Why automating verifications should be a core efficiency play in every lender’s 2026 plan

By Daniel Esquibel, Head of Partner Sales at Argyle

After years of riding waves—from record-high refinancing to purchasing volume surges—mortgage lenders are now facing a market where originations have plateaued and growth levers have all but disappeared. In recent months, origination volumes haven’t budged, and delinquency rates continue to climb. Meanwhile, according to Freddie Mac, the cost to originate a loan has surged 35% in recent years while profitability per loan has steadily declined.

In this environment, the winners won’t be the lenders who simply wait for rates to drop or volumes to rebound. They’ll be the ones who fundamentally reimagine their operations so they can do more with less.

I’ve spent the last few years working with some of the biggest lenders in the US, and I’ve seen firsthand how forward-thinking organizations are responding to market pressures. They’re not just cutting costs. They’re investing in automation to transform their cost structures and their competitive positions. And sitting at the center of this transformation are verifications.

Below, I break down the true cost of manual verifications, explain why the current landscape is making automation urgent, and demonstrate what a comprehensive verification solution looks like in practice—ultimately offering a roadmap for building efficiency into your strategic plan.

The hidden tax on every loan

First, let’s talk about what manual verification processes actually cost your business. Most lenders focus on direct vendor fees—the $50 to $75 they pay per verification. But the truth is, that’s just the beginning.

When your team is manually chasing down paystubs, calling up employers, and processing documents, you’re not just paying for verification services. You’re paying for hours of labor and energy that could be better spent on strategic, high-impact tasks. You’re paying for extended loan cycles that damage your borrower experience and tank your conversion rates. You’re paying for data entry errors and quality issues that come with human-based processes. And you’re paying the opportunity cost of a smaller pipeline because your team simply can’t process any more applications.

