It seems like every month a new aspect of our daily lives is engulfed by the “-tech” suffix.

In recent years the digital takeover of a number of fields has introduced us to a cornucopia of new terms like edtech, fintech, proptech, insuretech, femtech, and more.¹ If you feel like it’s becoming too hard to keep track of them all, you’re not alone.

Uber and Lyft are now household names — but there is an entire ecosystem of “click a button — have technology solve a real-world problem” companies driving similar change in every space you can imagine. Do you need to sell your house? Forget the real-estate agent; there’s a tech start-up for that.² Financial advisors? A thing of the past — download a robo-advisor app instead³. Need a birth-control refill? Sign up for the “Uber for birth control.”⁴ New-employee background checks? Check.⁵ The list goes on and on.

While these new internet-age solutions to old, boring problems are becoming more visible, what doesn’t get much attention is the underlying infrastructure that these new-age solutions rely on.

Infrastructure as a Service

There is an entire industry emerging made up of companies whose sole goal is to quietly enable the development of the apps and software solutions driving the “-tech” boom. Their products represent the unsexy infrastructure that lies beneath the surface and makes it possible for the apps we use every day to contact us, process credit cards, transfer our data, and much more. That unseen plumbing is incredibly important, as it facilitates the connections that we, as end-users, take for granted whenever we call an Uber or make a mobile payment.

Potentially the most well-known of these companies is AWS — Amazon Web Services — the on-demand cloud computing service that powers 34% of all cloud-use⁶ and generated over 25 billion dollars in revenue in 2018.⁷ But there is an army of companies that have popped up over the past ten years that are also building their own segments of the web’s infrastructure.

What is perhaps most interesting is that this set of companies are reverse engineering analog infrastructure built in the 80s and 90s and applying digital versions of it to today’s web services. They focus on areas like SMS message delivery, credit card payment processing, pulling credit scores, and storing data — areas that are costly, repetitive, and sometimes even impossible for most businesses to handle on their own.

Driving Innovation in Digital Infrastructure

The number of companies offering these types of below-the-surface digital infrastructure products is growing by the day, and this is by no means an exhaustive list. But there are some heavy-hitters that merit special mention both for their innovation and for the A-list partnerships they’ve already been able to establish.

Twilio

Twilio is a cloud-communications platform as a service — or CCPaaS for those looking to save (a few) letters. While Twilio is not yet a household name, they’ve been around since 2008, and Twilio technology is used by a number of companies that most definitely are household names.

Twilio offers a host of different communications products from voice to video to traditional chat, but the core of their business is sending text messages on behalf of their clients. Those clients include giants like Uber, Airbnb, and WhatsApp — ironically a company that ostensibly killed SMS messaging.⁸ Sending text messages might sound simple, but Twilio’s cloud-based platform essentially connects the entire global telecom network and offers a level of flexibility, security, and ease-of-integration that wouldn’t otherwise be available.

Plaid

Plaid is a banking-infrastructure company that connects to over 10,000 banks worldwide.⁹ It offers a suite of APIs that, in turn, allow its clients to access their users’ bank accounts (with permission, of course.) That makes Plaid an enormous part of the technology stack of a number of major players in digital payment processing.

Like the other companies on this list, most end-users will never realize they’re interacting with Plaid, but its APIs are used by companies including Coinbase, Venmo, American Express, Citi Group, Fannie Mae, and a host of other major fintech businesses.

Stripe

Stripe is an electronic payment infrastructure company that bills itself as the “payment platform for platforms.”¹⁰ It’s currently supported in 32 countries across the globe and allows sellers in those countries to accept secure digital payments from anywhere in the world.¹¹ Stripe can process payments from all the major credit card companies worldwide, and also supports local payment options like China’s AliPay.¹²

Stripe also offers a full-stack of products including applications for billing, fraud prevention, and data handling that sit on top of its cloud-based payment system. The list of clients whose payments are powered by Stripe is ridiculous — from Target, to Lyft, to UNICEF, to Shopify and countless other globally recognized companies.

