The 2025 housing market may not recover to the extent previously predicted, but when it does, will you be ready?

After the 2024 presidential election, mortgage forecasts took a turn, with experts now predicting higher mortgage rates in the near and long term than had been expected just weeks prior. In October, Fannie Mae projected rates would fall to as low as 5.7 percent by the end of 2025, but has since revised its forecast to suggest that rates will remain above 6 percent for the entirety of the coming year.

In turn, experts say home sale volumes will likely see little improvement over 2024, given that the last time rates fell to near 6 percent, in September 2024, the market experienced an insignificant upturn in mortgage applications.

But what goes up must go down. At some point, rates will fall, and mortgage application volumes will recover. And when they do, the lenders that will come out on top will be those that took advantage of the market lull to optimize their origination workflows.

Automating essential verification steps is one road to optimization that can help you make quicker, more cost-efficient lending decisions—now and when the market bounces back. In this article, we take a closer look at how automated verifications work and the value verification automations offer your organization.

How automated verifications work

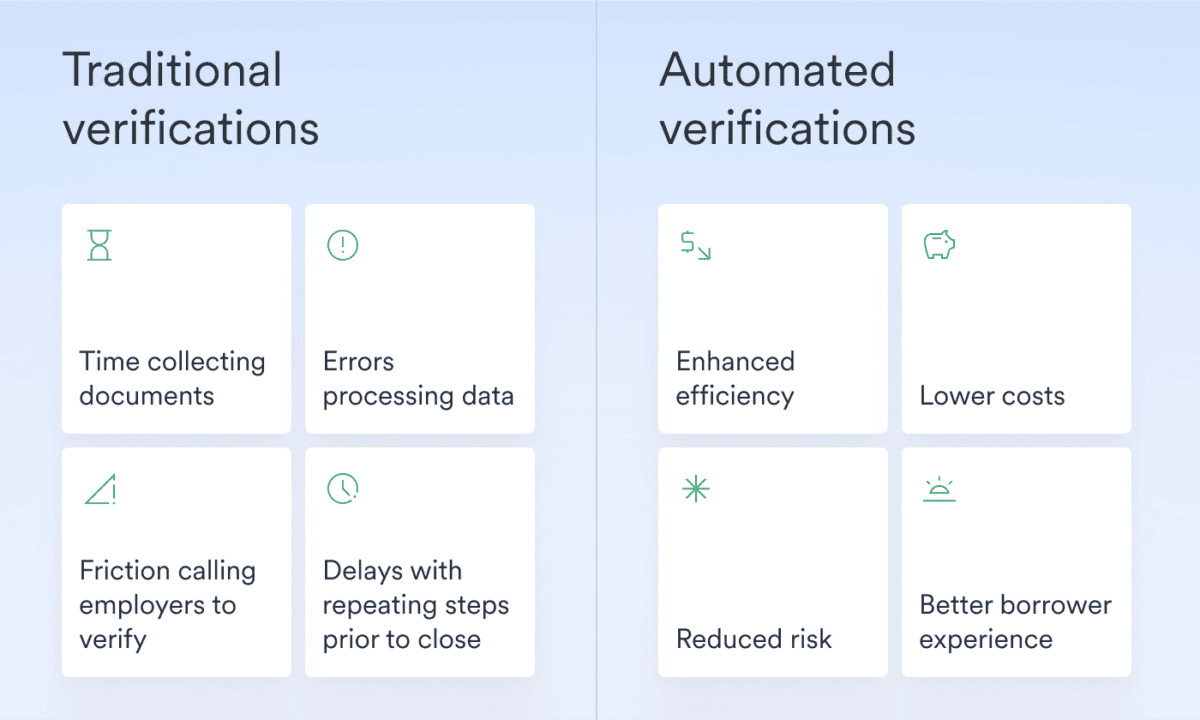

Traditional verification of income and employment (VOIE) methods can be costly, time-consuming, and fraught with errors.

Not only must your team get borrowers to submit financial documents like paystubs and W-2s, they also have to process the data by hand and reach out to borrowers’ employer(s) to confirm the details. This can take days or even weeks to carry out, and the final product can hide oversights and inconsistencies.

