How ongoing access to continually refreshed data helps financial service providers gain efficiencies and improve business outcomes

When it comes to consumer financial services, having access to income and employment data—information like your customers’ work history, paystubs, and gross and net income—is imperative. But not all income and employment data providers are created equal. One of the key differences among them is continuity of access.

Streaming income and employment data is best

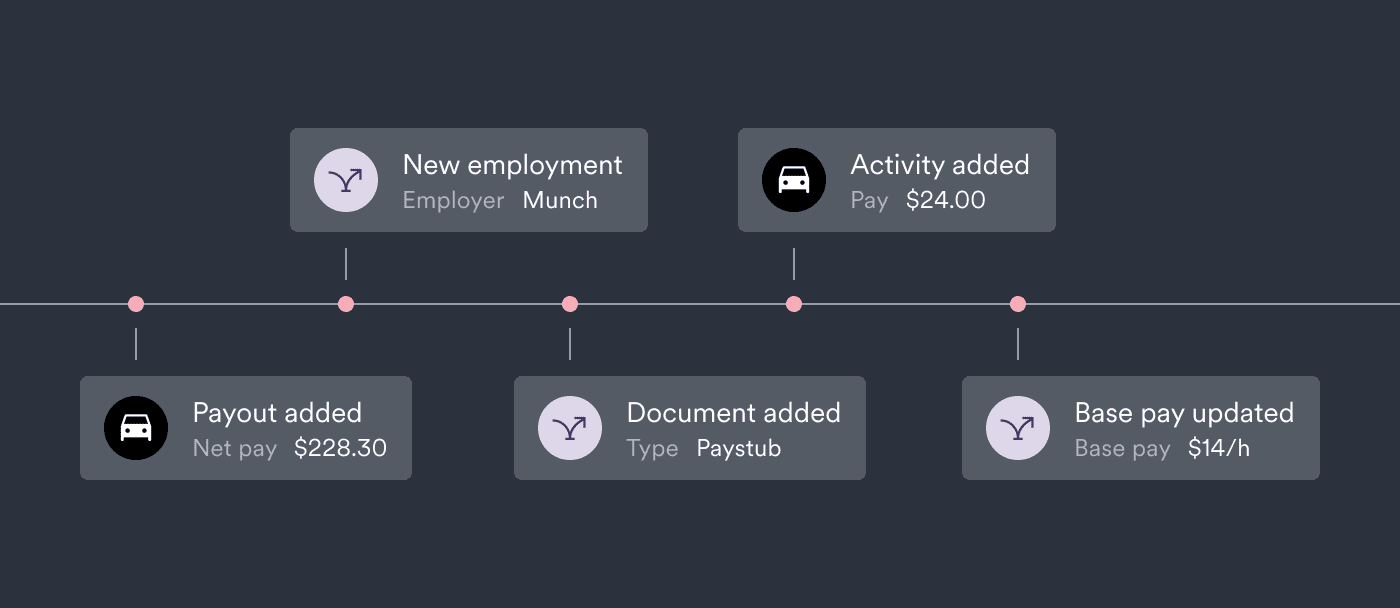

With Argyle, continuous access to employment data is standard. That means, once your customers give you permission to access their payroll records via Argyle (a process that’s as easy as entering a username and password), you receive an ongoing stream of real-time data that you can use to verify income and employment, inform underwriting decisions, service loans, and more.

The benefits of ongoing data access

Both financial services providers and their customers benefit from streaming income and employment data:

Less friction

Because you have visibility into customers’ income and employment data whenever you need it, you don’t have to go back to them for more information every time you need to update your records. That translates to a more streamlined experience for everyone.

Time savings

Fewer customer touchpoints means less back and forth, which ultimately shaves days off of your workflow. For example, with Argyle, Checkr completes employment verifications in 15-60 seconds—compared to 1-4 days before they used streaming data.

More reliable data

Because streaming data is constantly refreshed and comes directly from the source system, you can be sure the information you are referencing to make critical business decisions is accurate.

Reduced costs

If you have been paying for third-party income and employment data through a legacy provider like The Work Number or collecting data manually, you can expect significant cost savings when you switch to streaming data. There are a few reasons it’s less expensive:

It comes directly from the source, and access is permissioned by the consumer. That means Argyle isn’t purchasing the data and reselling it to you at a markup the way legacy providers do.

You can pull the data you need at any time, which means you don’t have to pay high fees for a reverification report.

It replaces many manual processes. More automations means lower operational costs.

Monitoring for changes to income and employment data

Streaming income and employment data also gives you the ongoing visibility you need to stay informed of changes to customer information. The changes you can monitor include income fluctuations and changes in employment status. To make it easy, Argyle lets you customize your notifications, so you are only alerted to the data changes that matter to you.

Real-world application: mortgage originations

One practical use for streaming income and employment data is mortgage originations.

The typical mortgage closing cycle is weeks to months long, and borrowers’ income and employment information frequently needs to be refreshed over that time. As a result, standard employment and income verification protocols in the mortgage industry require borrowers to:

Enter their employment history

Find, download, and upload past W-2s and paystubs

Confirm employment details and contact information as their application enters decisioning

Provide another paystub toward closing, so lenders can reverify income and employment if their original verification has expired.

Meanwhile, lenders have to coordinate all of these steps and chase down the necessary information. That amounts to a lot of back and forth—all of which adds time and cost to the mortgage process.

But with Argyle and streaming income and employment data, all of that is eliminated. Borrowers log in to their employer or payroll platform once—giving them a better overall experience—and lenders have all of the real-time data they need to see their application through closing.

Real-world application: superior loan servicing

In other scenarios, personal lenders use streaming income and employment data to alert them if a customer loses a job or income source. In turn, the lender has the information they need to proactively reach out and offer a loan extension or modified repayment terms to accommodate the customer’s new employment situation.

Not only does this represent an opportunity to deliver exemplary customer service, it also helps lenders prevent loans from going into default.

Banking institutions can also use streaming income and employment data to support customer service. One Argyle customer, Better Financial, receives notifications whenever customers begin missing work or losing pay, so they can offer support accordingly:

“We then send a push notification to the customer,” said Better Financial co-founder Kaushik Tiwari. “It might say, ‘We noticed a drop in your income last week. What happened?’ Based on the information they provide, we offer a cash advance or initiate an insurance claim.”

Recognizing when someone might be in financial distress allows Better Financial to extend help when customers need it most, which is central to their mission to provide users with a financial safety net in times of hardship.

Real-world application: assessing loan portfolio health

Lenders can also leverage streaming income and employment data to gain a holistic picture of the health of their loan portfolio. In tracking the income fluctuations and employment statuses of all of your borrowers, lenders can be cognizant of trends that could impact your business, allowing you to optimize workflows and respond accordingly in a timely fashion.

The bottom line

Streaming income and employment data access is a game changer for financial institutions who want to improve customer experience while serving their objectives. Contact us to learn how ongoing access to real-time data can transform the way you do business.