With DirectSwitch, digital banking services give customers a simple, secure way to update direct deposit settings and allocate their pay.

Argyle is thrilled to announce a new partnership with Access Softek, an omnichannel digital banking provider that helps credit unions and other financial institutions deliver better customer experiences with minimal effort.

Access Softek has always been at the vanguard of fintech, going mobile-first when the rest of the world was still learning how to send texts on a flip phone. Since first launching in 1986, Access Softek has evolved their offerings into a full suite of integrated services—including digital banking and lending tools, automated investing, conversational banking, biometric authentication, and real-time fraud control—all of which can be seamlessly embedded into any online platform.

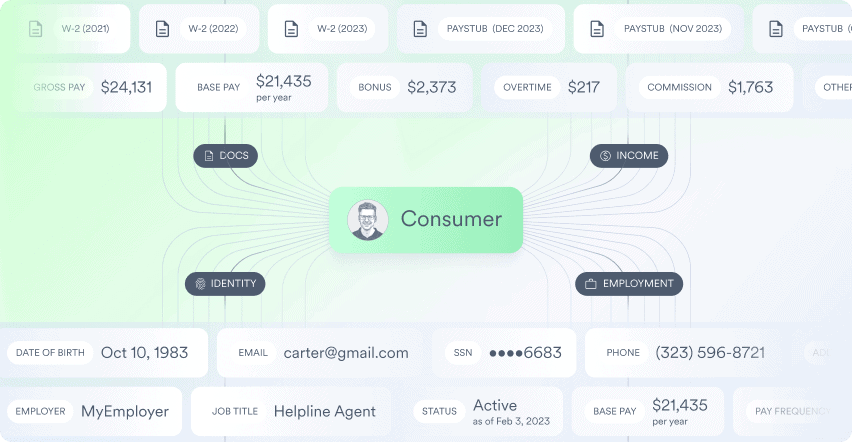

To enhance their account opening flows, Access Softek wanted to provide a simple way for clients to acquire direct deposits, achieve primary account status, and drive revenue. That’s where Argyle comes in—with a turnkey, automated Deposit Switching solution that makes it easy for consumers to update their deposit settings and adjust pay allocations with just a few clicks.

Streamlining deposit switching from end to end

Before Access Softek teamed up with Argyle, consumers would be required to contact their payroll provider, chase down any necessary forms and documentation, and manually update their pay settings if they wanted to reroute or modify their deposits.

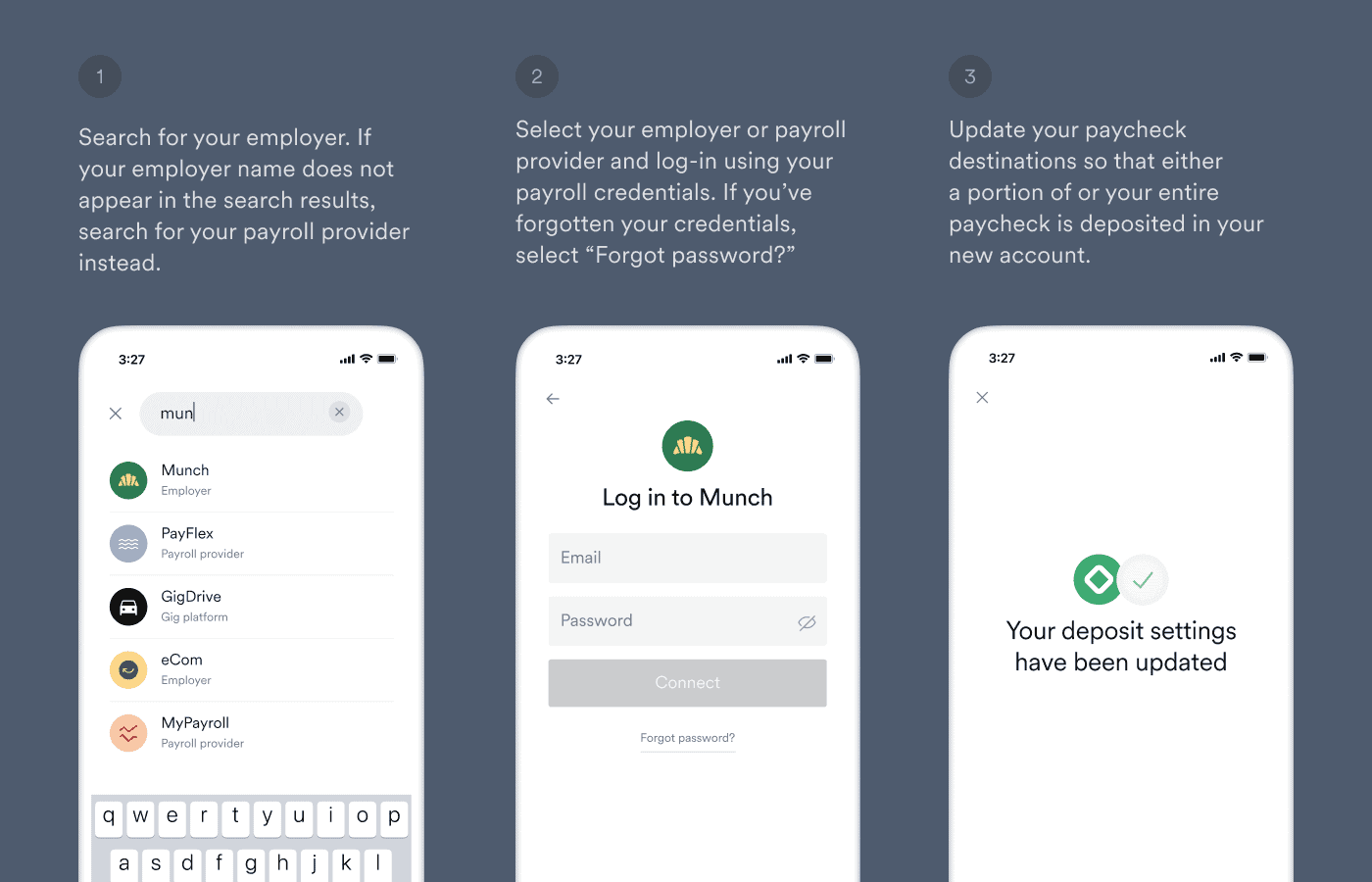

Now, all they have to do is select their payroll provider or employer from Argyle’s extensive network, sign in with their credentials, and tap a button to instantly switch their deposits or allocations to an Access Softek-powered account.

Better still, these flows are built directly into Access Softek’s onboarding as an add-on feature. Credit unions and other financial service providers can enable them on-demand and customize them to fit their unique branding—so their customers get a fast, frictionless deposit switching experience without ever leaving their digital banking application.

Argyle’s Deposit Switching solution has helped many tech-forward companies transform their onboarding. Among them is Dave, a mobile banking app on a mission to level the financial playing field by helping customers budget, avoid overdraft fees, and more. By automating direct deposit switching with Argyle, Dave made it simple for customers to fund their Dave account and take advantage of the bank’s numerous features and products. In turn, banks like Dave can experience a more than 75% increase in direct deposits, increase customer retention 50% or more, and earn, on average, an additional $38—per customer, per month—in revenue.

A growing partnership

Access Softek is excited to identify new opportunities to build Argyle into their digital banking and lending experiences—like using Argyle’s automated Income & Employment Verification solution to optimize their loan origination flows. Stay tuned to learn how this dynamic collaboration progresses to unlock even further innovations in digital finance.

To learn more about Argyle’s deposit switching solution, reach out to a member of our team—or register for a free account to explore our platform and see our tools at work.