Paystubs. You’ve seen them. You’ve used them. You’ve even asked your customers to put up with them. They’re everywhere from loan and mortgage applications to auto lease agreements and apartment screening tools. They’re the (seemingly) unavoidable paystub upload request:

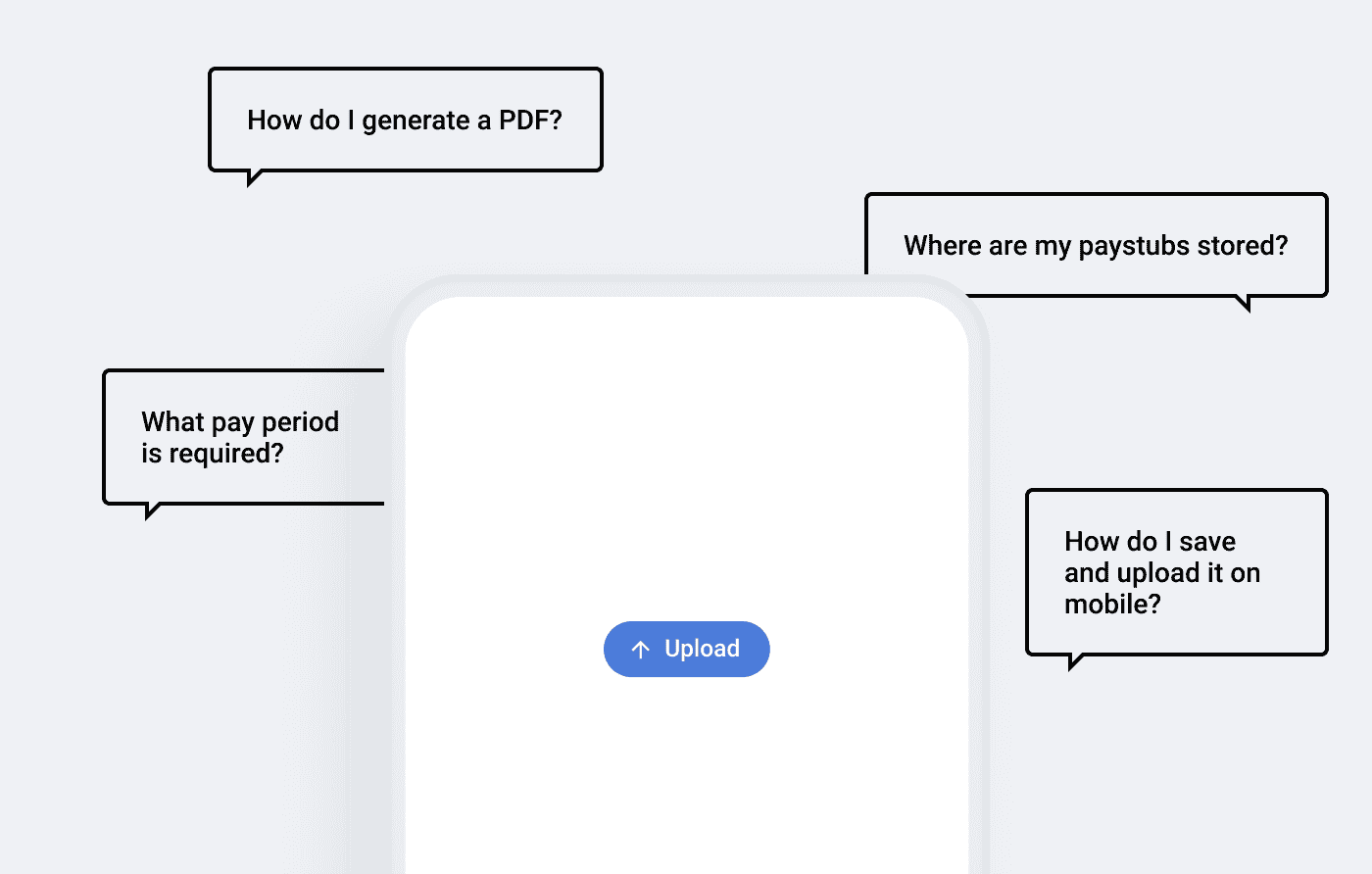

You might think that it’s a simple enough ask. But what if your customers aren’t in the habit of keeping their paystubs for weeks or months on end? Do they know how to retrieve them digitally? And even if they do manage to track down their paper records, do they have the time and patience to convert them to digital files one by one? And can they do it all from their phone, on the go, which, let’s face it, is how most of your customers live?

