Do people really know their passwords?

This is one of the most common questions we get asked. If you’re considering implementing Argyle, you know that your return on investment hinges on your users successfully authenticating their payroll accounts. So, it comes as no surprise that when we talk to prospective customers, they question whether their users even know their payroll account passwords.

The truth is, many people—including your users—have a close relationship with their payroll account (or the employment account where their payroll information lives), so their password is second nature.

This surprises business leaders

Among the C-suite executives in our customer base, we’ve found that very few know the password to their payroll account. But that makes sense. If you’re in the C-suite, you aren’t being paid hourly, your work schedule isn’t being tracked and monitored, and your earnings aren’t variable week to week, so there’s no incentive to check your account. That’s not true for millions of consumers.

Here are just some of the reasons why many consumers regularly log in to their payroll account:

To view, swap, change, or cancel upcoming shifts

To see when they’re getting paid and how much

To see progress toward their commission check or hours accrued

To request PTO

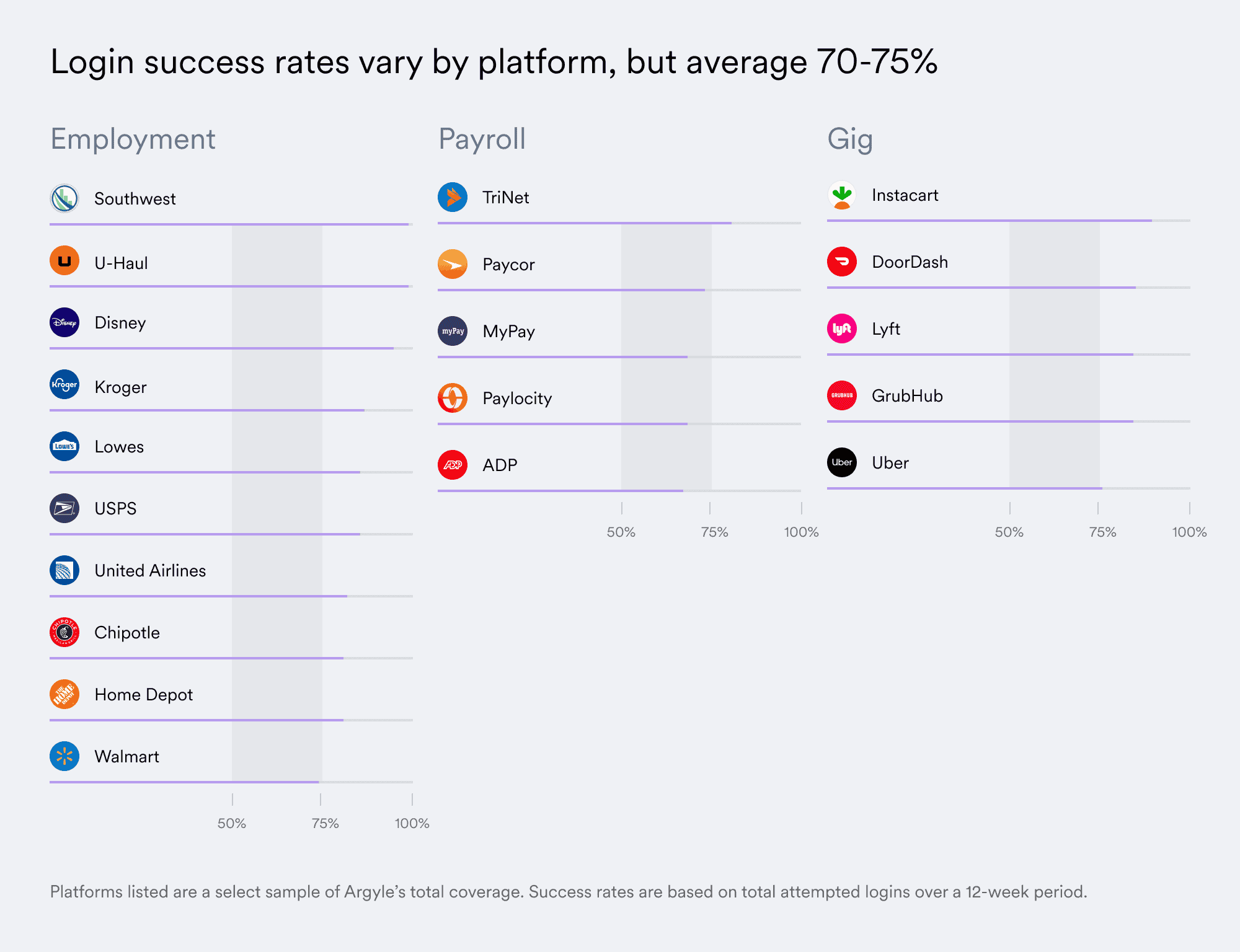

Password recall varies by platform

Of course, not all of your users know their login credentials all of the time, and certain factors affect the chances of successful and unsuccessful authentication attempts. Knowing these factors and how likely your users are to remember their payroll password is an important consideration when you are assessing if and how to deploy Argyle in your user flow.

At Argyle, we make a point of staying keenly aware of password recall behaviors by observing hundreds of thousands of Argyle users provide their credentials. We closely monitor their success rate—aka conversion rate—because it drives the performance of the products and applications that our customers build on top of our platform.

One of the most observable factors affecting password recall is the employment or payroll platform the user is attempting to log in to:

*No affiliation, sponsorship, or endorsement is implied by the identification of the entities listed below. All rights in the trademarks and logos of such third parties remain solely and exclusively with their respective owners. For further legal details, click here.

The factors that affect password recall

Based on real-world data like this, we are constantly making tweaks to our product. Here are just a few of the product enhancements we’ve developed in response to feedback that drive conversion:

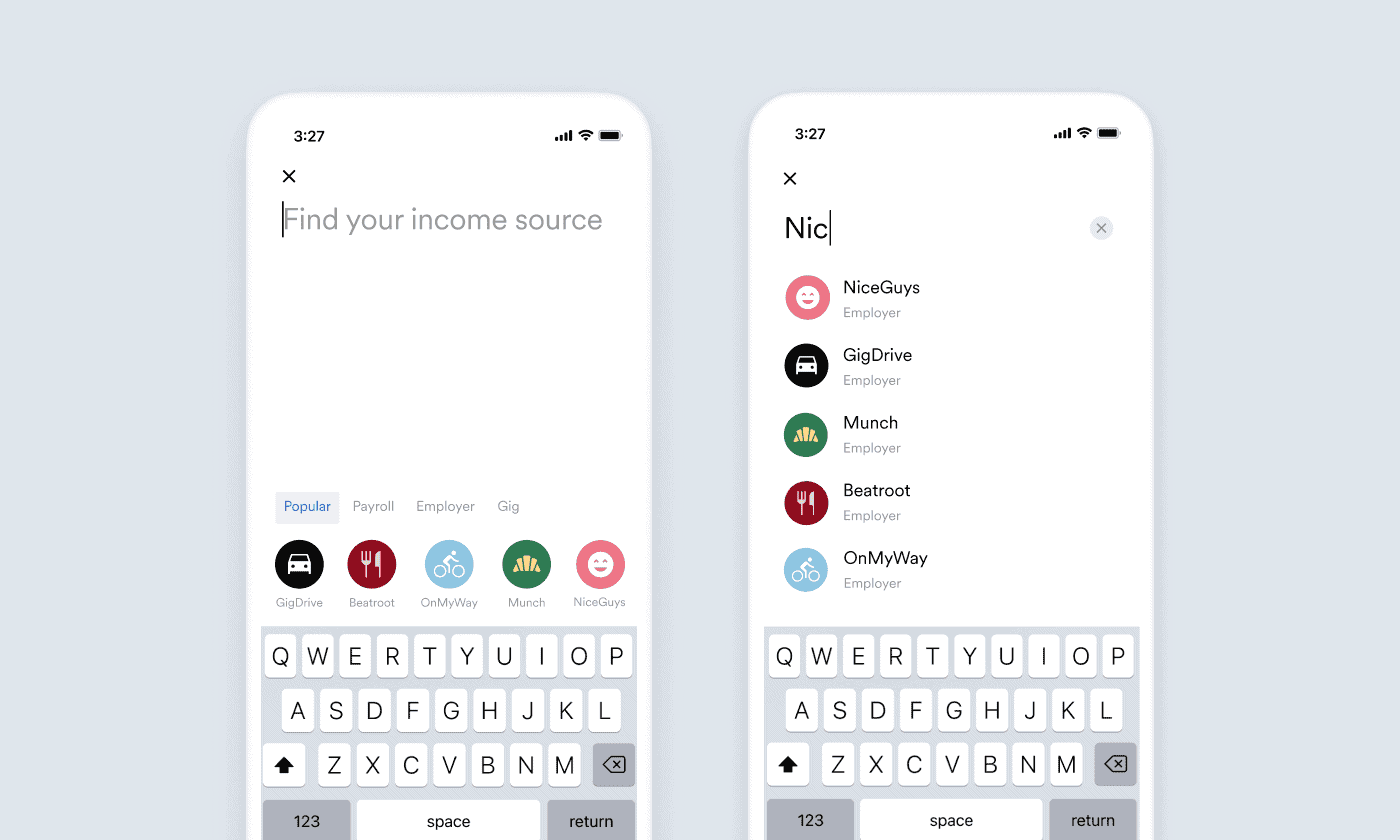

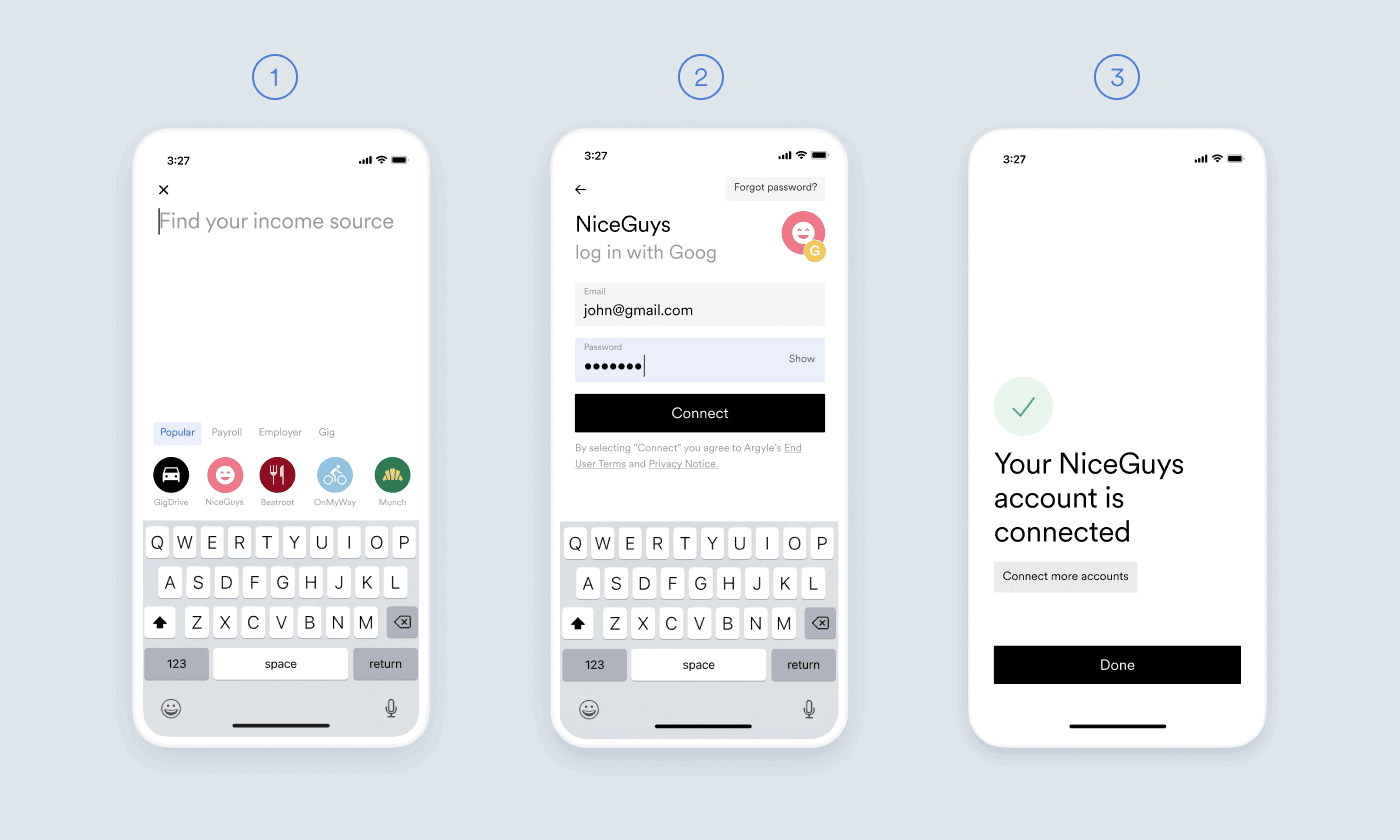

Enhanced employer search

Some users are comfortable searching directly for their payroll provider—MyADP, for example—while others are more familiar with their employer (e.g., Walmart). Argyle Link, our front-end widget, is flexible enough to allow someone to search for either depending on their preference. Our search bar now also includes a suggestions component that intuits users search entries and guides them to the correct platform as well as a new “popular” category, where you can promote your most-linked platforms for a quicker, more frictionless search.

Deep-linking

If you know the employer or payroll platform that you want your user to select, the “company selection screen” can be bypassed completely. Our data shows this reduction in clicks can result in a 5 percentage point conversion increase.

Multi-factor authentication and single sign-on

Argyle supports up to 10 different authentication methods depending on what your platform requires, including SMS and email one-time passcodes, security questions, confirmation SMS and emails (i.e., magic links), and time-based one-time-passcodes (e.g., Google Authenticator). Argyle also supports authentication via single sign-on (e.g., Okta, OneID, Microsoft SSO). All of our MFA experiences have been recently updated to be even simpler with passcode pre-fills and deep-linking features.

