Renasant Bank earns R&W relief on more than 50% of loans with Argyle’s verifications

Legacy lender, modern results: real-time data brings speed and confidence to verification

Renasant Bank has been helping people reach their goals since 1904, when it first opened its doors in Tupelo, Mississippi. What began as a community bank has grown into a trusted financial partner with more than 280 branches across eight states and a team of 1,000 licensed loan officers who keep relationships at the center of every transaction. Grounded in service and guided by growth, Renasant continues to invest in the people and communities it proudly serves.

Challenge

As Renasant continued to expand its reach and modernize its services, one area stood out for improvement: the bank’s income and employment verification process. Renasant’s workflow relied on The Work Number and similar third-party providers. These tools were expensive and cumbersome, offering little advantage over manual processes.

“Our previous provider felt like a true third party,” says Betsy Turner, mortgage LOS support analyst at Renasant. “It wouldn’t have made much of a difference if we’d gone back to the old way of calling employers or sending written forms.”

Because the bank sells nearly all of its loans on the secondary market, those inefficiencies carried extra weight. Renasant needed a verification of income and employment (VOIE) solution that improved data accuracy, reduced costs and expanded eligibility for representation and warranty (R&W) relief with Fannie Mae and Freddie Mac.

Solution

After an extensive search, Renasant chose Argyle for its direct-source, consumer-permissioned approach and seamless integration with Empower by Dark Matter Technologies, the bank’s partner for both loan origination and point-of-sale technology.

Unlike static database providers that depend on purchased consumer data, Argyle connects directly to payroll systems and financial institutions, delivering real-time income, employment and asset information that’s both accurate and GSE eligible.

Argyle now sits at the top of Renasant’s verification waterfall, supporting both sales and operations teams. Loan officers, processors and underwriters can view verified income within minutes of an application, giving teams an edge when competing for a borrower’s business.

“By switching to Argyle, we get way more information, and it’s way more accurate,” Turner says. “Within 10 minutes of an application, loan officers have a full income picture.”

Argyle’s team supported every step of the rollout, from onboarding and training to weekly reporting and performance tracking.

“When we have a question, the Argyle team responds within hours,” Turner says. “They make themselves completely available.”

