Setting you up for success with the right expectations on how employment data records can work for you

Streamlined access to employment data is here. The pitch of “instantaneously and securely access the work history of your users” is compelling enough to lure any financial institution.

And it’s true – employment and income data is accessible in novel and unprecedented ways: Argyle has championed a new, user-permissioned, API-driven model allowing for employment and income data to be digestible in real-time. But, there are limitations and building on top of these data sets is not so simple.

Learnings from the Field: The Right Expectations and Tools

Below are some learnings to set you up for success with the right expectations of the data limitations and nuances of employment records

Argyle reaching hundreds of customers, hundreds of thousands of Americans consumers, and 80M+ employment records gives us insight into the capabilities and drawbacks of user-permissioned data. Below are reflections and learnings to share from our journey alongside the personal and mortgage lenders, insurance providers, and neo banks that we work with.

To be set up for success, it is important to have the right expectations for data delivery, syncing, and availability. Working closely alongside our customers, we have created the tools to navigate the data limitations of employment records: here is our transparent representation of what we’ve seen.

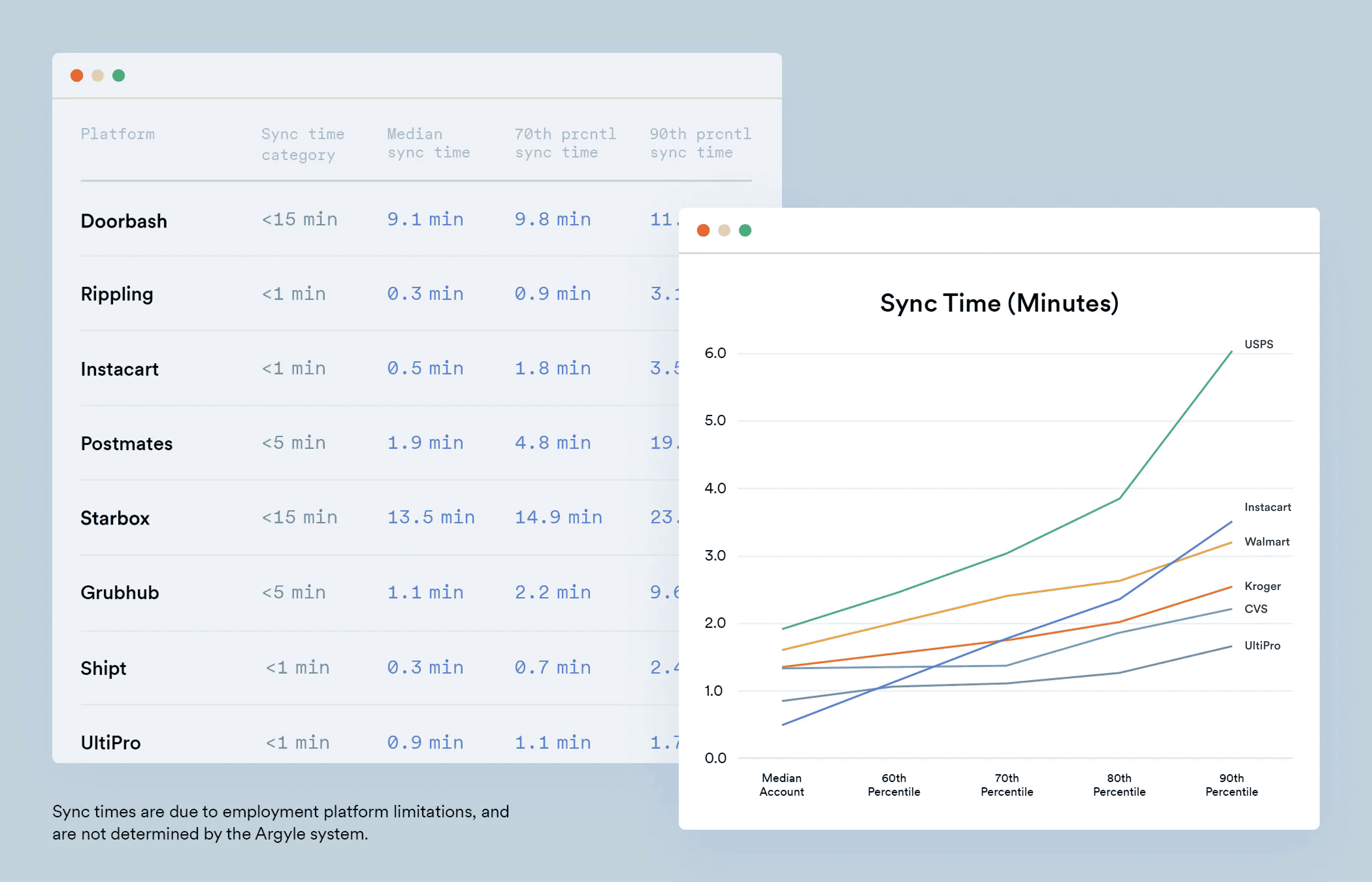

Data Sync Times

For many lenders, insurance companies, and other financial institutions: real-time decisioning is key to your user flow. You spend to acquire users up-funnel, and you want to ensure that you can make decisions and convert those users effectively within a single session. However, an employment record can be much heavier than you’d expect. 500MB of data can be delivered for a single Uber account, or for a Walmart employee with 25 years of tenure. At Argyle, we have seen employment accounts that contain up to 1.5GB of data.

Keep in mind: data this large takes time to pull and deliver.

To enable our customers for success, we have robust reporting capabilities to show data sync times, both for your users and aggregated across our customer base.

This provides you with the right expectations when building your user flow to answer the following questions:

How long do my users need to remain occupied before I can make a decision?

