Argyle’s Empower LOS integration makes it simple for mortgage lenders to turn on direct-source income and employment verifications

Explore the integration

Unlock faster, lower cost loan cycles with the flip of a switch. The Argyle + Empower integration can transform how you verify income and employment without leaving your loan origination system.

Get the most accurate verification reports in seconds, from application to closing.

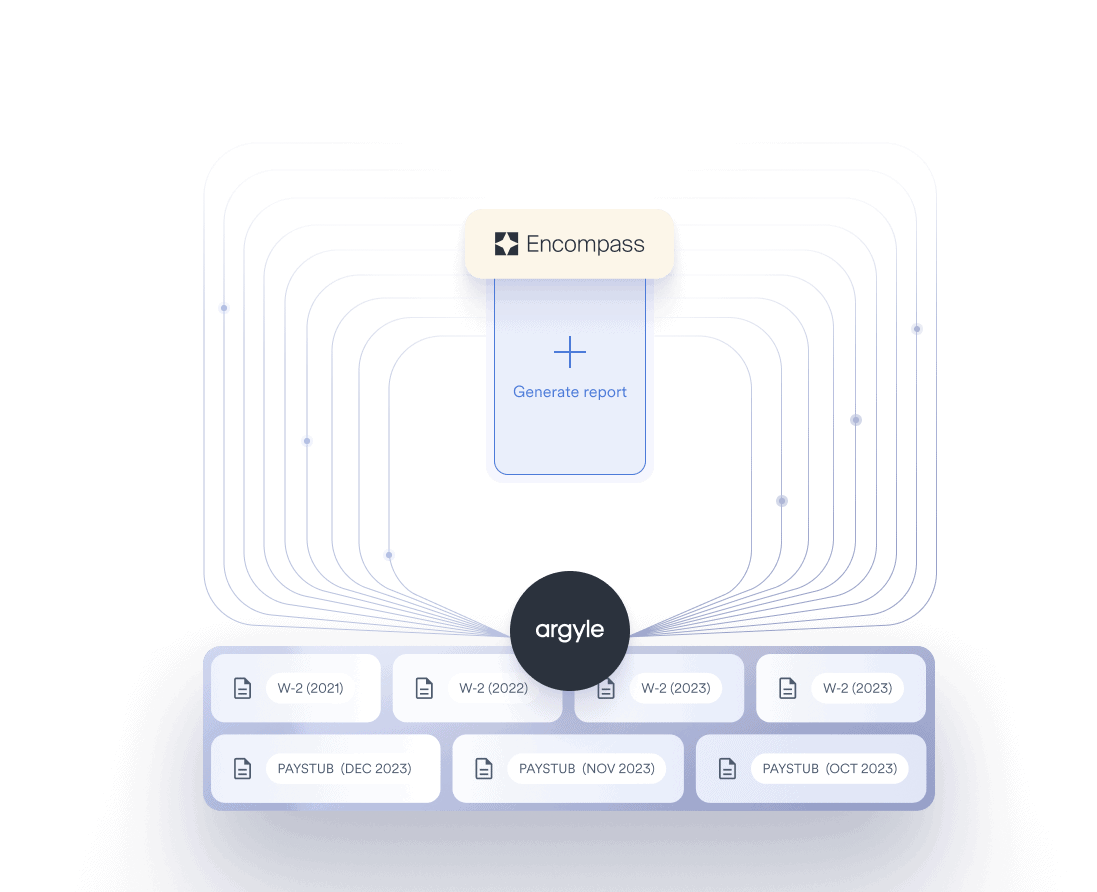

Auto-retrieve borrowers’ paystubs and W-2s, so they don’t have to.

Significantly reduce your variable verification expenses, including $0 reverifications.

Use with Fannie Mae’s Desktop Underwriter® to get relief from representations and warranties.

How it works

Argyle’s Empower integration makes it simple for mortgage lenders to turn on direct-source income and employment verifications