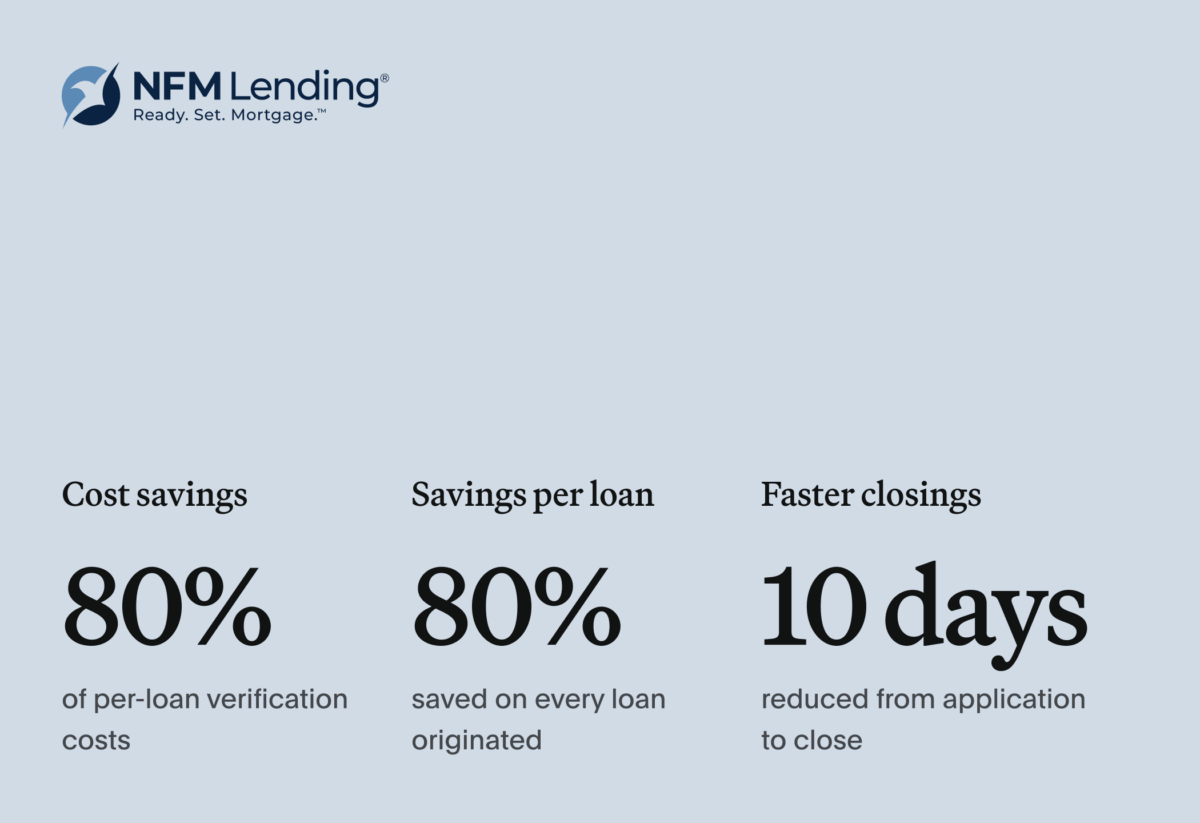

Consider our customer NFM Lending. Before partnering with Argyle, they worked with a vendor that kept increasing prices while also requiring NFM’s loan officers to manually reach out to borrowers to collect paystubs and W-2s—driving up both hours and costs. Now, with Argyle’s direct-source verification solution, NFM’s borrowers can click a link and sign directly into their payroll, employer, or bank account, giving loan officers real-time, ongoing access to their data and documents. In NFM’s first year with Argyle alone, they saw 80% cost savings (around $100 per loan) plus a 10-day reduction in the time from application to close.

That’s the real ROI of end-to-end automation—not just lower verification costs, but fundamentally more efficient and effective operations.

Why 2025 challenges are making automation urgent

Three converging forces are making verification automation essential right now.

