Outdated verification processes create needless barriers for over a third of U.S. workers and the financial service providers that support them.

The face of employment has evolved dramatically in recent years, but verification methods haven’t kept a similar pace.

Today, over 64 million U.S. workers, or roughly 38% of the total adult workforce, operate as 1099 independent contractors. They drive for Uber, deliver for DoorDash, freelance on Upwork, and even juggle multiple different gig roles at once. But when they need to verify their income and employment for an apartment lease, loan application, or government benefit, they’re often left high and dry. That’s because they’re forced to rely on verification systems designed for a 9-to-5 world that increasingly doesn’t exist.

The result is a lose-lose situation. Gig workers face systematic barriers to the financial services they need and deserve, while service providers miss out on revenue from the fastest-growing segment of the workforce—costing both sides massive opportunities.

Understanding why traditional verifications fail gig workers (and what service providers can do about it) has become critical for any company serving today’s diverse workforce. This post will explore the fundamental limitations of legacy methods and show why direct-source payroll connections promise a better way forward for comprehensive income and employment verifications.

The traditional verification playbook was written for a different economy

For decades, income and employment verifications rested on a predictable foundation. Workers received regular paychecks deposited into their bank accounts, with standardized paystubs and year-end W-2s neatly documenting their earnings.

This enabled two verification approaches that are still common in the market today:

- Verification databases like The Work Number (TWN) purchase income and employment data from employers in batches and then resell it to lenders, landlords, and other service providers looking for insights into an applicant’s financial health. Despite considerable flaws, this model works reasonably well for traditional employees whose data flows as expected through common payroll systems.

- Manual verifications

When automated databases aren’t available or sufficient, many service providers resort to manual verification methods—like asking applicants to send in paystubs or tax documents for human review or contacting their employers via phone or email to confirm employment. While time-consuming and error-prone, manual verifications have historically functioned as the industry’s safety net when other systems fail.

