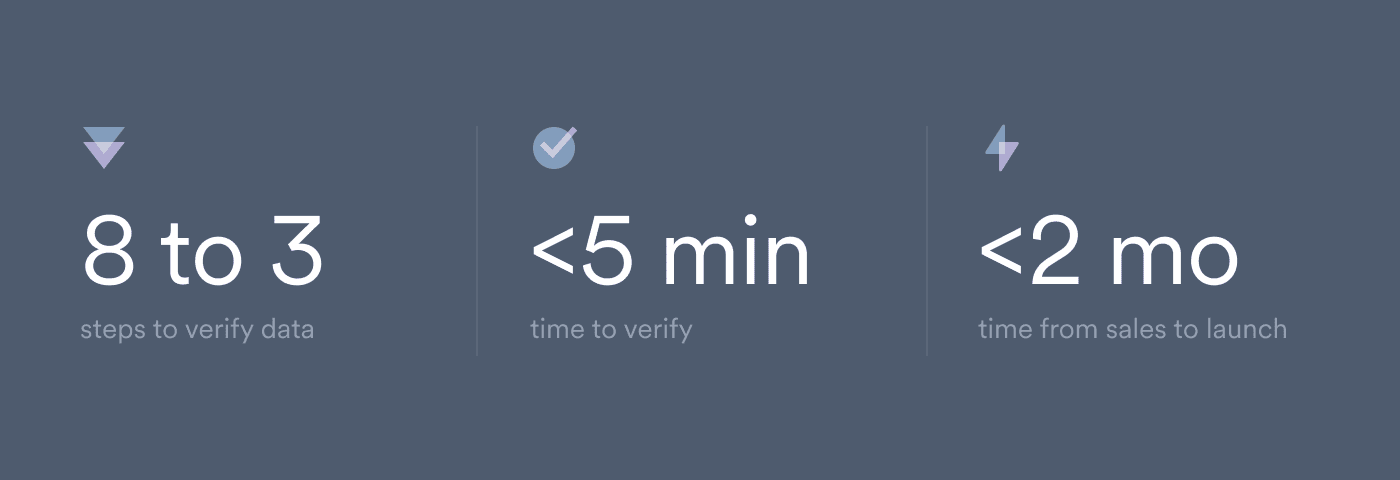

With Argyle, Mirza reduced their application process from eight steps to three, delivering accurate identity, income, and employment verifications in under five minutes.

Since 2020, Mirza has aimed to make caregiving easier on working families—with particular focus on the “motherhood penalty,” which accounts for 80% of the gender pay gap. Due to factors like unpaid leave, unequal divisions of household labor, and high daycare prices, new mothers often take a year or more away from work, losing 39% of their lifetime earning potential. While Mirza can’t fix the underlying social issues, they can help with the financial ones. Their app began as an open-access financial planning tool and soon evolved into a proactive solution offering employer-sponsored subsidies that offset the costs of care, so working families can afford to stay at work.

Deploying funds on employers’ behalf means Mirza needs an easy way to verify a worker’s identity, employment status, and income, so they can process applications fairly and securely. For that, they turned to Argyle.

Challenge

When Mirza was a financial planning app, they could rely on self-reported employee data. But moving to employer subsidies raised the stakes. Now, they must ensure not only that the data they’re working with is 100% accurate, but that funds are going to the right person and fit both an employee’s income and an employer’s budget. This becomes especially difficult when it comes to hourly workers—a key part of Mirza’s applicant pool—who may not know their total annual income.

Mirza found that establishing and verifying an employee’s identity, earnings, and employment often meant filling out endless paperwork and tracking down dozens of paystubs and tax forms, manual tasks requiring time most caregivers don’t have.

Solution

With Argyle’s direct payroll connections and automated Income & Employment Verification, Mirza can pull verified payslip data straight from the source. That not only allows employees to share accurate information in real time—streamlining application and onboarding processes and allowing them to access funds sooner—it offers them comprehensive visibility into their own wages and work activity, so they can boost their financial literacy and create more effective family budgets.

Now, Mirza hopes to use the granular insights they get from Argyle to expand their platform, so every kind of company can confidently support their caregiving employees. Mirza is also excited to explore other Argyle solutions—like Paycheck-Linked Lending—which would enable employers to cover upcoming costs like summer camp and allow employees to pay back the advance over time.

Outcome

8 steps to 3: Argyle’s automated solution more than halves the number of steps employees need to take to verify their identity, income, and employment data through Mirza’s platform.

< 5-minute verifications: Instead of spending weeks manually filling and processing applications, Argyle reduces verifications to a matter of minutes, accelerating time to funding.

< 2 months to launch: Mirza was working against a hard deadline to get their app up and running, but Argyle stepped up, with less than two months between the first conversation and the first payroll connection.

“Argyle’s customer support has been an invaluable asset. They make it so that Argyle feels like a true partner, not just a product we’re using.”