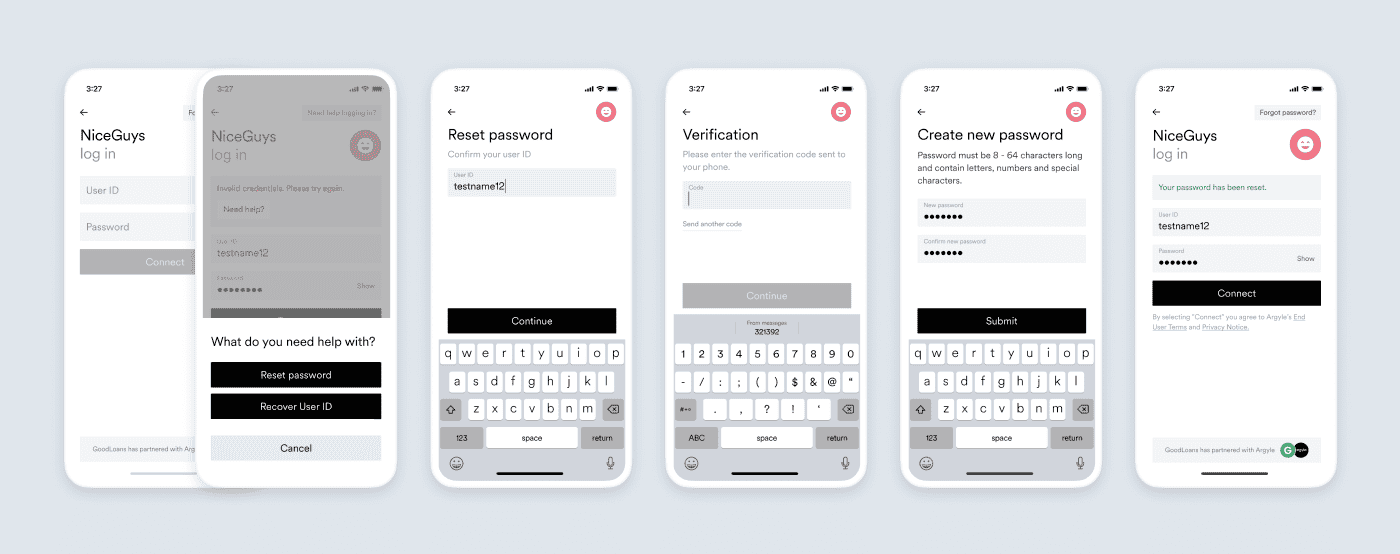

Embedded password-reset flows

Some users don’t know their passwords. Argyle makes it easy for these users to reset their passwords directly within Argyle Link.

