Forward-looking credit unions are using direct-source verifications and real-time income and employment data to cut costs, save time, and enhance their member experience.

Credit unions face unique challenges as they strive to fulfill their member-first mission in today’s competitive financial services market. The rise of digital-native fintechs, growing consumer expectations for seamless online experiences, and surging operational costs are pushing many to rethink the way they approach critical processes like income and employment verifications.

At the heart of these obstacles sits an opportunity. By automating verification workflows and leveraging real-time, direct-source data through platforms like Argyle, credit unions can enhance their member experience while also streamlining operations.

The credit union verification dilemma

Credit unions share a common goal to serve their members with honest value, reliable high-touch support, and trusted advice. But, too often, they believe adopting advanced technologies and automating key parts of their process will rob them of that personal touch. As a result, many still rely on traditional verification methods that introduce friction at crucial moments of the member journey.

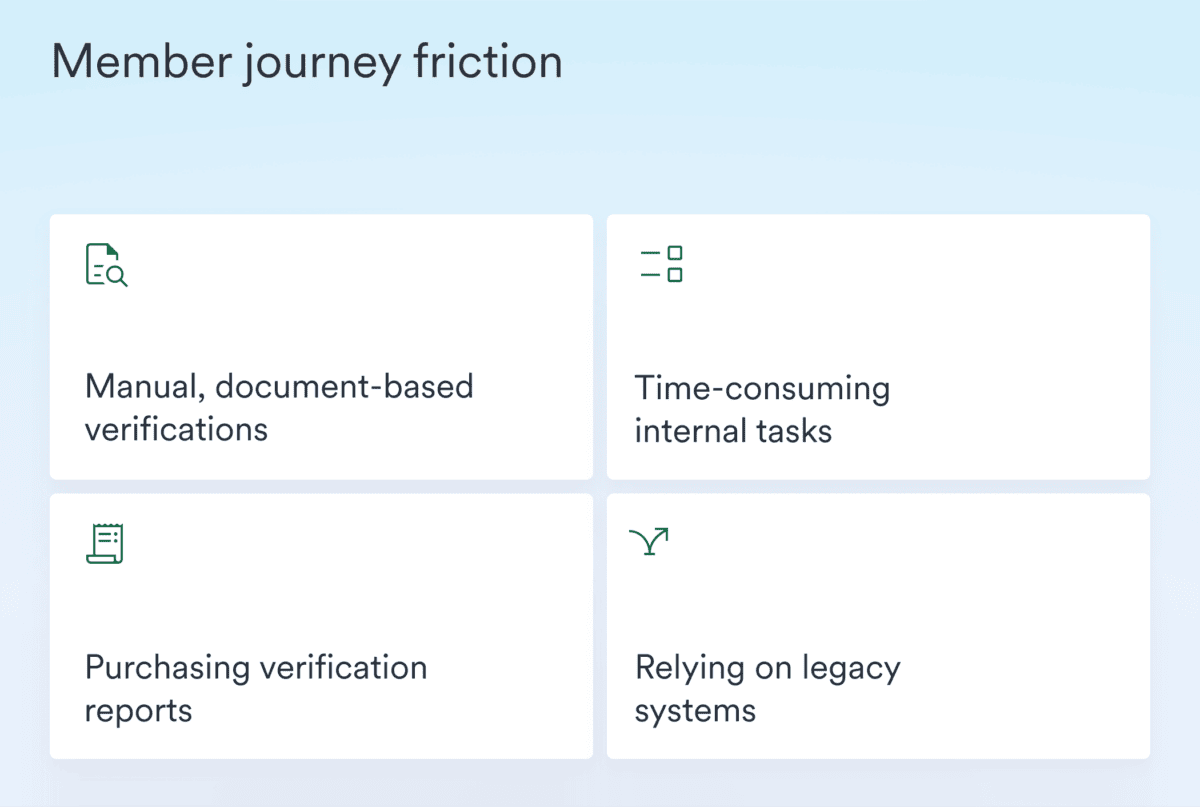

This might look like:

- Manual, document-based verifications that require members to track down, upload, and send paystubs, W-2s, 1099s, and other proof of income documents.