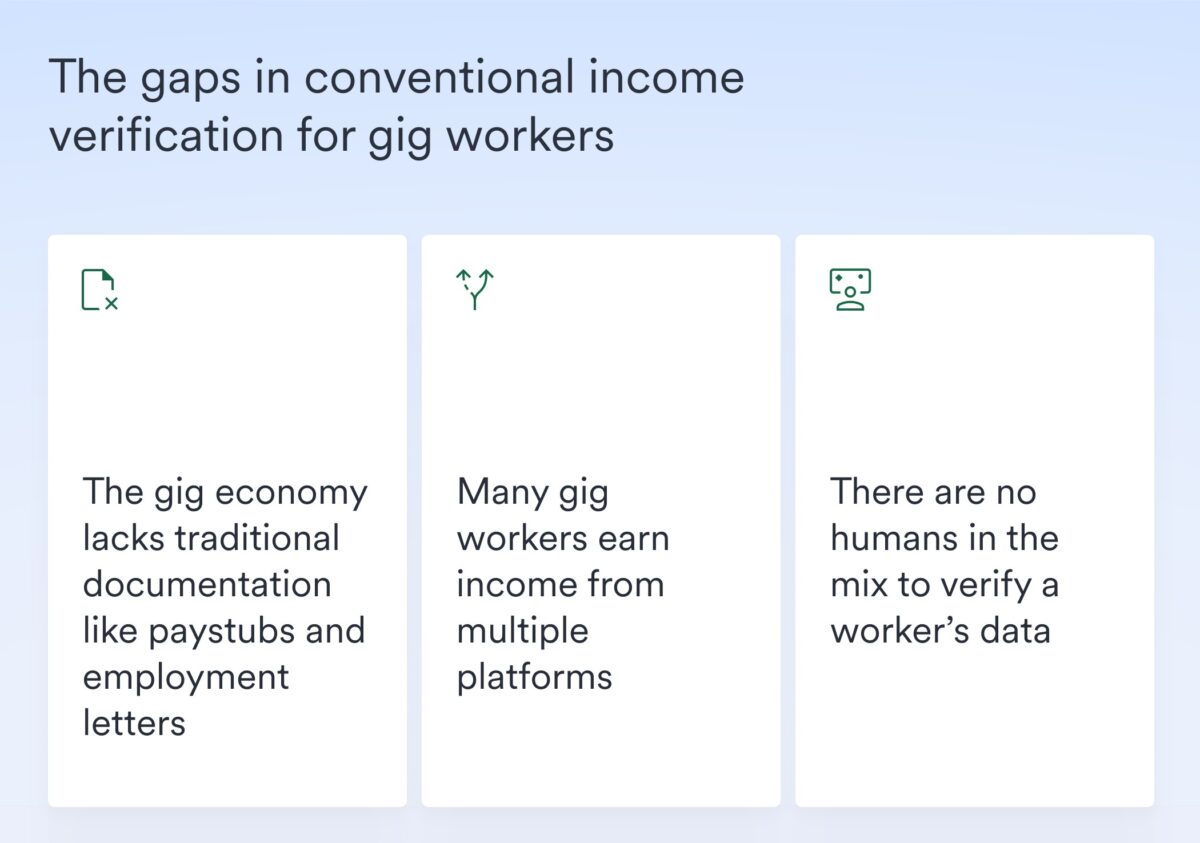

Both of these methods served the market adequately when workers followed conventional employment patterns—and, in some cases, they still do. But gig work breaks the mold they depend on in a few critical ways:

1. The gig economy lacks traditional documentation like paystubs and employment letters.

Gig workers don’t receive conventional paystubs with employer letterheads and HR contact information. Instead, they get platform-specific earnings summaries that vary wildly in format and level of detail, plus 1099s at year-end that lack the granular information required for comprehensive verifications. That means gig workers can’t scan and upload the sorts of standardized documents that service providers might expect.

2. Many gig workers earn income from multiple platforms.

A typical gig worker might drive for both Uber and Lyft, deliver food through DoorDash and Instacart, and complete freelance tasks through a platform like Fiverr, all in the course of a week. Traditional verification methods can struggle to aggregate these various income streams into a holistic financial picture, so they often overlook significant portions of a worker’s total earnings.

3. There are no humans in the mix to verify a worker’s data.

Gig platforms don’t have traditional employment structures, centralized offices, or HR departments. That means, when a lender or landlord calls to verify a worker’s income and employment, there’s no human to speak with—just an automated payroll system that can’t provide the answers they need.

