Mutual of Omaha Mortgage saves over $600,000 annually by moving Argyle’s VOIE to the POS

About Mutual of Omaha Mortgage

Mutual of Omaha is a name millions know and trust. In 2016, the company expanded into mortgages, building a division with headquarters in San Diego and Chicago. Today, Mutual of Omaha Mortgage helps customers navigate every stage of homeownership—offering purchase, refinance, and reverse mortgage options—always with the goal of building confidence during life’s biggest transitions.

Challenge

For Mutual of Omaha Mortgage, income and employment verification (VOIE) was becoming one of the biggest line items in the loan process. With roughly 2,000 orders each month, costs could spike to $200 per file when relying on legacy databases—especially with multiple borrowers or reverifications in the mix.

“Verification costs have become significant enough that we’ve had to be thoughtful about when and how often we order them,” says Lucas Curtolo, senior vice president of operations at Mutual of Omaha Mortgage. “We wanted an option that was both cost-effective and reliable for the majority of our borrowers.”

Cost wasn’t the only issue. Curtolo and his team wanted to simplify the process, too. By moving VOIE earlier—at the point of sale—loan officers could get complete borrower information upfront, helping them make smarter decisions faster while giving customers a smoother experience.

“We knew that the more information you can gather upfront, the easier it is for the consumer and the faster we close loans,” Curtolo says.

And because Mutual of Omaha Mortgage sells to Fannie Mae and other investors, they needed a VOIE solution that could deliver high-quality data and help reduce repurchase risk.

Solution

After running a detailed cost analysis, the team zeroed in on Argyle. What stood out?

- Transparent, pay-per-use pricing (no hidden costs)

- Direct-source, consumer-permissioned payroll data covering 90% of the U.S. workforce

- Seamless integrations with their LOS (Encompass) and POS (nCino)

Unlike legacy databases that rely on purchased consumer data, Argyle provides real-time data directly from consumer-permissioned payroll connections—covering 90% of the U.S. workforce.

“Too many providers throw out inflated ROI assumptions without really understanding your business—ignoring critical factors like loan volume, current verification spend and operational workflows,” Curtolo explained. “With Argyle, the math was easy and just made sense. It was based on real usage data, tailored to our operating model.”

Implementation was another highlight. The team started by shifting as much volume as possible from The Work Number to Argyle, then moved verifications into the POS through the nCino integration. From there, data flowed automatically into Encompass.

“There’s not much more we could ask for from a technology standpoint in terms of getting the VOIE solution we needed and making it effective,” Curtolo says. “We saved money instantaneously and also improved our loan process by incorporating it upfront in the POS.”

Implementation turned out to be a major win for the team. Whenever new technology is introduced, there’s usually concern about the lift required—how much time, effort, and resources will need to be dedicated. In this case, the rollout of Argyle was straightforward and seamless. That smooth implementation is what allowed Mutual of Omaha Mortgage to start seeing savings almost immediately, making it a clear success from day one.

Outcome

Since switching to Argyle, Mutual of Omaha Mortgage has:

- Over $600k saved annually

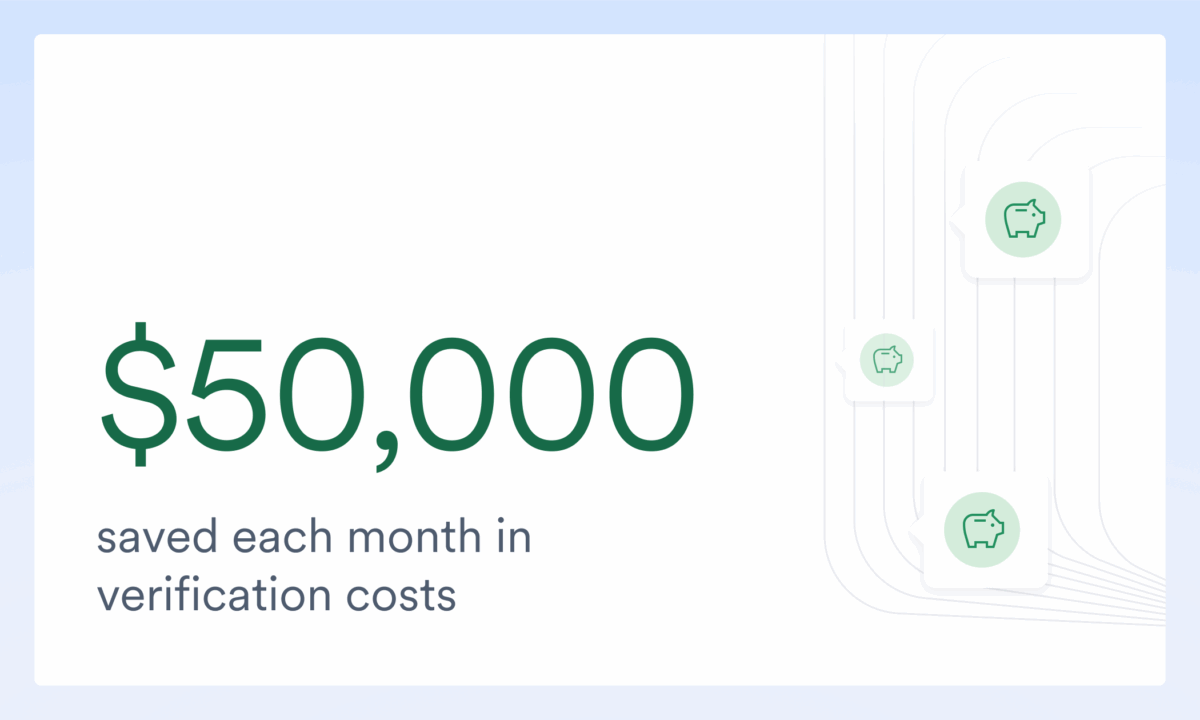

The savings were immediate. In the first two months, Mutual of Omaha Mortgage reduced costs by roughly $10,000 per month as they transitioned volume. Now, with Argyle rolled out across branches, monthly savings exceed $50,000—adding up to more than $600,000 a year.

“The transition from The Work Number to Argyle, literally from A to B, was cost savings,” Curtolo says. “As Argyle rolls out to our branches, we’re seeing a strong correlation between adoption and profitability.”

- Faster, smoother loan processing

Because verifications happen automatically at the point of sale, loan processors open files that already have complete income and employment data. That eliminates duplicate steps and manual uploads.

“When we first implemented Argyle, the first reactions among our loan officers clearly pointed to a solution that works,” Curtolo says.

- Maximum chances for R&W relief

By pulling verified income and employment data up front, directly from approved sources, Mutual of Omaha Mortgage strengthens its position for GSE rep and warranty relief. That means fewer buyback requests and easier loan sales.

“The R&W relief is a game changer,” Curtolo says. “It means fewer buyback requests down the line.”

Today, Mutual of Omaha Mortgage continues to grow its savings as more verification volume flows through Argyle. The partnership with Argyle and nCino includes ongoing training, team onboarding, and regular check-ins to keep adoption high.

Do you want to learn more about Mutual of Omaha’s journey with Argyle? Watch our webinar with nCino to hear from Lucas yourself.