Mortgage companies are increasingly adopting verification waterfalls—a sequential process involving multiple vendors—to streamline loan origination. Here’s what you need to know about this growing technology trend.

What’s a verification waterfall?

For those unfamiliar, a “waterfall” refers to any multi-step workflow where the steps follow a linear sequence, progressing from one to the next in a defined order—much like a river flows downstream. For example, in real estate investment, profits are distributed to investors in a cascade, where cashflow fills one pool before spilling over into the next. Similarly, servicers of Federal Housing Administration (FHA) loans must adhere to the agency’s waterfall process for loss mitigation.

Specifically, in the context of loan origination, an increasing number of lenders are transitioning from reliance on a single provider to employing a series of vendors to complete verification of income and employment (VOIE)—in other words, a “verification waterfall.”

A change in course

Everyone agrees that the manual VOIE is time-consuming, costly, and typically considered a last resort. The labor-intensive tasks of collecting, reviewing, and verifying documents lead to high operational costs that reduce loan profitability. These costs are then passed down to customers in the form of higher fees. Moreover, the paper chase can extend processing times by days or weeks, delaying loan approvals and increasing application abandonment.

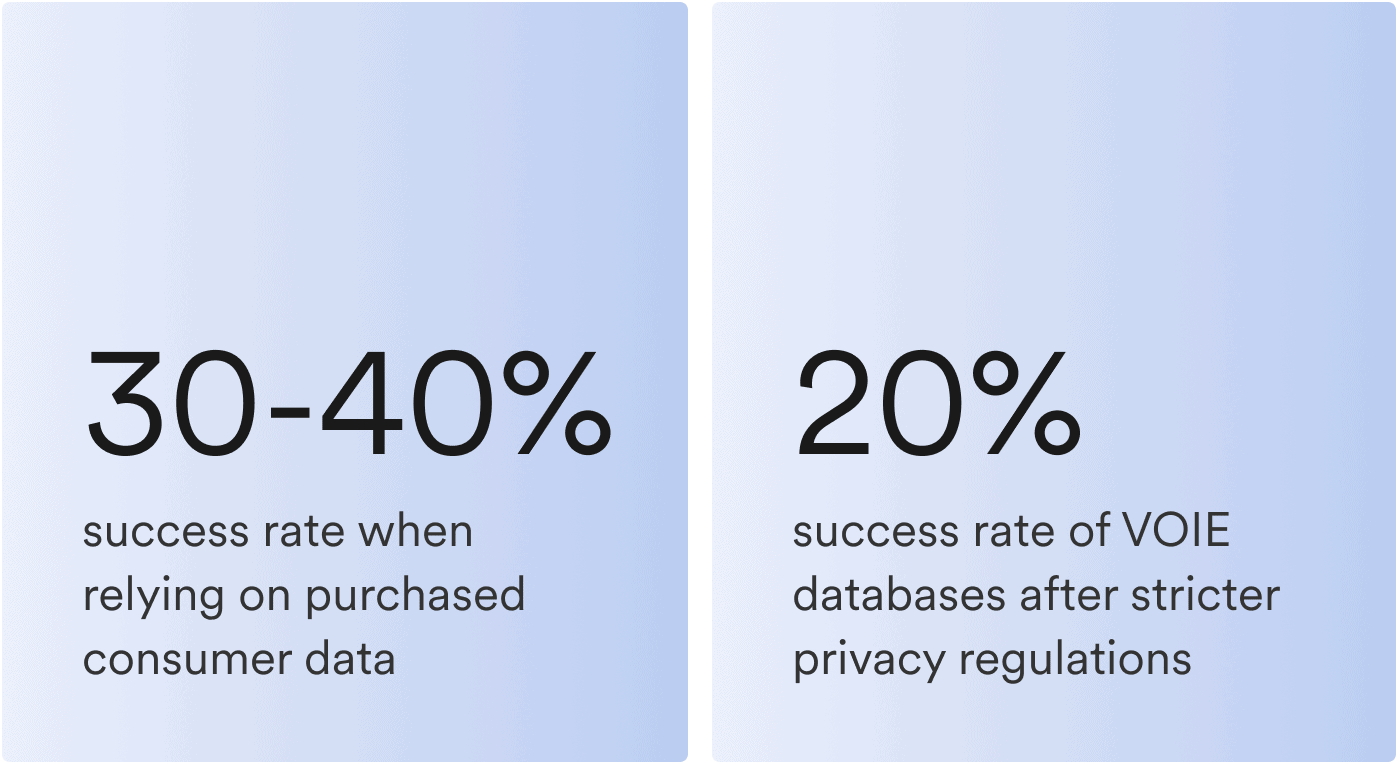

For nearly 30 years, lenders have automated VOIE using any available means. Until recently, this involved relying on consumer data purchased from employers—usually without consumers’ direct knowledge. This data frequently turned out to be stale, incomplete, and inaccurate. In fact, even at the peak of its popularity, this method of VOIE achieved success rates of only 30-40%. And now that regulatory advances in data privacy make it easier for consumers to restrict the unauthorized resale of their employment data, the success rate of VOIE databases has dropped closer to 20%. Consequently, lenders who depend on them have to manually verify income and employment for three-quarters of all loan applicants.

Still, despite its waning effectiveness and high price tag, a surprising number of lenders continue to rely on VOIE databases—a phenomenon that’s done nothing to curb runaway net production losses. But thanks to the emergence of new verification approaches, there are more VOIE automation options than ever before.

