We’ve made it easier than ever for people to control who has access to their income and employment data and for how long.

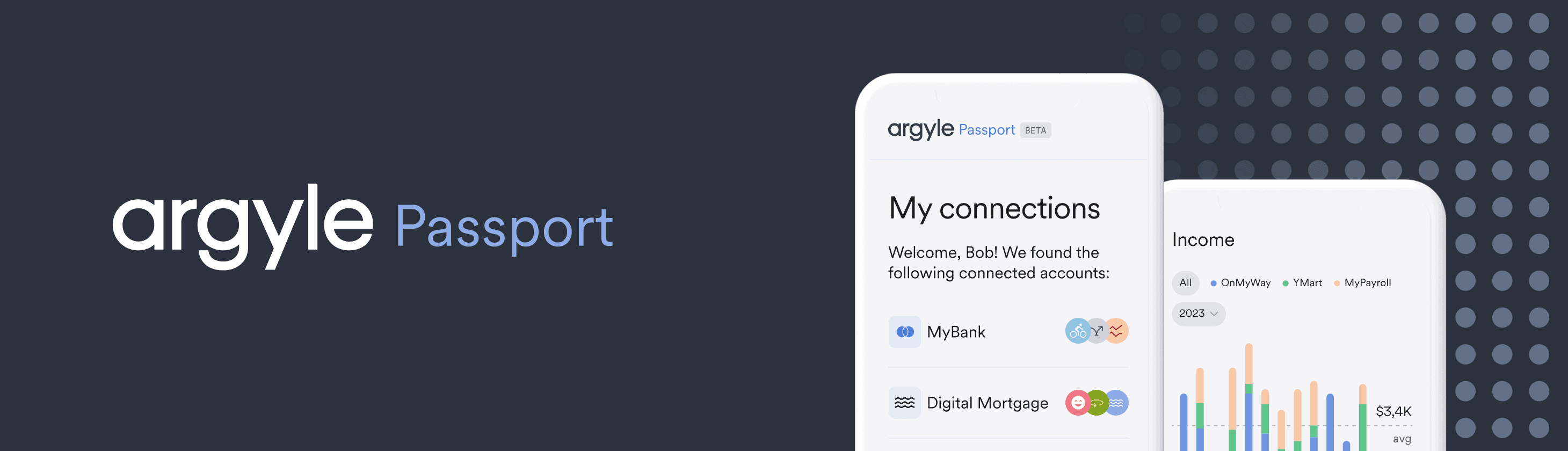

In our mission to make consumer income and employment data effortlessly and securely portable, the rights of the consumers who own that data have always been paramount to Argyle. Today, we’re making good on our commitment to them with the release of Argyle Passport.

