Document fraud has never been easier to execute. With most forgeries going undetected, direct-source, consumer-permissioned income and employment verification offers a safer, more reliable alternative to traditional VOIE methods.

Can you distinguish between an authentic paystub and a fake one?

Chances are, you can’t. But you’re not alone. Most people, including professionals trained to assess income documentation, struggle to determine its validity.

Tools for generating fake documents have become increasingly sophisticated, making it harder to identify fraudulent ones. The results are so good at deception that 90% of document fraud is undetectable to the human eye.

The implications are real for any income and employment verification process that still relies on uploaded documents, scanned records, or visual inspection.

Want a deeper look at how document fraud is reshaping VOIE? Download The State of Income & Employment Verifications 2025 for the latest data, industry challenges, and practical strategies to strengthen your verification workflows. Download your free report.

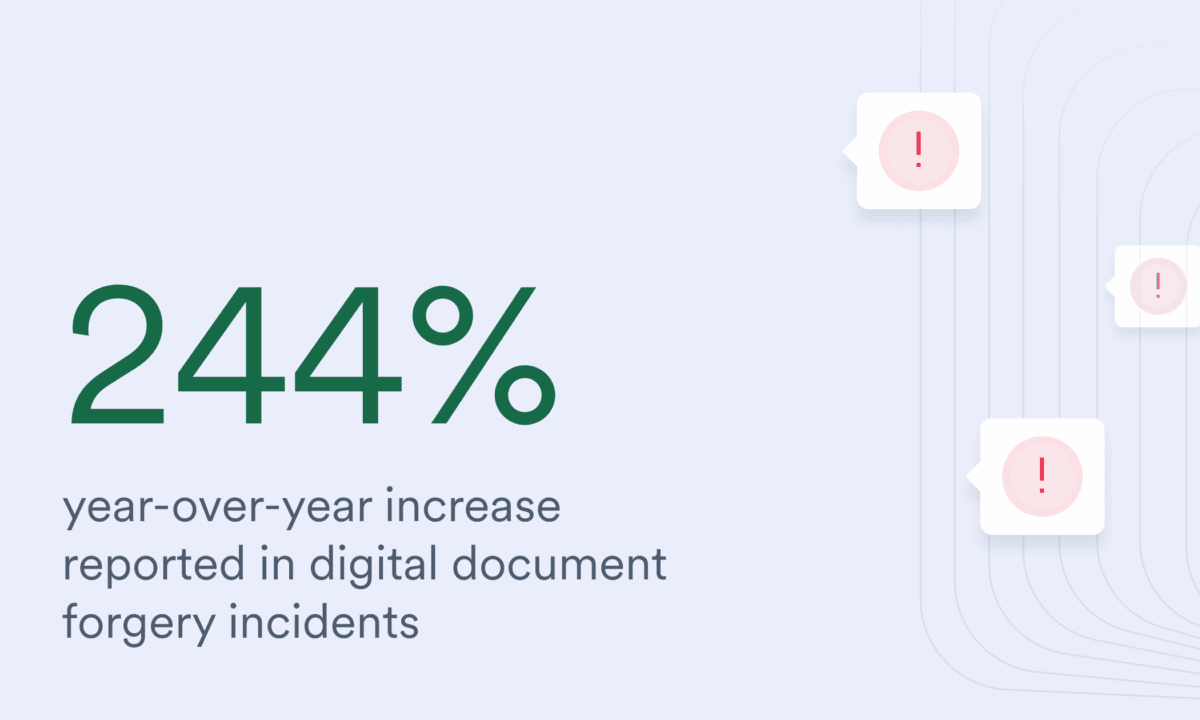

Document fraud is escalating quickly

Digital document forgery has increased significantly, with reported incidents rising 244% year over year.

That surge is driven in part by the usual suspects—bad actors operating in the shadows. But it’s also fueled by greater access. The circulation of editable paystub templates on online marketplaces has risen over 500%, suggesting that manipulation is shifting from the margins to the mainstream.

Income misrepresentation is now the leading type of mortgage fraud found in Fannie Mae investigations. In the rental market, nearly every property manager surveyed (93%) reported encountering attempts at fraud. Most of those attempts involved forged income documents.

It’s no longer just professional fraud rings exploiting weaknesses in the system. Individual consumers are modifying documents to meet income qualification thresholds. The impact is becoming evident.

The cost of insufficient income and employment verification

These forgeries are not theoretical threats. They introduce significant financial risk, operational strain, and regulatory exposure.

- In mortgage lending, delinquency rates are increasing. FHA and VA loans saw pronounced increases.

- Total credit card write-offs reached $46 billion in 2024, the highest in 14 years.

- In tenant screening, each fraudulent application can result in $10,000 to $25,000 in losses due to eviction costs, missed rent, and unit turnover.

- Across industries, institutions bear hidden costs. Research shows that for every $1 lost to fraud, an additional $4.41 is spent on fines, investigations, and remediation.

The risks extend beyond dollars. Teams waste time reviewing flawed documentation, escalating edge cases, and revisiting decisions that should have been settled with reliable data up front.

As a result, fraud becomes both a security issue and an operational issue.

Legacy VOIE can’t handle the current risk environment

Many income and employment verification workflows still rely on manual review of uploaded documents or static database queries. These methods are increasingly ineffective.