- Time-consuming internal tasks like calling or emailing current and past employers, which can delay application approvals by days or weeks.

- Purchasing verification reports from expensive third-party services and databases that drive up costs without necessarily improving the member experience.

- Relying on legacy systems that require lending teams to painstakingly transfer data to and from their loan origination system (LOS).

Rethinking the verification process with direct-source data

To address these pain points, innovative credit unions are turning to direct-source, consumer-permissioned verification solutions that connect them directly to members’ employer or payroll provider accounts. This creates a fundamentally smoother lending experience by removing obstacles at critical touchpoints.

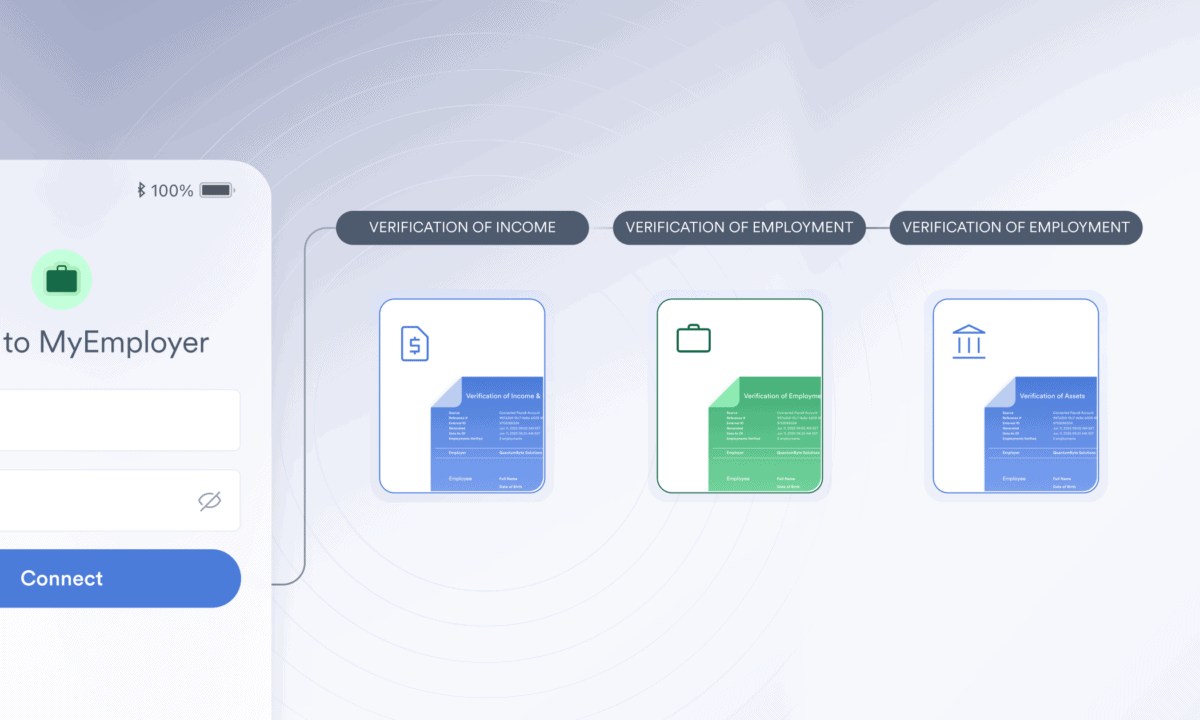

With Argyle, for instance, members simply select their employer or payroll provider from Argyle’s data network and log in using the same credentials they enter any time they check their work hours or review their paychecks. Instantly, their credit unions get ongoing access to real-time income and employment data, essential documents, and GSE-authorized verification reports.

Argyle’s direct-source payroll connections allow credit union members to:

- Connect lending teams directly to their existing payroll accounts instead of having to hunt down and submit proof-of-income documents.

