Verification of income and employment is one of the most taxing processes of originating a new mortgage—but it doesn’t have to be that way.

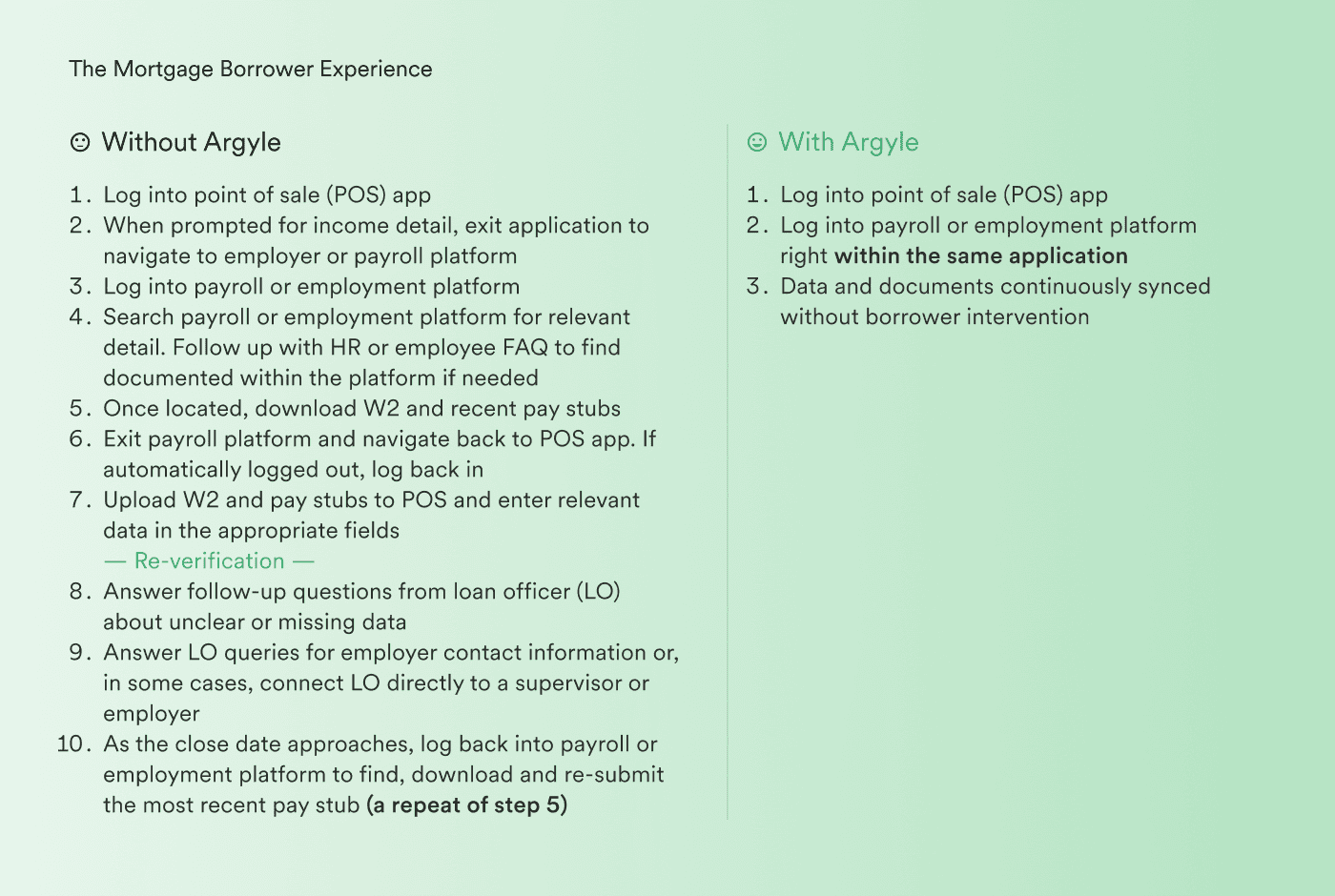

When it comes to mortgage lending, standard income and employment verification processes ask borrowers to complete a number of manual, inconvenient tasks that increase friction and lower conversion. Over the course of the loan cycle, this includes requiring borrowers to:

Enter details related to their income and employment history. This can constitute dozens of fields, much of which they may have to recall from memory.