A consumer control center

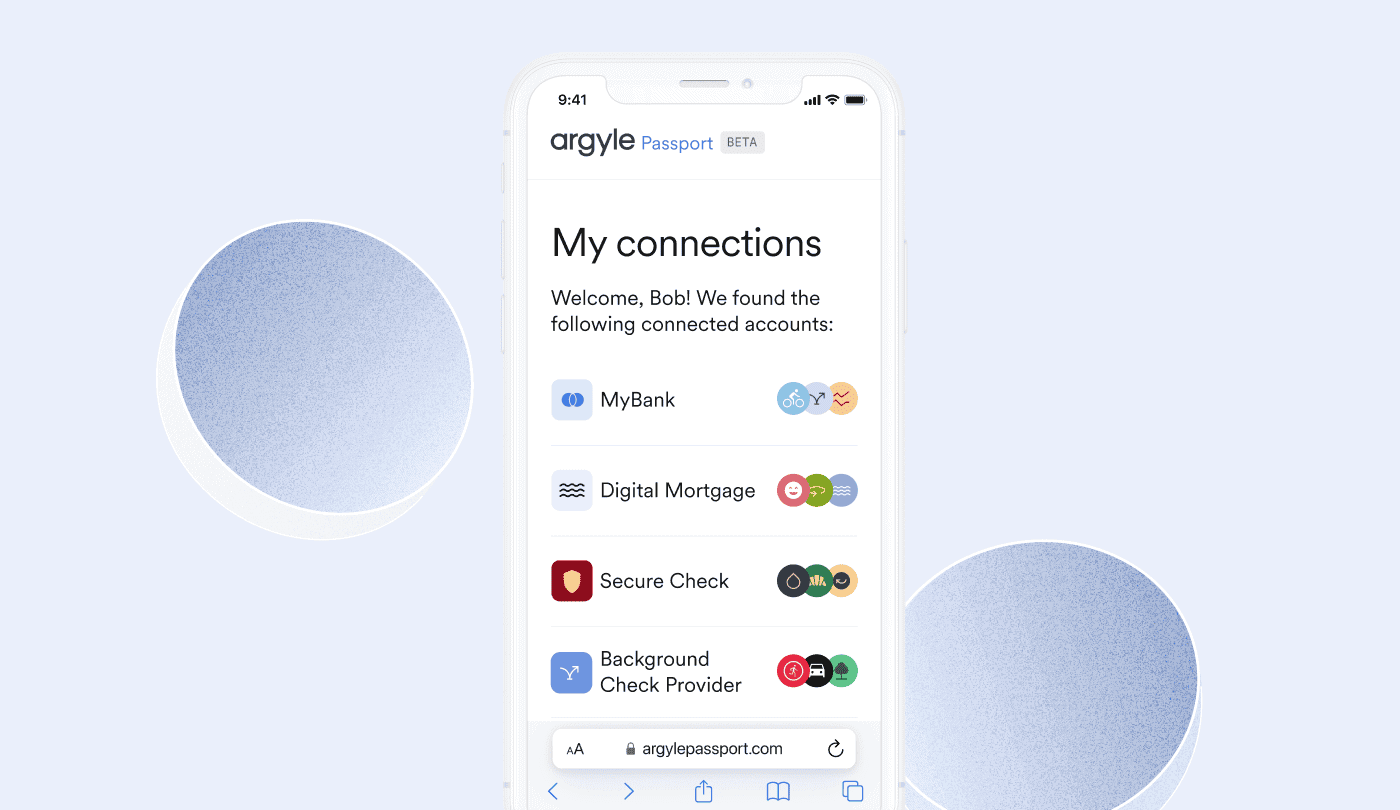

Argyle Passport is the mechanism by which consumers have complete control of the payroll connections they authorize via Argyle. Think of it as a sort of next-generation switchboard, where individual consumers can view all of the payroll connections they’ve made to third-party service providers and turn those connections on and off as they see fit.

What Argyle Passport means for consumers

Put simply: autonomy and privacy.

