With growing IT talent shortages, financial service providers need access to intuitive, off-the-shelf tech solutions if they want to keep up with digital trends.

As anyone in or around finance knows, the industry is facing stark shortages when it comes to IT talent, and they’re not expected to subside anytime soon. IT talent deficits are actually projected to snowball across every sector over the coming years, ultimately impacting 90% of all companies and costing over $5 trillion in lost revenue by 2026.

Tech team shortages can have serious consequences for financial service providers. Without sufficient IT support, many are unable to adopt new API-based technologies and follow digital trends with the speed and agility the market demands.

If the finance industry is going to continue to grow and evolve, business leaders need access to financial technology (fintech) that’s intuitive enough—and customer service that’s comprehensive enough—that it can be launched with little to no development time or resources.

Below, we share why user-friendly tech is so critical to the future of finance innovation—and how financial service providers can be sure the fintech companies they’re partnering with are delivering easy-to-implement solutions.

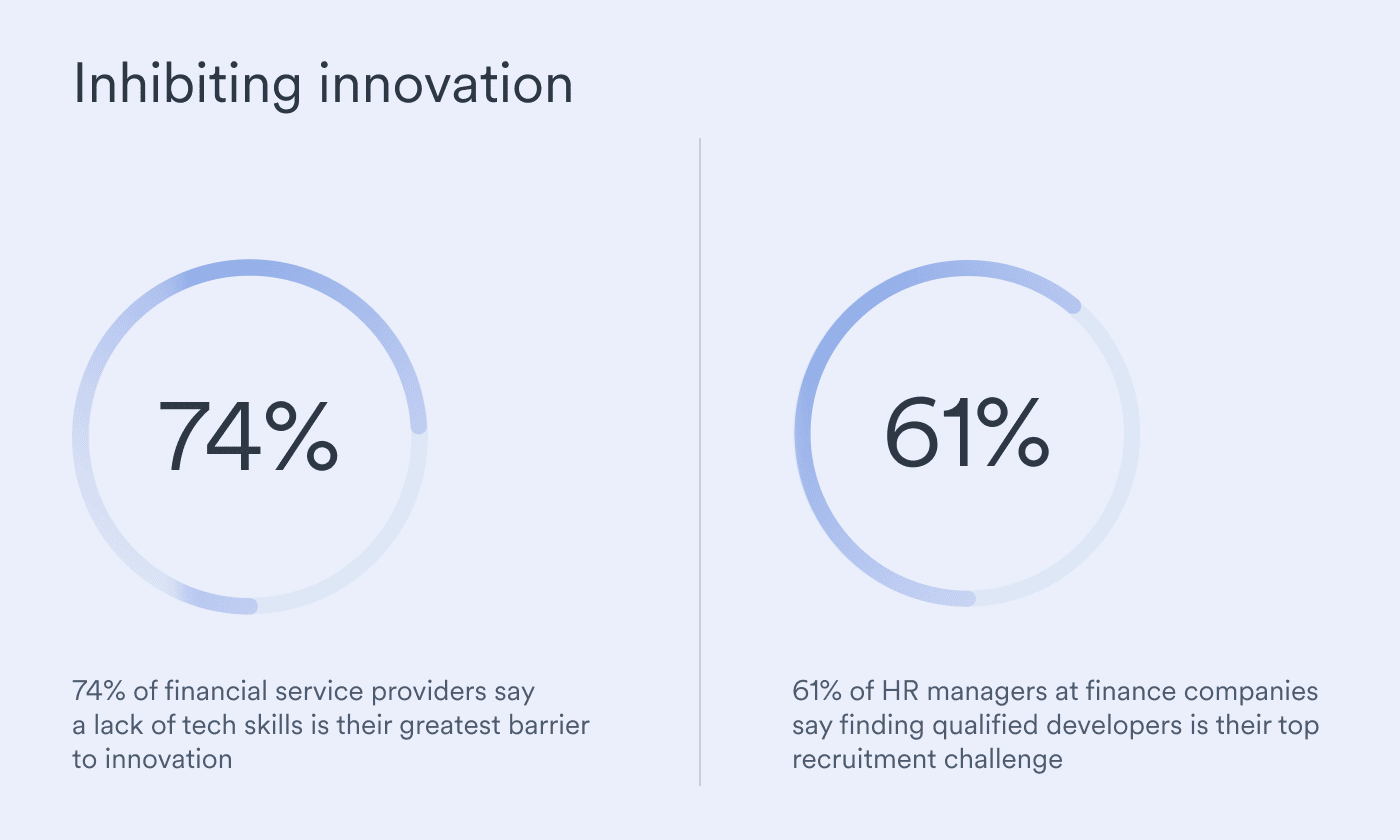

Inhibiting innovation

According to a study by Deloitte, 74% of financial service providers feel that their greatest barrier to implementing new technology and expanding their digital offering is a lack of technical expertise. And this particular skills gap is hard to overcome. The same study found that 61% of surveyed HR managers listed finding qualified developers as their top recruitment challenge.

Without a robust development team, organizations can have trouble finding the work hours, resources, and capabilities they need to integrate new API-based tools into their products and services—especially if those tools are needlessly complex.