Where traditional methods fall short

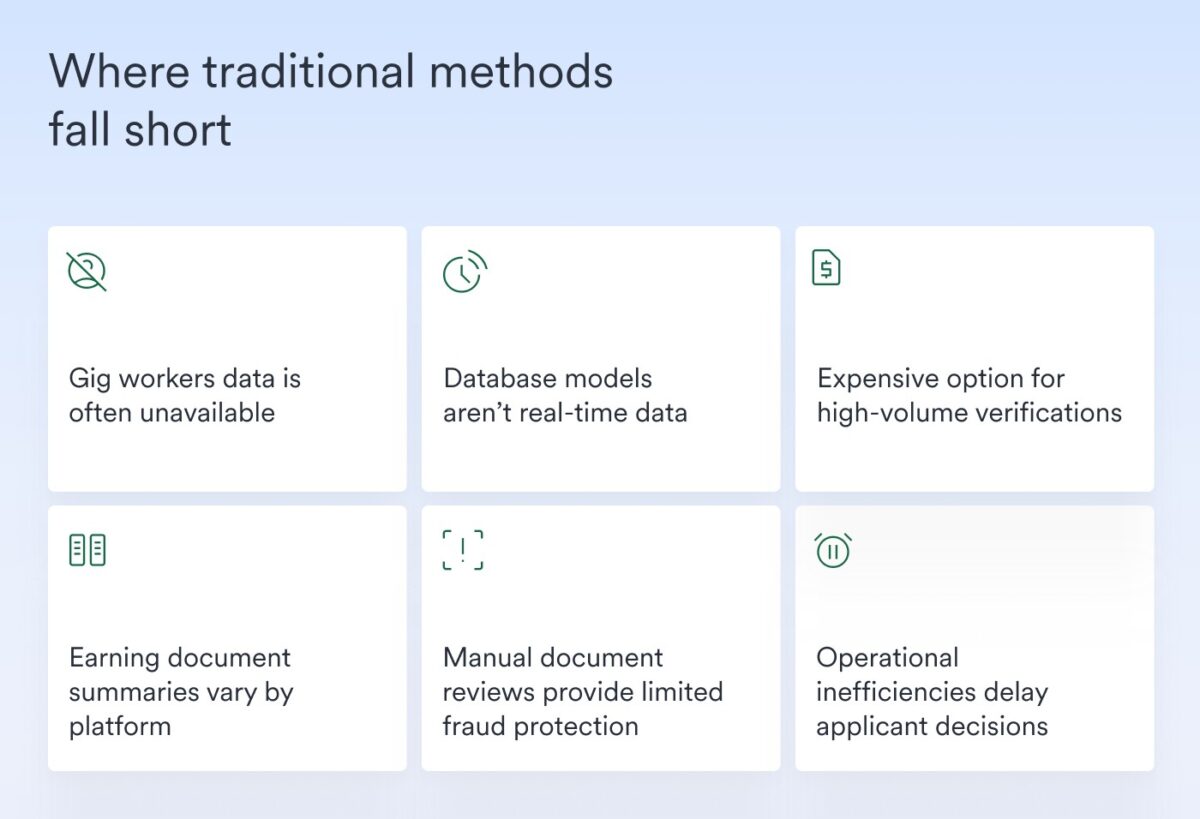

In addition, traditional verification methods face their own structural limitations when it comes to assessing gig workers’ finances.

For databases like TWN, these include:

- Sourcing issues: Gig platforms aren’t structured like the employers and payroll providers that databases like TWN purchase workers’ data from. In most cases, they see their gig contractors as users of their tech platforms, rather than employees to be reported. As a result, many don’t participate in database programs or make their data available at all.

- Data delays: Even when they do include gig platform data, static database models involve significant lag times. Earnings data sitting in their repositories can grow stale by the time it reaches a verification system, which is particularly problematic for gig workers whose income can fluctuate from day to day, let alone month to month.

- Cost structures: Databases like TWN charge per verification report, making them expensive options for high-volume screening operations—especially if each applicant needs to be verified more than once.

For manual verifications, the challenges can be even more discouraging, including:

- Irregular documentation: Each gig platform formats its earnings summaries differently and follows unique standards, making documents difficult for verification teams to review by hand.

- Fraud vulnerability: Manual document reviews face a 244% surge in digital document forgeries, emboldened and supported by advances in artificial intelligence (AI). With the help of these technologies, 90% of modern fraud signals are now invisible to the human eye.

- Inefficiencies: Reviewing documents and chasing down employers takes time, often delaying important decisions by days or weeks. This not only leads to a poor application experience, it drives up operational costs and prevents teams from working on more strategic and impactful initiatives.

A note on banking data

Direct banking connections have also emerged as a sophisticated and valuable verification tool. Lenders, landlords, and other service providers can connect to an applicant’s bank account and review their transactions, deposit patterns, and cash flow to verify their financial assets and gain important insights into their financial health.

Still, banking data faces certain limitations when it comes to verifying gig workers’ income and employment:

- Downstream versus upstream data

Banking data can only reveal income that actually reaches an applicant’s bank account, not the gross pay-level details that can only be accessed at the upstream source where that income originated—a payroll account. It also doesn’t account for any income that an applicant may have elected to route to other destinations.

- Debit card payouts

As many as 75% of gig workers now have their wages issued directly to debit cards rather than via traditional direct deposits. That means, when an Uber driver cashes out after their shift or a DoorDash courier opts for instant payouts, that transaction bypasses banking networks entirely. A driver earning $60K a year on an Uber-issued card would appear to have $0 verifiable income if a provider only looks at their bank account and deposit history.