Paystubs Are Not That Great

Truth be told, if you’re using paystubs to verify income and employment, you’re probably ready to bid them goodbye, you just haven’t been presented with a better solution. You deal in paystubs not because you like them, but because they are less irritating than the alternatives:

You could call customers’ employers (but this is time consuming).

You could ask a third-party verification vendor like Equifax to run reports (but the data is outdated by months, it’s expensive, and there’s something discomforting about companies profiting off of private data customers never consented to share).

You could check customers’ bank transactions (but that doesn’t provide the level of detail you need).

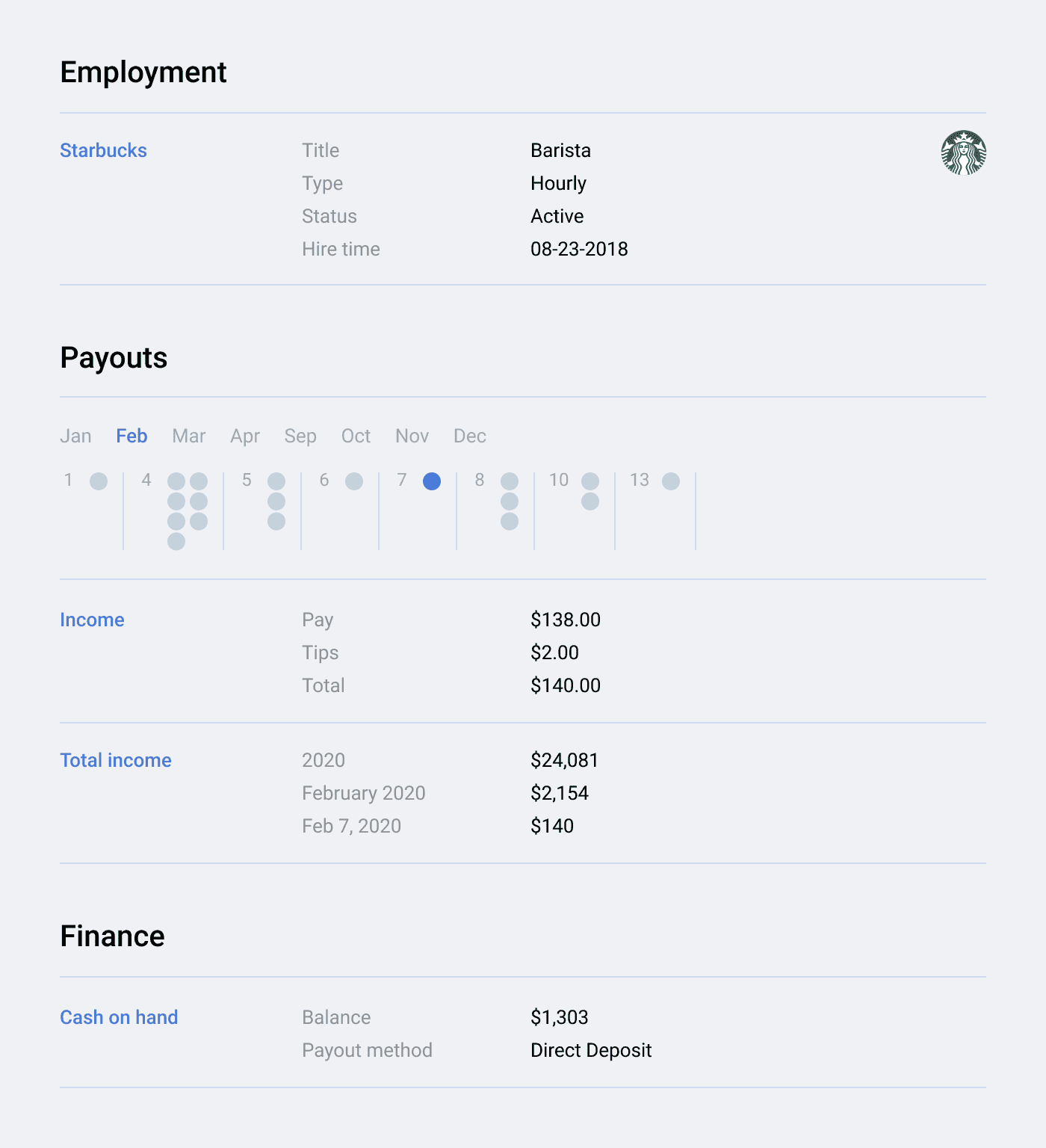

Asking for paystubs is your go-to, because it’s relatively inexpensive and rich with information; gross earnings, taxes, deductions, job title, address, health care contributions, length of employment, and net pay are prized possessions in your world.

But paystubs pose big problems, too. For one, customer experience suffers. Whether you are using paystubs to onboard customers or as part of a lending or rental application, you’re likely experiencing a dramatic drop off in completion rates.

Why? Well, let’s break it down. You’re asking your customers to log in to their employer’s payroll service provider, download their paystub files, and then upload them to whatever system you’re using. That’s a lot of effort, and payroll service providers intentionally make it difficult. It can take 16 clicks to download paystubs through an ADP account, and that’s when you know exactly what you’re looking for and how to get there. Overall, it’s a clunky, time consuming, and unfriendly process.

After that, the work is still not over, it just transfers back to you. After all, some combination of software and human intervention has to read the uploaded files and evaluate for fraud, accuracy, and eligibility.

All this to verify income. Everyone’s time is wasted. You’re saddled with low conversion rates, bloated marketing costs, and unneeded administrative tasks. At the same time, your customers have to perform a lot of unnecessary manual work, leaving them with a negative impression of your business.

There’s finally a better way. Meet Argyle.

Better Data, Better Risk Decisions

Think of Argyle as your gateway to better business decisions through employment data. We’re a technology interface that fetches the valuable consumer information you need to make smarter risk assessments.

