The simple workflow shift that’s transforming mortgage lending processes and outcomes

For years, mortgage lenders have approached income, employment, and assets verification as a mid-flow necessity, something to handle once an application reaches the loan origination system (LOS) or underwriting.

Even lenders that adopt modern, direct-source verifications—which connect directly to a borrower’s payroll, employer, or bank account and pull real-time data straight from the system of record—often opt to keep them downstream. But this forces loan processors to manually trigger verification requests, and it forces borrowers to respond to isolated invitations to connect after they’ve already submitted their application.

Forward-thinking lenders are discovering that moving automated, direct-source verifications earlier in the workflow—from the LOS to the point of sale (POS)—doesn’t just improve efficiency. It fundamentally transforms their operations from end to end, delivering higher conversion rates, enhanced cost savings, and faster processing times.

Mortgage lenders that implement this strategic change are seeing cost savings multiply, completion rates surge, and cycle times drop by double digits compared to LOS-stage verifications, all while improving the borrower experience.

In this post, we’ll explore what this workflow shift actually looks like, why it delivers outsized results, and how leading lenders like American Pacific Mortgage and GreenState Credit Union have successfully made the transition.

Understanding LOS and POS integrations

Before exploring the benefits of moving verifications up in the workflow, it’s helpful to establish the role different mortgage tech systems play for the typical lender.

Loan originations systems (LOS) like Encompass serve as the operational backbone where loan officers and processors manage applications after initial submission. This is where underwriting, documentation review, and compliance activities happen, usually after a borrower has already invested significant time in the application process.

On the other hand, point of sale (POS) systems like nCino Mortgage, Consumer Connect, Tidalwave, and LenderLogix represent the front door of a lending operation. This is where borrowers first interact with an application, where they provide their personal and financial information, and where loan officers carry out pre-qualifications and pre-approvals.

Leading verification providers, like Argyle, integrate with both LOS and POS systems, so they can plug seamlessly into lenders’ existing workflows and streamline their processes across systems. But where exactly verifications are placed within a workflow can significantly change the outcome.

The growing, more strategic approach embeds verifications into the POS, capturing accurate income, employment, and assets data at the very start of the borrower journey.

The strategic advantage of moving verifications to the POS

The shift from LOS to POS isn’t just about timing; it’s about changing who drives the verification process and when it occurs during the borrower journey. This shift can deliver multiple compounding benefits:

Eliminating manual coordination

When verifications live in the LOS, someone on your lending team has to remember to trigger the verification request. A processor, loan officer, or assistant must send an email or text message to the borrower prompting them to connect. From there, your team has to follow up, often more than once, if the borrower doesn’t respond.

Chris Sutherland, director of production strategy at American Pacific Mortgage, put it this way in our recent webinar: “The struggle we kept hearing [about] was that fragmented process. Branch managers were counting on a processor to trigger [verifications] to occur. It requires what I call bird dogging. To really get a high conversion rate, you need a processor or loan officer to go, ‘Hey, I just sent you this. This is why we need it. Let me know if you need any help.’”

Moving verifications to the POS eliminates this burden. The borrower encounters verification as a natural, built-in step while still completing their application. No need for a separate request, manual follow-up, or an email or text message that might get lost in the mix or ignored.

