Argyle has integrated with Unit to launch a new way for fintechs to up their pay distribution game.

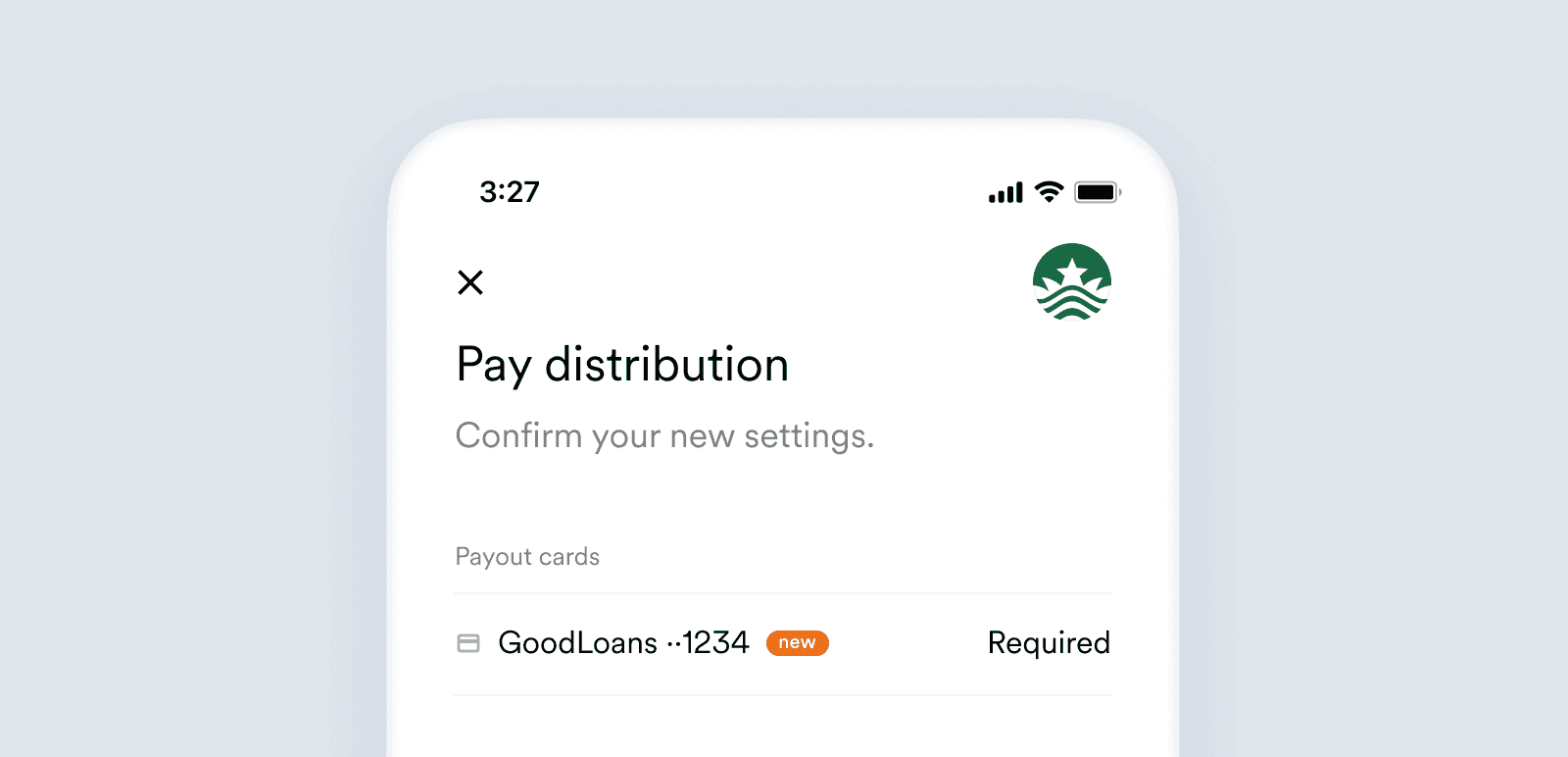

To stay relevant as a fintech, you have to stay agile and meet users where they are. With the gig and creator economies thriving, that increasingly means paying out workers directly to cards—helping them access their earned income faster.

Now, Argyle has partnered with the banking-as-a-service platform Unit to unlock PCI DSS-certified services for joint clients—enabling fintechs to access and help manage their users’ card balances and pay distribution preferences simply and securely.

All the right Moves with Argyle

Launched in 2020, Moves provides accessible financial services for gig workers who want a better alternative to traditional banking that’s tailored to their needs.

