Only about half of all financial institutions have digitized their loan origination process from end to end—leaving lenders and borrowers to do the rest by hand.

In a recent article, we shared how borrowers are increasingly demanding flexible lending experiences that span multiple channels—including both human and digital touchpoints.

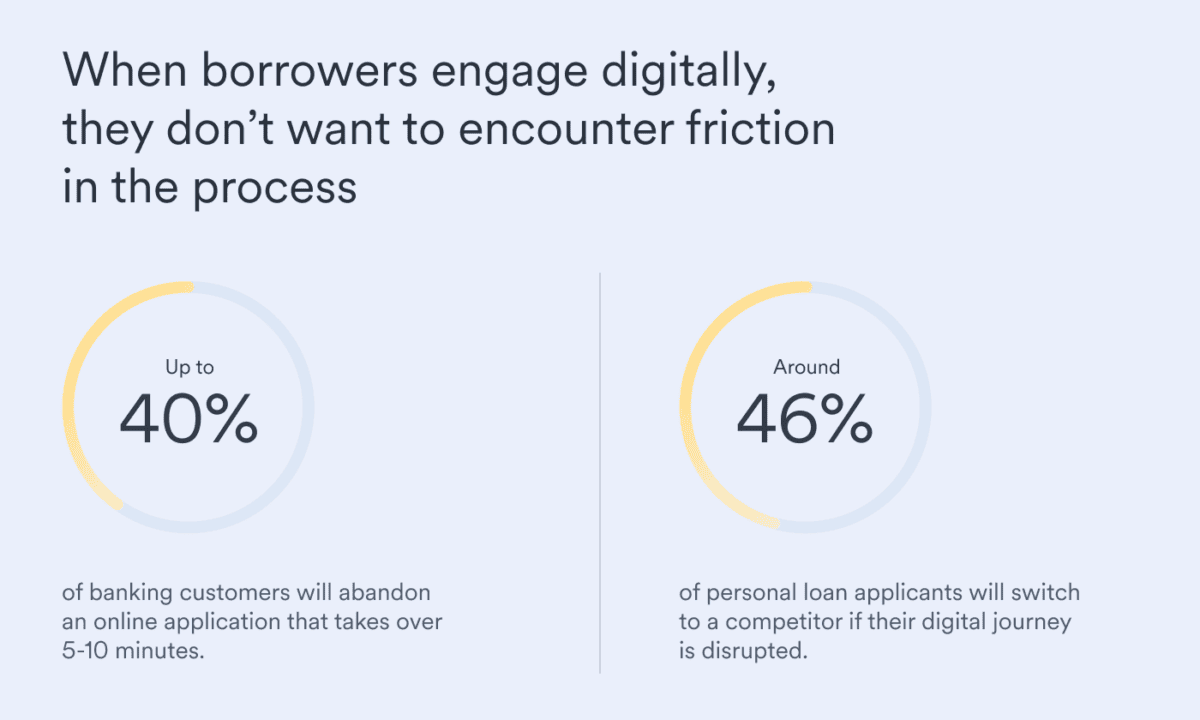

But when borrowers do engage digitally, they don’t want to encounter friction or delays partway through the process. In fact, one survey revealed that up to 40% of banking customers abandon online applications that take over five minutes (for mobile) or ten minutes (for desktop) to complete. Another found that 46% of personal loan applicants who applied online through their primary bank had their digital journey disrupted—by being required to phone a call center, visit a branch, or scan and send physical documentation—and ended up closing with a competitor instead.

Conversely, there is overwhelming evidence that a fast, fully digital application process leads to greater borrower satisfaction and reduces the likelihood of churn. Unfortunately, many lenders are still falling short.

While 90% of financial institutions currently offer digital loan applications, only around 57% are able to manage the entire application process online. In many cases, technology is only applied intermittently—with key tasks like submitting and processing financial documents or verifying income and employment being carried out by hand.

The main message? If lenders want to convert borrowers looking for frictionless financial experiences, they need to invest in solutions that automate loan originations from end to end—starting with highly manual verification of income and employment (VOIE) tasks.

Continued borrower friction in the origination process

Completing a loan application can sap a lot of borrowers’ time and energy, especially when it comes to verifying their financial details.

Not only do they have to provide exhaustive information about their assets, credit history, income, and employment status, they typically also have to track down and submit required financial documents (like paystubs and W-2s) that back up their claims. And they often have to submit updated documents again before closing.

That’s because, historically, lenders haven’t had access to optimized income and employment verification tools—let alone automated ones.

For example, lenders might purchase a VOIE report from a database like The Work Number (TWN) so they don’t have to call a borrower’s employer(s) to confirm key data points. But TWN doesn’t provide access to critical financial documents, which means lenders are still required to collect and process paystubs, W-2s, and other documents by hand. Plus, they need to manually intervene and engage in lengthy back-and-forths if a VOIE report is incomplete or incorrect.

That not only perpetuates friction for borrowers, it drags out the whole approval process—leaving many borrowers to look for a better, faster solution elsewhere.

Lenders lose out, too

Without a fully automated verification solution, lenders don’t just spoil their borrower experience and potentially drive good business away. They also run into operational hurdles that can hinder productivity and negatively impact their bottom line.

