A look at the past, present, and future

In 2023, the value of mortgage originations in the United States totaled about $444 billion, making them an essential part of the economy. Meanwhile, for many individuals, buying a home represents a once-in-a-lifetime milestone and the largest investment they’ll ever make.

However, this expensive purchase can quickly turn into an economic liability for lenders and buyers if mortgage processes are left unchecked. Inaccuracies in the mortgage process can impact everything, from lenders’ operations and individuals’ home ownership experience to the broader economic stability, as seen by the National Mortgage Settlement that cost financial institutions over $25 billion.

In this article, we’ll explore the evolution of mortgage lending in the US. Because reflecting on the past and being aware of the industry’s present state, particularly when it comes to verification technology, makes it easier to create a future in which mortgages live up to their role in the American Dream.

History of mortgage lending in the US

To fully appreciate present (and future) innovations that refine the mortgage lending process, it’s important to grasp the historical context of mortgages.

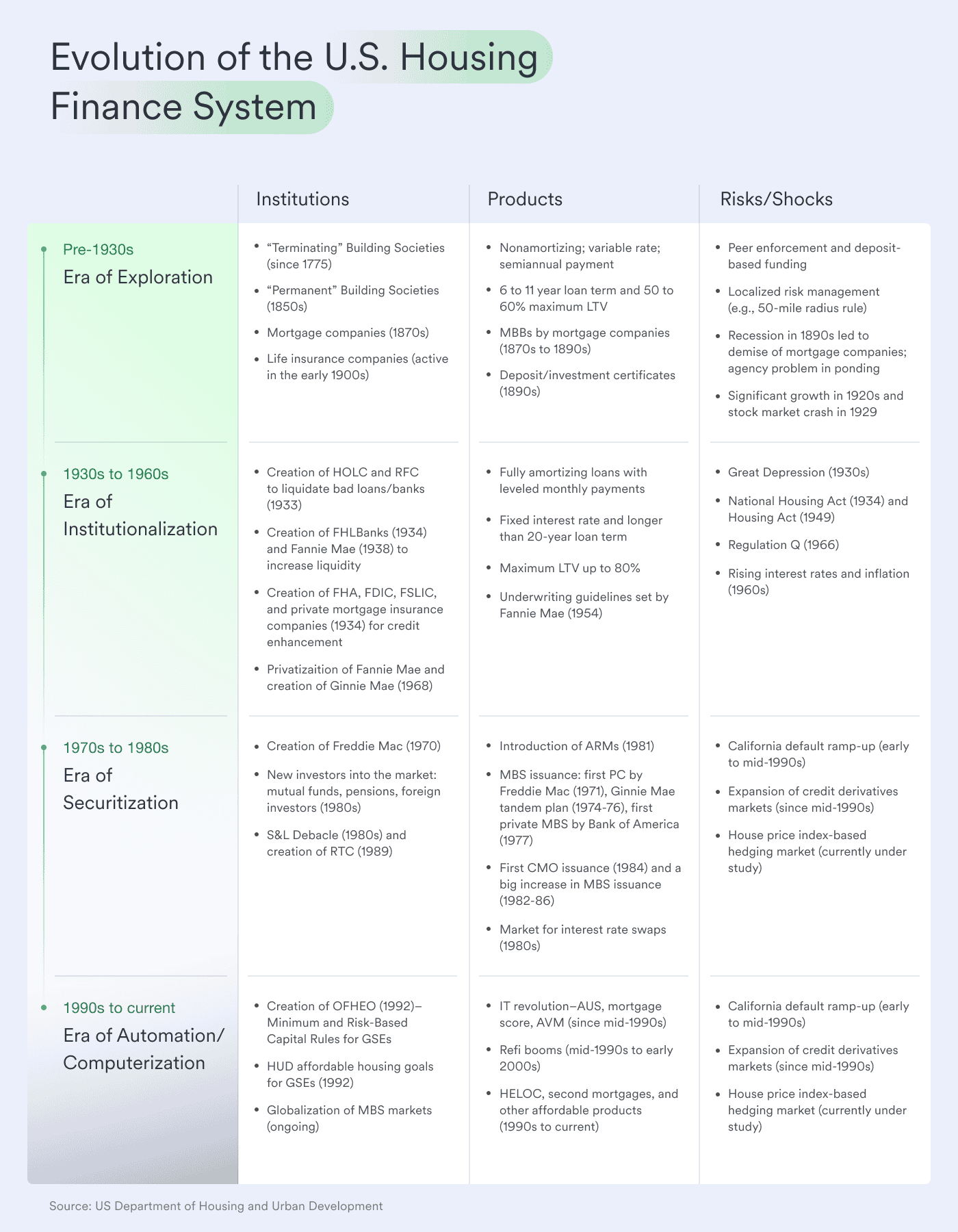

Before the 1930s, the US mortgage system was quite different from what we know today. Back then, residential mortgages in the United States typically only lasted 5 to 10 years and ended with large “balloon” payments of the principal. For the most part, bullet loans, variable interest rates, high down payments, and short loan terms were the norm.

