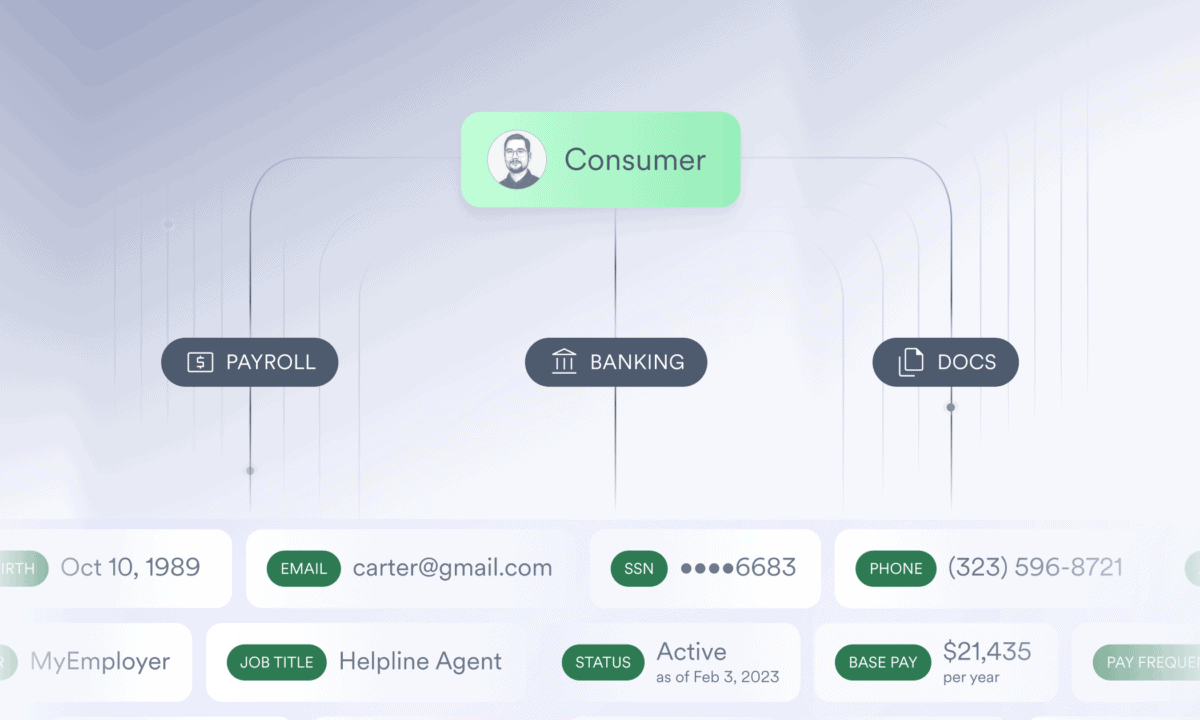

Argyle is excited to announce an expansion of its verification platform with direct-source banking connections powered by Mastercard open finance technology Finicity.

With this launch, Argyle becomes a single-source provider for income, employment, and asset verifications (VOI, VOE, VOAI, and VOA)—giving lenders, tenant screeners, and fintechs the ability to access payroll, banking, and documents through one unified provider.

Verifications are GSE approved for use in automated underwriting and decisioning workflows, giving mortgage lenders the confidence they need with real-time and compliant data.

By consolidating the verification waterfall, Argyle helps teams streamline operations, reduce provider overhead, and qualify more applicants—faster and more cost-effectively.

The Data You Need from A Single Provider

Historically, providers have had to juggle multiple providers and systems to complete the verification waterfall. Now, Argyle customers can streamline operations with data from:

- Real-time, direct-source payroll connections

- Real-time, direct-source banking connections

- Processed, uploaded documents

The result? Faster, more complete insights with fewer handoffs, lower costs, and better borrower experiences.