- Share data seamlessly and continuously without having to manually scan and upload files at multiple points in the lending journey.

- Complete the verification process in seconds instead of having application decisions drag on for days or weeks.

- Enjoy a more modern, digital lending experience that meets and exceeds their expectations.

For credit unions, this is a win-win scenario. Their members enjoy a faster, more convenient process, while their internal team benefits from reduced operational costs, quicker decisioning timelines, and more accurate data that comes straight from the system of record.

Better still, direct-source verifications don’t limit credit unions’ ability to provide hyper-personalized service. They actually augment it.

For example, Argyle’s direct-source verification reports give credit unions deeper financial insights than they get through other sources—including gross-pay income details like base pay, bonuses, and commission rates—that allow them to better understand their members’ financial situations.

Why credit unions choose direct-source verifications

Direct-source verifications processes are perfectly suited to credit unions’ goals and values for three key reasons:

1. Member-first philosophy

Credit unions exist to make their members’ lives easier. Direct-source verifications help them achieve this by removing significant pain points from members’ financial journeys. They do this through:

- Simplified application processes that eliminate paperwork and create a more modern and convenient experience

- Faster, more confident decision-making that allows members to access important funds or close on a home more quickly

- Consumer-permissioned data sharing that builds relationships on trust and transparency

2. Operational efficiencies

Credit unions are expected to keep operational costs low, so they can continue to offer competitive rates and services to their members. Direct-source verifications support this with:

- Reduced manual processes that allow loan officers to refocus time and effort on value-adding activities

- Lower verification costs that save 80% compared to traditional methods, helping credit unions protect their bottom line

- Faster processing times that increase application throughput without prompting staffing needs or augmenting risk

3. Flexible implementation options

Credit unions vary dramatically in size, technical capabilities, and application volumes. Direct-source verification solutions like Argyle offer multiple implementation pathways that can meet them where they are. These include:

- System integrations with popular LOS and POS systems that credit union teams are already using, like ICE Encompass

- A customizable, easy-to-implement API for credit unions with established technical capabilities that want to fully tailor Argyle to their branding and workflows

- A no-code, web-based tool through Argyle Console for credit unions with limited technical resources that need to get up and running right away

This flexibility ensures credit unions of all sizes and stripes can access the benefits of direct-source verifications—and ensure a quick time to value—without major technical hurdles or implementation barriers.

Real results: how credit unions are benefiting today

Credit unions nationwide are already seeing transformative results after partnering with direct-source verification solutions like Argyle.

Here are two prominent examples:

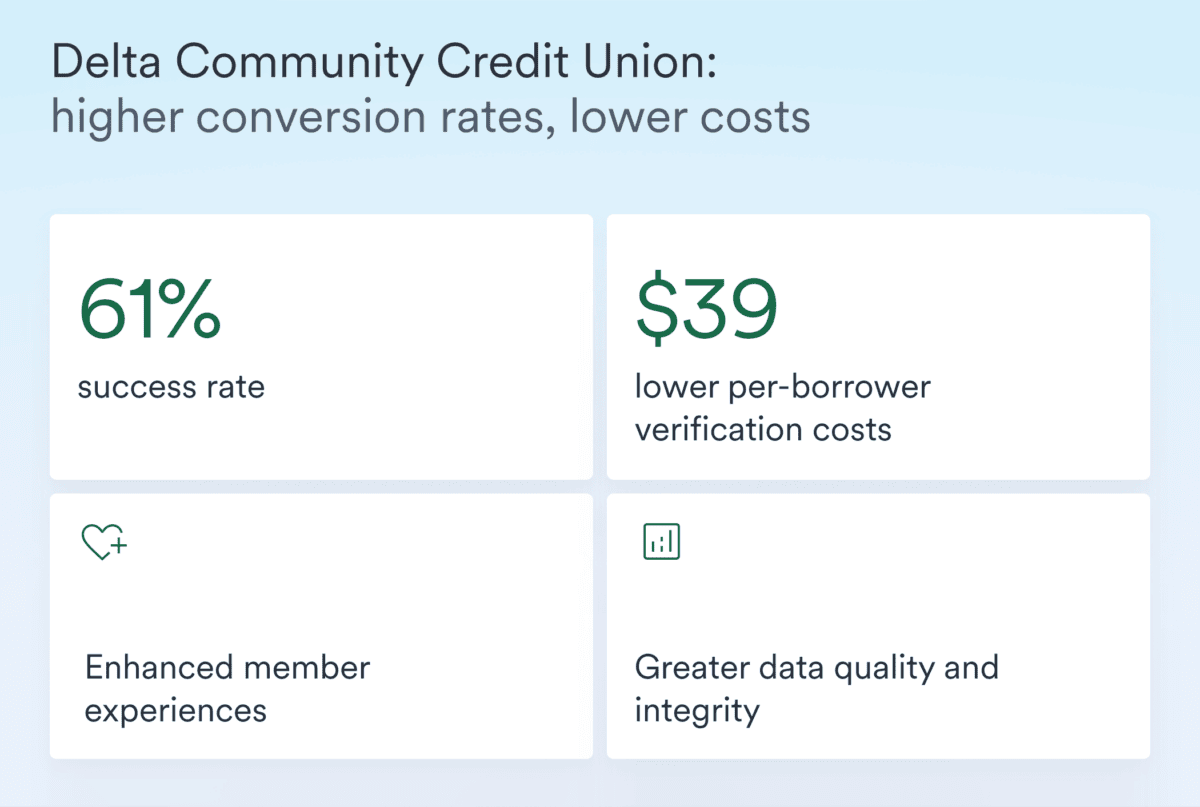

Delta Community Credit Union: higher conversion rates, lower costs

Delta Community Credit Union is Georgia’s largest credit union, with $8.6 billion in assets. Delta Community’s team encountered critical roadblocks when their legacy verification system and report providers couldn’t access key payroll records. The team needed an alternative that could maintain Delta Community’s exceptional member experience while delivering complete and accurate income and employment verifications.

After putting Argyle’s direct payroll connections at the top of its verification waterfall, Delta Community achieved some remarkable results, including:

- A 61% success rate for complete, fully automated income and employment verifications

- $39 lower per-borrower verification costs in the first four months of using Argyle

- Enhanced member experiences by eliminating the need to chase down documentation

- Greater data quality and integrity thanks to pulling income and employment details straight from the system of record

“The conversion rates we’re seeing through Argyle are well above the industry standard. Having a more reliable path to the accurate, recent data we need to make informed underwriting decisions empowers our loan team to focus on the member experience—instead of the paper chase, manual data entry, and constant re-checking.” – Kathy Weber, VP of Residential Lending at Delta Community Credit Union