How does my data delivery lag compare to Argyle’s customer base? And where is there room for potential improvement?

For most accounts the information syncs within 60 seconds, yet some systems run slower. It’s important to note that there is a data syncing limitation from the platforms themselves, and so you should be prepared that syncing times vary on a per platform basis. Also keep in mind: we have a flexible webhook system. If you want to decision on 12 months of payout information, for example, you can configure the Argyle system to notify you when 12 months of payout information is synced.

Field-level Availability

Lack of standards across employment records means data varies depending on where that information is stored (which is why we created OEDS: to push the world towards a standardized, dependable view of employment data). While Argyle provides insight into all the data that is available, we also bring transparency towards which data fields are unavailable across each employment platform to set you up for success sooner. We’ve seen that there is nothing more frustrating for a customer than launching a lending product built on top of our pay_cycle data field, for example, to realize that for some of the largest employment platforms, that field needs to be deduced based on the frequency of payouts.

Available for Argyle customers, the Scanner Matrix provides transparency within the Argyle Console to show field-level availability for each employment platform. This will help you make the most informed decisions possible when building your solution.

Pay Distribution Limitations

Lenders and neo banks leverage Argyle to automatically update a user’s pay distribution – either to repay a loan or fund a checking account respectively. If you are a lender, your requirement for repayment is very specific. For example: $52.87 for the next 10 pay cycles.

However, some employment platforms in the market suffer from the following shortcomings:

Not allowing for multiple pay allocations, meaning 100% of the paycheck needs to go to a single bank account

Only allowing for whole dollar pay allocations

Only allowing for percent allocations.

If you are a lender attempting to fund a loan directly from an employment platform, any of these limitations are likely deal-breakers for you.

We outline the data limitations of employment platforms through our link-items endpoint. For every employer listed within Argyle Link, Argyle provides transparency as to whether each employment or payroll platform meets your criteria.