That means, when fintech companies don’t prioritize ease of use, the implementation and upkeep of their solutions can become prohibitively taxing for their customers.

Implementing inconvenient, overly complicated fintech solutions can require teams to undertake a range of challenging and time-consuming tasks, including:

If teams don’t have IT specialists at the ready to handle each of these tasks, it can be a challenge to get a new tech solution off the ground—let alone optimize it to drive significant business outcomes. It’s no wonder that only around 30% of banks have been able to successfully carry out a digital strategy and implement the innovative tech solutions they require to thrive.

What’s at stake?

While financial service teams are struggling to keep up, their customers are increasingly expecting more in the way of digital transformation.

One study found that most (57% of) consumers reported they’d likely switch to a new financial institution if their current bank couldn’t deliver tech-forward features like personalized debt planning and repayment reminders, predictive insights into future spending, and automated transaction categorizations. That number jumps to 63% for Gen Z and Millennial consumers and to 67% for consumers with an annual household income over $100K.

In other words, adopting new technology isn’t just about keeping pace with the industry, but about retaining customers and staying afloat as a business. In today’s finance environment, fintech solutions do more than help service providers meet customers’ expectations. They’re also an essential part of enhancing efficiency, lowering costs, and reducing risk across different financial sectors.

Simplifying solutions

So, how can financial service providers take advantage of the latest technologies without having to expand their IT team or commit extensive development time and effort? The key is to find off-the-shelf solutions from companies that make customer service and support a top priority.

