Argyle is committed to modernizing financial services and eliminating the practice of buying, selling, and reselling consumers’ personal data.

Outdated models presume that databases like Equifax’s The Work Number and Experian Verify own the consumer data they trade, including highly sensitive material like income and employment details. They also presume that compliance with data protection and privacy laws is enough to make up for buying and selling consumers’ personal information behind their backs, without their knowledge or consent.

But ethical data exchange isn’t just about security. It’s about acknowledging that consumers should have complete control over their own personal data—down to who has access to it, for what reasons, and for how long.

That’s why we’ve built fully permissioned, fully automated income and employment verification tools that save consumers time and put them back in the driver’s seat.

Below, we outline Argyle’s approach to consumer data—and what we’re doing to ensure consumers themselves have a say in how it’s used.

Industry standards are broken

It may seem obvious that income and employment data rightfully belongs to the individual it represents.

But, for 70+ years, consumer data has been widely bought and resold by credit reporting agencies and databases to just about any third party who can pay for it. The result is that a consumer’s income and employment data—along with other highly sensitive financial details—can be collected, packaged, and resold for profit without the consumer’s explicit consent.

Fortunately, it is possible to create financial tools with consumer-based permissions and data transparency at their core. We know that because we’ve done it.

It starts and ends with consumer permission

Argyle makes it easy for consumers to take charge of who sees their income and employment information, which data fields can be accessed, and when that access is revoked.