Cloudflare

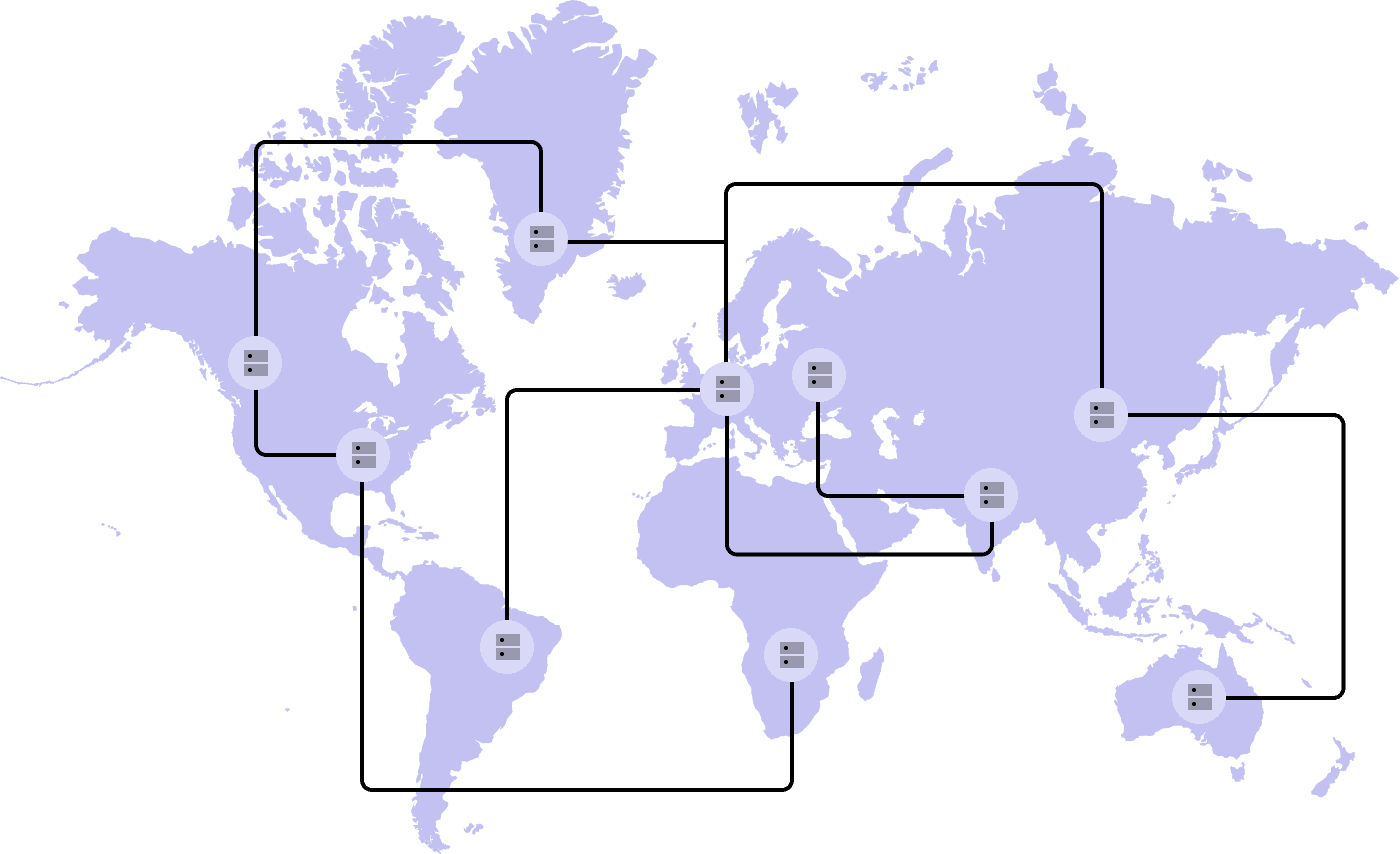

Cloudflare provides cloud-based content delivery network (CDN) services to over 13 million websites, applications, and APIs.¹³ Its worldwide network of over 165 cloud-connected data centers boost up-time and supercharge response times by ensuring that requests are served from data-centers closer to the end-user.

The CDN model on which the Cloudflare platform is based represents a huge evolution in performance in a world where users constantly demand higher and higher speeds. As a result, the company has landed some heavy-hitting clients like ZenDesk, OkCupid, and the U.S. Library of Congress.

A Revenue Model Designed Around Stickiness

These companies represent real value to their partners because they perform services and provide infrastructure that isn’t practical for the vast majority of companies to manage or build themselves. And while each offers different pricing and service packages, certain pillars are common to the business models of essentially all of them.

The first is a free or extremely low-cost version of their services designed to attract startups and small businesses. The second is a pay-per-use revenue model for partners that outgrow the free model. Think of it as a toll system on a road where each car that passes through pays a fee. Each text message sent, each request served, and each payment processed results in a tiny — less than a cent — fee.

It’s an intelligent — and well-proven — model and the primary principal it’s based on is “stickiness”. Essentially, these companies are confident that once a partner integrates them into their product or service, they’ll stick around for the long run. So, while only a subset of their free users will ever grow into paying clients, and a tinier fraction still will ever grow into behemoths, the ones that do cover the cost of all the free users while bringing in 70% margins will pay enough tiny fees to add up to huge revenues.¹⁴

It can be easy to get caught up in the deluge of marketing and PR we’re hit with every day telling us about the latest and greatest app that’s going to change the way we do X, Y and Z. And while some of those products represent truly great innovation, we should also keep an eye on what’s going on below the surface as well.

The innovation that’s taken place over the past ten years in the infrastructure fields that power our web-driven lives has been incredible — and it shows no signs of slowing down. From an investment standpoint, these companies represent serious potential for future growth, and some, like Twilio and Stripe, are already valued in the double-digit billions. From a tech-history perspective, the growth of these companies represents the laying of the foundations that the future of basically everything we do will be built on. In my opinion, that’s far more exciting than any new app to help save me the frustration of trying to wave down a taxi at rush-hour.