How continuous income and employment data ensures you are in the right place at the right time for your buyers

Buying a home is not something that happens overnight. On average buyers will shop for four and a half months before making an offer, and that doesn’t include the months of casually window shopping on home listing websites beforehand.

The home buyer journey takes months and is rarely a linear path, so mortgage lenders need to get in early and know when it is time to support key decisions in the process. Here’s how Argyle’s continuous income data not only makes that possible, but automates the process for loan officers.

Pre-approval

Gaining and then nurturing leads is an expensive process for mortgage brokers. Not everyone shopping for a home is financially ready to pull the trigger on buying a home, so how do you stay in the loop with leads and know when they have crossed that line?

With continuous income data access, a lead can submit for pre-approval with a lender at any time and then be guided on when their financial situation has changed towards a more favorable mortgage, based on their current financial situation. That also means loan officers can optimize who they are spending their time with and passively nurturer leads.

Being involved in a pre-approval and proactively reaching out when someone is financially ready to jump into the home buying process not only converts more leads into borrowers but also provides a strong customer experience and more referrals.

Processing

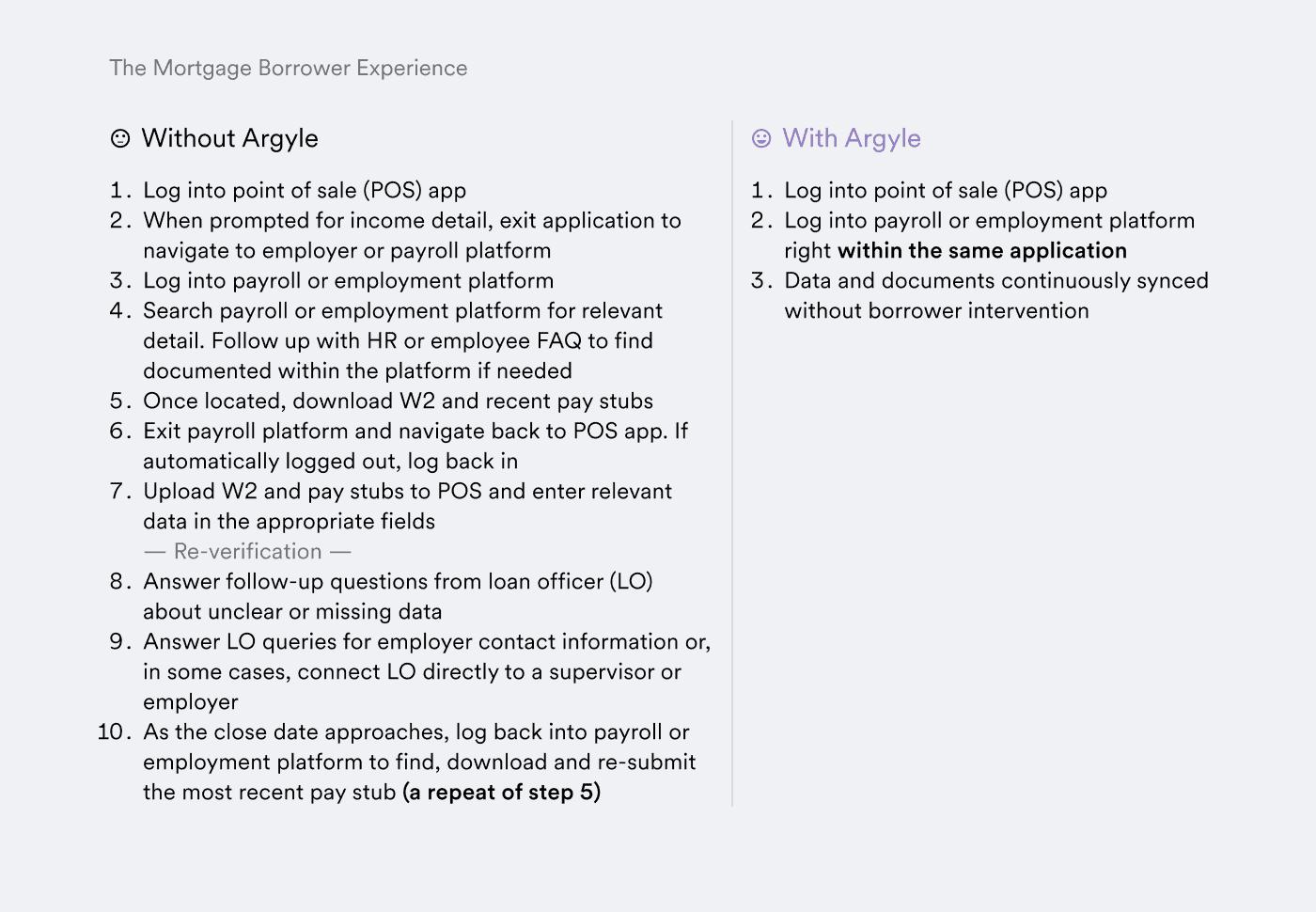

Timing is everything in a tight market. When that nurtured homebuyer is ready to pull the trigger, you want to do everything you can to expedite underwriting and be the first to make them an offer. However, the mortgage application process can often leave loan officers at the mercy of the buyer.

With Argyle, you can fast-track any application and be the first in line, without worrying that you missed a step or document review. Argyle’s automated income and employment verification is continuous, meaning unlimited fee-free reverifications throughout the closing cycle, and a holistic view of applicants’ creditworthiness.

This all translates to a low-friction borrowing experience that eliminates manual touchpoints, reduces cycle lengths, and lowers first payment default risk, all at less cost to you.

Closing

How often has it happened that you have all the paperwork in place, the borrower’s income has been verified, and then you find out days before closing that they have changed jobs or their income situation has changed?

Income verification is often rechecked right before closing specifically for this reason. With Argyle, not only is this a free and automatic process for loan officers, but with our powerful webhooks technology, you can even be immediately alerted to any change in income or employment. This limits surprises closer to closing and allows you to reach out proactively to the borrower to learn more.

Implementing Argyle into your mortgage loan origination process

Including Argyle in your mortgage application flow offers an immediate improvement to your lending experience, your internal efficiencies, and your bottom line.

Want to see Argyle in action? Create a free Argyle Console account to access demos and sandbox tools. Or reach out to our team! We are happy to answer any questions you may have.