Borrowers are increasingly demanding seamless lending experiences across different channels and touchpoints—prompting an even greater need for accurate, real-time data.

For some time, digital transformation has been top of mind for modern lenders.

Even before COVID-19, industry experts advised that digitizing key origination processes—like income and employment verifications—could help speed up credit decisions, reduce costs and risk, and provide a better borrower experience. The pandemic only accelerated adoption, with many lenders beginning to offer (and many borrowers beginning to use) digital financial tools.

Today, an impressive 90% of financial institutions offer loan applications through a website or app. And there remains a resounding sense that the future of lending will unfold online.

But now, borrowers are revealing that they don’t necessarily want digital-only lending options. What they do want is flexible options that offer digital convenience but maintain different channels—including in-person interactions.

If lenders want to keep pace with these expectations, they need to be able to meet borrowers where they are. That means having instant access to precise financial data, so they can deliver a consistent and seamless experience at every touchpoint, no matter how borrowers are choosing to engage.

The continued demand for omnichannel lending

A recent report by ICE Mortgage Technology® found that only 18% of mortgage borrowers want to interact with lenders exclusively via digital tools like PCs, tablets, and mobile devices, with the vast majority preferring at least some level of human touch.

Even if a borrower submits an application online, they may opt to continue the lending process through more traditional means—in person, over the phone, or via mail.

Meanwhile, a survey of credit union members discovered that they expect to contact lenders online, in person, and by phone in roughly equal numbers, seeing unique value in each channel. And a study of banking customers found that they use brick-and-mortar branches more than any other channel to open accounts, seek advice, and shop for new financial services, with 63% electing to solve more complex problems in person.

With so many channels regularly in play, it’s easy for critical borrower data to become siloed and grow stale in separate, disconnected systems—especially if lenders are processing and maintaining that data using inefficient manual methods.

That means lenders might not be working with the most up-to-date view of a borrower’s financial details, causing many opportunities to fall through the cracks.

The case for better data

Without a reliable, holistic understanding of borrowers’ finances, lenders struggle to make prompt, fully informed decisions. That not only drags out the origination process, frustrating anxious borrowers, it can also put their business at risk. Dependable data helps lenders minimize risky or fraudulent applications—or inadvertently rejecting worthy ones.

That’s why innovative third-party providers have developed automated solutions that enable lenders to pull accurate borrower data directly from the system of record.

