Mobilizing data for car rental success

Ago offers a smart, flexible platform for anyone looking to rent a car effortlessly. As a vertically integrated, stable app built over several years, they were missing just one connective link. To keep costs low and build off an already effective, data-driven pricing model which utilized driving behavior data directly from the vehicle, they needed a more precise understanding of why and how their customers are driving. For that, they turned to Argyle.

Measurable success

80% lower premiums

Partnering with Argyle lets Ago know whether users are driving on personal or professional time, lowering their liability insurance rates by hundreds of dollars each month.

The background

Quick, hassle-free mobility

For drivers in need of a temporary ride, options have historically been limited. Renting a car can be inconvenient, with time wasted at check-in, energy wasted on paperwork, and money wasted on fees. This is especially true for gig drivers who need easy access to a vehicle to earn a living through apps like Lyft and DoorDash. That’s why Ago was started, a simplified mobility platform that instantly pairs users with affordable vehicles.

Go with Ago

With Ago, the rental process is streamlined. Once a driver downloads the app and verifies their identity, they can find a nearby car and unlock it remotely. The car is theirs for as little or as long as they need and is priced by hour, day, or week. This rate includes everything from insurance to maintenance to round-the-clock roadside assistance.

The problem

A limited view of driver risk

Ago is a vertically integrated business, so their inventory, technology, physical damage insurance, and risk management system are developed in-house. Still, they rely on external partners to meet select needs like liability insurance, which is calculated per mile based on each driver’s risk profile. With their current system, Ago could get a clear picture of a driver’s history and safety record, as well as a users driving behavior, but they could only guess at whether drivers were using cars for business or leisure. This uncertainty made insurance companies uneasy.

“We had very traditional rental car insurance. They didn’t understand what we were doing, and they were uncomfortable allowing commercial drivers on our platform.”

Since Ago couldn’t say when drivers were working—in other words, when liability was covered by their employer—they had to insure every mile, driving up costs for the company and its customers.

