directly to debit cards, bypassing borrowers’ bank accounts altogether. And with 62% of U.S. adults engaging in some form of gig work, it’s not an income source lenders can afford to ignore.

Invest in better verifications for better underwriting

The alternative—direct-source income and employment verifications via payroll connections—remedies both issues.

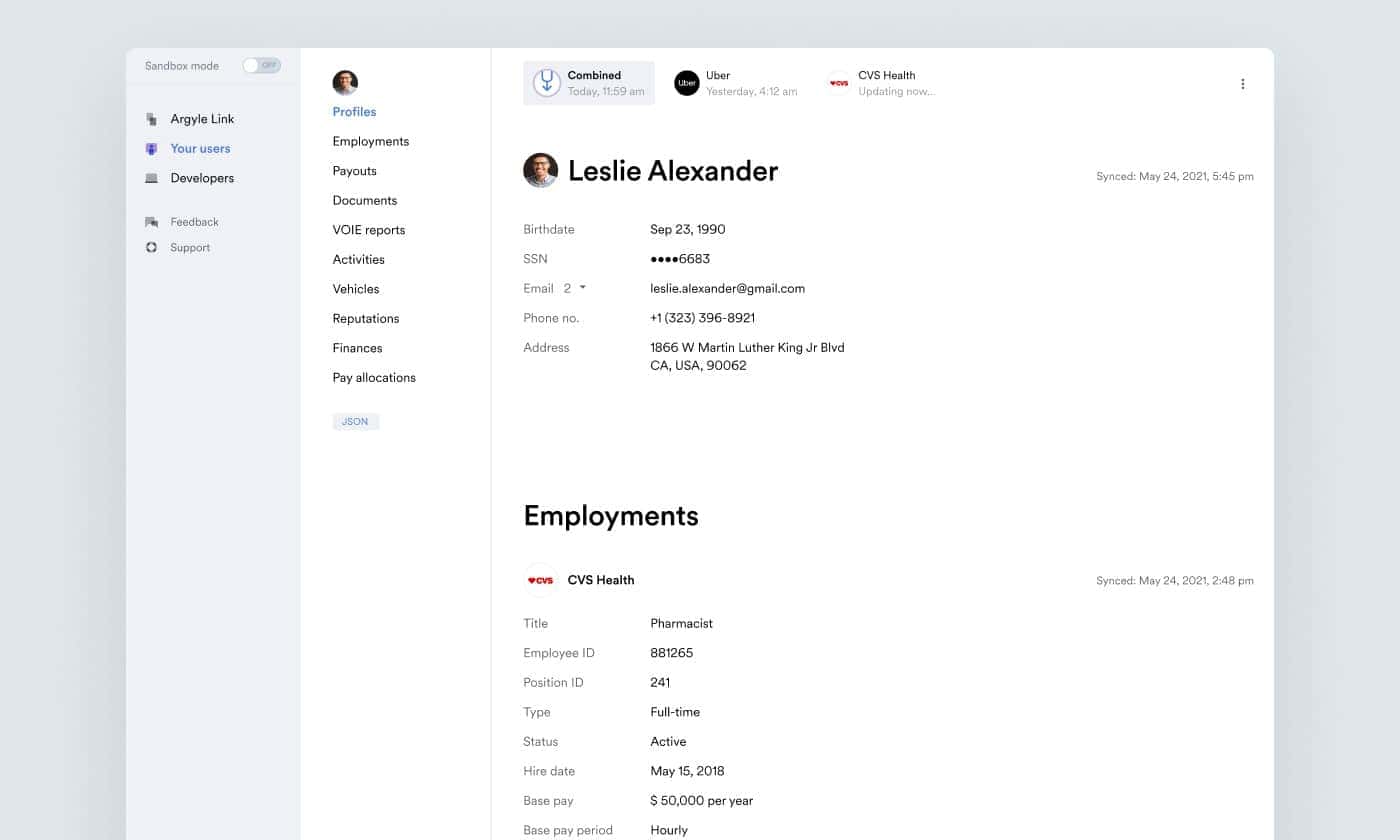

By tapping into borrowers’ income and employment data in real time, directly from the source of truth (i.e., borrowers’ payroll accounts, both traditional and gig), lenders can be confident that they are running verifications on the most accurate and complete dataset possible. There’s no middleman and effectively no time lag, ensuring lenders don’t have to guess gross income, worry that a borrower has recently lost their job, or wonder if they failed to take into account important income sources.