If borrowers couldn’t refinance these loans at maturity, they had to pay the full remaining balance, making it challenging for consumers to effectively manage these loans. At this time, mortgage underwriting was also heavily based on personal relationships and limited documentation, making lenders vulnerable to fraud and borrowers vulnerable to bias and discrimination. Plus, verification of income and employment (VOIE) was inconsistent across institutions.

Despite the risks of fraud, mortgage lenders still held significantly more power in the process than borrowers. Back then, mortgages initially had very low loan-to-value ratios of 50 percent or less, so mortgage loans posed minimal risk to lenders. If borrowers faced financial difficulties, they could simply sell their property to settle the debt—that is, until the Great Depression in the early 1930s. After that, US property values plummeted.

During this time, mortgage holders were in precarious positions and refused to refinance the maturing loans. Consequently, many borrowers defaulted because they lacked the cash or home equity to repay their debts.

And the impact was drastic. There was a surge in foreclosures between 1931 and 1935, with about 250,000 occurring annually. At the height of the Great Depression, nearly 10% of all mortgaged homes were foreclosed. Financial institutions tried to resell these repossessed properties, which depressed the housing market further.

That’s when the US federal government stepped in and created three institutions to help restore the market: the Home Owner’s Loan Corporation (HOLC), the Federal Housing Administration (FHA), and the Federal National Mortgage Association (FNMA), now known as Fannie Mae.