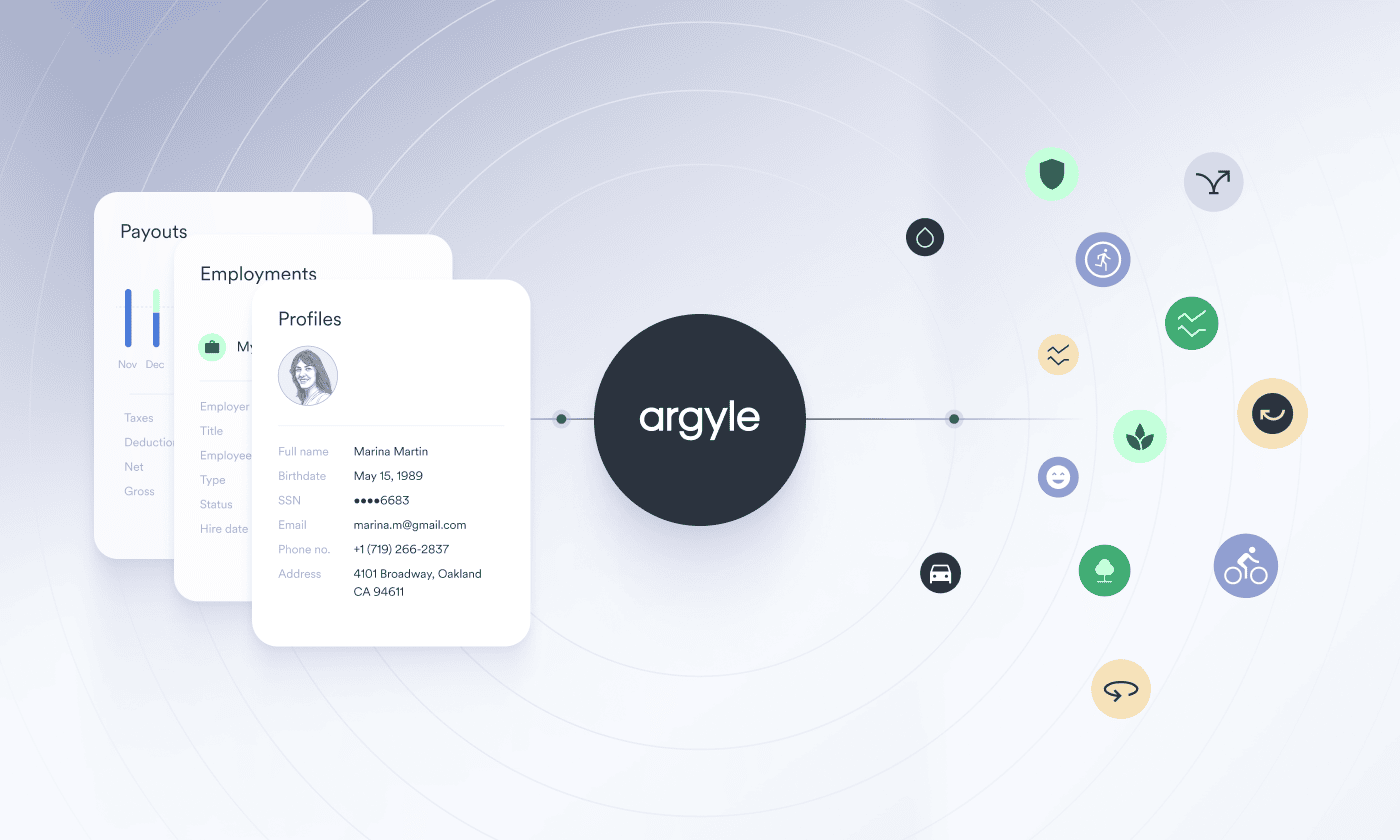

For instance, with Argyle, borrowers can connect lenders directly to their employer or payroll provider account, granting real-time, permissioned access to their income and employment data. Borrowers simply select their employer or payroll provider from Argyle’s extensive data network and log in with the same credentials they use any time they review their paychecks, manage their shift schedule, or request time off.

Once connected, lenders get a standardized verification of income and employment (VOIE) report with granular insights into a borrower’s earnings—including gross-pay details like bonuses, commissions, and withholdings—plus ongoing access to required documents like paystubs and W-2s.

Argyle continuously refreshes borrowers’ data, makes it available around the clock through a centralized platform, and sends automatic alerts any time there’s a significant change, so lenders at any touchpoint can feel confident they’re working with the latest information.

Argyle also integrates with popular point-of-sale (POS) and loan origination systems (LOS) including nCinco, Floify, Encompass, and Empower. Lenders can instantly tap into Argyle’s superior data wherever they are and through these software solutions they’re already using.

Consider Regional Finance, a personal lender that tailors credit services to customers’ individual needs. By partnering with Argyle, Regional Finance not only streamlined verifications but made borrowers’ income and employment data easily accessible for their lenders—so they could serve customers faster and without friction, whether online or at any of their 340 branches.

“Argyle’s consumer-centric approach makes it easier for lenders like Regional Finance to automate the verification process, validate the data quickly, and ultimately make life easier for borrowers.” – Chris Martin, Vice President and Head of Digital Product, Regional Finance