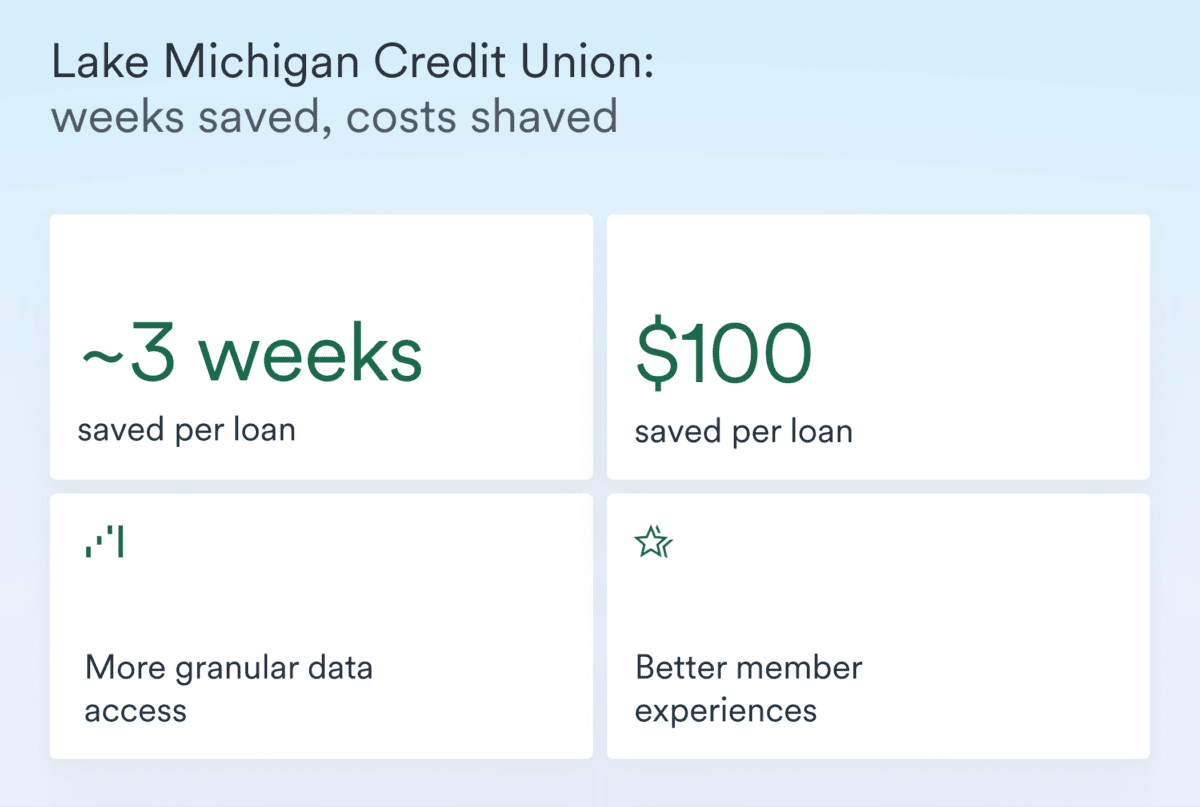

Lake Michigan Credit Union: weeks saved, costs shaved

Lake Michigan Credit Union (LMCU) is Michigan’s leading mortgage provider. Before partnering with Argyle, LMCU’s team was using traditional verification methods that involved manually collecting documents or purchasing expensive, one-time reports from third-party databases—all of which created delays and inconsistent member experiences. LMCU needed a more powerful, user-friendly solution to address rising verification costs and inefficient processes.

After implementing Argyle’s direct-source verifications, LMCU experienced:

- Up to 3 weeks saved per loan, with verifications that previously took days or weeks to complete now done in under a minute

- $100 saved per loan, leading to $250K total verification cost savings over the course of a year

- More granular data access, including shift-level and gross-pay income details

- Better member experiences through simple, automated verification flows

“Competition is fierce among banks and credit unions. You have to differentiate yourself, and one of the key indicators is speed. Argyle’s cutting-edge technology allows us to improve our turnaround times, so we can close faster, with a better borrower experience, and with fewer gaps late in the process.” – Eric Schlagheck, Director of Mortgage Processing at Lake Michigan Credit Union.

Are direct-source verifications worth the investment?

For credit unions considering a move to direct-source verifications, the fundamental question is whether the benefits justify changing their process. The experiences of Delta Community, LMCU, and other credit unions return a resounding “yes.” They’re seeing:

- Member experience improvements that align with their member-first mission

- Significant cost savings that directly impact operational efficiency and keep member costs down

- Faster loan processing times that create a competitive advantage in key lending categories

- Improved data quality that enhances decision-making and reduces risk

Delta Community’s high conversion rate demonstrates that members are ready and willing to connect their payroll accounts when the process is simple and secure. And the resulting time and cost savings make direct-source verifications not just worth the upfront investment—but an essential tool for any financial institution looking to thrive in today’s tough market.

Key takeaway

By implementing direct-source income and employment verifications, credit unions aren’t just streamlining a single process. They’re taking an important step toward a full digital member experience that maintains their competitive edge while staying true to their core values.

If you want to learn more about how direct-source income and employment verifications can transform your credit union’s operations, get in touch with Argyle’s team—or request a demo to see our platform in action.