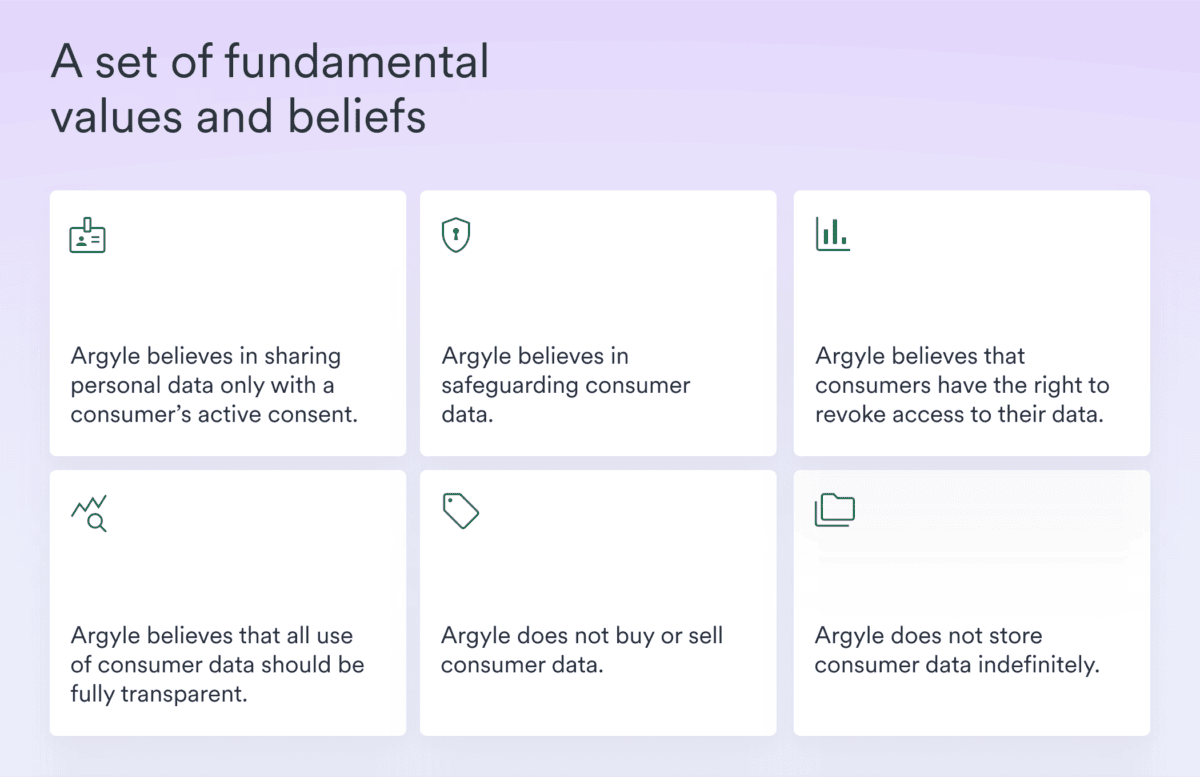

It all comes down to a set of fundamental values and deeply held beliefs.

- Argyle believes in sharing personal data only with a consumer’s active consent.

- Argyle believes in safeguarding consumer data.

- Argyle believes that consumers have the right to revoke access to their data.

- Argyle believes that all use of consumer data should be fully transparent.

- Argyle does not buy or sell consumer data.

- Argyle does not store consumer data indefinitely.

Let’s break these points down one by one to demonstrate how we put them into practice.

We share data only with consumers’ informed consent.

In order for lenders, property management companies, potential employers, or any other service providers to access a consumer’s income and employment data, the consumer themself must log in to their employer or payroll provider account and establish a connection.

That means that, with Argyle, every consumer is an active participant in the data-sharing process.

We keep consumer data safe.

We take our responsibilities as a data transfer agent seriously and have robust security policies in place to protect consumers’ private information.You can take a high-level look at how Argyle works and review our consumer and legal terms here—or visit our Trust Center to learn more about our security protocols and certifications.

We allow consumers to revoke data access at any time.

Argyle gives consumers control over the use, retention, and removal of their own data.

Through a simple and accessible dashboard in Argyle Passport, consumers can see all of their connected accounts and adjust all of their connection settings. That includes the ability to remove a connection with just a few clicks.Consumers can also request the removal of their personal data at any time by completing and submitting this form.

We make the use of consumer data fully transparent.

In Argyle Passport, consumers get a comprehensive, real-time view of their live connections, along with which service providers have access to which data points. They can also see a complete breakdown of the income and employment data fields that Argyle provides.

We never buy or sell consumer data.

At Argyle, consumer information is shared; it’s not up for sale.

Instead, consumers willingly and enthusiastically grant service providers access to their own income and employment data—because it helps them submit applications faster and without having to track down and scan required documents like paystubs and W-2s.

We do not store or share consumer data indefinitely.

Argyle makes consumer-permissioned income and employment data available to service providers (our customers) for a period of 30 days after the expiration or termination of the master service agreement. After that point, all of a consumer’s data is then permanently removed from our server.

Why is access to income and employment data so important?

Income and employment data is at the heart of many important life events. It’s an essential part of buying or renting a home, starting a new job, or getting a personal loan.

But the businesses that provide these services haven’t always looked at every consumer’s application the same way.

For example, it can be hard for service providers to access or interpret the income or employment status of workers in nontraditional careers—like gig workers, freelancers, creators, or independent contractors. That’s why Argyle makes every type of income easy to access and understand, opening new doors for workers and unlocking new opportunities that can meaningfully change their lives.

Most importantly, we do it all honestly and in the open, ensuring that the income and employment verification process is fair and frictionless for consumers and service providers alike.

It takes a village

We’re proud that Argyle is at the vanguard of making ethical financial data sharing a universal standard—but we’re not doing it alone.

We’re backed by a number of forward-thinking investors, and we work hand-in-hand with many innovative, industry-leading partners to bring fully automated, consumer-permissioned income and employment verifications to over 90% of the U.S. workforce (and counting).

If you want to learn more about our efforts to democratize financial access—and how we’re putting personal data back in the hands of the consumers it represents—you can reach out to our team at [email protected].

Got Questions? We’ve got answers.

Check out our list of FAQs for answers to common queries and concerns.