Your work identity is changing; why isn’t the infrastructure around you.

Everyone has heard it by now

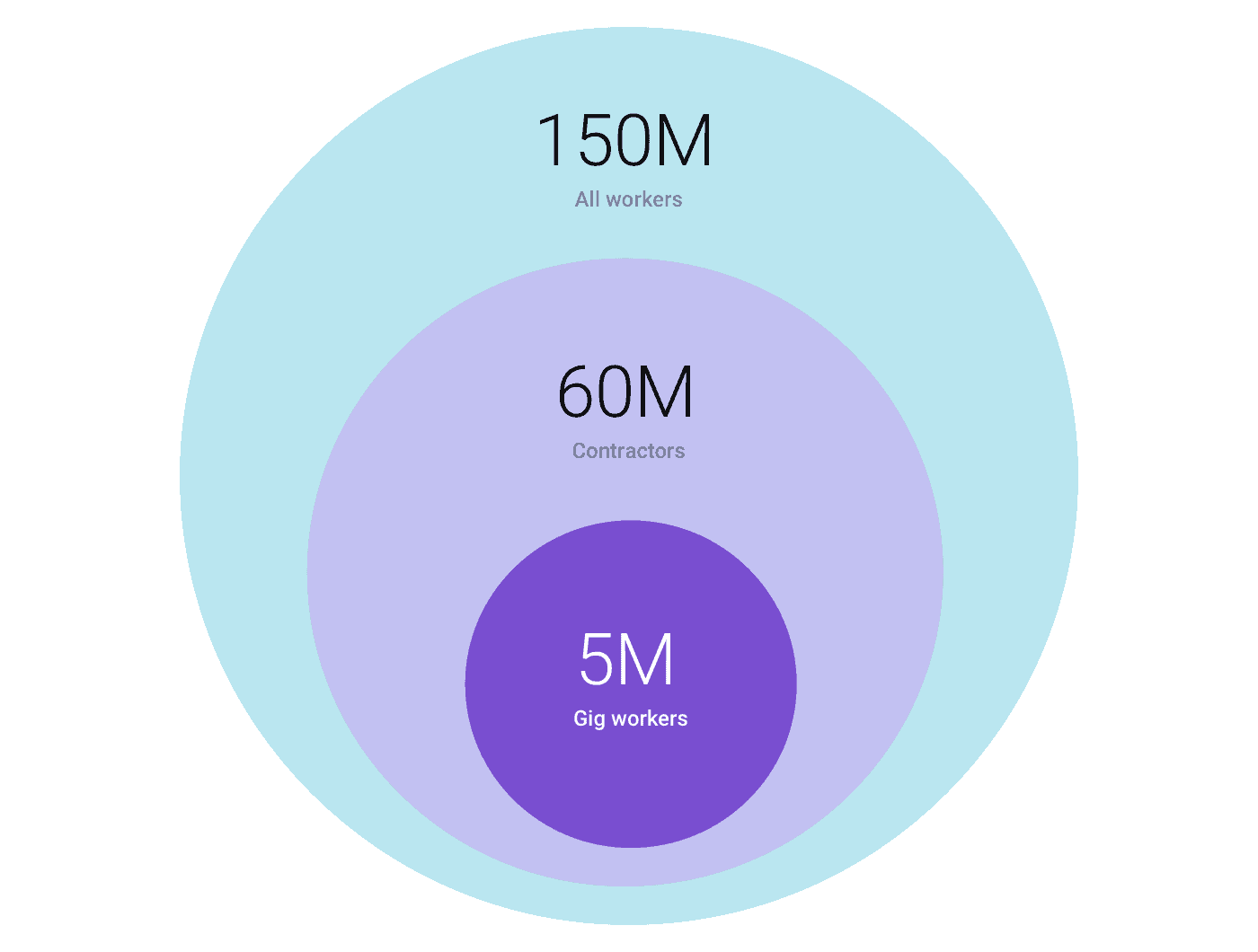

“By 2020, more than 40% of the US workforce will be so-called contingent workers” according to a study by Intuit. If you go search the label contingent work you’ll learn that “contingent work is usually not considered to be a career or part of a career” — but why not?

The amount of people participating in some form of shift-based work is undoubtedly growing at a rapid pace with nearly four out of five employers using some form of nontraditional staffing and 80% of large corporations planning on substantially increasing their use of a flexible workforce— yet — we refuse to acknowledge this work as ‘career’ work or a fair basis of someone’s professional identity solely because it’s considered supplemental.

Why should the barrier of creditworthiness and trust only exist within the confines of a traditional ‘career’ when applying for insurance, a credit card, or a mortgage?

The truth is

Legacy systems in industries such as insurance, lending, and banking have historically had a difficult time verifying employment and the irregular income patterns that go hand in hand with contingent or non-traditional work. The process today involves an applicant digging up some form of government documentation and gathering (hopefully) well-documented business practices. Even at that, underwriting risk when an applicant’s employment agreement is non-existent, their pay-stubs are stuck within numerous applications and they have zero income predictability gets a bit tricky.