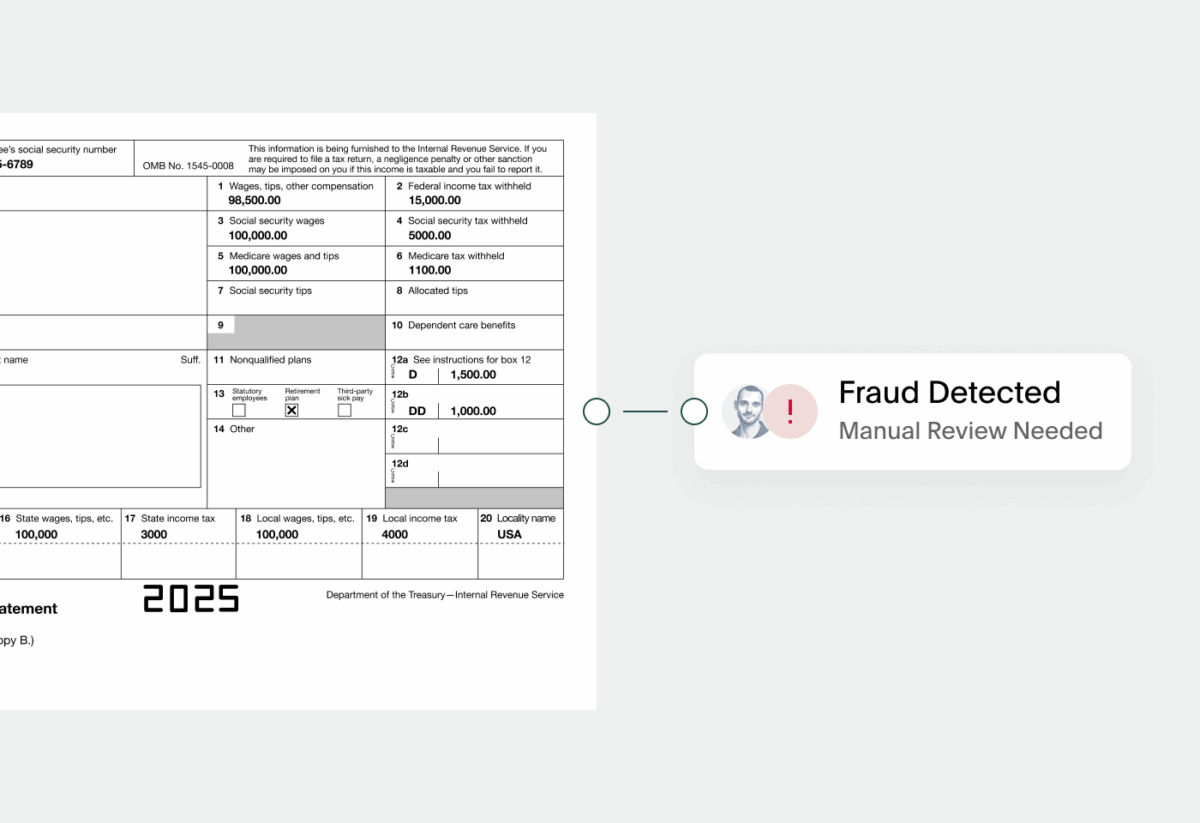

- First, rising fraud is creating verification challenges that traditional methods can’t solve.

CoreLogic’s Mortgage Application Fraud Risk Index jumped 8.3% in 2024, with one in 123 mortgage applications showing indications of fraud and nearly half (46%) of Fannie Mae’s fraud investigations revealing misrepresentation of income.

Meanwhile, with advances in artificial intelligence, 90% of document fraud signals are now invisible to the human eye—meaning manual reviews are failing to catch more sophisticated forms of forgery that AI-driven tools can produce in a matter of minutes.

