Direct Payroll

Complete VOI and VOE for any consumer in minutes

When you automate income and employment verifications with Argyle, you get faster turn times at a lower cost—plus all the benefits of direct-source, consumer-permissioned payroll data.

Contact sales

Benefits

The advantages of Direct Payroll are transformational

80% cost savings

Save more versus The Work Number

Argyle customers see a significant reduction in verification costs compared to manual processes and The Work Number.

55%+ VOIE conversion

Automate more verifications

Use Argyle’s integrations, API, and web-based tools to reduce manual steps and increase operational efficiency.

12.5 days off your cycle time

Power fast, delightful experiences

Give applicants and your team a verification experience that’s simpler and far less time-intensive.

How it works

Getting an employment or income verification report is fast and easy

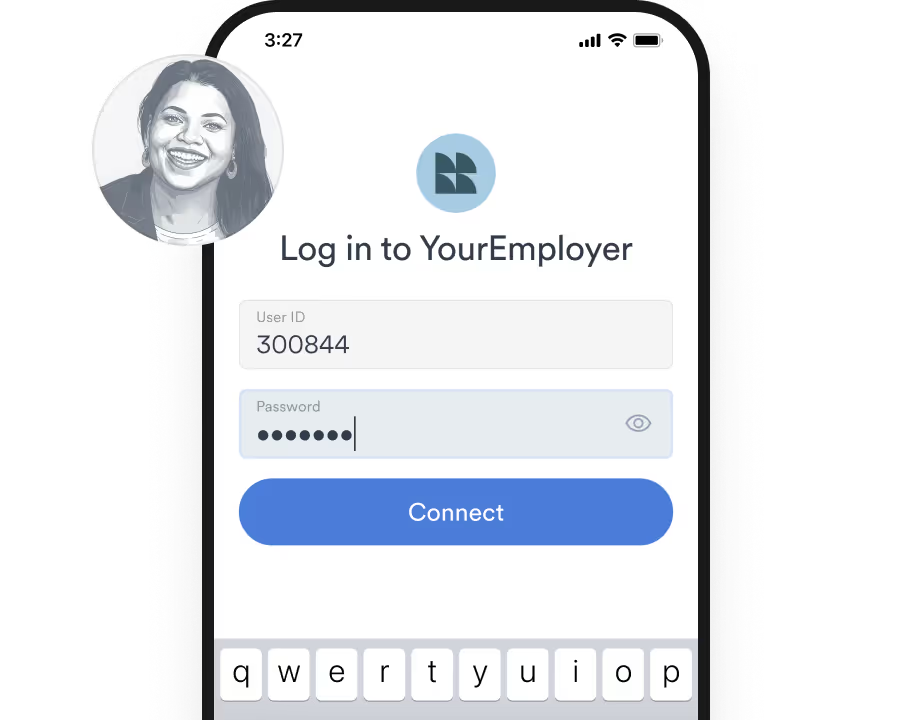

- ①

Customer authentication

Your customer completes a quick connection flow.

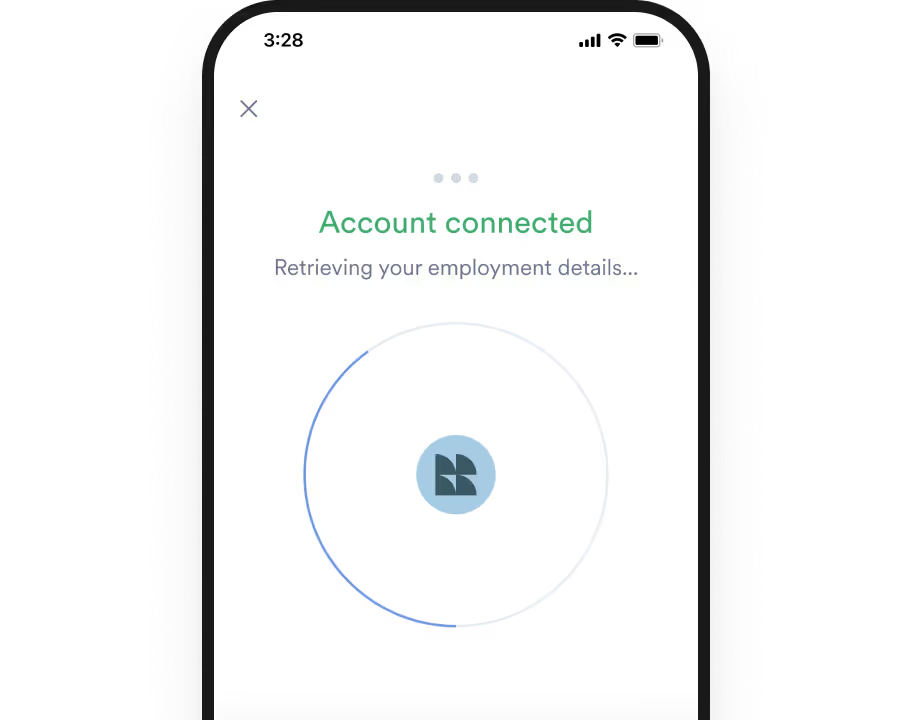

- ②

Establish connection

Argyle establishes a direct link to their account records.

- ③

Complete verification

You get a real-time report plus relevant data and documents.

Why Argyle

Market-leading performance with proven payroll data quality

Broader coverage

90%

of the U.S. workforce with 30+ gig platforms

Higher VOIE conversion

55%+

across industries

Better datasets

90%+

data completeness

Features

Everything you need for modern verification

Rep and warrant relief

GSE-ready income verifications

Use Argyle with Fannie Mae’s Desktop Underwriter® and Freddie Mac AIM.

Flexible integration

Quick to start, easy to scale

Whether you use our POS/LOS integrations, embed via API, or use our self-serve web-based tool, Argyle fits seamlessly into your existing workflows—delivering minimal lift and optimized data flows.

Mortgage

Reduce production costs, increase pipeline capacity, and shorten loan cycles.

Tenant Screening

Improve data quality to spot application fraud, save time, and increase compliance.

Government Benefits

Improve data quality to spot application fraud, save time, and increase compliance.

Personal Lending

Approve more qualified borrowers, more confidently with a better view of creditworthiness.

Background Check

Accelerate approvals, dramatically lower costs, and reduce manual work.

Gig Economy

Leverage real-time work activity to enhance products and reduce risk.

FAQ

Answers to your frequently asked questions

What kinds of employment and income verification services are available on the market, and what makes them different?

How does Direct Connect differ from Doc Processing?

What is automated income verification?

Is Argyle a paystub verification service?

How long does it take to implement Argyle’s Income & Employment Verification solution?

Explore more resources

Ready to see what Argyle can do for you?

Get in touch to learn more about our verification platform.