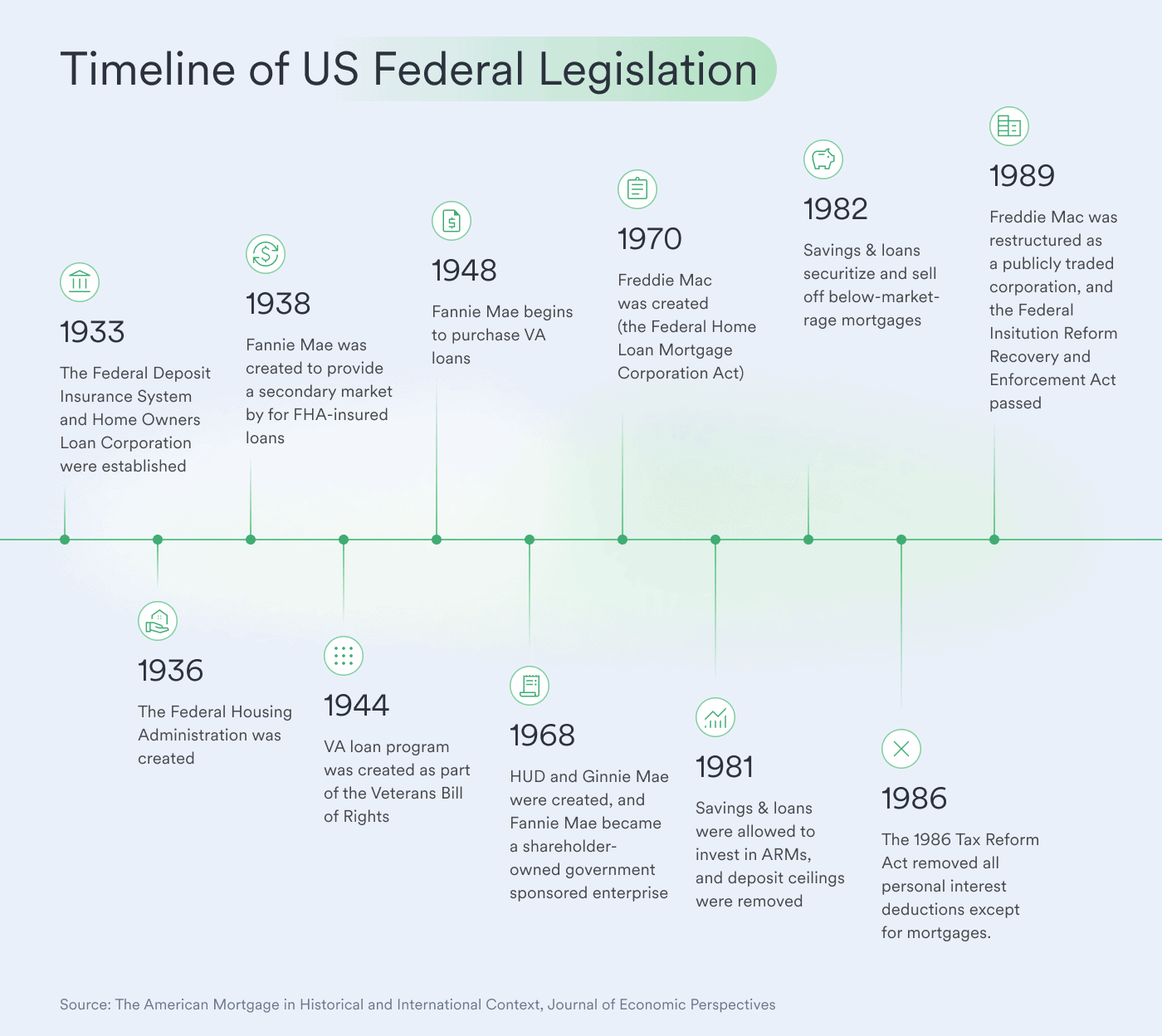

This move led to various federal legislations that have shaped the US mortgage industry. The outcome was a shift from a restrictive, high-barrier mortgage system to one centered on affordability, standardized underwriting, and government-backed insurance—the foundations of the modern US mortgage market.

Mortgage lending as we know it today

Fast forward to the present day, and the US mortgage system offers a variety of options that are less commonly available in other countries. Borrowers can now choose between fixed or floating interest rates, and can lock in these rates when applying for a mortgage. They have options to decide when the rate resets, the loan term, and the amortization period. Additionally, they can prepay without penalty, borrow against home equity freely, and access mortgages with minimal down payments and favorable terms.

In many ways, the US mortgage system provides significant advantages for homeowners and contributes to overall economic stability.