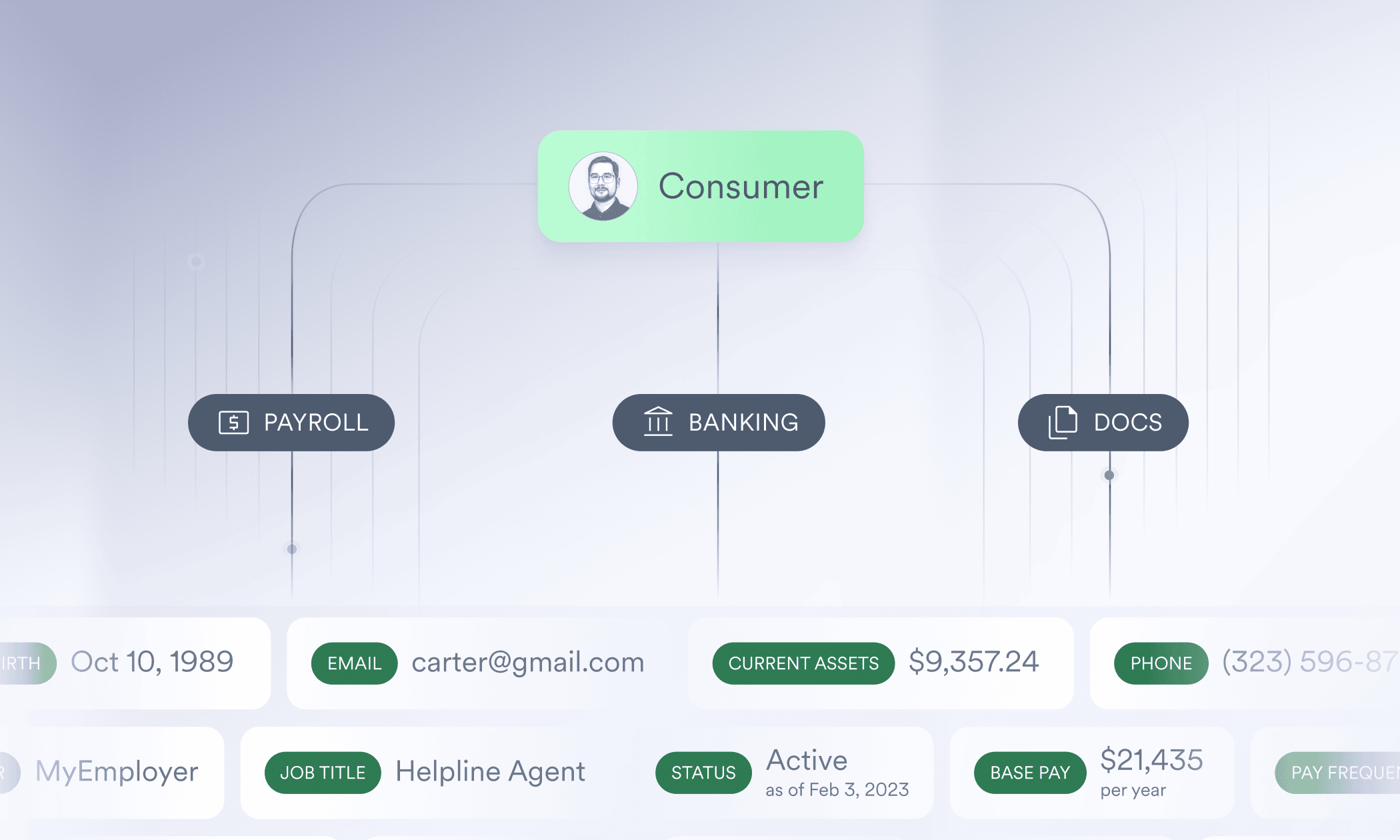

When your verification process rests on documents that borrowers provide, you’re essentially choosing to trust paper that you can’t reliably validate. Direct-source verifications eliminate this risk by pulling data directly from the systems of record (borrower’s employer platforms, payroll systems, and bank accounts), giving you accurate, real-time information you know you can trust.

- Second, the shift away from legacy databases is accelerating.

The verification database model that dominated for decades is quickly losing ground. Many mortgage processors are shifting volume away from traditional databases like TWN, with most citing rising costs as their primary motivation. When service quality and coverage become secondary concerns to affordability, it’s a clear sign that the market is demanding better alternatives.

Lenders are now discovering that direct-source verifications offer superior coverage (Argyle reaches 90% of the U.S. workforce, including over 30 leading gig platforms) and at a fraction of the cost (with 55% conversion rates and 90% data completeness, on average). In short, the economics are simply better.

- Finally, workforce constraints are necessitating operational change.

After the downturn in 2024, mortgage firms are operating with leaner teams and more cautious hiring plans. When you’re doing more with fewer people, every efficiency gain multiplies across your organization. In that case, automation isn’t just about cutting costs. It’s about creating the capacity to grow without proportional increases in headcount.

Taking a different approach in 2026

Forward-thinking lenders are turning away from manual verifications and toward comprehensive verification waterfalls that maximize automation while minimizing costs and friction.