Outcome

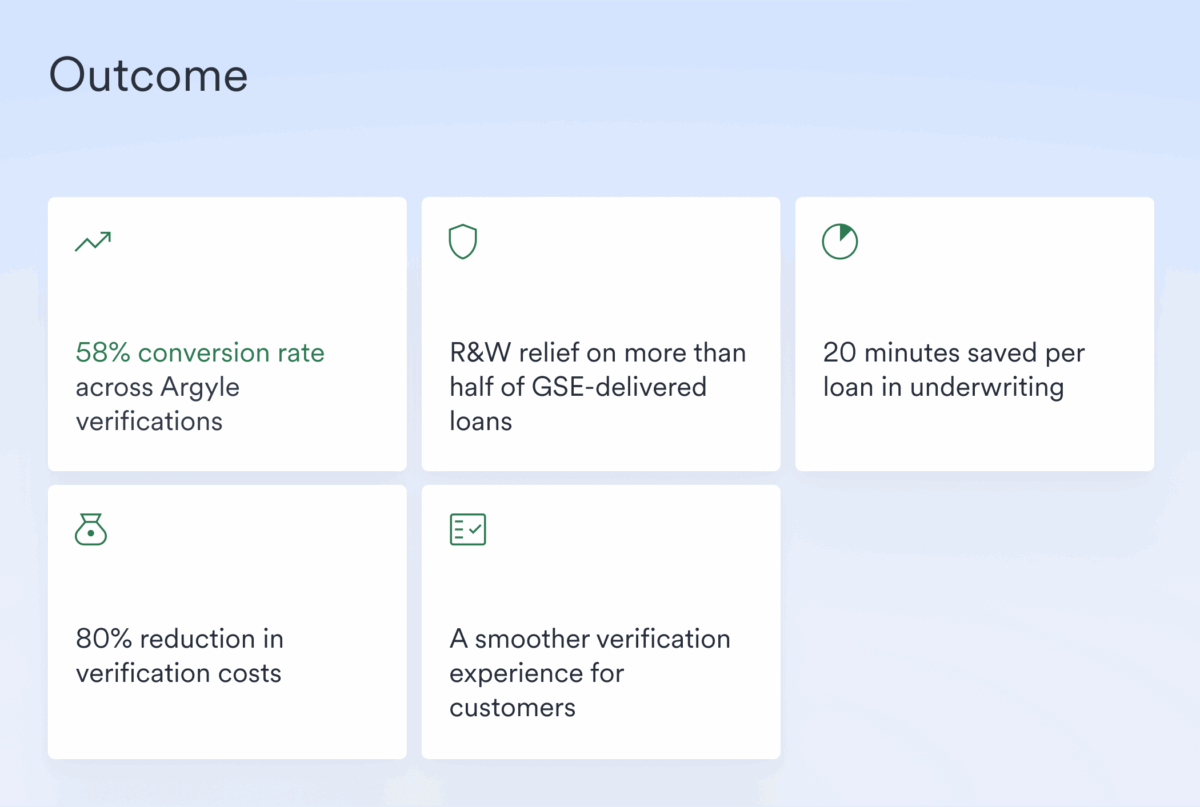

- 58% conversion rate across Argyle verifications

By leveraging Argyle via Empower, Renasant has achieved a 70% year-to-date take rate, meaning seven in ten applicants choose to verify income and employment through Argyle when presented with that option.

Of those who opt in, 58% successfully complete verification through Argyle’s consumer-permissioned payroll connections, giving Renasant faster, more accurate visibility into each borrower’s financial profile. - R&W relief on more than half of GSE-delivered loans

Renasant’s Fannie Mae Connect validation rate also averages 58%. That means more than half of the bank’s Fannie Mae-delivered loans that use Argyle’s verified data earn R&W relief for at least one validated loan component.

This level of performance is driven by Argyle’s data completeness and accuracy. Over 90% of loan files using Argyle contain all fields required by Fannie Mae’s Day 1 Certainty® and Freddie Mac’s Loan Product Advisor®, giving underwriters cleaner files and greater confidence at submission.

“Getting rep and warranty relief is the No. 1 advantage to having Argyle,” Turner says. “That’s made possible by the validity of the data. It’s coming straight from the source.” - 20 minutes saved per loan in underwriting

Because Argyle provides verified income data upfront, processors spend less time chasing documents and can handle more volume. But the biggest time savings occur not in processing, but at the decisioning stage, where Turner says underwriters are saving at least 20 minutes per file.

“Argyle gives underwriters a complete, verified picture right away,” Turner says. “They can move faster and with more confidence.” - 80% reduction in verification costs

With each Argyle order, Renasant saves more than 80% in costs compared to its previous provider.

“The cost savings are amazing,” Turner says. “It’s a modern solution that saves money and delivers reliable data instantly.” - A smoother verification experience for customers

Argyle’s real-time payroll data makes verification a seamless part of the loan process, reducing friction for customers and giving loan officers more time to focus on relationships.

One top-producing loan officer at Renasant says Argyle has transformed the way he connects with customers, helping him close more loans in less time.

“Customers really appreciate how easy it is,” he says. “When the process feels seamless, they’re more confident moving forward. Argyle removes the back-and-forth and makes for a better experience on both sides.”

By replacing costly, legacy verification providers with Argyle, Renasant has modernized verification across its lending network, giving loan officers, underwriters, and investors confidence in every loan file.

“Argyle has completely changed how we approach verification,” concludes Dave Sander, vice president of business development at Renasant. “It’s not just about faster turn times or lower costs, it’s about giving our teams a smarter way to compete.”