- Processing delays and fragmentation

Even when gig earnings do reach bank accounts, they may arrive long after being earned due to ACH and other processing delays. Plus, workers often split their deposits across multiple accounts, meaning banking data may provide only a partial view of their full wages.

Banking data remains an essential part of a comprehensive verification approach—particularly when verifying financial assets—but it cannot on its own solve gig worker verification challenges.

Why this gap matters more than ever

The verification blind spot for gig workers isn’t just widening; it’s creating cascading problems across multiple industries at once.

Tenant screenings

With rental markets tightening and housing more difficult to access, property owners and managers are increasingly relying on automated screening methods that flag or discount nontraditional applicants whose earnings don’t appear in legacy databases.

As a result, gig workers struggle to secure housing despite having the steady income to afford it—and property managers end up missing out on a high volume of worthy, qualified renters.

Government benefits

Government agencies administering benefits like unemployment insurance, housing assistance, and Social Security need access to accurate income and employment verifications to determine recipients’ eligibility and benefit amounts.

When gig workers’ earnings are invisible to traditional systems, it leads to miscalculations that withhold benefits from deserving groups—and creates administrative headaches for the agencies overseeing them.

Loan originations

Lenders still leaning on traditional verification methods are missing out on serving the fastest-growing segment of the workforce, resulting in a massive opportunity cost.

Gig workers need auto loans, mortgages, and personal credit just like traditional employees, and their exclusion from mainstream lending channels forces them to rely on predatory lending practices that only magnify the problem.

The direct-source solution: real-time verifications for real-time work

The solution isn’t trying to retrofit the gig economy into traditional verification systems. It’s adopting direct-source, consumer-permissioned verification solutions that connect providers directly to the systems of record where gig workers actually receive and track their earnings: their payroll accounts.

Direct-source payroll connections allow service providers to access:

- Real-time earnings data from a range of gig platforms at once

- Instant, up-to-date verifications without having to wait for database updates

- A comprehensive picture of income across multiple platforms

- Granular financial insights including shift-level data and gross-pay income details like bonuses, commissions, and withholdings

This approach doesn’t just solve the coverage problem—it provides richer, more accurate income and employment data than traditional methods ever could. Instead of just a yearly W-2 summary, service providers can access up-to-the-minute, shift-by-shift income details that provide a much clearer and fuller picture of a gig worker’s financial stability.

The Argyle advantage

Of course, not all direct-source payroll connections deliver equal results. Argyle’s comprehensive approach combines multiple verification methods into a single, integrated platform that delivers unmatched performance. This includes:

- Verification of income, employment, and assets from a single provider and platform, as well as OCR-powered document processing

- 90% coverage of the U.S. workforce, including payroll, employer, and gig platforms

- 55% conversion rates for payroll verifications, as well as 65% conversion rates for banking verifications

- Real-time data updates with continuous monitoring and no re-verification fees

- GSE-approved verification reports across all verification types and use cases

- Extensive POS and LOS mortgage integrations for streamlined, intuitive workflows

- Up to 80% potential cost savings compared to legacy verification solutions

As a result, organizations using Argyle’s verification platform consistently see benefits such as broader market access, lower total costs, higher completion rates, and the ability to serve previously out-of-reach populations like gig workers with confidence.

The key takeaway: verification processes must evolve

The U.S. workforce has changed, and its millions of gig workers can no longer be ignored or treated as edge cases.

Service providers who continue to rely solely on verification databases and manual methods are systematically excluding over a third of their potential customers, missing countless opportunities for growth. Meanwhile, the ones who recognize this shift and adopt verification solutions designed for the modern economy will have a significant advantage in serving its fastest-growing segment.

For gig workers, this transformation can’t come soon enough. Every day that verification systems lag behind reality is another day they face needless barriers to housing, credit, and financial services they’ve earned—and deserve—access to.

The gig economy isn’t going anywhere. So it’s time for our verification systems to catch up.

Ready to modernize your approach to verifications?

Reach out to Argyle’s team to learn how our direct-source payroll connections offer real-time income and employment data for the entire workforce—including the gig workers that traditional methods leave behind.