Locate and upload a backlog of W-2s and paystubs.

Confirm employment details and employer contact information plus correct any missing or inaccurate information.

Do it all again near closing.

Meanwhile, for the loan officers and processors involved, coordinating these steps and chasing down this information requires a lot of time and back-and-forth—all of which adds time and cost to the loan process. And if borrowers have gig, freelance, or other non-traditional income streams, this process is even more difficult and time-consuming.

A better borrower lending experience is possible with Argyle

With Argyle, lenders can fully automate both income and employment verifications and paystub and tax form retrievals. What’s more, Argyle covers the widest range of income sources, from traditional employment to gig work to federal benefits, ensuring even the most complex loan files are eligible for a seamless VOIE process. The result is a low-friction borrowing experience that eliminates manual touchpoints, accelerates loan cycles, reinforces compliance, and reduces costs.

But that’s not all. Argyle also makes possible next-generation digital experiences that will allow lenders to remain not just viable but vital in the years to come. The streaming, granular nature of the data we transfer enables you to build a personalized, end-to-end home-buying experience that takes your customers from pre-approval to refinancing with minimal (if any) interventions from your team.

Faster loan cycles for less money

As a direct-source, consumer-permissioned VOIE solution, Argyle is also leading a paradigm shift in the price of income and employment verifications. Not only do we offer dramatically less expensive initial VOIE reports than The Work Number, we also enable lenders to avoid expensive reverifications. With Argyle, access to a borrower’s income and employment data is continuous, so lenders can generate additional reports at no extra cost.

In addition to direct savings, implementing Argyle also reduces operational costs for lenders via:

Fewer instances of inaccurate or missing data

Fewer borrower touchpoints

Fewer manual reviews and interventions

Efficiency plus relief from reps and warranties

Argyle doesn’t just enable unprecedented verification efficiencies, it can also be used in conjunction with Fannie Mae’s DU validation service, a component of Day 1 Certainty®, and Freddie Mac’s Loan Product Advisor® (LPA℠) asset and income modeler (AIM), to get relief from reps and warranties. In other words, when lenders choose Argyle, they get all the operational advantages of direct-source, consumer-permissioned verifications plus the peace of mind of GSE compliance and a lower buyback risk.