Built for the Modern Verification Waterfall

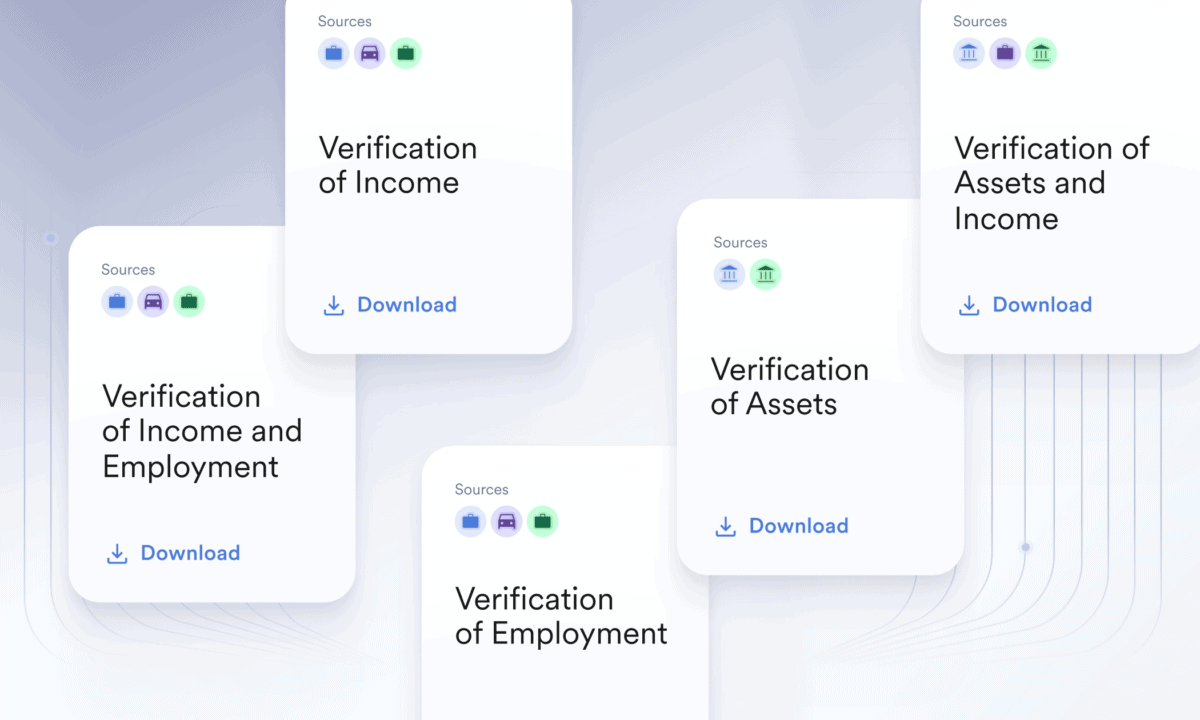

Argyle now supports all the major verification types:

- VOI & VOE: verification of income and employment using payroll data

- VOA: verification of assets using bank transaction data

- VOAI: verification of assets and income using bank transaction data

This waterfall approach can be embedded directly in the point of sale (POS), allowing mortgage lenders to qualify borrowers faster, with GSE-approved verifications generated in seconds.

Deeper Insights. Smarter Approvals. Better Experiences.

With direct access to up to 24 months of transaction history, lenders and tenant screeners can now include investment accounts, rent payment history, and broader cash-flow insights into their decisions—opening doors for first-time homebuyers and credit-invisible applicants.

This expanded view with payroll and bank data enables:

- Streamlined applicant experience

Applicants no longer need to track down documents or repeat verification steps. The embedded, direct-source workflows create a fast and seamless process—reducing friction and improving satisfaction from application to approval.

- More comprehensive approval decisions

Go beyond traditional data points with access to verified income, employment history, transaction-level banking data, and more. This holistic view supports smarter, faster, and more confident credit decisions—especially for nontraditional applicants.

- Enhanced risk and fraud mitigation

Direct-source connections minimize reliance on self-reported or manipulated documents, helping teams detect inconsistencies early, reduce fraud exposure, and strengthen compliance across all verification types.

Centralized Support. Unmatched Service.

From implementation to everyday support, Argyle customers benefit from a single support team across all verification types. Whether it’s payroll, banking, or docs, you’ll work with the same high-performing experts who understand your goals and workflows—no ticket juggling or provider confusion.

“Extending Argyle’s verifications to include direct-source banking data means customers can satisfy every major verification requirement—income, employment and assets—through one streamlined relationship,” said John Hardesty, VP of Mortgage at Argyle. “Lenders gain comprehensive insights into their consumers, maximize their verification waterfall conversion and receive world-class service from a centralized team—getting the support they need from a single, trusted partner.”

Ready to learn more or see it in action?

Streamline your consumer verifications with real-time, direct-source data with Argyle.

Contact our Sales team for a demo to learn more about asset verifications for mortgage, lending, and tenant screening.

Learn more about Argyle Direct Banking.