Part the sea of manual paperwork and move to instant digital verifications

Fintech can often be a misnomer; while technology has automated and opened so many doors, many fintechs are still tied to outdated documentation and forms that keep them from really opening up the throttle. These forms contain critical information that is necessary to operate within margins of safety, but that doesn’t mean they are the only way to collect this information.

With Argyle, you can skip requesting and reviewing documents and instead allow applicants to sign in to their work accounts to instantly verify their information, saving you time and money. Below we outline all the steps our partners are already able to skip through Argyle:

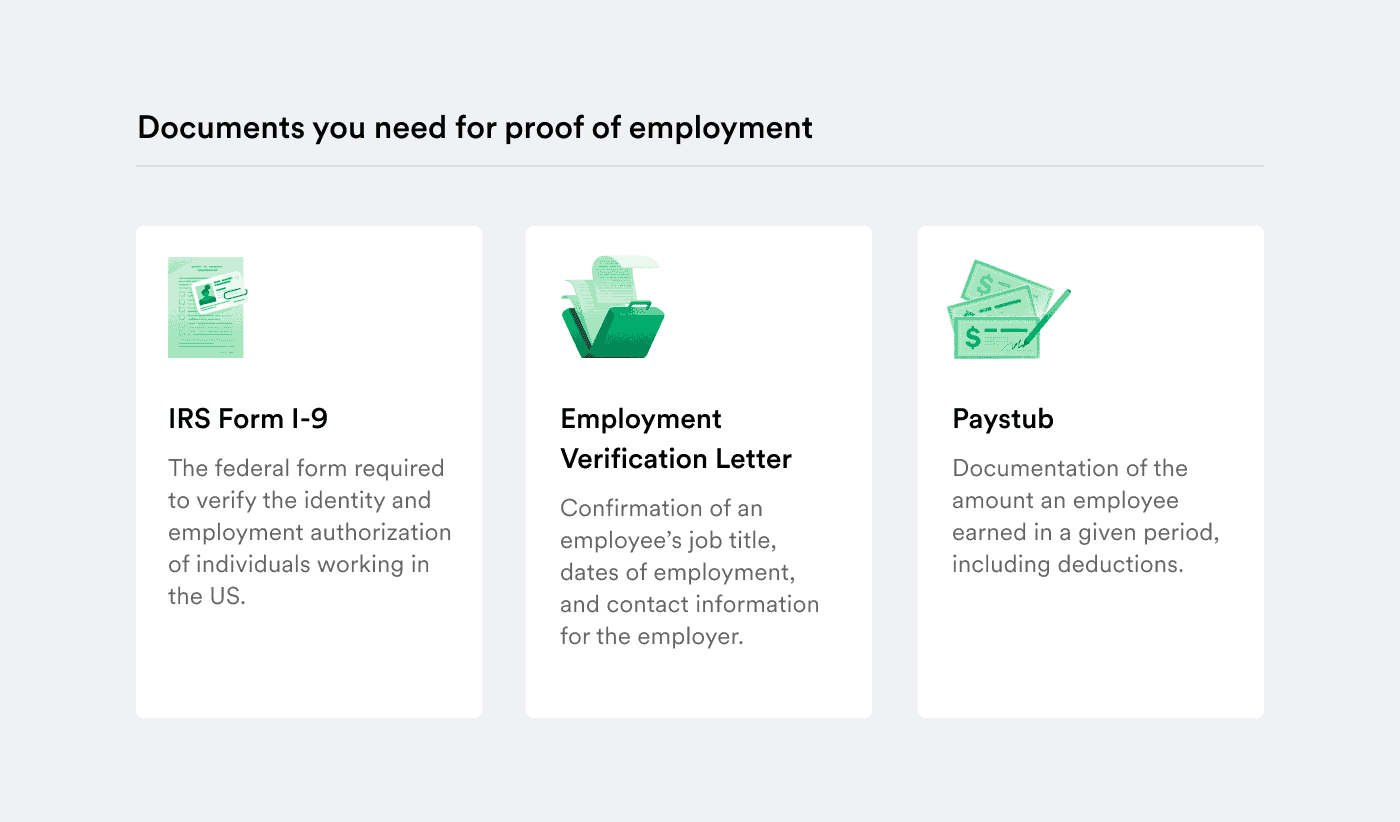

What documents do you need for proof of employment?

Financial institutions require employment verification for any number of reasons, including (but not limited to) extending a line of credit, confirming an applicant’s identity, or confirming eligibility for a product or service through the following documents.

Form I-9

IRS Form I-9 is required for all new employees in the US and documents an employee’s eligibility to work domestically. While the majority of the form is completed by the employer, the new employee completes the first part by including their personal information like name, address, contact information, and Social Security Number.

To complete an I-9, human resources will ask the new employee either for a single proof of employment eligibility and identity document, which would be a:

US Passport or Passport Card

Permanent Resident Card or Alien Registration

Employment Authorization Document Card

Foreign Passport with Endorsement to Work via Form I-94 or I-551

If the new employee doesn’t have one of those, they can still move forward by providing separate documents for proof of identity and proof of employment eligibility in combination.

Proof of identity documents

Current US Driver’s License

Canadian Driver’s License

Federal, State, or Local ID Card

School ID Card with Photograph

Voter Registration Card

US Military Card or Draft Record

Military Dependent’s ID Card

US Coast Guard’s Merchant Mariner Document (MMD)

Native American Tribal Document

Proof of employment eligibility documents

US Social Security Account Number Card

Consular Report of Birth Abroad

Certification of Report of Birth by the US Department of State

Original or Certified Copy of a Birth Certificate Bearing an Official Seal

Native American Tribal Document

US Citizen ID Card

Identification Card for Use of Residents of the US

Employment Authorization Document issued by the Department of Homeland Security

Employment Verification Letter

An Employment Verification Letter is issued by an employer to certify that an employee is in fact employed with that company. At a minimum, these letters will be on the company letterhead and confirm an employee’s job title, dates of employment, and contact information for the employer. Additional information in the letter might include salary and responsibilities of their role.

How Argyle replaces the need for employment documents

Anyone employed in the US has completed an extensive vetting process when completing an I-9 with their employer prior to starting. Financial institutions that have users input their employment credentials through Argyle as a part of their application process are able to access all those hours of vetting the employer’s already banked, instantly.

What are considered income verification documents?

Lenders and financial institutions may be looking beyond the employment verification request to also include salary information. Proof of income is a standard request from a financial institution, but what are acceptable documents for review?

Paystub

A paystub is issued by an employer with each paycheck and shows the amount earned in that period, including deductions. Unlike tax documents, paystubs are highly variable when it comes to what information is included beyond that earned amount, and the terminology is not consistent. Most paystubs are digital now, with salaries directly deposited into an employee’s bank account.

How Argyle replaces the need for proof of income documents

Rather than requesting a paystub and waiting for a PDF that a team member then has to manually review, Argyle gets you instant access to a streaming income information. This also allows a financial institution to see wages earned that have not yet been deposited into the user’s bank account.

Argyle eliminates PDFs, tax forms, and payslips from your income and employment verification process, replacing them with a modern income data platform. With consumer-permissioned continuous data, financial institutions can move quickly and with confidence in the data coming in.

Want to learn more? Contact us to see where Argyle can save your team time and money.