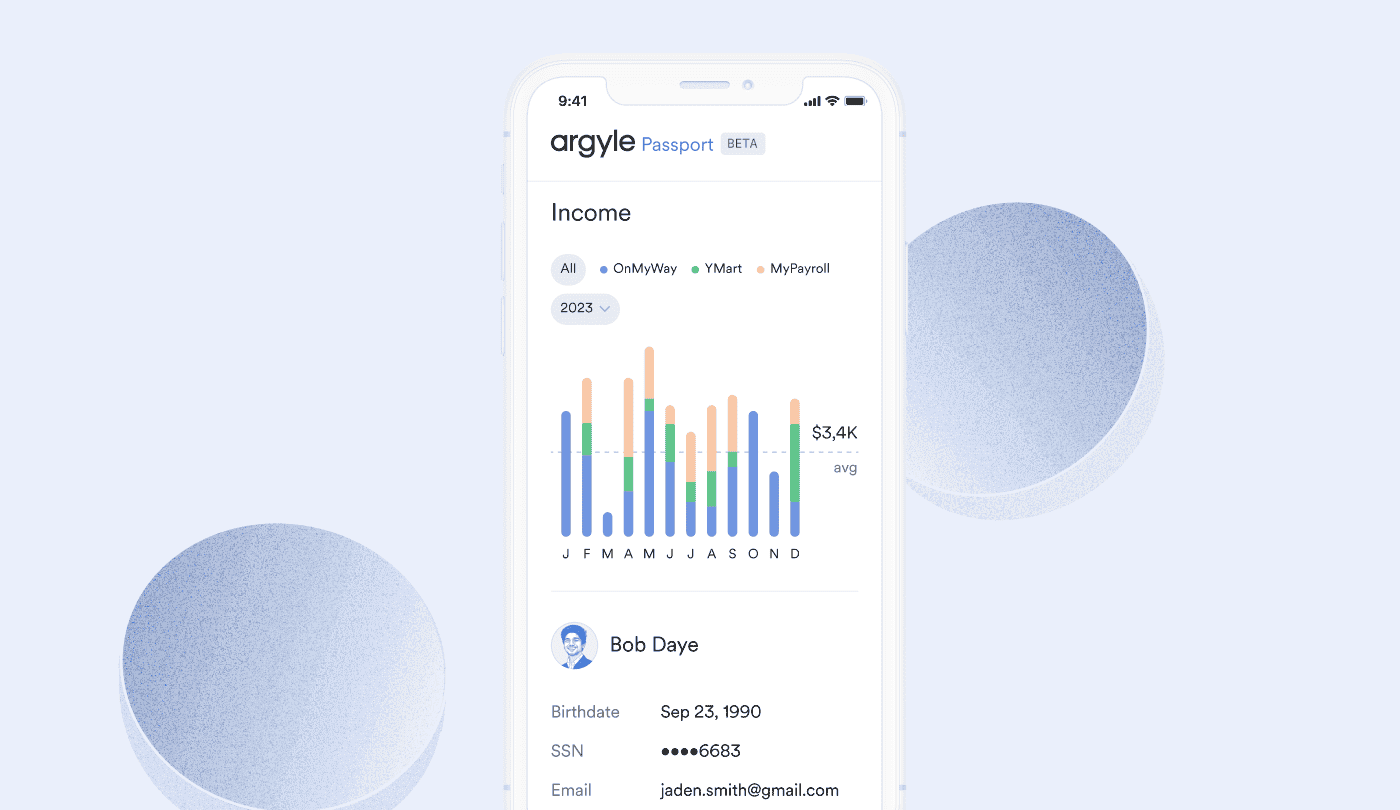

When a consumer goes to get a mortgage, apply for a personal loan, or rent an apartment, Argyle has always made it possible for them to share their most up-to-date and comprehensive income and employment data with the third parties they’re transacting with.

This not only makes the consumer’s experience faster, easier, and less stressful (they don’t have to run around digging up old paystubs and W-2s, for instance), it ensures that service providers have information that’s truly reflective of the consumer’s financial situation. In turn, consumers can be confident that they are getting the best services for them.

With the launch of Argyle Passport, we’re taking things a step further by giving consumers a single access point to manage all of the data connections they’ve made with Argyle. They’ve always had the ability to turn on and off their Argyle data connections—Argyle Passport just makes it a breeze.

It really is the best of both worlds for consumers: all the benefits of seamlessly sharing data plus the peace of mind that comes with knowing they have complete control over what they share, when, and with whom.

What it means for financial institutions and other service providers

When consumers are confident that they are in control of their data and that it will be handled securely, it’s safe to say that they will be more likely to share that data with third parties. For financial institutions and other service providers, this makes conversion through Argyle even more likely.

And when consumers convert via Argyle, the benefits for financial institutions and service providers are clear: they experience lower verification costs, more efficient processes, more accurate data, and more visibility into their customers’ financial circumstances.

Then there’s the advantage of being a responsible steward of consumer data. It’s something that will only become more important with time as open finance continues to grow and regulatory bodies dictate more rules around how consumer data is handled. Partnering with a fintech that takes transparency and security seriously—like Argyle—is crucial.

Setting up Argyle Passport is easy

Consumers interested in setting up Argyle Passport to control their existing Argyle connections or establish new connections can create an account here. It’s free and fast to complete.