The added value of automated data solutions

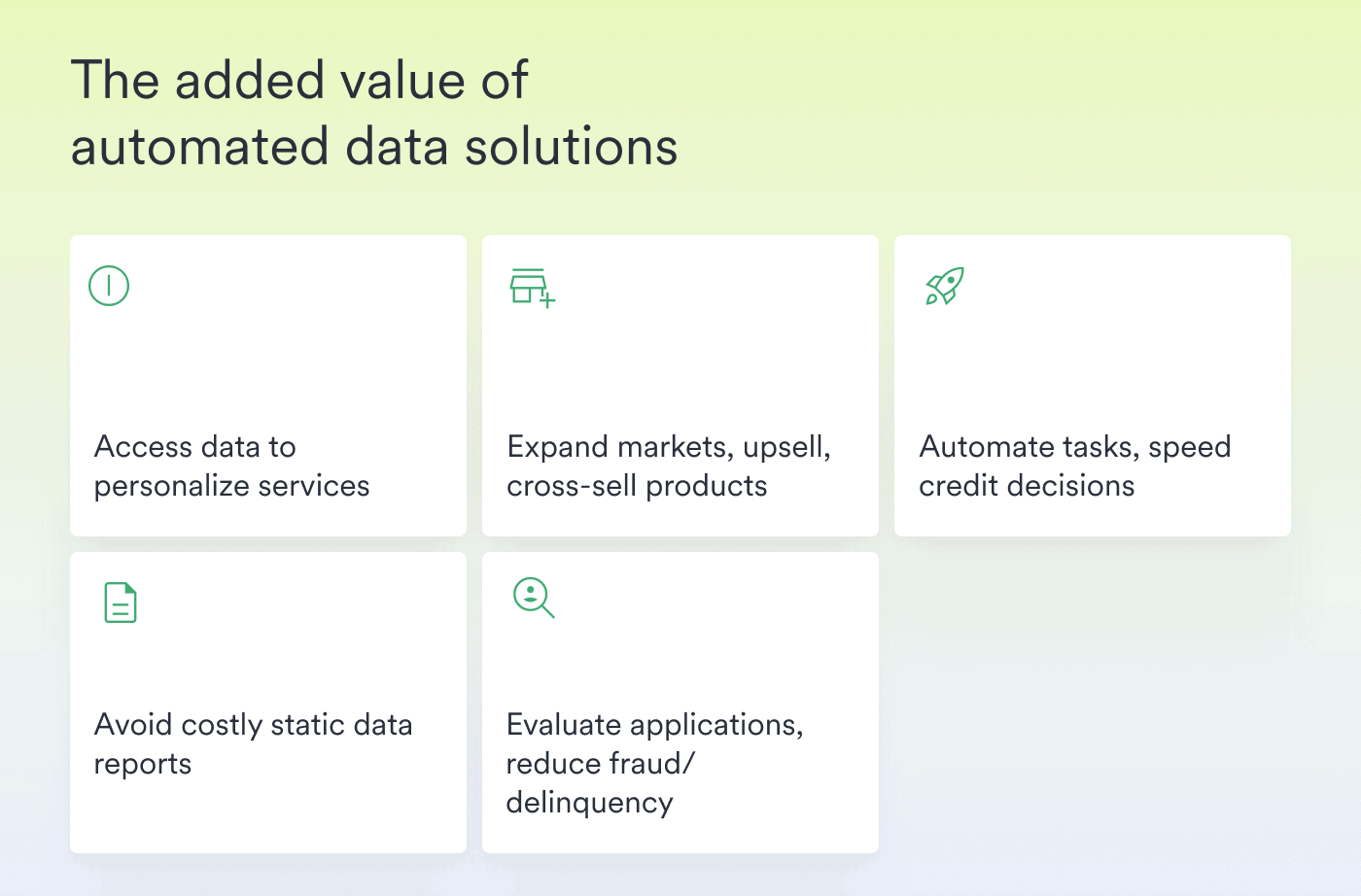

Aside from providing a universal source of truth—allowing lenders to quickly and effortlessly service borrowers across different channels—automated data solutions like Argyle offer concrete benefits that optimize their operations and boost their bottom line.

These include:

- Enhanced relationships

Having comprehensive data access means lenders can learn more about their borrowers, anticipate their financial needs, and further personalize their services, instilling greater trust, engagement, and loyalty.

- New revenue opportunities

With a firmer grasp of borrowers’ financial patterns and rhythms, lenders can safely expand their market. They can also better identify opportunities to upsell and cross-sell relevant financial products and services, maximizing each borrower’s lifetime value.

- Greater efficiency

Automated solutions like Argyle eliminate manual busywork and return complete data sets in a matter of seconds. That not only allows lenders to make faster credit decisions, it frees up their time and resources to focus on more interesting and impactful tasks.

- Lower costs

In addition to streamlining traditionally work-intensive processes, having ongoing access to real-time data means lenders won’t have to purchase costly, static reports from databases like The Work Number (TWN).

- Minimized risk

With more information at their fingertips, lenders are better equipped to evaluate the strength and integrity of every application, allowing them to more effectively curb rates of delinquency and fraud.

Considering all of these advantages, working with better data doesn’t just enable lenders to satisfy borrowers’ appetite for cross-channel experiences; it also helps them secure better business outcomes across the board.

Meeting the need for flexibility

At a time when borrowers are demanding more autonomy and flexibility from their financial interactions, it’s important for lenders to offer a range of engagement options.

They can start by partnering with service providers that prioritize borrowers’ needs and bake agility into their automation tools.