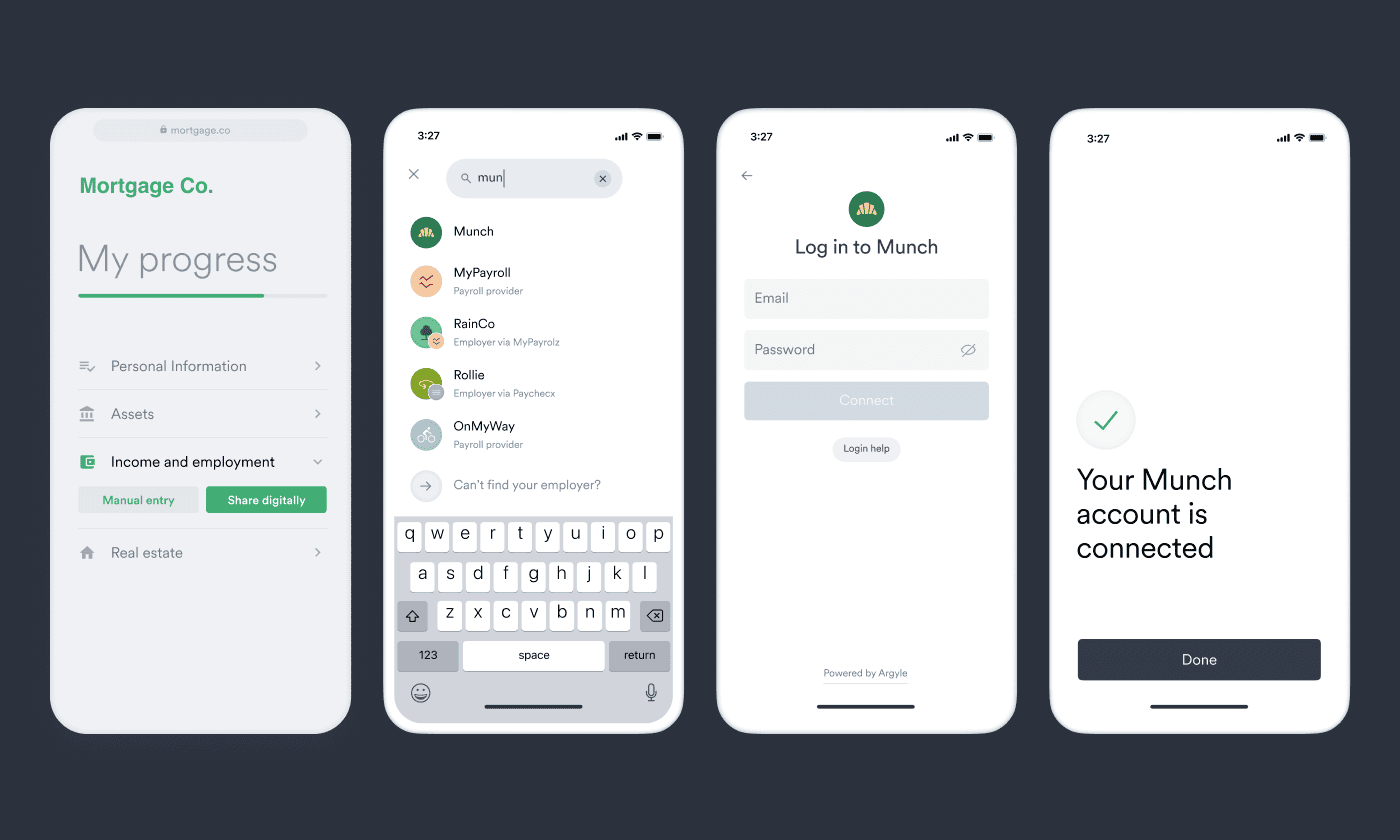

Adding Argyle to your mortgage loan process

You can easily implement Argyle in one of three ways. Most lenders opt for our enhanced POS and LOS integrations that require little change management, enable seamless workflow continuity, and move loan teams and borrowers smoothly from application to closing. Argyle integrates with leading mortgage technology, including nCino, Consumer Connect, Tidalwave, The Big Point of Sale, Floify, Encompass, Empower, and Byte.

Alternatively, some lenders use our API to build a completely customized verification workflow within their website or app or use Argyle Console, our no-code, web-based software. No matter the implementation method, we make it easy to verify borrowers’ income and employment, straight from the source.

Argyle reduces friction

You might think that asking borrowers to log in to their employment and payroll records creates friction. But the reality is, your current income and employment verification process already requires borrowers to log in to their employment or payroll account. They have to every time you ask them to track down a paystub or W-2.

The advantage of Argyle is that they only have to log in once, and we’ve engineered sophisticated UI elements like passwordless and single sign-on options and intelligent routing to ensure it’s a seamless part of their user experience. Once and seamless is always better.

The result? Faster, more affordable, more accurate verifications. Adding Argyle to your application flow offers an immediate improvement to your borrowers’ experience, your internal efficiencies, and your bottom line.

Want to see Argyle in action? Reach out to our team. We’re happy to answer any questions you may have.