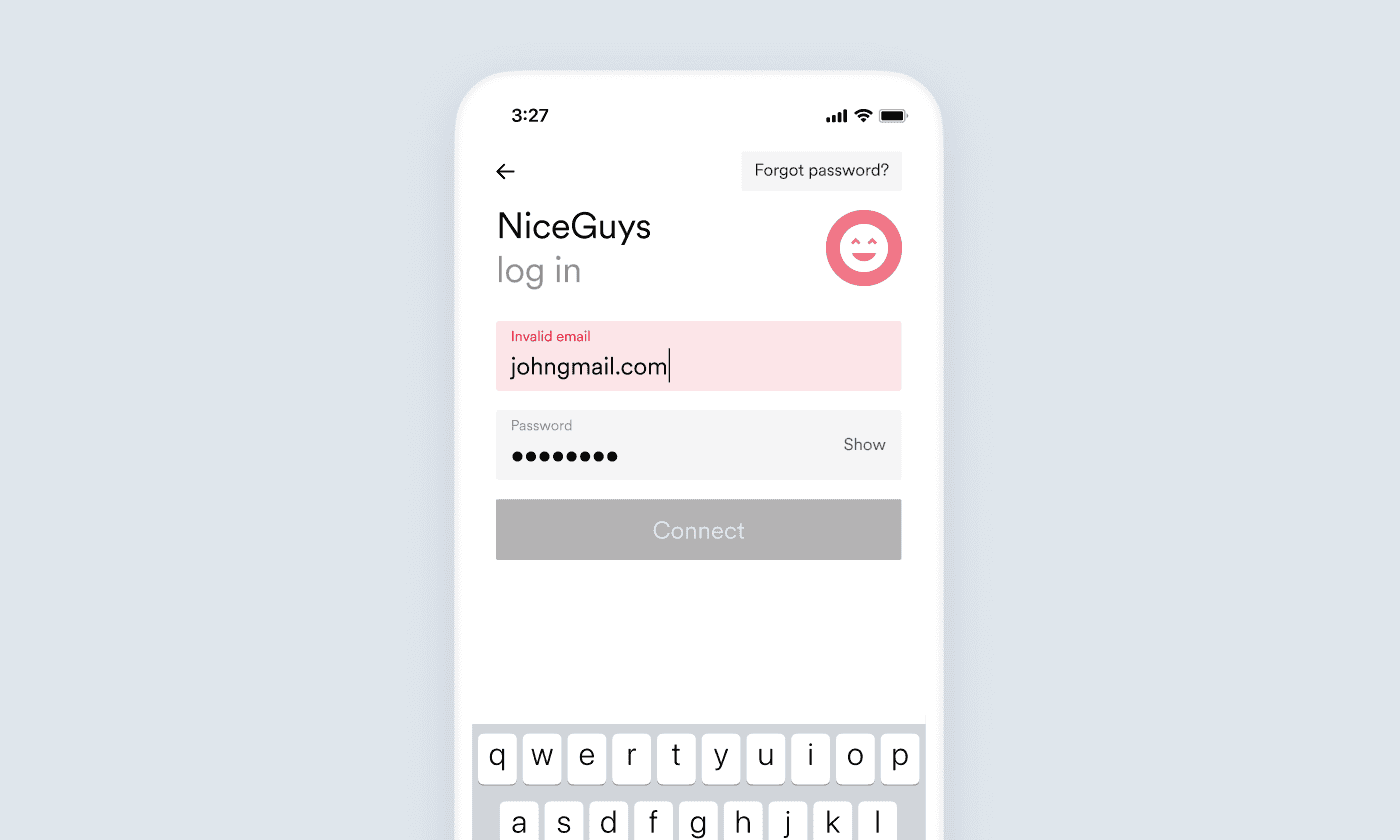

Improved error messaging

We’ve updated our error messaging to provide inline feedback and real-time validation that helps your users know how to proceed. Messages appear on the same screen where the error occurred, offer best-in-class clarity on what went wrong, and explicitly indicate if a user should try again immediately, or if a service is down and they need to try again later.

Motivation is key

Another driving factor of conversion is the average user’s desire to authenticate into their account—that is, how motivated they are to complete a password reset flow in the event that they forgot theirs.

The extent of a user’s motivation seems to be correlated with use case. At Argyle, we serve customers across many industries: lending, banking, insurance, recruitment, and more, and have found some differences in measurable user motivation among them. In lending, for instance, the larger the loan size, the more likely a user is to reset their password and complete their payroll account connection. In other words, it seems that more dollars are more motivating than fewer dollars.

Payroll passwords beat banking passwords

The other side of the coin is willingness. Even if a user remembers their password and is motivated to complete the flow, they have to be willing to input it. In this respect, our customers have found that:

Users are more likely to enter their payroll password than the password they use to log in to their bank account.

They feel safer sharing payroll or other employment account credentials than they do sharing banking credentials.

They feel safer sharing payroll or other employment account credentials than they do sharing banking credentials.

It’s part of the reason why some of our customers, like Moves, have moved away from onboarding with banking data altogether.

