How automating employment verifications with direct, PBSA-accredited payroll connections can optimize efficiency, eliminate data errors, and cut costs by up to 90%

When CRAs think about innovative verification technologies like Argyle, they typically think of us as a substitute for third-party data providers like The Work Number (TWN). And for good reason: Argyle is more cost-effective, offers superior coverage and access, and boosts the speed and accuracy of employment verifications when compared to legacy databases.

But, while not ideal, CRAs are often able to pass the costs of third-party verification services like TWN onto their clients. What they’re stuck with are the operational costs associated with in-house, manual employment verification processes—the costs that TWN can’t address.

That’s where Argyle shines. Below, we explore how replacing your manual verification processes with Argyle’s automated payroll connections and direct-source employment data can provide immediate business benefits—even if you keep the rest of your verification waterfall intact.

What Argyle does differently

Traditional employment verifications go something like this: Your operations team may collect and processes documents like paystubs and W-2s, contact an applicant’s current and former employer(s), and engages in back-and-forth until all questions are answered, all forms and verification letters are submitted, and all errors and oversights are corrected. All told, this can take days to complete, especially if employers are particularly difficult to track down.

With Argyle, on the other hand, an applicant connects their payroll account pre-onboarding, allowing for real-time, ongoing access to their employment records. Results are returned in an industry-leading 15 seconds, allowing CRAs to seamlessly move candidates who are unable to connect further down the waterfall.

Argyle can be leveraged to automate as much of the typical three-to-ten-year look-back period as possible. Due to the rising costs of employment verifications, some CRAs are also implementing Argyle for standalone products to verify a candidate’s current employment.

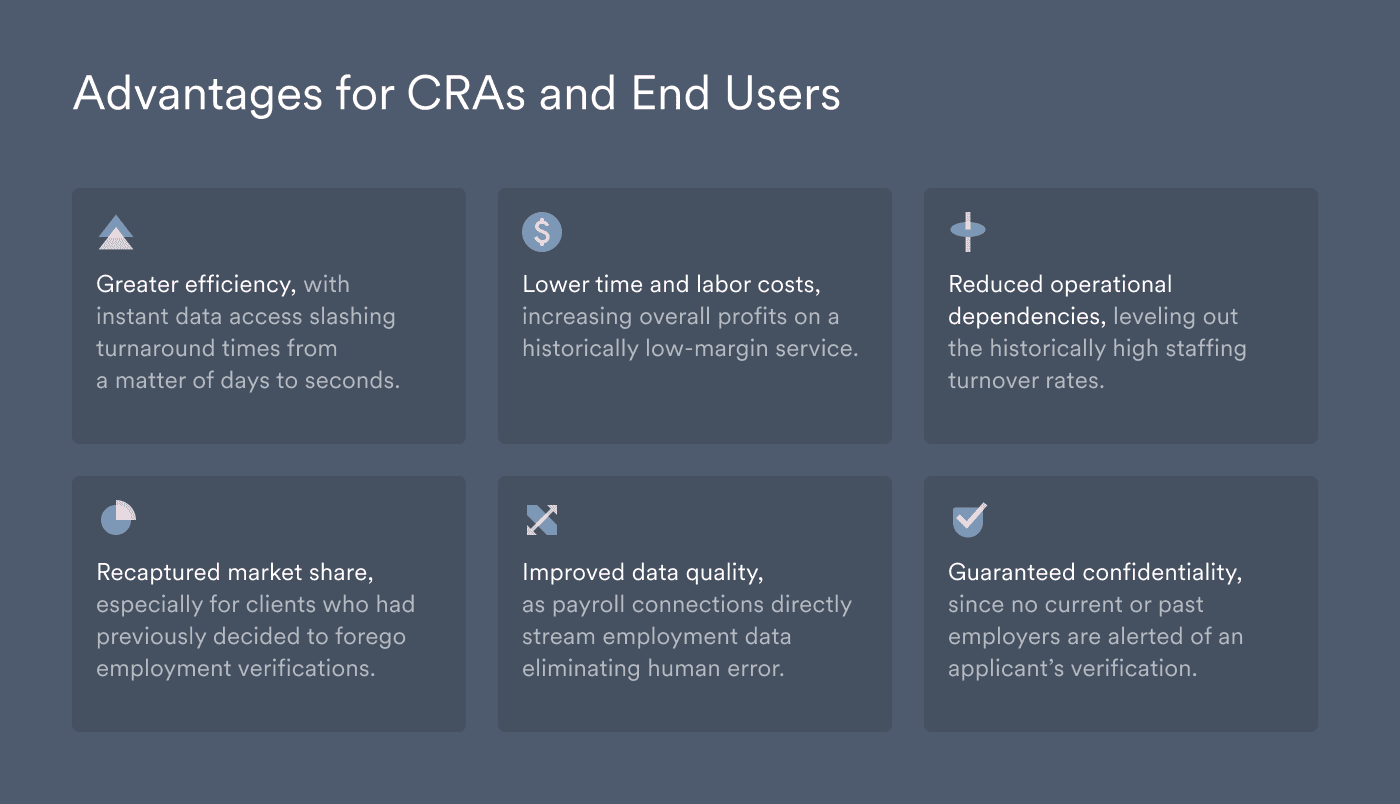

Using Argyle to automate manual verifications has several upfront advantages for CRAs and end-users, including:

Greater efficiency, with instant data access slashing turnaround times from days to seconds

Lower time and labor costs, increasing overall profits on a historically low-margin service

Reduced operational dependencies, leveling out the historically high staffing turnover rates that can occur during slower and busier application periods

Recaptured lost revenue from clients who previously decided to forego employment verifications due to TWN’s annual price increases

Improved data quality, as payroll connections stream employment data directly from the source, eliminating the potential for human error

Guaranteed confidentiality, since automated data collection means no current or past employers are notified of the verification during the screening process

Argyle’s employment verification solution can be rolled out right away to all end users on an opt-in or opt-out basis, while keeping other methods (like TWN) in the waterfall if desired. Down the line, Argyle also affords the opportunity to avoid TWN costs altogether.

Argyle in action

For an example of how Argyle’s employment verification solution gets results, consider our partners at Checkr—a technology-focused company that powers background checks for some of the largest global enterprises (think Netflix, Home Depot, and Uber).

Checkr used to have to verify each employment detail by calling or emailing former employers or combing through scores of work documents uploaded by prospective employees. According to Checkr, that tedious process could take up to four business days.

With Argyle, Checkr’s turnaround times were reduced from several days to 15 to 60 seconds, allowing their team to process more applications over time while guaranteeing accuracy. With increased productivity and decreased operational expenses, they were able to offer their customers more affordable services, for up to 90% cost savings.

Make manual employment verifications a thing of the past with Argyle

Want to learn more about Argyle’s automated, PBSA-accredited employment verification solution?

You can register for a free company account to begin exploring our platform first-hand—or get in touch with a member of our team for some one-on-one support.