With Argyle, NFM Lending optimizes the borrower experience and saves 80% on income and employment verifications.

NFM Lending got its start as a mortgage broker 25 years ago and has since grown into an award-winning, multi-state independent mortgage banker (IMB). NFM is dedicated to getting to know each borrower’s unique financial situation and finding a best-in-class solution. This attention to detail allows NFM to not only meet their borrowers’ needs but to support a wider community of real-estate agents and builders—not to mention the national housing market.

For NFM, providing an exceptional experience means pairing a high level of customer service with steady innovation. Recently, that included eliminating paper chases and speeding up the approval process while keeping costs at a minimum. To make it all possible, they turned to Argyle.

Challenge

NFM has seen the loan origination process change a lot in their quarter-century of operation. What was once a highly manual ordeal—requiring borrowers and employers to fill out verification forms and send them via mail or email—is now largely automated. Today, digital verification reports are often supplied by third-party vendors. But NFM found that these solutions can be limited and costly.

For example, NFM was working with a VOI/E provider that allowed them to instantly access income and employment data electronically. But prices kept increasing, and NFM’s loan officers still had to reach out to borrowers to collect documents like paystubs and W-2s. As part of a cost-reduction effort, NFM started shopping for a better solution. That’s when they found Argyle.

Solution

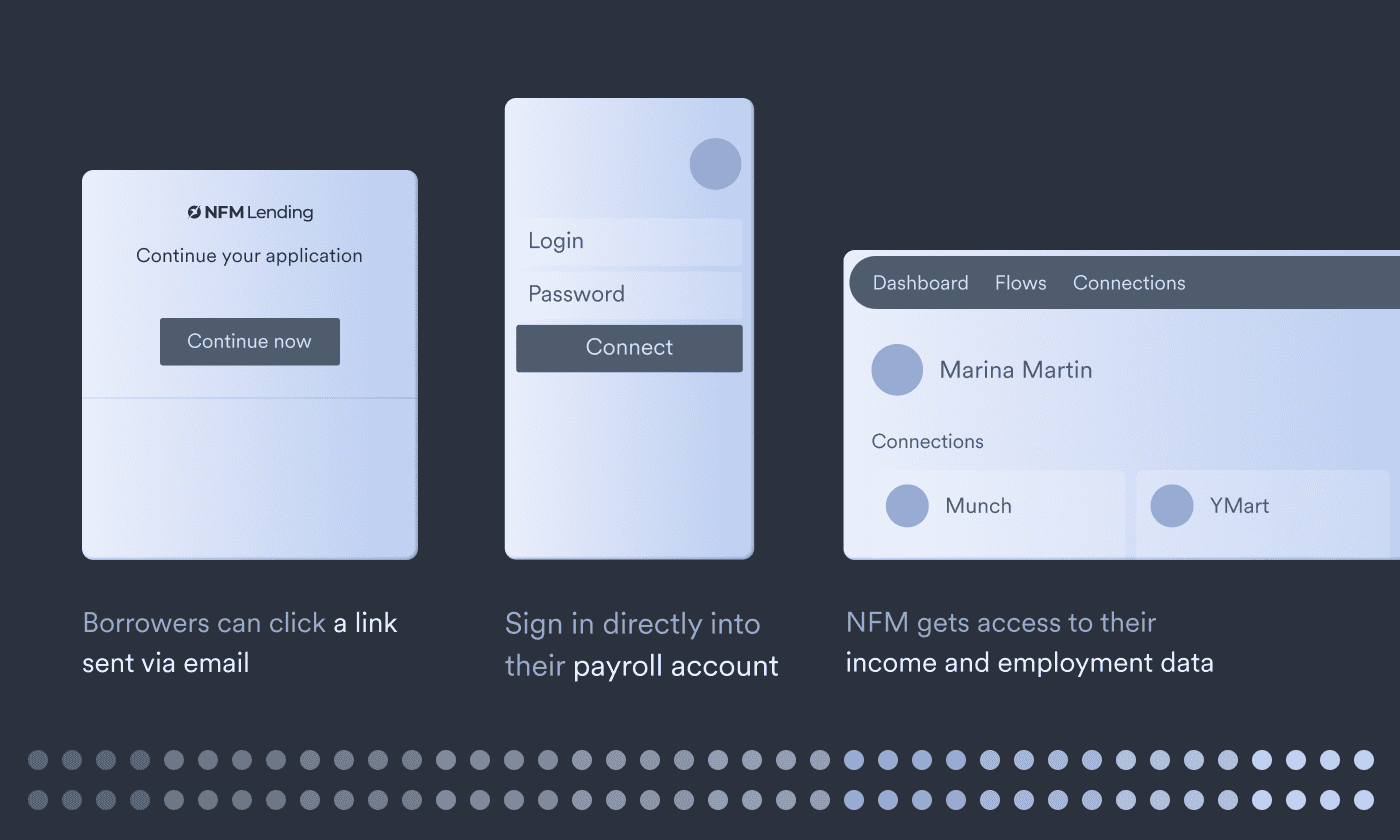

With Argyle, NFM’s borrowers can now click a link sent via email and sign directly into their payroll account, giving NFM real-time, permissioned access to their income and employment data. Even better, NFM gets unlimited access to every paystub and W-2 through that same connection, eliminating hours of time and paperwork throughout the origination process.