Higher completion rates

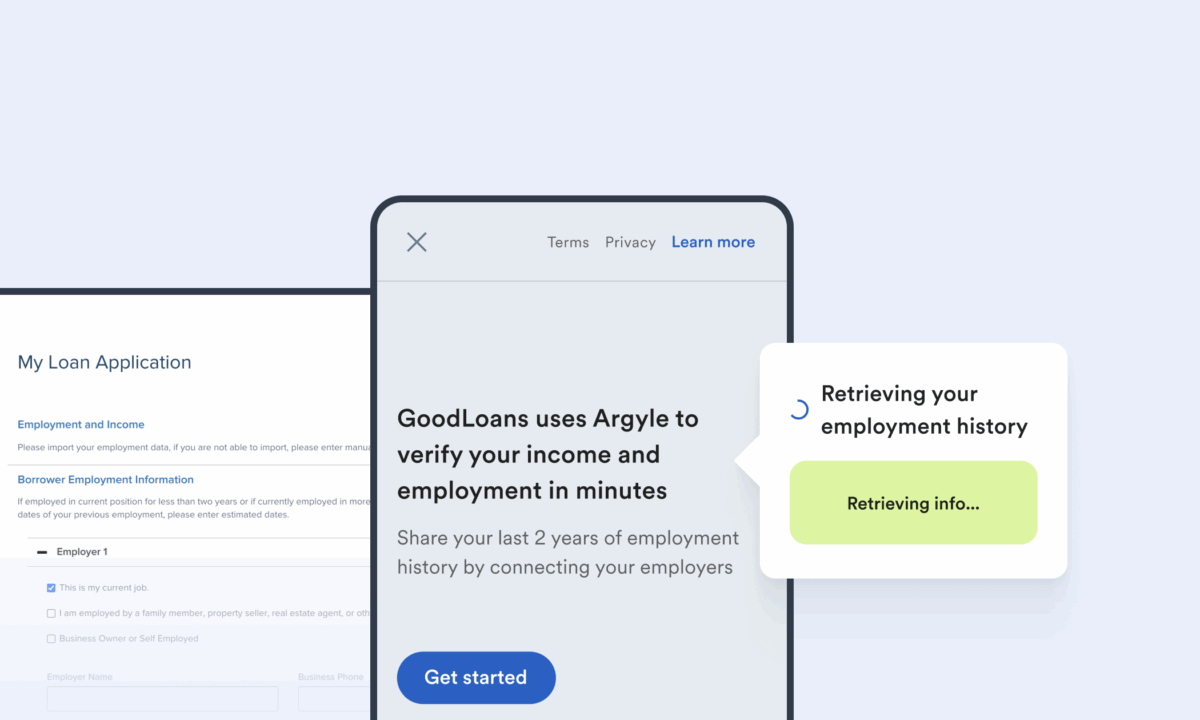

When verifications are embedded within the 1003 application flow at the POS, borrowers are still in an active, engaged mindset. They’re focused on completing a mortgage application they initiated, and verification is just another step in that process—just like providing their name, address, or employment information.

Once American Pacific switched on Argyle’s direct-source, consumer-permissioned verifications in their POS by default, they saw verification orders “absolutely hockey-stick”: “Once we made [verifications] part of the natural flow, completion rates skyrocketed. You no longer have processors sending links or explaining what to do—it just happens as part of the application.”