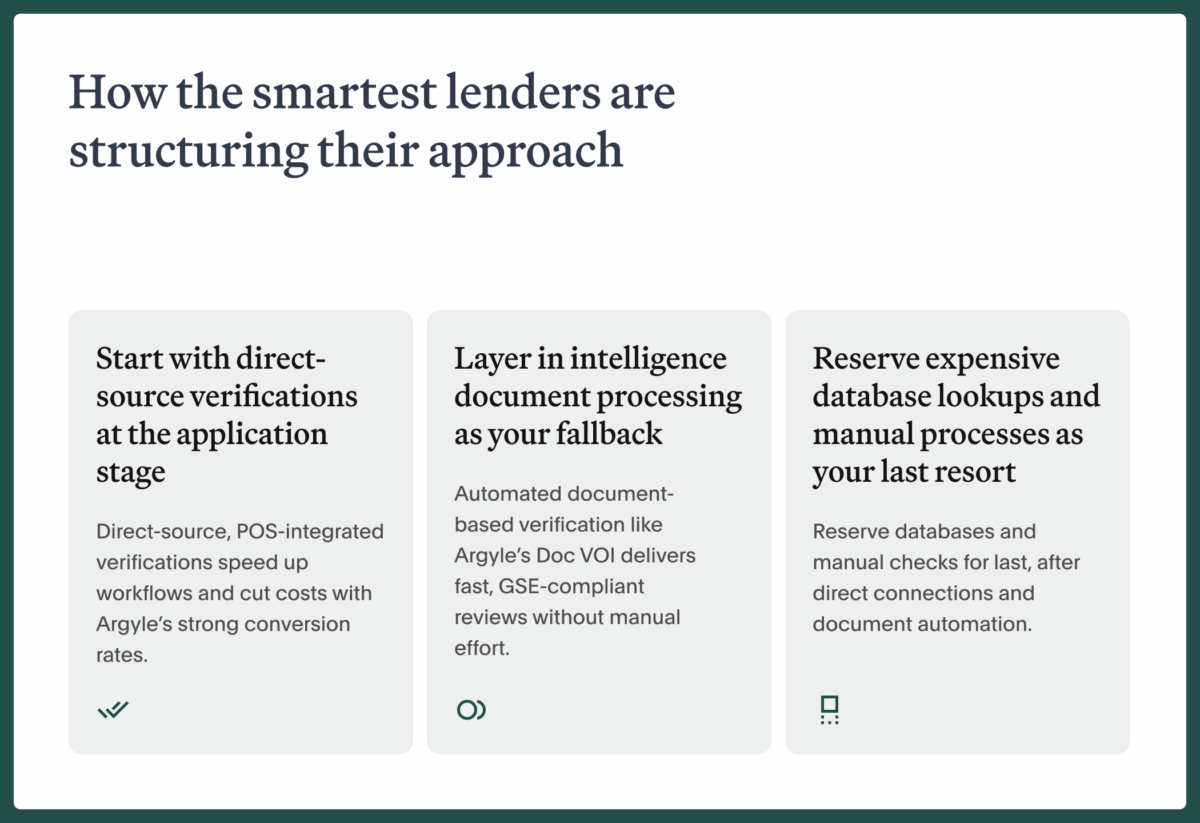

The most effective verification strategies follow a clear hierarchy: starting with the fastest and most cost-effective methods and cascading to alternatives only when necessary. Here’s how the smartest lenders are structuring their approach.

- Start with direct-source verifications at the application stage.

Whether through payroll connections (for verification of income and employment) or bank connections (for verification of assets and/or income), direct-source, consumer-permissioned verifications should always be your highest-priority method.

Additionally, integrating automated verifications directly into your point-of-sale (POS) system creates the best possible borrower experience. Your borrowers connect their account once, you get ongoing data access, and you both move forward faster. At Argyle, our integrations with platforms like nCino Mortgage, Consumer Connect, Tidalwave, and more make this seamless, automatically transferring verified data from the POS into the loan origination system (LOS) without requiring manual data entry.

Conversion rates matter here. Solutions like Argyle with 55% average payroll conversions and 65% average banking conversions mean more than half of your applications are verified in minutes, at a lower cost, and with the highest data quality. That’s the efficiency benchmark you should be targeting.

- Layer in intelligence document processing as your fallback.

For borrowers who can’t connect directly to their employer, payroll, or bank accounts, automated document-based verifications offer a middle ground between expensive databases and tiresome manual processing. Argyle’s Doc VOI uses optical character recognition (OCR) technology to extract and validate data from uploaded documents like paystubs and W-2s, providing GSE-compliant reports without the labor intensity of manual reviews.

- Reserve expensive database lookups and manual processes as your last resort.

Traditional databases and manual verifications still have a place, but they should be your last resort—not your first call. By cascading through direct connections and intelligent document processing first, you save costly database fees for only those applications that absolutely need it, when other methods fail.