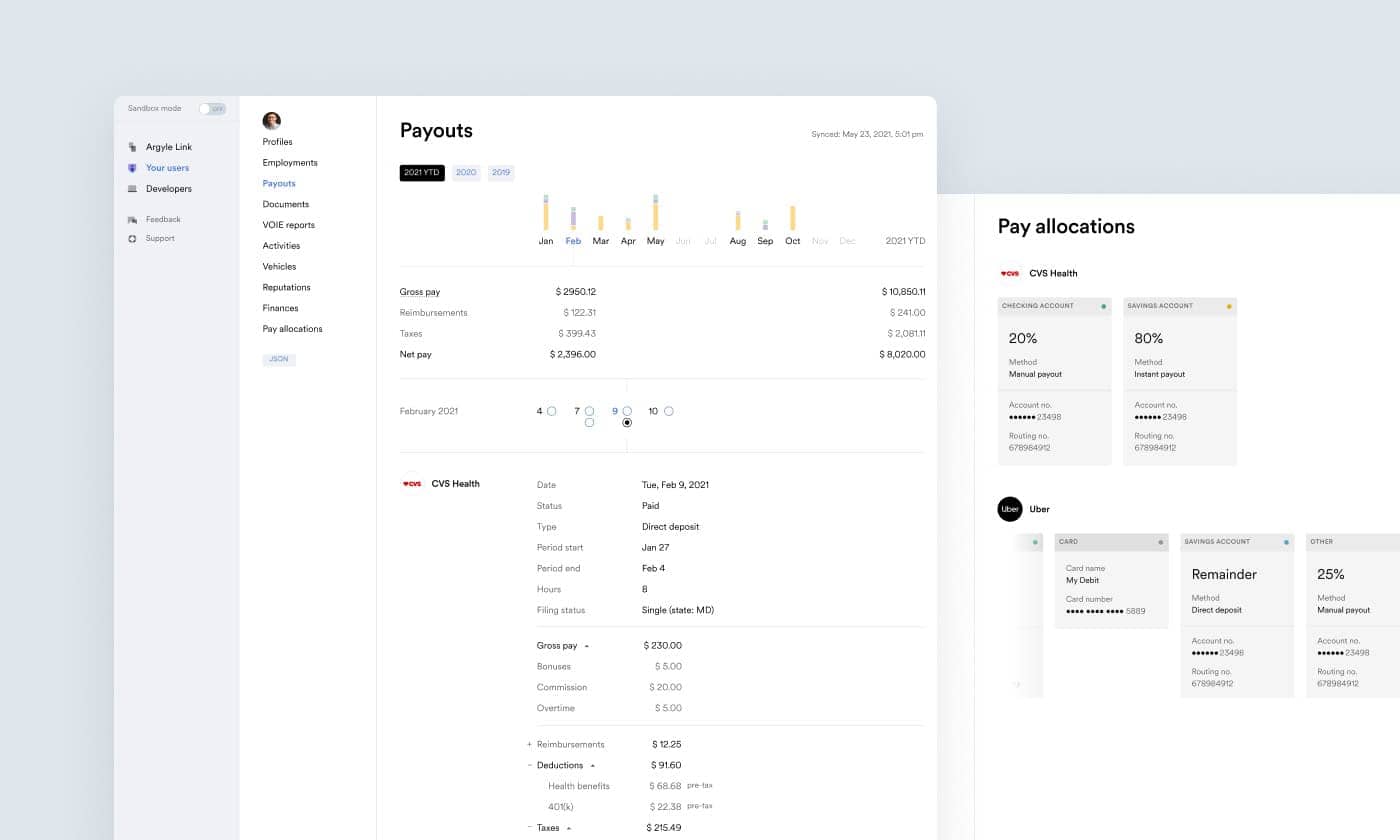

Payroll-based, direct-source VOIE solutions work by enabling borrowers to connect lenders to their payroll systems of record. Borrowers simply select their employer, gig platform, or payroll provider from our vast network and enter the same credentials they use regularly at work to log in to their account.

From there, lenders get continuous access to real-time, verified employment data straight from the source, live notifications any time there’s a significant event, like if a borrower gets a new job or experiences a change in pay.

In many cases, that means lower overall risk—not to mention a frictionless onboarding experience that allows everyone involved to avoid paper paystubs, paystub uploads, and manual data entry.

Key takeaways

In 2025, lenders can’t know what shifts and surprises lie in store for our economy. But they can get a handle on delinquency risk by switching to a smart, direct-source verification solution that provides a sounder assessment of borrowers’ ability to repay.

Ready to lower your delinquency risk?

Argyle is the leading provider of direct-source, payroll-based VOIE, and our team is always on hand to help you learn more. Reach out to schedule a consultation.