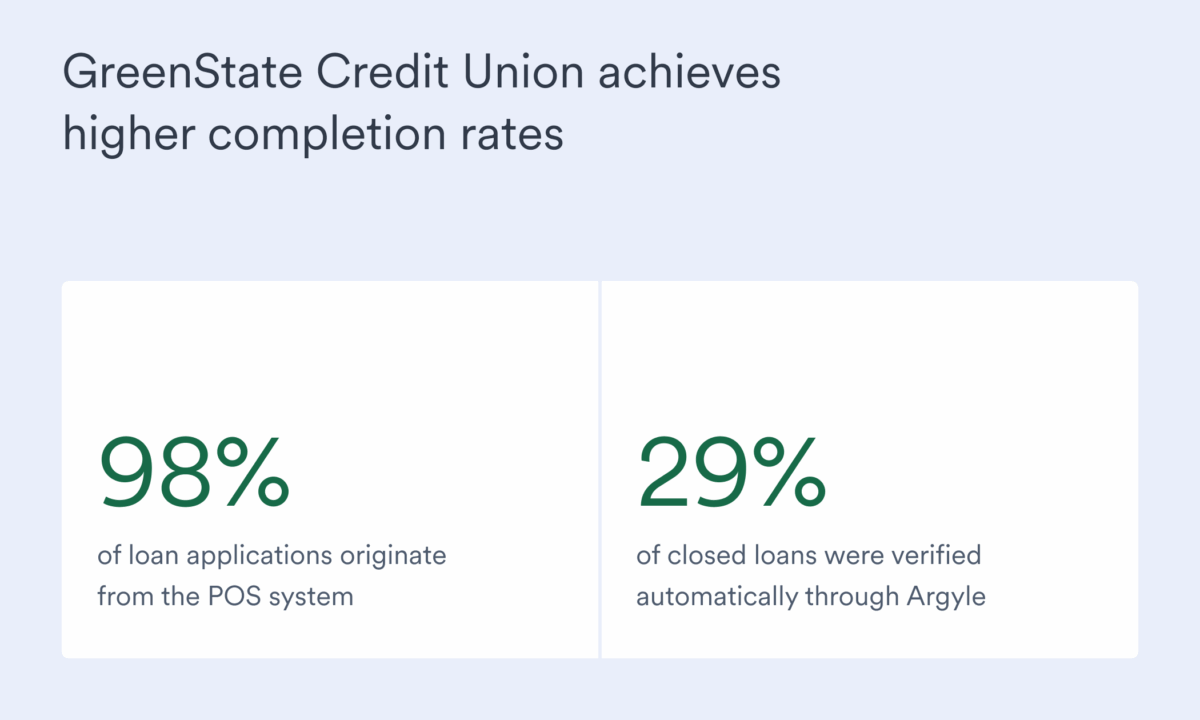

GreenState Credit Union also embedded verifications upfront in their POS—where 98% of their loan applications originate—and saw similarly strong adoption rates, with 29% of their closed loans verified automatically through Argyle.

Multiplied cost savings

Most lenders that adopt direct-source, consumer-permissioned verifications see immediate cost savings when compared to legacy methods, often as high as 80% per verification. But if verifications are only available in the LOS, savings can be limited to a portion of their loans.

When you move verifications to the POS, you’re not just saving money per verification; you’re completing dramatically more GSE-eligible verifications at that lower cost.

That’s why lenders consistently report higher savings when they move from LOS to POS implementation. It’s the same underlying technology, but the workflow placement determines how much value is actually captured.