Now, lenders can use services like Finicity or Plaid to infer income and employment status from the direct deposit history found in consumers’ bank accounts. They can also partner with platforms like Argyle, Pinwheel, or Truv to verify income and employment through direct connections to payroll software and employer payroll systems. Alternatively, they can combine these solutions in a verification waterfall, maximizing the relative strengths of each.

The case for cascades

By incorporating multiple providers into their workflow, lenders can prevent loan applications from grinding to a halt when VOIE fails. For instance, instead of being relegated to a loan processor’s manual verification queue—where it might languish for days or weeks—the borrower’s information is simply passed to the next designated provider until successful verification is achieved. Since this process requires no human intervention or back-and-forth communication with the borrower or their employer, it leads to significant time and cost savings. Moreover, reducing dependency on a single vendor also minimizes the risk of vendor lock-in, allowing lenders to negotiate better terms and pricing with each provider.

“If a waterfall cuts down the lender’s reliance on manual verifications, it will almost certainly lead to quicker cycle times and significantly reduce origination costs.”

Wading in

Whether building its own waterfall or configuring one in collaboration with an LOS or POS provider, a lender must decide how many services to cascade and their order. Sometimes, this decision is straightforward, such as placing the lowest-cost provider at the top of the waterfall and arranging the rest in order of increasing cost. However, there are plenty of valid reasons to prioritize factors beyond cost.

For example, an independent mortgage bank that sells a substantial portion of its loans to Fannie Mae and Freddie Mac may opt to put at the top of its waterfall a VOIE service that qualifies for government-sponsored enterprise (GSE) representation and warranty relief. Conversely, a credit union that services its own loans and places a high value on the member experience might prioritize the provider with the highest customer service rating.

Lenders also need to determine the placement of the VOIE waterfall within the context of their overall mortgage process. During boom periods, it’s not unusual for lenders to verify income and employment early in the loan application process—sometimes even during initial lead qualification. In a more cost-sensitive market, lenders are more likely inclined to implement VOIE later in the mortgage process, after the 1003 form has been submitted and conditionally approved.

Regardless of how a VOIE waterfall is configured, its success metric remains the same: If a waterfall cuts down the lender’s reliance on manual verifications, it will almost certainly lead to quicker cycle times and significantly reduce origination costs.