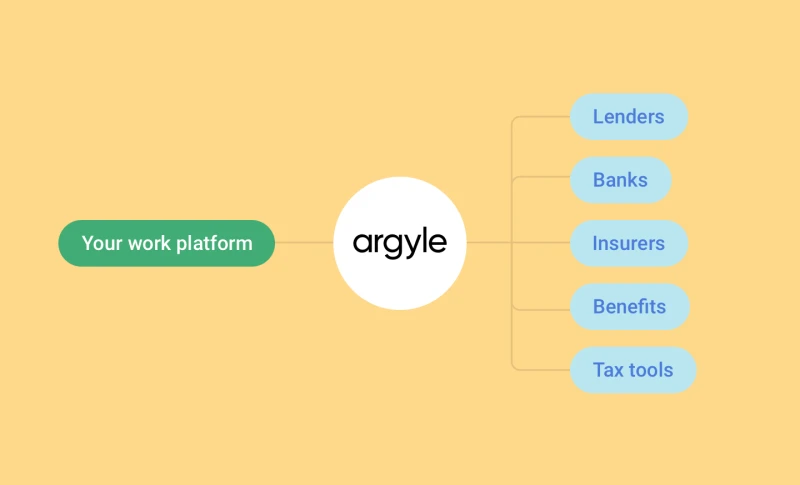

This is why we created Argyle — to provide an easy, fair, and secure way for individuals to access their holistic work identity when applying for data-driven products, services, and opportunities.

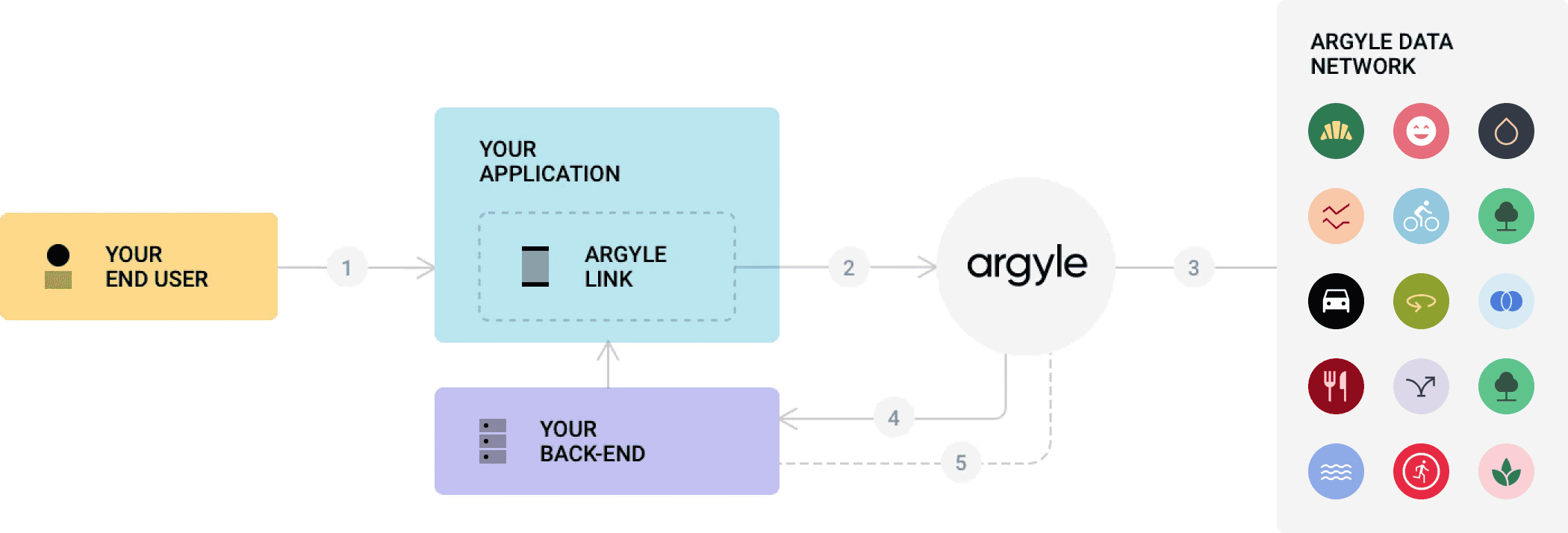

Applications leveraging Argyle can allow their end-users to credential into their work accounts securely, providing source-based data for more efficient underwriting, monitoring, and a tailored user experience. Data points tied to a worker’s identity (e.g. name, driver’s license), career (e.g. hours worked, jobs completed), finances (e.g. net income, tips, cash on hand), and reputation (e.g. ratings, reviews) are all available in real-time.

While businesses such as Tink, Plaid, and Yodlee have paved the way providing infrastructure tools to access financial data, we believe there is an even larger opportunity to gain more granular insights by allowing end-users to plug-in their workforce platforms — bearing not only financial insights but a holistic view of a worker’s identity.

The big picture

Argyle was created not only for ride-hailing drivers and app-based workers but for everyone who will soon be partaking in some form of ‘transactional’ or ‘shift-based’ work. We view the work world on a spectrum with a few universal truths:

Truth 1: Workers should have a right to access, download, or otherwise use their own workforce data — period. While your data today is fragmented and difficult to self-manage this will inevitably change to unlock a whole host of opportunities similar to open banking within the finance and banking industries.

Truth 2: Workforce data is workforce data. Your average pay per day/week/month/year may look different in your HR system vs. your Uber Driver dashboard but at the end of the day, it’s perspective, not content, that differs between the two.

Truth 3: Given the above statement, HR systems and other systems of record in the future will soon be more consumer-friendly and increasingly transactional. We’re already seeing this happen with advance payments for contingent workers (e.g. I’ve accrued $X why should I have to wait a full ‘pay cycle’ to cash out my paycheck?)

Let’s build on Argyle

It’s clear that the work world is changing and this is only the beginning. In order to keep up and provide adequate opportunities for our workforce, our infrastructure must change. If you’re an innovative company looking to accommodate the future of work please feel free to drop me a line — [email protected].

We’re excited to see what the world can build on top of Argyle.