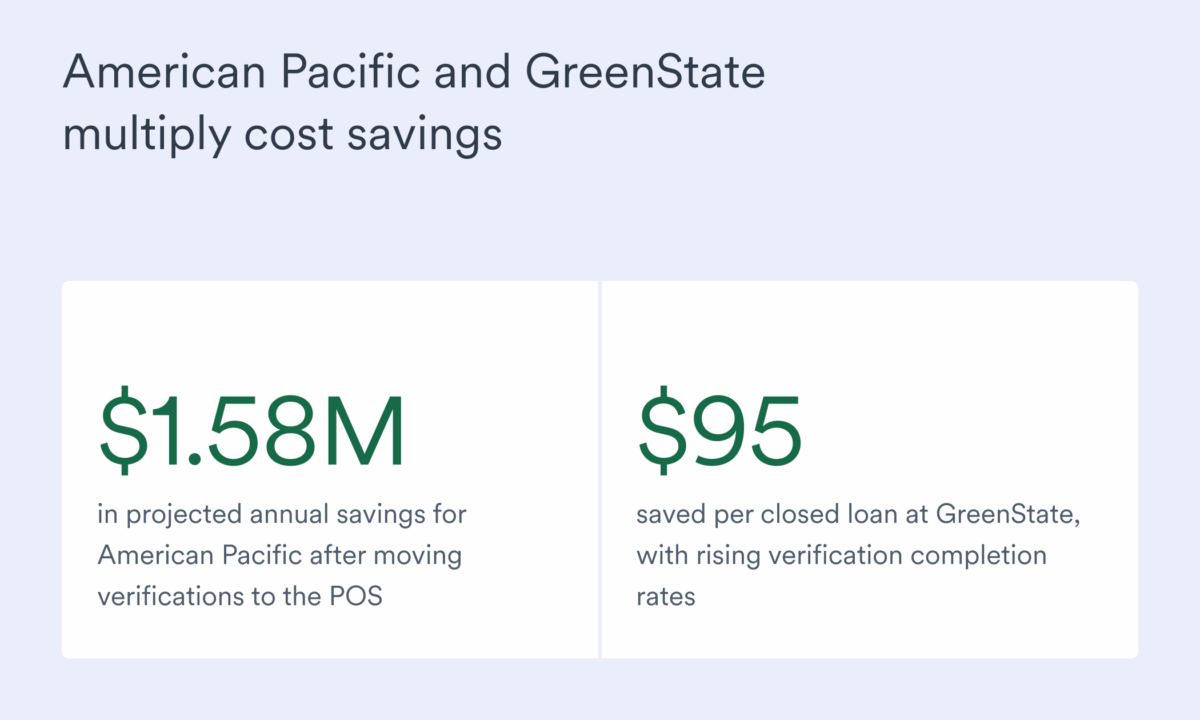

For American Pacific, moving verifications to the POS is helping them drive over $1.58 million in projected annual savings. Similarly, GreenState reported $95 in savings per closed loan, savings that only scale higher with their ramped-up verification completion rate.

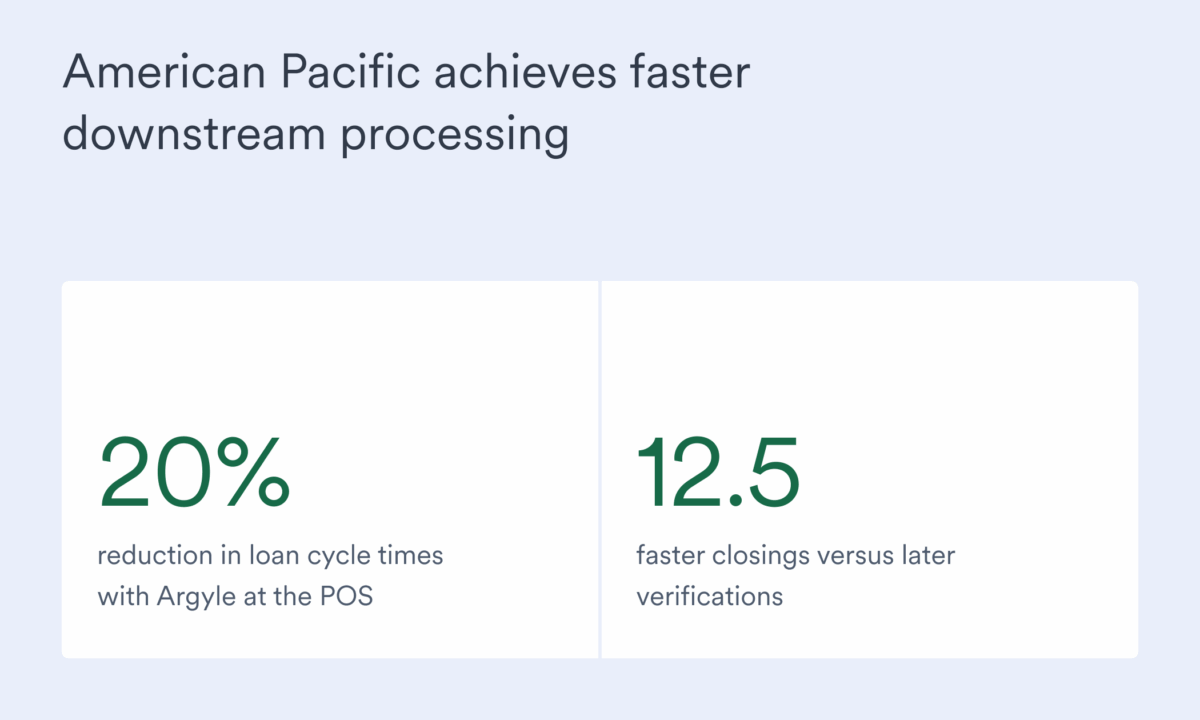

Faster downstream processing

When income, employment, and assets data is verified and captured at the POS, it’s already sitting in your system by the time a processor receives the file. There’s no waiting for the borrower to respond to a verification request, and no delay while their data gets pulled and populated into the LOS.

Instead, processors can immediately review complete and accurate information and quickly prepare the file for underwriting submission. This head start compounds throughout the rest of the loan origination process.

As a result, American Pacific saw a 20% reduction in processing-to-underwriting cycle times for loans implementing Argyle verifications at the POS, closing 12.5 days faster than when they verified borrowers later in their workflow.