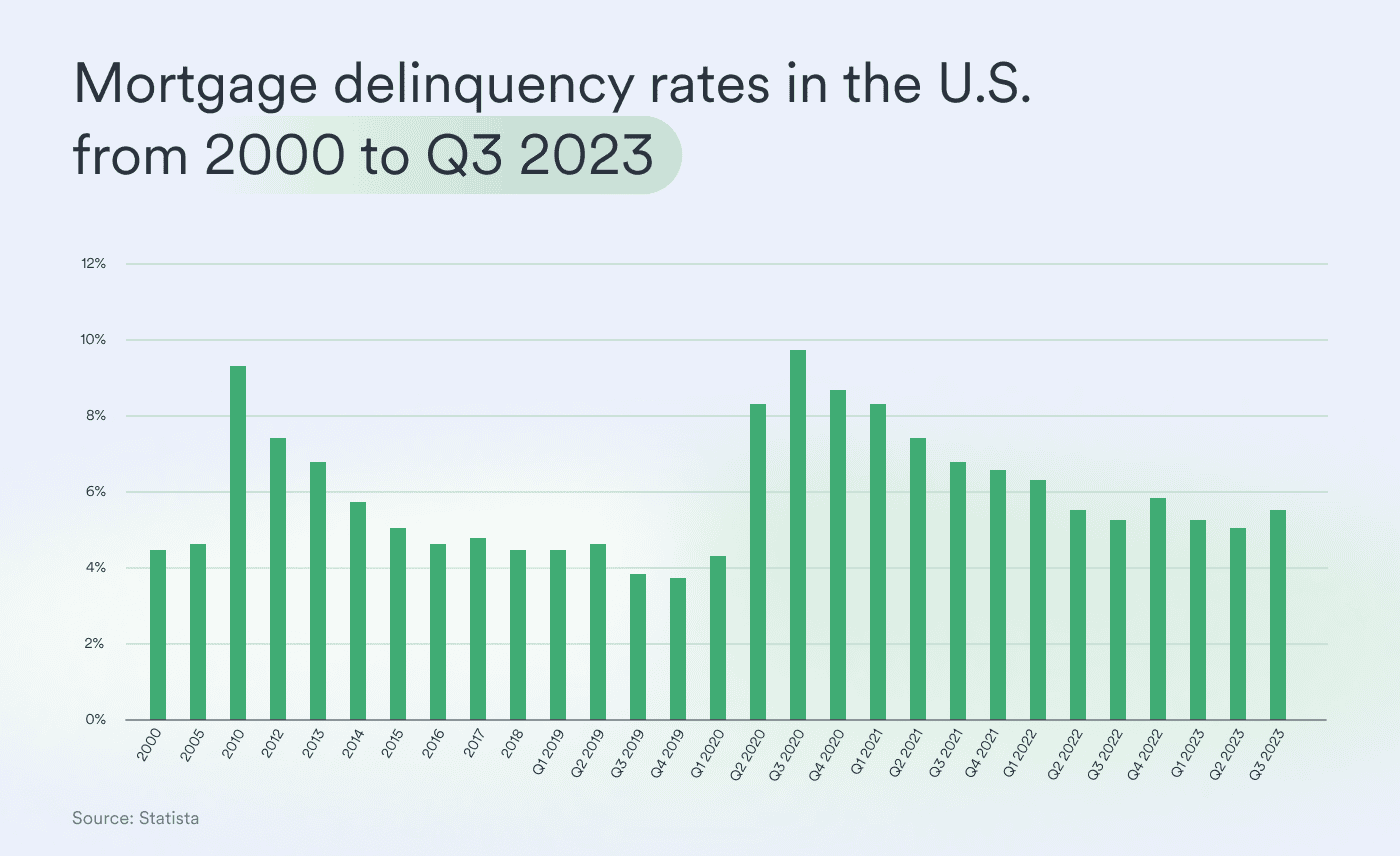

Of course, the US housing market has also experienced its fair share of peaks and valleys over the last few decades. For example, the 2008 collapse was triggered by a mix of fluctuations in interest rates and a high number of unqualified borrowers, while the 2021 surge in housing demand was driven by pandemic-related, historically low interest rates. Yet, in 2023, even amid high interest rates, the industry maintained some of its lowest delinquency rates in recent years.

Another change over the past century has been the degree of risk. Considering that mortgage loans these days involve significantly higher loan-to-value ratios than in the 1930s, ranging anywhere between 70% and even 100%, lenders carry much of the credit risk. This means that due diligence, especially in VOIE, is more important than ever in determining a borrower’s ability to repay the loan.

Errors and oversights in the verification process can quickly snowball into a larger problem, with a ripple effect on the borrower, lender, and the broader US housing economy. Simply put, credit decisions shouldn’t be made on unreliable or static borrower information.

Moreover, we live in an age where borrowers expect seamless digital experiences. According to McKinsey, 72% of customers begin their loan process online. And, customer demand for digitally originating mortgages is often twice as high as the supply of digital mortgages. To remain competitive, lenders need to double down on digitization.

And that’s where mortgage technology comes into play.

The Role of VOIE technology in mortgage lending

Despite these changes, the US mortgage industry still lags in leveraging mortgage technology, especially when it comes to VOIE.

A 2024 Stifel survey revealed that a significant portion—50% to 75%—of mortgage lenders still rely on manual verifications.

From our perspective, these numbers indicate that a majority of lenders are clinging to an outdated method that doesn’t fully serve their or the industry’s needs. Moreover, manual verifications involve several challenges: They expose lenders to mortgage fraud, compliance risks, and poor credit decisioning based on incorrect or incomplete borrower data.

For example, two prominent mortgage loan originators (MLOs) were recently charged for falsifying loan documentation to secure mortgages at lower interest rates, consistently deceiving mortgage lenders in the process. And there are numerous other cases of mortgage fraud involving doctored loan documents in the US. Essentially, manual VOIE negatively impacts a lender’s ability to accurately gauge the borrower’s authenticity and ability to repay the loan.

Additionally, it is extremely expensive and time-consuming from an operations standpoint, especially considering that VOIE has to be repeated multiple times throughout the loan process. These steps introduce additional friction to the mortgage loan process and can result in application drop-off, so lenders could also lose out on potential customers.

Of course, in lieu of manual verifications, many lenders opt to use The Work Number (TWN). But at approximately $66.45 (and rising) per report, TWN is problematically expensive. And because these reports are pulled multiple times per loan cycle, the costs quickly add up.

Then there’s the issue of data quality. TWN operates on a delay, which means the borrower income and employment information lenders receive from TWN can be weeks or even months old, and a lot can happen to a borrower’s income and employment status in that amount of time.

On the other hand, leveraging the right mortgage technology can streamline the mortgage lending process, help lenders mitigate much of the associated risks, and minimize any unintended negative consequences for the financial institution and the broader economy.

How Argyle shifts the balance

That’s where VOIE technology, like Argyle, makes a difference.

With Argyle Income & Employment Verification, lenders can pull VOIE reports as many times as needed without worrying about rising costs or questioning the reliability of the data. More importantly, lenders can verify income and employment in seconds rather than days, speeding up the mortgage loan process.

While Argyle doesn’t eliminate fraud entirely or guarantee error-free decisioning, it definitely reduces the odds of these happening—all while making the loan experience much better for both lenders and borrowers.

That’s because Argyle relies on payroll connections, meaning Argyle pulls borrowers’ income and employment data straight from the source—continuously, in real time, and with the borrower’s consent. Lenders can benefit from greater financial visibility and feel confident that the information they receive is current and accurate, reducing compliance risks and human bias from the process.

The US mortgage system has changed, so should the tech stack

In the long run, payroll connectivity is the future of verifications. Lenders that leverage this technology sooner rather than later will be primely positioned to lead the mortgage market—especially as consumer consent becomes increasingly important in lending. Fortunately, you don’t have to wait long to make the switch.

If you’re interested in seeing Argyle in action, contact us for a product demo delivered by one of our mortgage team members.