The solution

Complete driver profiles with real-time data

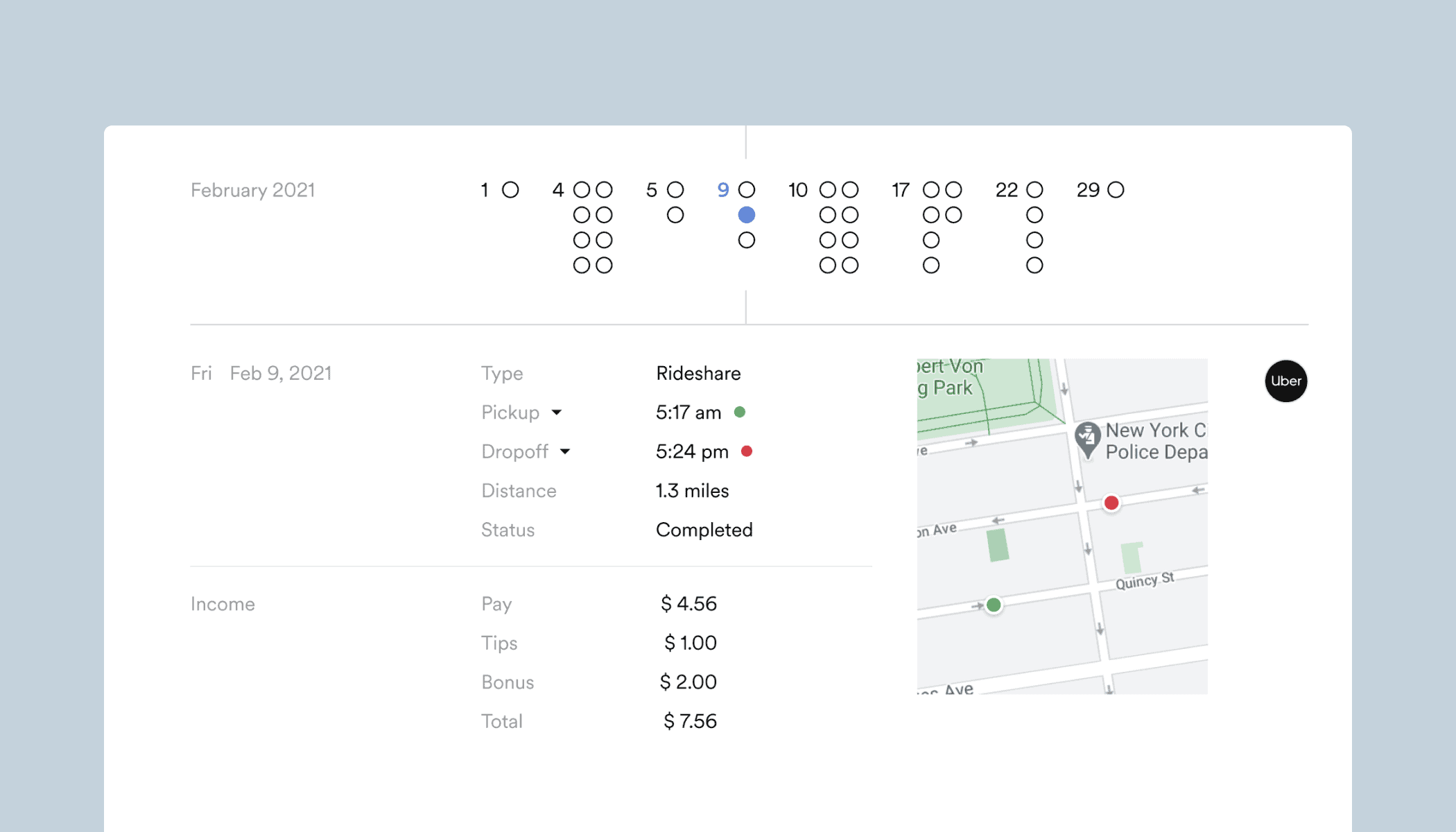

With Argyle, gig drivers connect Ago directly to their employment platform, so Ago knows when they’re on and off the clock, down to the minute.“It’s not even an estimate,” said Spoon. “With Argyle, we can determine the exact number of miles that were driven for personal and professional reasons.”Now, Ago can approach insurance companies with a much fuller picture of their drivers activity and tailor coverage to their specific needs.

The results

Pared-down premiums

With this big-picture view, Ago only pays liability on drivers’ personal time, leading to substantial savings. In total, they’ve reduced insurance premiums from about $400 to as low as $75 a month—a reduction of up to 80%. And if any problems arise, Argyle saves Ago equally valuable time with claims adjudication“If there’s an accident,” said Spoon, “we know with zero ambiguity when it happened and if they were driving personally or on-app. That allows us to be much more efficient with claims, because we know if we’re using our insurance or their employer’s commercial plan.”

Customized, comprehensive pricing for drivers

Of course, lower insurance costs mean lower prices for Ago’s drivers, whose rental fees now more accurately reflect their needs.“Argyle made it possible for us to complete the data pie around driver risk, scale down our insurance rates, and truly price a user correctly. In practice, it’s been flawless,” said Spoon.

A smarter, more inclusive platform

Gaining broader gig worker income and activity data insights allows Ago to welcome drivers who may otherwise fall through the cracks.“In some cases,” said Spoon, “they have no other options, because we’re the only ones who assess them holistically. Instead of just pulling their credit, which is what every other company does, we look at factors that are much more relevant to the type of driver they are.”