You might bypass some of these manual tasks by purchasing VOIE reports from a verification database like The Work Number (TWN)—but that means paying steep prices for static, one-time reports that are often outdated or missing key information. And even with a verification database report in hand, you still have to chase down borrowers for required documentation.

Automated VOIE solutions overcome these challenges by connecting lenders directly to borrowers’ payroll system of record and pulling income and employment data straight from the source.

For example, Argyle allows borrowers to connect you to their employer or payroll provider account, so you can access accurate income and employment data in real time.

All a borrower has to do is select their employer or payroll provider from Argyle’s extensive network and log in using the same credentials they input any time they review their paychecks.

From there, you get a GSE-compliant VOIE report that can be used in conjunction with Fannie Mae’s Desktop Underwriter® (DU®) and Freddie Mac’s Asset and Income Modeler (AIM). You also get direct visibility into borrowers’ gross earnings (including granular details like bonuses, commissions, withholdings, and contributions), ongoing access to documents like paystubs and W-2s, and instant updates any time there’s a significant change to a borrower’s income or employment status.

Argyle even integrates with popular point-of-sale (POS) and loan origination systems (LOS), so the reports, data, and documents you need can be delivered right to your platform of choice.

The value of automated verifications

There are several immediate benefits to automating mortgage verifications and streamlining access to income and employment data and documents. These include:

- Enhanced efficiency

Eliminating manual verification tasks enables everyone on your team—from loan officers to closers—to work both faster and smarter. They’re able to process more applications in fewer hours with a single borrower touchpoint and accurate data at their fingertips, freeing them to focus on higher-impact initiatives and innovations like borrower relationship-building.

- Lower costs

By amplifying productivity and limiting operational expenses, automated VOIE solutions keep loan origination costs to a minimum. They’re also more cost-effective because they don’t buy borrower data and sell it to you at a markup like verification databases.

Argyle, for example, has been proven to reduce verification costs by 80% compared to manual workflows and databases like TWN.

- Reduced risk

Fewer manual interventions, 100% data accuracy, and more comprehensive VOIE reports make for more informed lending decisions. That substantially reduces your chances of approving loans that are fraudulent or at risk of default.

Argyle consistently returns 170+ verified data points 95% of the time—vastly outperforming sources like banking data—with completion rates even higher for GSE-required fields. Moreover, Argyle’s data is continuously refreshed, so you’re always working with the most up-to-date information.

- Better borrower experience

For your business to grow, it’s important that borrowers not only submit applications but stick with your services. That means providing a best-in-class borrower experience.

Automating your verification process ensures borrowers won’t be asked to track down digital or physical paystubs or W-2s, and they’ll be delighted to supply their data and secure a faster approval with just a few clicks.

The proof? Argyle has an industry-leading net conversion rate of 55% and climbing. This comes down to an empowering, consumer-permissioned approach to VOIE—plus frictionless flows that use deep-linking, single sign-on (SSO) and passwordless login capabilities, and instant document upload and OCR features to keep your borrower experience simple and seamless.

Together, these benefits can transform your verification process at scale, so your team can make smart, business-boosting lending decisions time after time—no matter how many applications come your way.

Automation in action

For a glimpse into how automated VOIE solutions work in practice, consider Lake Michigan Credit Union (LMCU). LMCU needed a way to reliably expand their mortgage market while addressing rising verification costs, accelerating close times, and improving member engagement.

They partnered with Argyle and saw impressive results, including three weeks and $100 saved per application.

“Competition is fierce among banks and credit unions. You have to differentiate yourself, and one of the key indicators is speed. Argyle’s cutting-edge [VOIE] technology allows us to improve our turnaround times, so we can close faster, with a better borrower experience, and with fewer gaps late in the process.” – Eric Schlagheck, Director of Mortgage Processing, LMCU

The bottom line

As a mortgage lender, lackluster home sales may mean you have extra bandwidth to dedicate to strategic internal initiatives that will prime your organization for success once application volumes rebound. The best way to make that happen is turning to tech-forward tools that automate income and employment verifications from end to end—ensuring not only faster processing times and overall cost savings, but also stronger risk management and an optimized borrower experience.

Want to learn more about the benefits of automated VOIE for mortgage lending? Read up on Argyle’s Income & Employment Verification solution—or reach out to our expert team to get your questions answered.