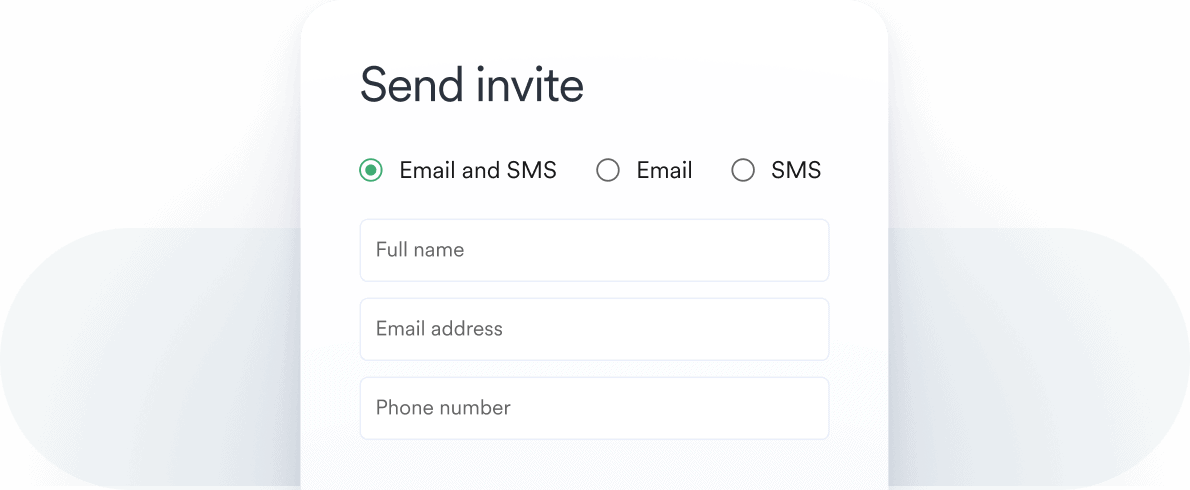

You automate or submit a verification request within Empower.

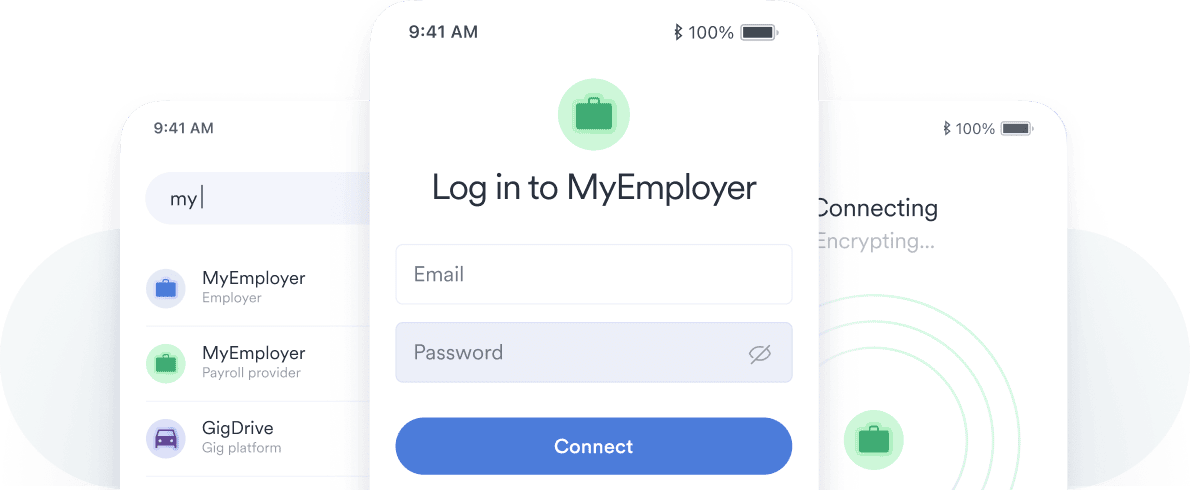

Argyle prompts the borrower to connect their payroll account.

The borrower completes Argyle’s easy, conversion-optimized payroll connection process.

Argyle generates a VOIE report, pulls required paystubs and W-2s, and sends them to you through Empower.

Start using Argyle within Empower mortgage software

Contact our sales team to request your company credentials, so you can begin using Argyle with Empower today.

Contact sales

Your questions answered

What are the advantages of direct-source VOI and VOE?

Direct-source income and employment verifications use a live data connection to pull relevant information directly from borrowers’ payroll accounts in real time. By using live data directly from the system of record, direct-source verifications provide the most accurate VOI and VOE reports, giving lenders peace of mind that they are basing their decisions on sound and reliable information.

Because direct-source verifications are automated and leverage consumer consent, they also save lenders money compared to vendors that use manual methods in their verification waterfall and vendors that buy data to populate verification databases. Learn more about direct-source verifications.

Who owns Empower mortgage software?

Originally owned by Black Knight Origination Technologies, Empower was acquired by Perseus Operating Group, a subsidiary of Constellation Software Inc., in September 2023. As a result of the acquisition, Black Knight became Dark Matter Technologies and operates Empower under this new brand name. Meanwhile, Empower continues to offer mortgage lenders cutting-edge technology backed by years of business maturity and industry experience.

Blog