Superior borrower experience

Nathan Seyfer, senior vice president of mortgage lending at GreenState, emphasized the importance of keeping members in a single, cohesive workflow during a recent webinar: “Any time we bifurcate and say, ‘Hey, member, you’re starting in this channel, but we need you to go over here and do this,’ it just feels incongruent. We want to try to keep the member in that track from start to finish…Meeting members where they are is the biggest thing. The more we can keep them in that ecosystem and working through it, the better the experience.”

When verifications happen directly in the POS, borrowers experience a smoother, more logical flow. They apply for a mortgage, verify their income and employment as part of that process, and they’re done. They’re not pulled out of the application to tend to a separate task, and they’re not confused about why they’re being asked for information they thought they’d already provided.

This improved experience shows up in customer feedback, loyalty, and lifetime value. GreenState, for instance, noted how streamlined processes positively impact NPS. Meanwhile, American Pacific reported that embedding verifications within their application flow made it feel effortless rather than cumbersome.

Greater pre-qualification accuracy and confidence

With GSE-eligible verifications happening at the POS, loan officers have more precise income, employment, and assets data immediately—not just estimates or self-reported figures, but real-time, granular data straight from the system of record. That means pre-qualification letters reflect reality from day one.

As a result, loan officers can have more informed conversations about qualification based on comprehensive data, including base pay, overtime, bonuses, and other employment and earnings details that borrowers might otherwise forget to mention. They can identify opportunities to maximize purchasing power in cases of variable income, and they can set appropriate expectations that won’t be undermined by surprises later in the process.

This accuracy builds borrower confidence and reduces fallout from qualification changes as real income data replaces rough approximations.

Addressing the upfront cost concern

Lenders’ most common objection to moving verifications from the LOS to the POS is the fear that they’ll be paying to verify applications that never actually become closed loans. But leading lenders have consistently found that the math works strongly in favor of POS placement.

The key is understanding that higher completion rates at the POS more than compensate for verifying a larger number of verifications—including ones for applications that never close.

American Pacific worked through this systematically. They calculated their pull-through rate, then compared completion rates and costs in both scenarios. “We did the math,” explained Sutherland. “And when we asked, what if we take five or 10% off that expected success rate and get really conservative? There’s only upside built into this equation.”

That analysis gave them the confidence to deploy POS verifications by default, resulting in savings that far exceeded what they saved with LOS-level verifications.

GreenState took a similar view. “It’s just a law of averages,” said Syfer. “The reduced costs in manufacturing the loan will play out in the end. It becomes a baseline—an expected cost that delivers a better member experience.”

Successfully making the shift

Moving verifications from your LOS to POS requires the right technology foundation.

First, your verification provider must offer native integrations with major POS platforms like nCino, Consumer Connect, Tidalwave, LenderLogix, as well as an embedded user experience that keeps borrowers in the application flow and automatic data flows to downstream systems.

Coverage matters, too. Solutions (like Argyle) that cover 90% or more of the U.S. workforce ensure most borrowers can verify successfully, making POS-stage verifications the primary method in your waterfall rather than one of several tools you’re juggling in your tech stack.

The competitive advantage is real

The mortgage industry’s shift toward upfront POS-stage verifications is accelerating. And lenders across the spectrum are seeing substantial results: exponential savings, slashed cycle times, and measurably better borrower experiences.

For organizations still running verifications through their LOS, the question isn’t whether to add them to the POS, but when. As more lenders adopt POS-level verifications, the speed and cost advantages compound. Borrowers will soon begin expecting instant verifications as part of a modern application.

The transformation from cost center to competitive edge happens one workflow change at a time. And moving verifications from the LOS to the POS is one of the highest-impact changes you can make now.

Ready to transform your operations right from the point of sale?

Get in touch with Argyle’s team to learn more about our comprehensive LOS and POS integration network—and see how lenders are achieving outsized results.You can also watch our webinars featuring American Pacific Mortgage and GreenState Credit Union, or read our American Pacific case study, to hear from lenders who made the switch and never looked back.