When Moves switched from using Plaid at the beginning of their application flow to using Argyle, they saw their conversion rate increase 3x.

The security factor

The final element of successful conversion is trust. Asking a user to provide their username and password requires that they feel confident that their information is safe. For that reason, Argyle has built a platform with security at its core, including data encrypted at RSA 4096 (the same encryption grade used by the military).

We also recently updated Argyle Link to include a new intro screen experience, including an improved call to action, context on what the user is about to do, and clear Argyle branding so users know that they are signing in with a third party that you have partnered with. This increases transparency, and conversion while complying with regulatory frameworks. At the same time, Argyle Link can still be customized to feel part of your application’s native experience to enhance the legitimacy of the partnership. This security-centric design and seamless user interface is vital to creating trust with users.

If you’d like to kick the Argyle tires, so to speak, our no-code solution allows you to send your users invitations to connect their payroll accounts via email or SMS. In turn, you are able to visualize the data being returned in Argyle Console, our browser-based customer platform. While it is a quick way to test Argyle and see if we are a good fit, it’s worth keeping in mind that we see a 50% drop-off rate with our no-code solution. Clicking into an SMS or email and then sharing credentials doesn’t seem to invite trust in the same way our embedded implementation does.

Please get in touch with our team if you are building an application on top of income and employment data. We are happy to share more learnings to set you up for success.