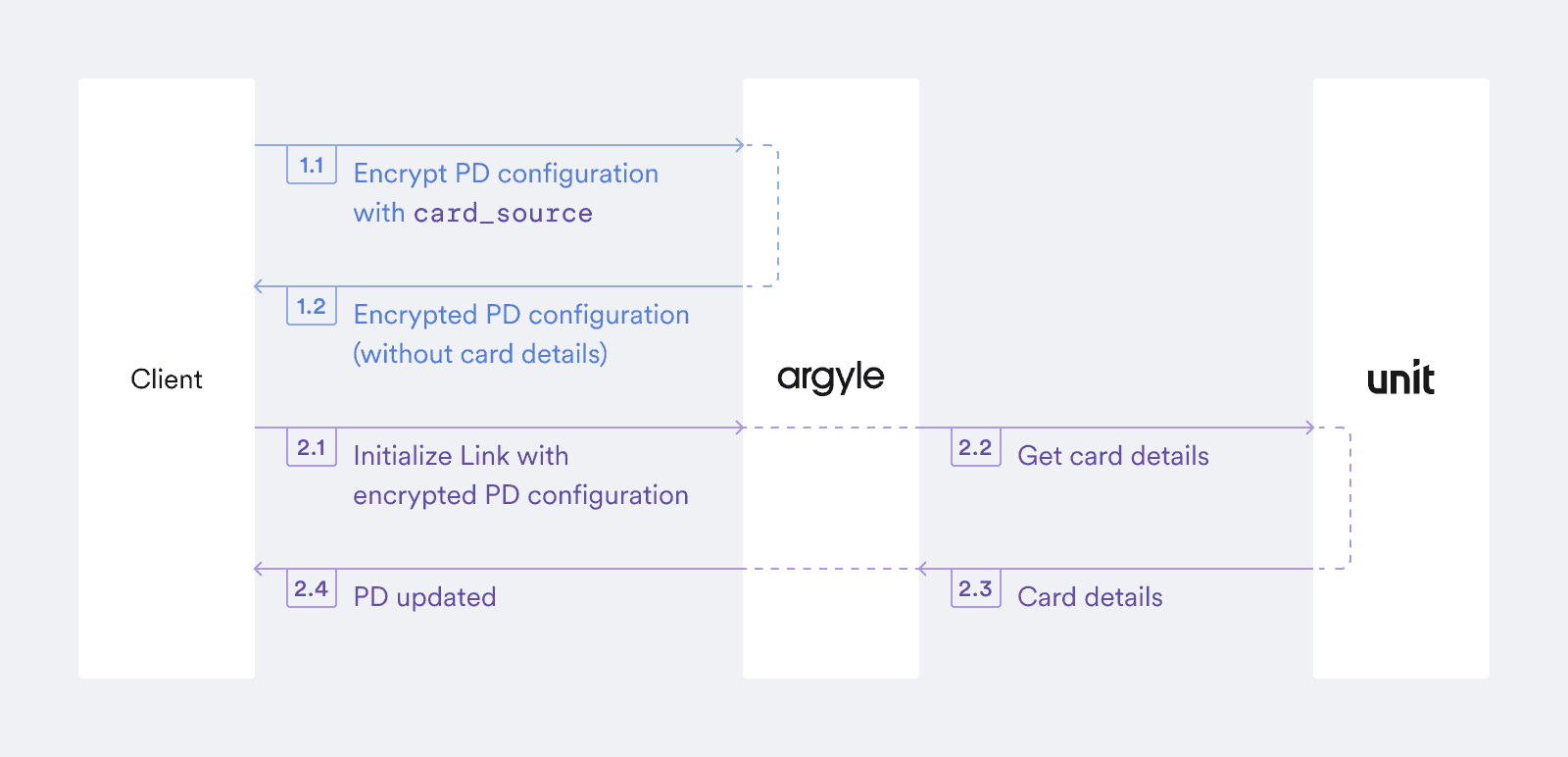

Moves has long used Argyle to pre-approve accounts, and they wanted to take advantage of one of our latest offerings: pay distribution to cards to make it easier for customers to move their income deposits. That prompted Argyle to partner with their card issuer, Unit, to ensure PCI DSS compliance when handling sensitive card data—empowering Moves to grow their deposit base and deliver PCI DSS protections without having to pursue a costly internal security upgrade.

Both Argyle and Unit are certified as PCI DSS-compliant. That means our compliance practices meet the highest standard of security when processing or transmitting credit card and cardholder data. Teaming up to innovate on a safe and seamless solution, our new integration allows Argyle to retrieve the card details needed to populate users’ pay distribution configurations directly from Unit—removing massive financial, technical, and infrastructural hurdles for any fintechs they work with.

“We’re excited to see new solutions that help people get paid faster. Being able to easily pay directly to cards means that people access their hard-earned funds when they need them. Removing the burden of PCI compliance will help more companies offer instant payments – and do it more securely,” said Itai Damti, co-founder and CEO at Unit.

“We’re thrilled with the solution the Argyle-Unit team came up with,” said Stephanie Overholt, VP of Product at Moves Financial. “The integration will encourage more deposits to flow into the Moves ecosystem and expand our interchange revenue stream. That’s good for us, of course, and great for the gig workers we serve, who will be able to make pay distribution changes more easily to be able to access the full value that Moves provides.”

All of us at Argyle see terrific potential as well. Our immediate goal is to build the integration to scale and help even more customers easily leverage our PCI DSS certification and securely mobilize our pay distribution functionalities.

If you’re interested in learning more about our new pay distribution features, reach out to your customer success manager.

Not yet an Argyle customer? Contact [email protected] to see how we can help accelerate the growth and success of your financial services organization. You can also sign up for a free account.