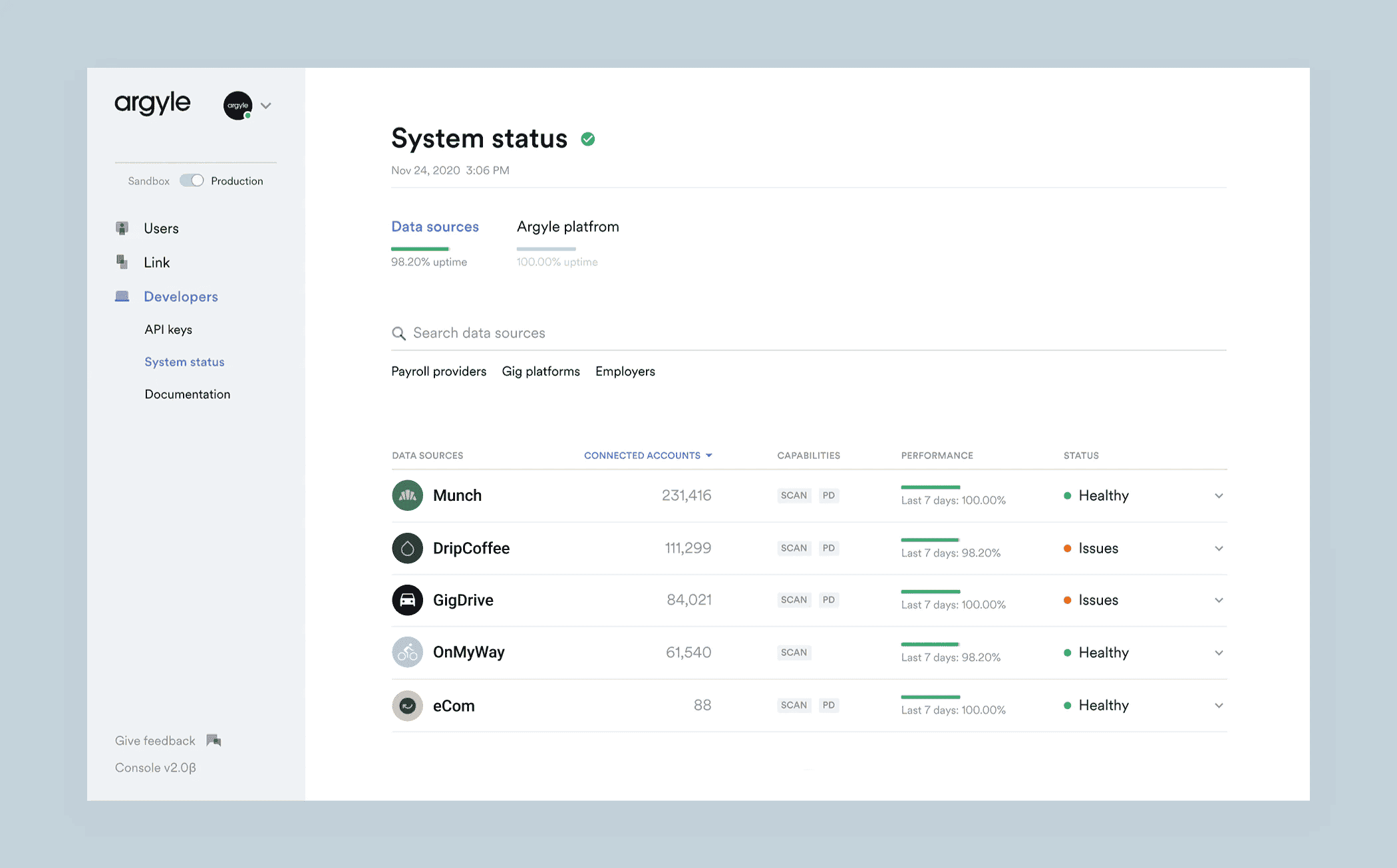

3rd Party Platform Uptime

ADP goes down. It’s unfortunate, but it happens. In order for Argyle to deliver employment data to you, those employment platforms need to be accessible. We make this 3rd party availability transparent to you via our system status page, so you can understand the frequency and cause of outages.

Your Partner for Success

We are proud and excited to work everyday with our customers to build innovative products powered by employment and income data. With the benefit of hundreds of thousands of transactions, we have learned the importance of communicating the right level of expectations with our customers to ensure their success, and have built the tools to assist in this. Over the long run, we strive to push the industry towards a more standardized structure of employment data and mitigate these discrepancies – for the benefit of all consumers and businesses.