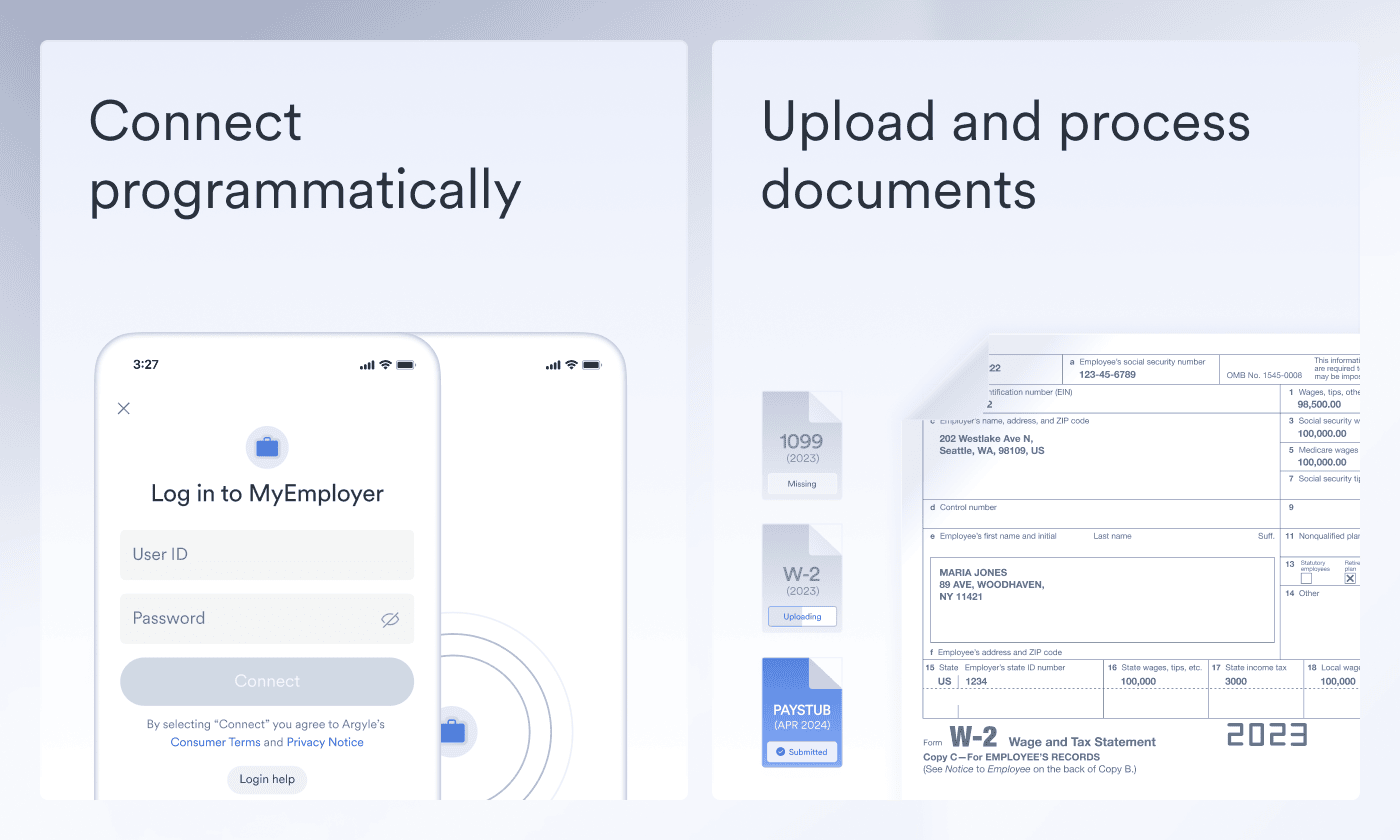

Argyle, for example, has built a proprietary verification waterfall—or multi-step verification workflow—into its income and employment verification solution.

Borrowers who are unable (or unwilling) to locate their employer or payroll provider in Argyle’s network or who can’t log in to their account (which happens, on occasion, despite Argyle’s in-app password reset flows) can upload their paystubs, W-2s, 1099s, and other documents using a simple Document Upload tool. Optical character recognition (OCR) capabilities then convert these files into machine-readable text and auto-fill any related forms and applications, resulting in clean and compliant VOIE reports.

Borrowers can choose to connect programmatically via Argyle or instantly upload and process their documents instead.

That means borrowers can decide how they supply their income and employment data for themselves—while lenders still enjoy all of the benefits of a fully automated solution.

It’s one of the features that makes Argyle a one-stop destination for streamlined income and employment verifications that put the borrower experience first. And that’s something that should be on every lender’s mind.

Want to learn more about using a seamless lending experience across your channels?

Read up on Argyle’s industry-leading Income & Employment Verification solution to discover how it unlocks exceptionally precise, comprehensive data—or reach out to our expert team to set up a call.