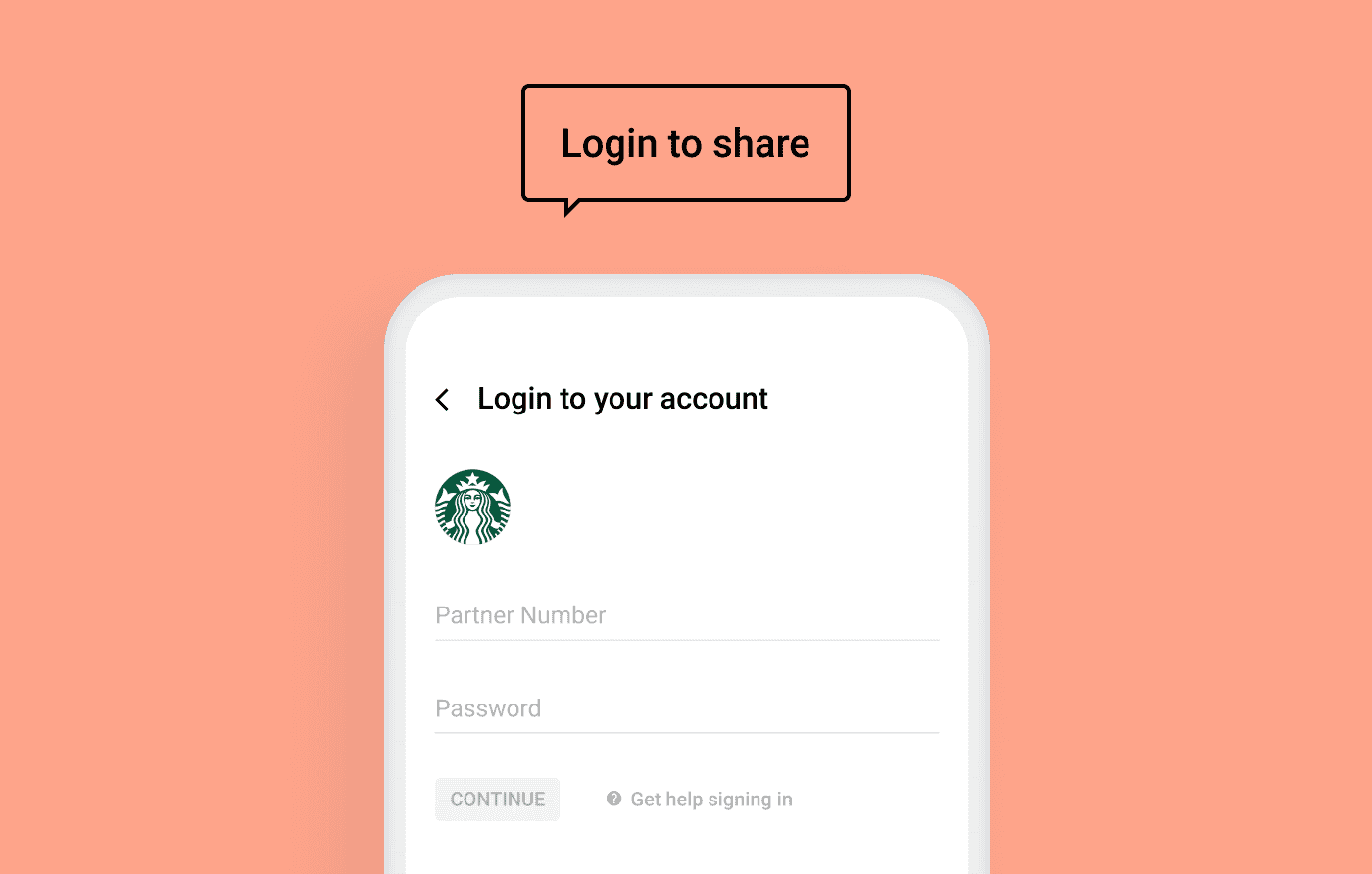

With Argyle, you can replace analog “upload a PDF” buttons with a much more convenient “select your income source” menu. From there, customers simply search for their employer and credential into the employment account just like they would at work. Our secure technology takes over from there, transferring the income and employment data you need and sending it to you in a matter of seconds. We can even store the information for you, lessening your liability.

It’s a small adjustment that profoundly alters both your business and your relationship with your customers. Here’s what happens when a business like yours uses Argyle to verify income and employment:

16+ clicks fall to 3—no switching between tabs, windows, or applications required.

The customer experience improves, cutting drop-off rates by at least 50%.

As more consumers complete applications, your conversion rates increase and your marketing costs decrease.

Fraud and KYC/AML costs come down. Because there is no federal mandate for paystub generation, paystubs are highly susceptible to tampering. Removing paystubs from your on-boarding or application process eliminates the risk that the data set has been tampered with.

Tedious manual admin tasks like paystub review and authentication become a thing of the past.

Real-time data sets become the standard. Instead of relying on information that was true two weeks ago, you are given access to consumers’ up-to-the-second employment records, ensuring you are making risk decisions based on the most sanitized, reliable data possible.

To cap it all off, you’ll feel better and rest easier knowing that you’re working with 100% consent-based data that’s delivered and stored to the highest security standards.

In short, Argyle is killing the paystub upload button once and for all and making income and employment verification faster, friendlier, and unimpeachable in the process.

Shmulik Fishman CEO and Founder