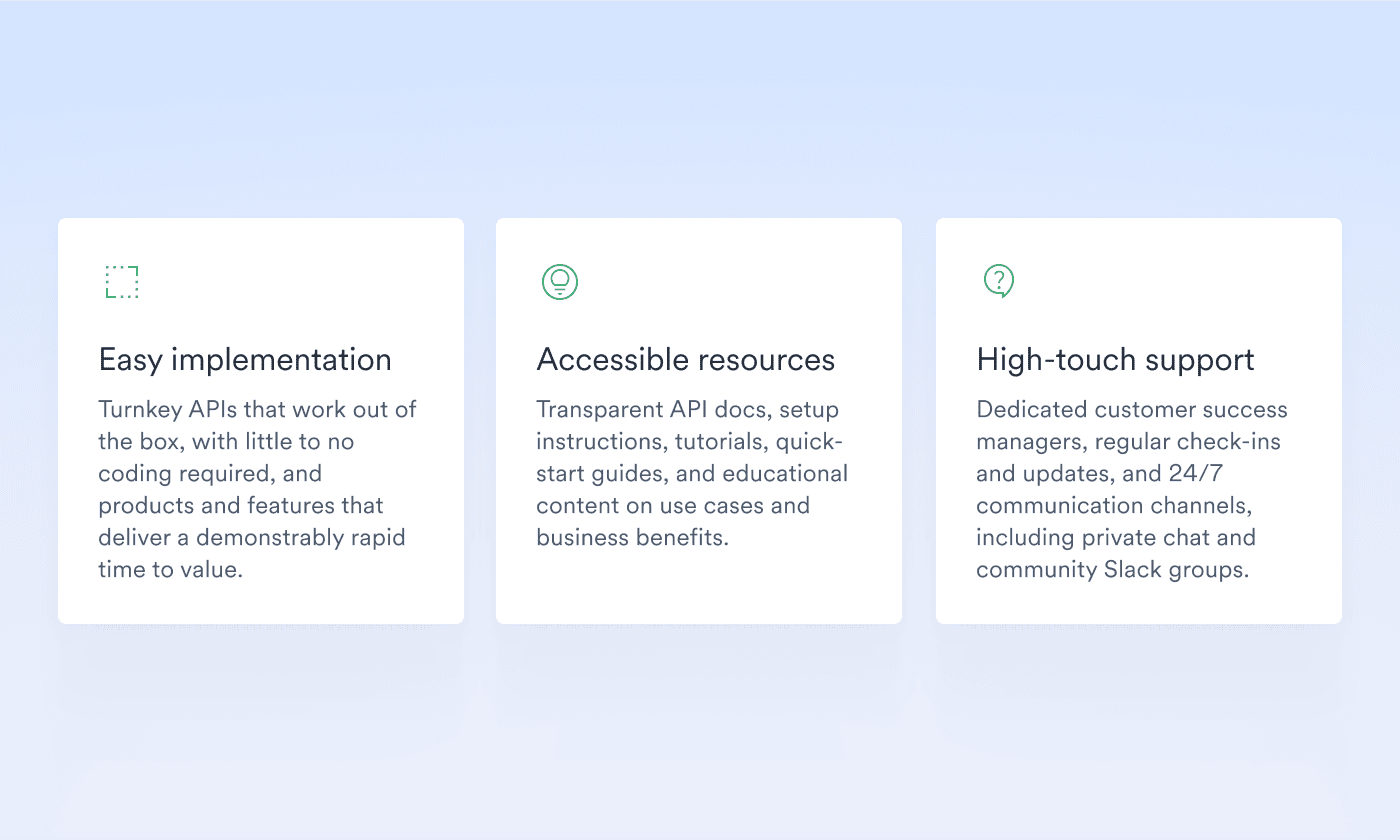

Specifically, they should look for three fundamental criteria:

Simplicity in action

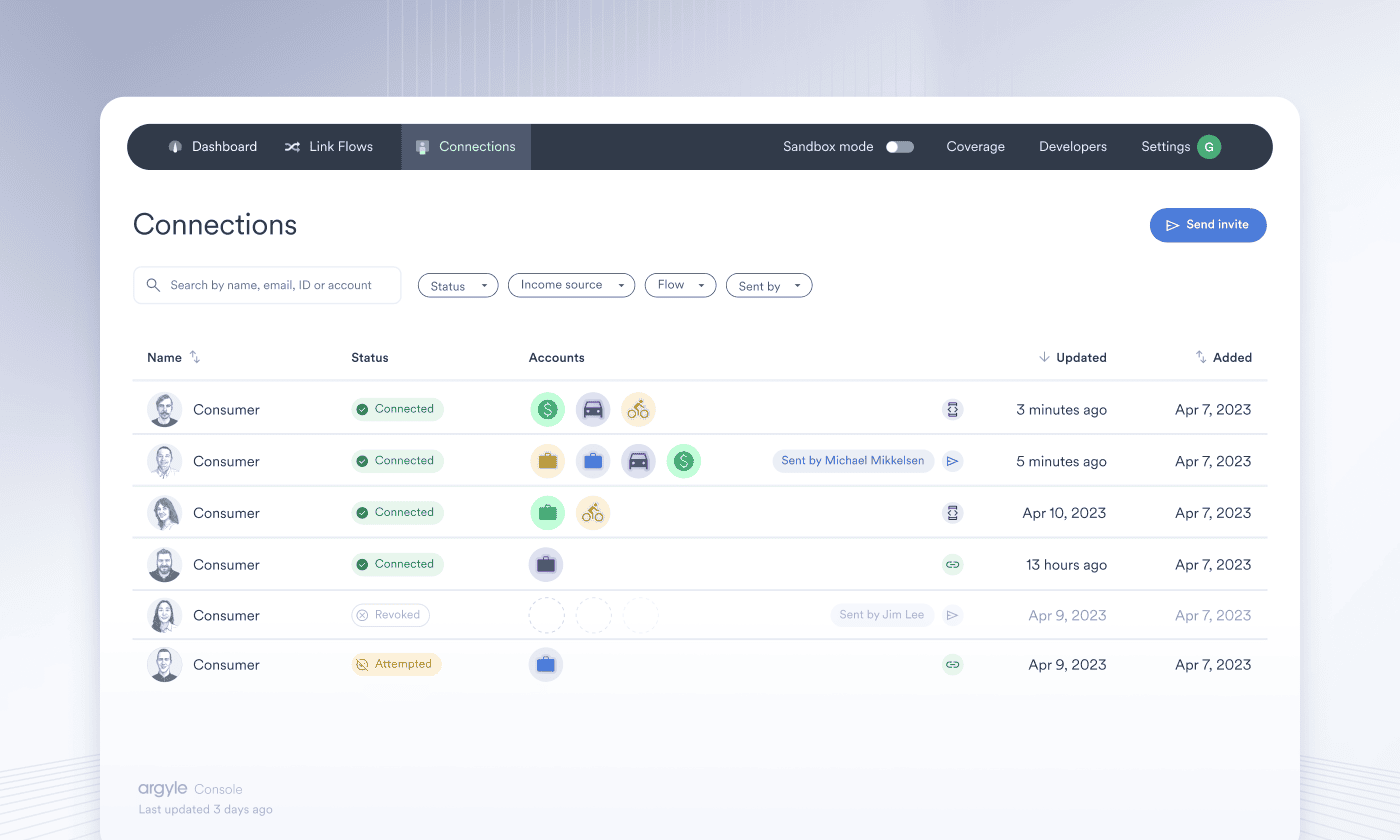

Argyle is a prime example of a company offering convenient, easy-to-use tech solutions—in this case, direct payroll connections that allow mortgage and personal lenders to verify income and employment in real time and straight from the system of record.

In addition to a flexible and intuitive API, Argyle offers an enterprise-grade, web-based interface called Argyle Console that helps financial service providers test, launch, and manage their connections. This imposes a fraction of the development lift—transforming entire verification processes in less than 24 hours—while delivering the same instant, high-quality data.

With Argyle, financial service providers can tap into reliable data, generate GSE-compliant VOIE reports, and retrieve required documents like paystubs and W-2s with just a few clicks.

What’s more, lenders can leverage Argyle’s readymade integrations to access Argyle within their existing front- and back-office systems, including popular point-of-sale (POS) and loan origination systems (LOS).

With every partnership, Argyle’s experienced customer success team and subject matter experts are also on hand to ensure smooth implementation, accelerate time to value, and track and improve key performance metrics. Plus, they can steer less tech-savvy customers toward useful resources and updates that help them optimize their Argyle experience.

< 2 months time to value

Consider Argyle’s partnership with Mirza, a personal finance app aimed at offsetting the cost of dependent care for working families through employer-sponsored subsidies.

Mirza’s small development team was working against a hard deadline to get their app up and running—but they still needed a quick and easy way to verify employees’ identity, income, and work status. With Argyle Console, they were able to build automated verification flows right into their platform, with less than two months between the first conversation and the first live payroll connection.

Looking to advance your digital transformation without burdening your dev team?

Argyle can help you get started with simple, automated income and employment verifications. Reach out to our expert team to set up a call.