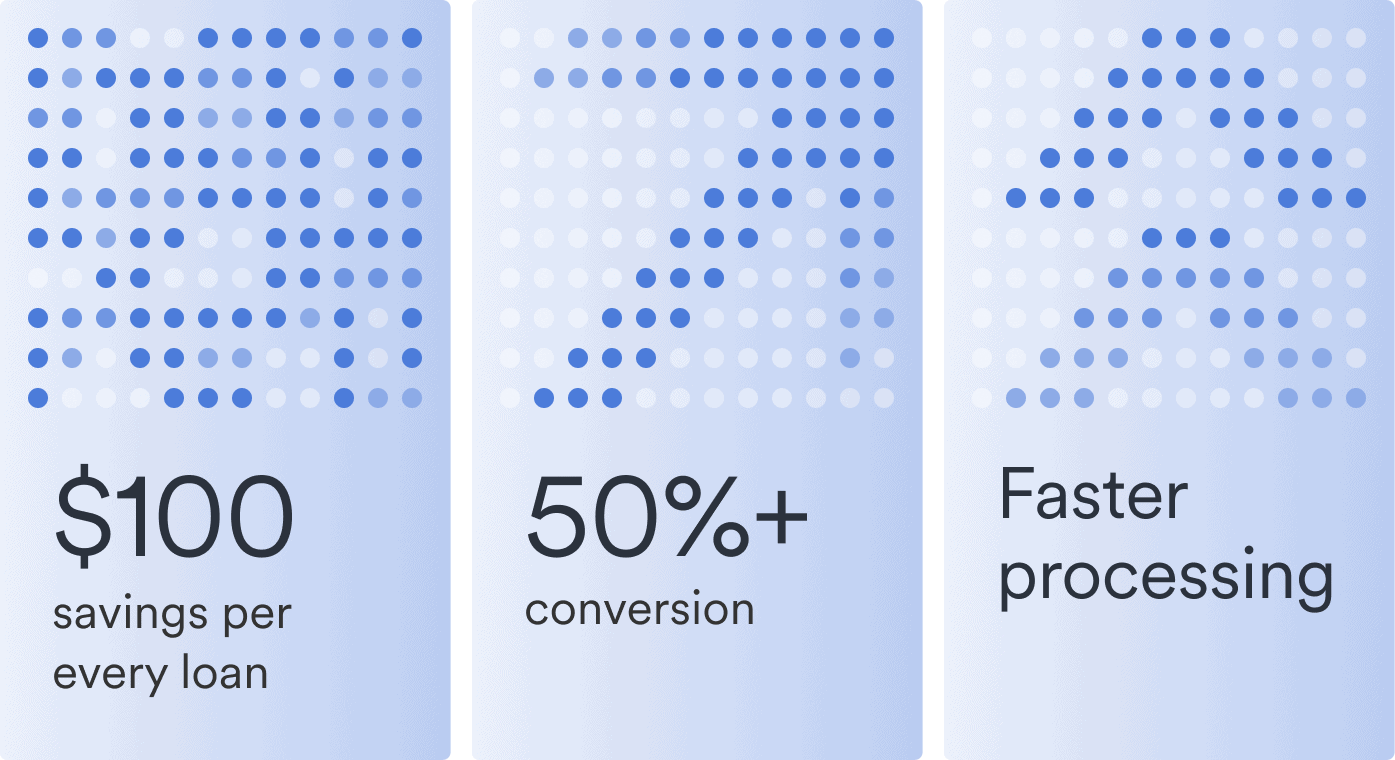

Originally, NFM was skeptical that borrowers would remember their payroll credentials, but they quickly found that wasn’t a hurdle. In fact, over 50% of borrowers find and connect seamlessly to their source(s) of income, saving NFM $100 for every loan in VOI/E report orders. Over the course of a year, these savings add up substantially.

Now, Argyle sits at the top of NFM’s verification waterfall, offering stronger data—at a fraction of the cost—compared to the next provider in line. Plus, NFM is in the process of integrating Argyle into their online application, for an even faster and more frictionless application experience.

Outcome

80% savings: In their first year with Argyle, NFM saved around $100 for every loan, which added up significantly over the year. Plus, they expect to save much more as internal adoption increases.

50%+ conversions: More than half of borrowers are able to find their income source(s) through Argyle’s network and log in to their payroll account, allowing NFM to avoid more expensive or manual solutions.

Faster processing: When borrowers provide their own income and employment data via Argyle, NFM sees at least a one-day pickup in application processing time.

“Argyle is at the top of our verification waterfall because they give us one-stop access to all of the income data and documents we need. Only after Argyle do we move on to other options, where prices might increase.”