This waterfall approach isn’t theoretical. Lenders using this strategy routinely achieve standout cost reductions while also improving both speed and data quality.

Verification waterfalls in practice

ALCOVA Mortgage implemented this exact waterfall approach and saw 88% cost savings per loan with 55% automated verification conversions. Delta Community Credit Union achieved a 61% automated verification conversion rate, vastly reducing expensive fallback verifications. And NFM Lending saved 80% on total verification costs while optimizing their borrower experience.

These examples aren’t outliers. They’re the new baseline for competitive lending performance.

The transformation extends beyond conversions and cost savings. When verification happens in minutes instead of days, your loan officers can pre-qualify borrowers with confidence, your underwriters can focus on tackling complex files instead of collecting basic data, and your borrowers can navigate a modern, digital-first application flow that matches their expectations for frictionless experiences on demand.

Building your efficiency roadmap

If you’re serious about automating verifications as a core efficiency play, here’s where you can start.

- Map your current verification costs: Look beyond vendor fees to include labor costs, cycle time delays, and quality issues from manual processes. The real cost of manual verifications is typically much higher than the vendor fee alone once you factor everything in.

- Audit your tech stack to gauge your integration readiness: Automated verifications deliver maximum value when they can integrate directly into your POS and LOS. Verification solutions that require manual data transfers or separate workflows undermine the efficiency gains you’re out to achieve. Look for native integrations that can automate the entire data flow from end to end.

- Prioritize direct-source solutions with the broadest coverage: Coverage determines your conversion rates, which in turn determine your cost savings. A solution like Argyle with 90% workforce coverage and 55%+ average conversion rates will deliver significantly higher automation rates than alternatives with lower coverage and conversion metrics—meaning more loans verified automatically, fewer manual fallbacks, and greater overall savings.

- Calculate the ROI of automation across your full pipeline: If you originate 100 loans per month and automating verifications saves you $100 per loan and two weeks of processing time, that’s $120,000 annually in direct savings—plus the capacity to handle up to 20% more applications with your existing team. The business case quickly becomes compelling, and you can take it straight to your organization’s decision-makers.

The future of the industry belongs to operational innovators

Over the course of my career in real estate and mortgage origination, I’ve had the privilege of working with hundreds of lenders across the country—from large institutions to small community credit unions. Through those partnerships, I’ve learned that the most successful organizations aren’t necessarily the ones with the biggest marketing budgets or the flashiest technology. They’re the ones willing to fundamentally rethink the way they operate when it becomes necessary.

That’s what drew me to Argyle and to partner sales: the opportunity to help lenders transform their verification workflows and build more efficient, scalable operations. Recently, I was honored to be named a 2025 HousingWire Rising Star for this work. But the real recognition belongs to our customers and our team.

The lending professionals at ALCOVA, Delta Community, NFM Lending, and so many other forward-thinking organizations are the ones doing the hard work of challenging legacy processes and reimagining what’s possible for the industry. And none of their success stories would be possible without the exceptional people behind Argyle’s partnerships—the customer success managers, implementation specialists, and support professionals on our mortgage team who work hard every day to make automation a reality.

The industry’s future belongs to the leaders who understand that efficiency isn’t about doing less. It’s actually about creating the operational leverage to do more.

The mortgage market may not give us another volume surge anytime soon. In fact, it’s likely that interest rates, economic uncertainty, and housing affordability challenges will continue to hinder origination activity. But that doesn’t mean growth is impossible. It just means growth requires a different approach, one built on operational excellence instead of market tailwinds.

In short, automated verifications aren’t just a cost-saving measure. They’re the foundation for more efficient, scalable, and competitive lending. And, in 2026, that efficiency will be the difference between lenders who thrive and those who merely get by.

Ready to see how automated verifications can transform your lending operations?

Get in touch with Argyle’s team to learn more about our comprehensive verification platform and discuss your organization’s specific needs.