With our $55M Series B, Argyle is out to make fair credit decisioning possible for every lender and consumer through real-time, user-permissioned access to employment data.

Imagine you’re a contract worker driving for gig platforms like Uber and Lyft while working the early shift as a barista at Starbucks. You’re earning a steady income, and you pay your bills on time. Still, you can’t secure the mortgage you need for a family home, because your low credit score is the only thing lenders have to go on when considering your application. With no way to verify your nontraditional wages from multiple employers and demonstrate your current financial health, you’re left with no options for credit access.

This scenario is becoming more common as the gig and creator economies expand at record rates, “deskless” workers increasingly have multiple income streams, and financial industries struggle to keep up with changing employment patterns. We recently commissioned a survey of over 1,200 freelancers and found that nearly 49% had been denied essential credit access for resources (like leases and personal loans) they knew they could afford because outdated underwriting models don’t assess their finances holistically.

Upgrade the Way You Verify Data

That’s the sign of a decision-making process that’s failing everyone, from the workers looking to access financial services to the businesses and institutions looking to provide them.

I founded Argyle to redefine credit-worthiness in this shifting economy. We’re a team of outsiders (from outside traditional credit and data verification industries, that is) who understand firsthand how hard it is for the average consumer to access financial resources in this country. What started as a platform to streamline job applications has become a mission-driven company that levels the financial playing field, allowing lenders and consumers to stop relying on a credit score process that’s:

Opaque: Research shows around 40% of adults have “no idea” how their credit score is calculated.

Inaccurate: One survey says over a third of consumers find errors in their credit reports.

Exploitative: A proliferating number of companies are buying and reselling private consumer data.

With Argyle’s real-time, consumer-permissioned employment and payroll data, workers regain control over their information and unlock the assets they need to thrive. Meanwhile, financial service providers gain a more comprehensive and accurate view of borrowers’ ability to repay, increasing their addressable market—all without having to chase down, upload, and interpret a stack of pay stubs.

In contrast to aggregators like Equifax, Experian, and TransUnion, Argyle’s employment data platform:

Doesn’t exploit users’ privacy or sell their personal data

Puts workers—not employers or reporting companies—in charge of their own information

Enables real-time access to 160+ endpoints to reduce friction and risk

Allows for continuous visibility into workers’ financial picture—80% of our top 500 connections by volume permit ongoing data access

Structures data in a way that’s both granular and easy to understand

Streamlines verification in a quick, two-step flow to maximize conversion

Supports a variety of industries and use cases that need VOIE

Gets the data details right—every time

Want Real-Time Data Updates? Contact Us.

We recently closed a $55M Series B led by SignalFire and supported by existing investors Bain Capital, Bedrock, and Checkr. In this round, we took a more transparent, narrative approach to fundraising, telling our users’ stories and showing how a credit score-based system—as the current gatekeeper to financial and credit access—leads to unfair outcomes across the board. You can check out our full deck here.

This new funding will help us take our work to the next level and extend our data network to reach even more employers and payroll providers, in turn helping even more workers and businesses and truly creating financial access for all.

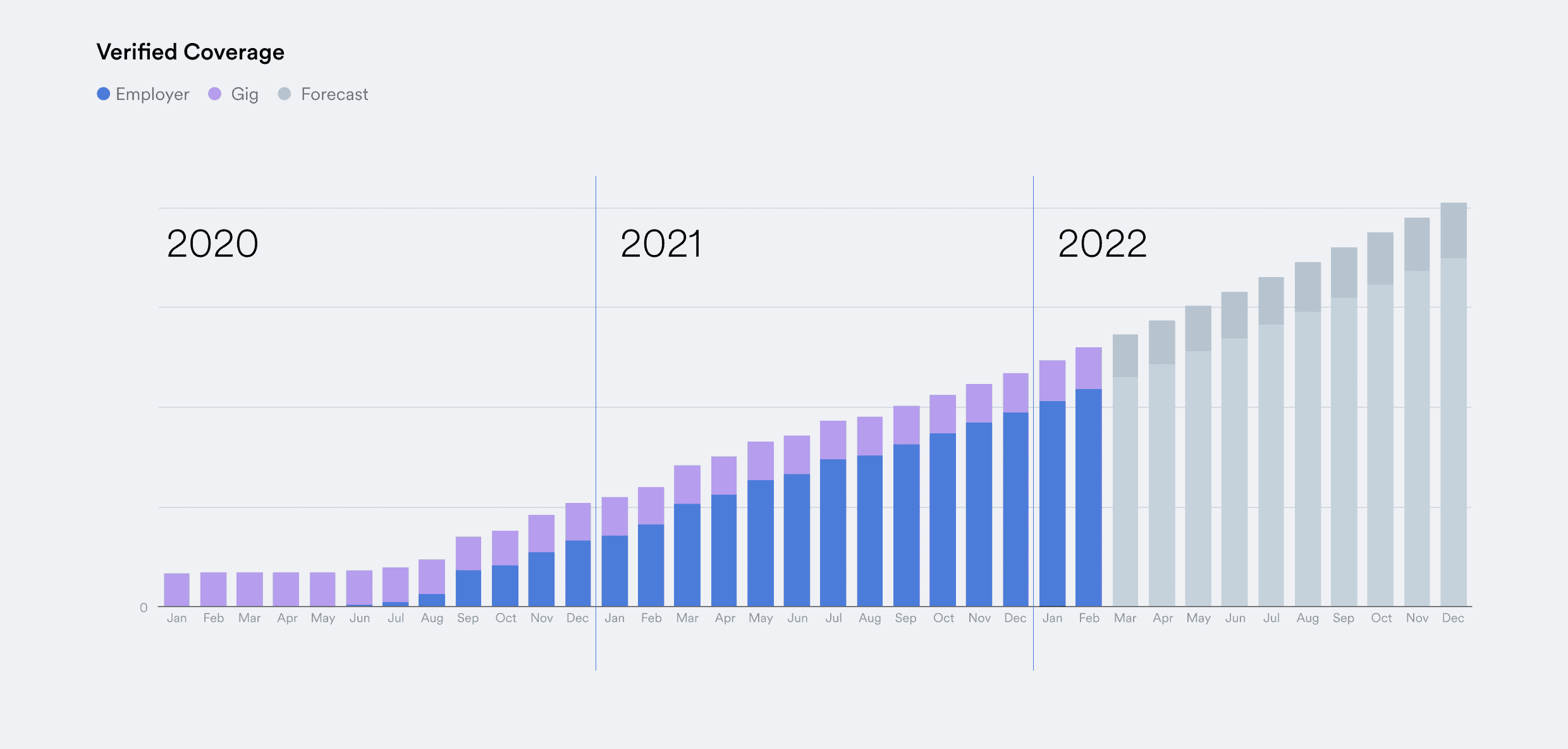

We already connect to over 80% of the US workforce through our ever-expanding programmatic network. Combined with our OCR document processing capabilities, that translates to 100% coverage of employment records. Because it shouldn’t matter if someone earns a salary from a Fortune 500 company or works flexible shifts at Amazon, or if they’re paid through Square or ADP—they need access to employment data that works for them, not against them, and paints a complete picture of their financial strengths.

We’re proud to lead the way as fintechs develop new standards for how data is shared and evaluated, and that means helping every kind of business go digital-first while bolstering their data security and integrity.

Years ago, Equifax changed the game by applying income and employment data to the lending market—but that game is evolving fast. The world needs a new trailblazer that takes an equitable, ethical approach to data sharing while still meeting the need for access on demand. It must be user-permissioned, it must be real-time, and it must be fair. And that’s precisely where Argyle is breaking ground.