AI-generated forgeries are designed to pass visual inspection. Databases may reflect outdated employment records or fail to capture recent changes in job status. Even with compliance checklists and internal controls, these systems cannot match the speed or complexity of today’s fraud tactics.

At a time when forgeries are both easier to produce and harder to detect, the question is no longer whether fraud is getting through; it’s how often it gets through.

Direct-source, consumer-permissioned VOIE is a safer alternative

To reduce exposure, more service providers are turning to direct-source, consumer-permissioned VOIE models. This approach eliminates the need for manually uploaded documentation, instead providing a secure, real-time connection to the consumer’s payroll account.

By removing the consumer as a middleman in the data flow, direct-source VOIE closes off the most common entry point for fraud: the document itself.

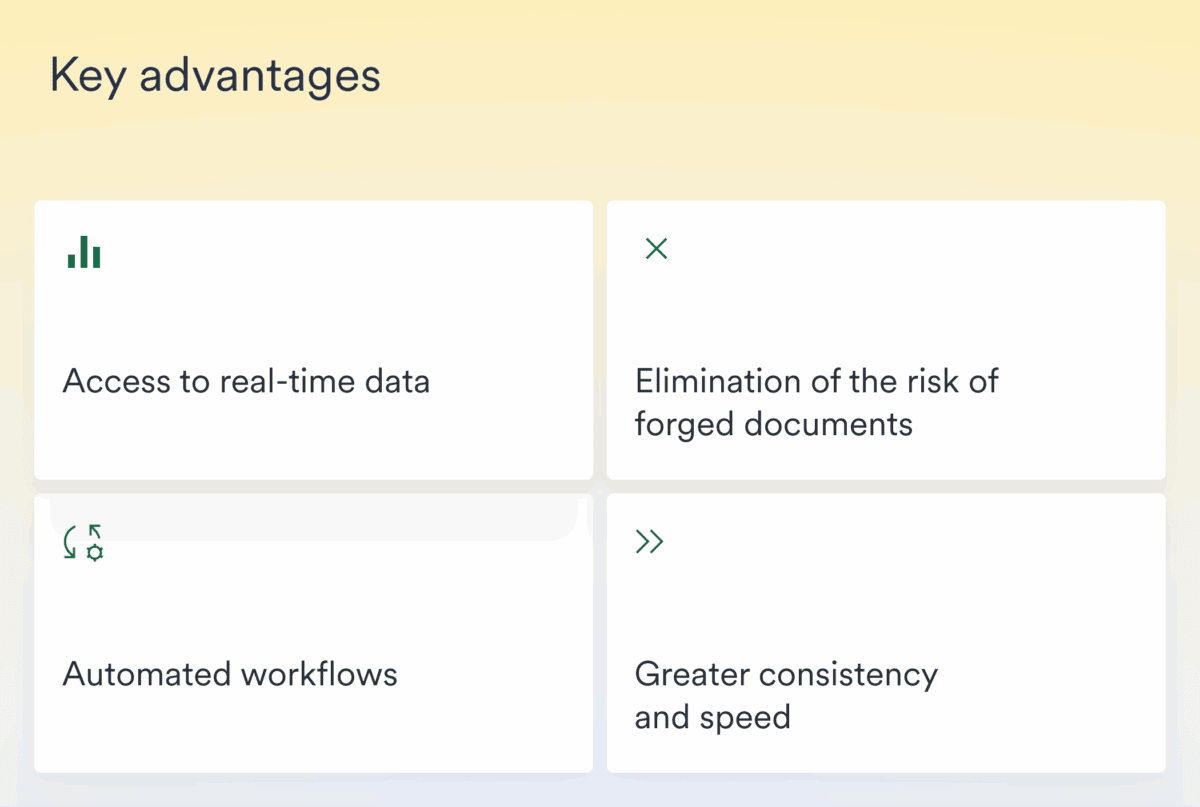

Once the consumer provides permission, the system automatically and securely retrieves verified income and employment data. This offers several key advantages:

- Access to real-time data, directly from payroll systems

- Elimination of the risk of forged documents, since no uploads are required

- Automated workflows, including delivery of paystubs, W-2s, and 1099s without manual intervention

- Greater consistency and speed, reducing processing time and operational overhead

Organizations that have implemented this model report measurable results: Snappt increased application completions by 30% after removing document upload requirements. Byrider identified a job loss in real-time that a legacy provider had missed, and Lake Michigan Credit Union shaved three weeks off its loan processing timelines by verifying income at the point of application.

Moving forward with direct-source VOIE

As document fraud continues to evolve, traditional income and employment verification methods introduce unnecessary risk and are no longer sufficient. The shift toward direct-source models is not simply a response to fraud; It’s an acknowledgment that verification must be both accurate and resilient to manipulation.

Direct-source, consumer-permissioned VOIE provides a safer path forward. Institutions can make faster, more confident decisions using data that reflects a consumer’s actual financial position, not just what appears on a PDF.

Is your income and employment verification process built for today’s fraud landscape?

Contact our team to discover how direct-source VOIE from Argyle can minimize exposure and enhance efficiency by eliminating reliance on inaccurate or outdated documents.