The future

Opening opportunities

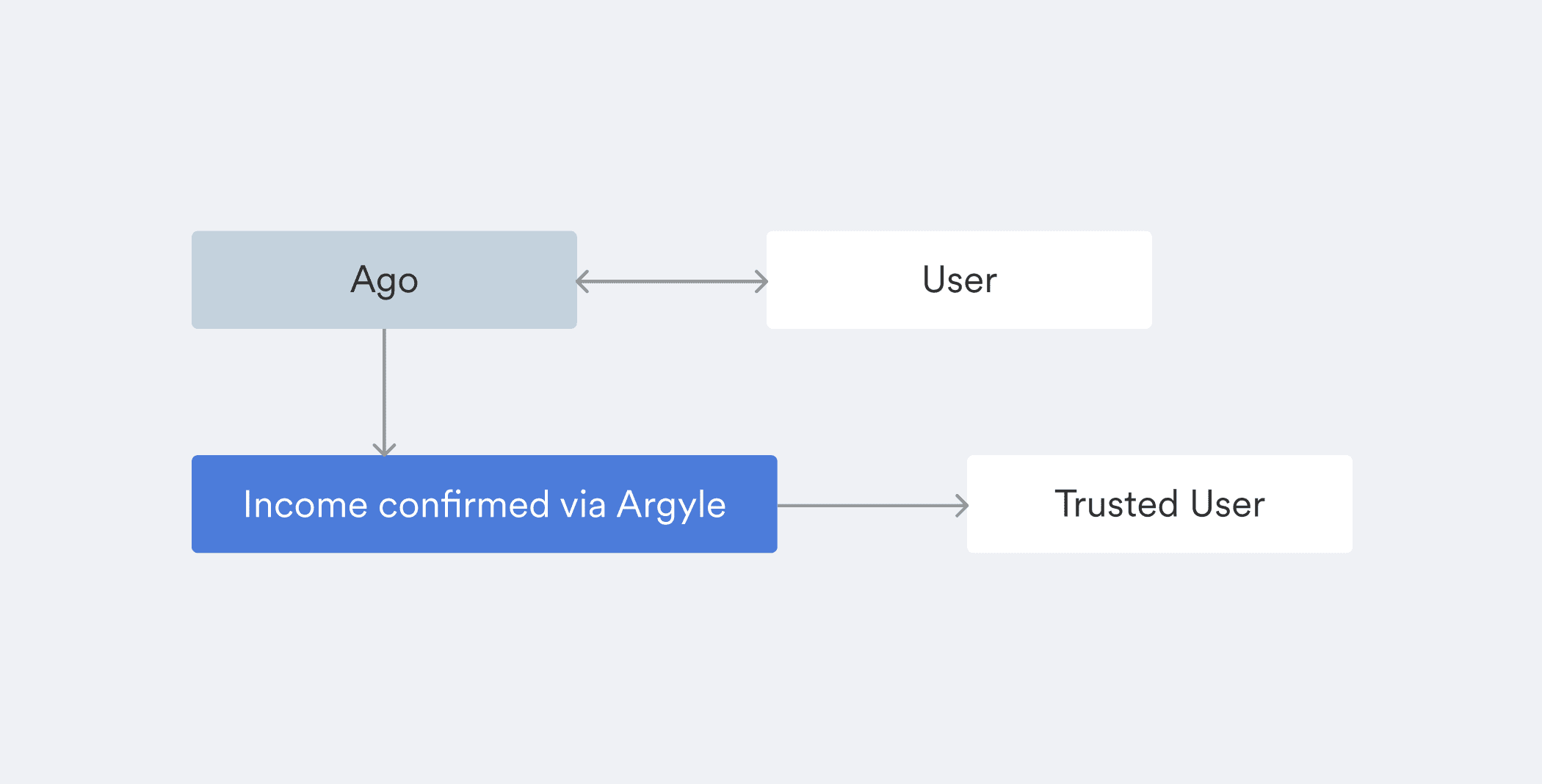

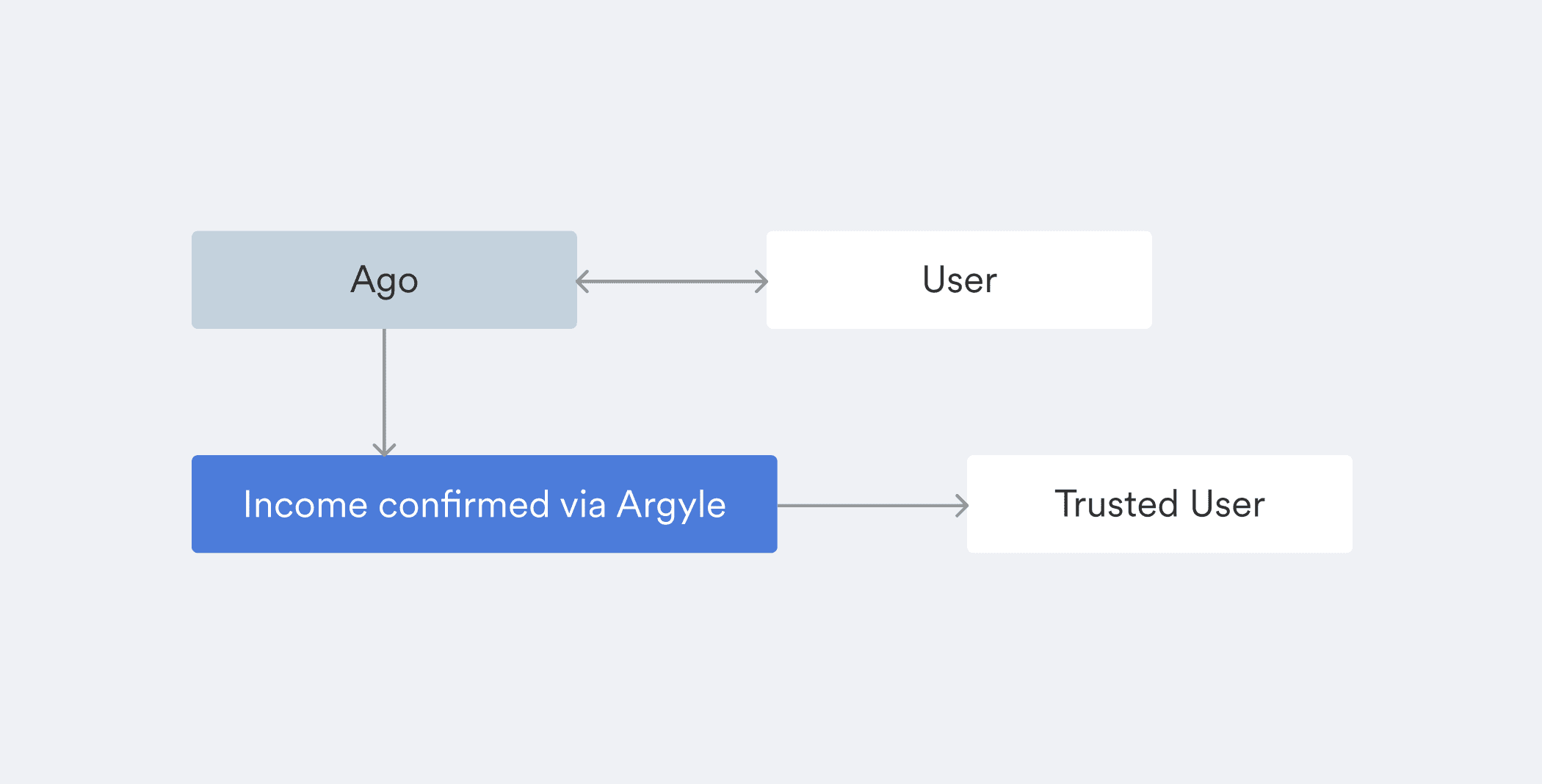

While Ago’s vehicles are currently prepaid, partnering with Argyle lets them work toward a different model, where trusted users with consistent income could pay directly from their earnings. For Spoon, this means Ago could eventually empower even more drivers.

“Theoretically, with our program and Argyle’s architecture, anybody experiencing financial hardship could get into one of our vehicles and start to make money right away.”

Driving toward growth

Argyle has helped Ago build confidence not only among outside investors and partners, but also internally as a company, and they’re planning to make significant strides in the years ahead.