Among other challenges, these include:

- Operational inefficiencies

Gathering financial documents and transferring the data by hand can extend lending decisions by weeks or even months. It also drains countless hours into busywork that lenders could better spend on business growth and innovation.

- High costs

In addition to increased labor expenses, lenders typically have to pay for one-time VOIE reports from TWN or other databases to verify borrowers’ income and employment—and then pay again for updated reports prior to closing. These fees quickly add up at scale.

- Limited insights

With just a partial, static view of income and employment data, lenders have trouble understanding their borrowers’ finances—making it difficult not only to make informed loan decisions but also to identify opportunities to upsell and cross-sell relevant services.

- Elevated risk

Without a dependable, single source of truth for borrowers’ income and employment, lenders can unknowingly approve bad loans or bad actors, exposing their business to higher rates of delinquency and fraud.

Automating verifications helps streamline the process

To automate these critical income and employment verification processes, lenders can turn to tech-forward solutions like Argyle.

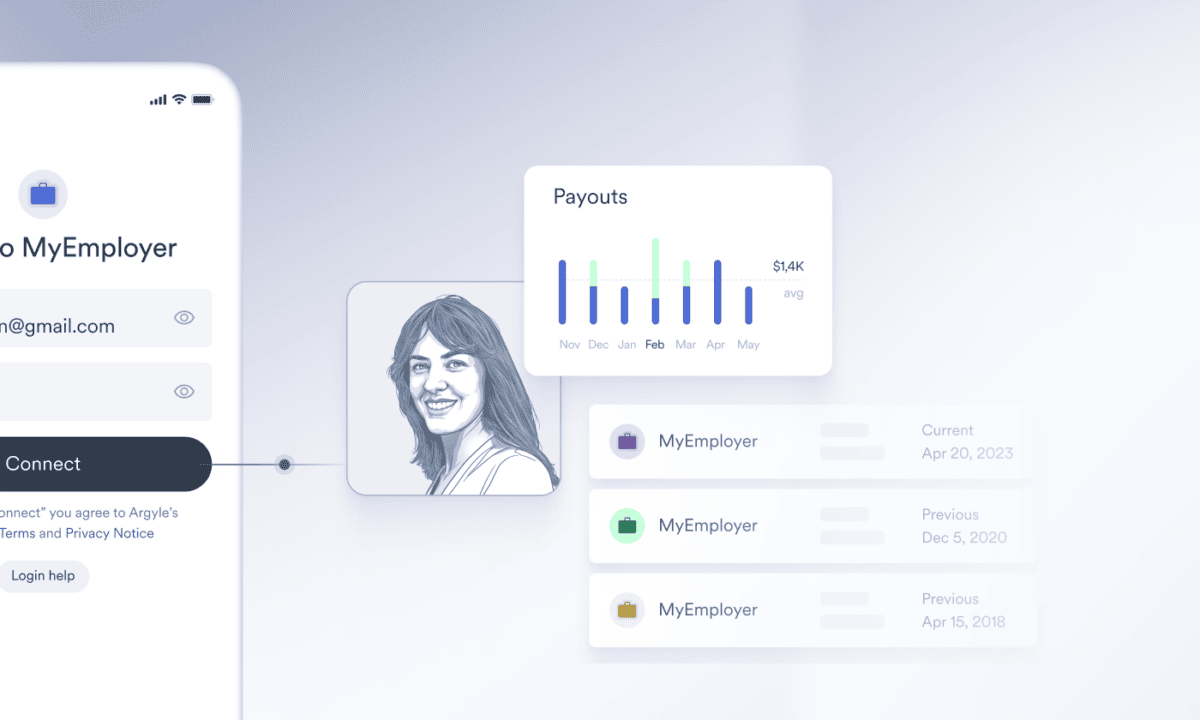

With Argyle, borrowers connect directly to their employer or payroll provider account, so lenders can pull accurate data in real time from the system of record.

For borrowers, the experience is simple: They select their employer or payroll provider from Argyle’s broad data network and log in using the same credentials they input any time they view their paychecks or request time off. That’s it.

From that one connection, lenders get ongoing access to VOIE reports with granular insights into the borrower’s earnings—including granular details like bonuses, commissions, and withholdings—plus required financial documents like paystubs and W-2s.

Argyle’s data is continuously refreshed, meaning the information lenders get is always up to date. And Argyle’s platform integrates with common point-of-sale (POS) and loan origination systems (LOS), so lenders can use it in conjunction with familiar software.

In the rare event a borrower can’t connect programmatically and has to upload documents instead, Argyle allows them to do so instantly and without leaving the lenders’ app—using an effortless Document Upload tool with optical character recognition (OCR) capabilities. This reduces friction and drop-off to a minimum. In short, automating the verification process through a digital platform like Argyle helps streamline the entire loan origination process—so neither borrowers nor lenders face manual hurdles that could stand in the way of success.

How does it work in practice? Argyle’s partners at OneBlinc used our automated Income & Employment Verification solution to simplify loan originations for low-income federal workers. By streamlining their application and underwriting processes with Argyle, OneBlinc reduced borrower application times from 20 hours to 10 minutes—and they saved lenders at least 1,000 hours of busywork each month.

What can a fully automated loan origination process do for your business?

Reach out to Argyle’s expert team to set up a call, and learn how our Income & Employment Verification solution can take your operations to the next level.