Transforming financial infrastructure for today’s consumer

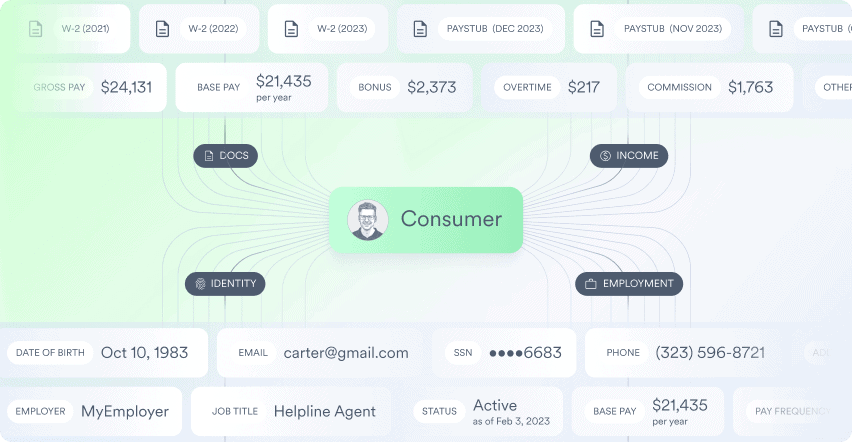

With the popularity of gig work on the rise, it’s more critical than ever to ensure your financial infrastructure includes ways to serve this ever-growing market segment. Yet, many financial service providers aren’t designed for the modern-day workforce, resulting in misunderstanding a consumer’s real-time financial health while simultaneously leaving potential revenue on the table.With Argyle’s payroll connectivity, you can:

Verify income and employment in seconds (and with significantly less cost)

Get the full picture of a consumer’s financial health (full-time, shift, and gig income)

Make direct deposit switching effortless

Offer the ability seamlessly change debit card payouts

Verify 85% of the workforce digitally (100% coverage through OCR document upload)

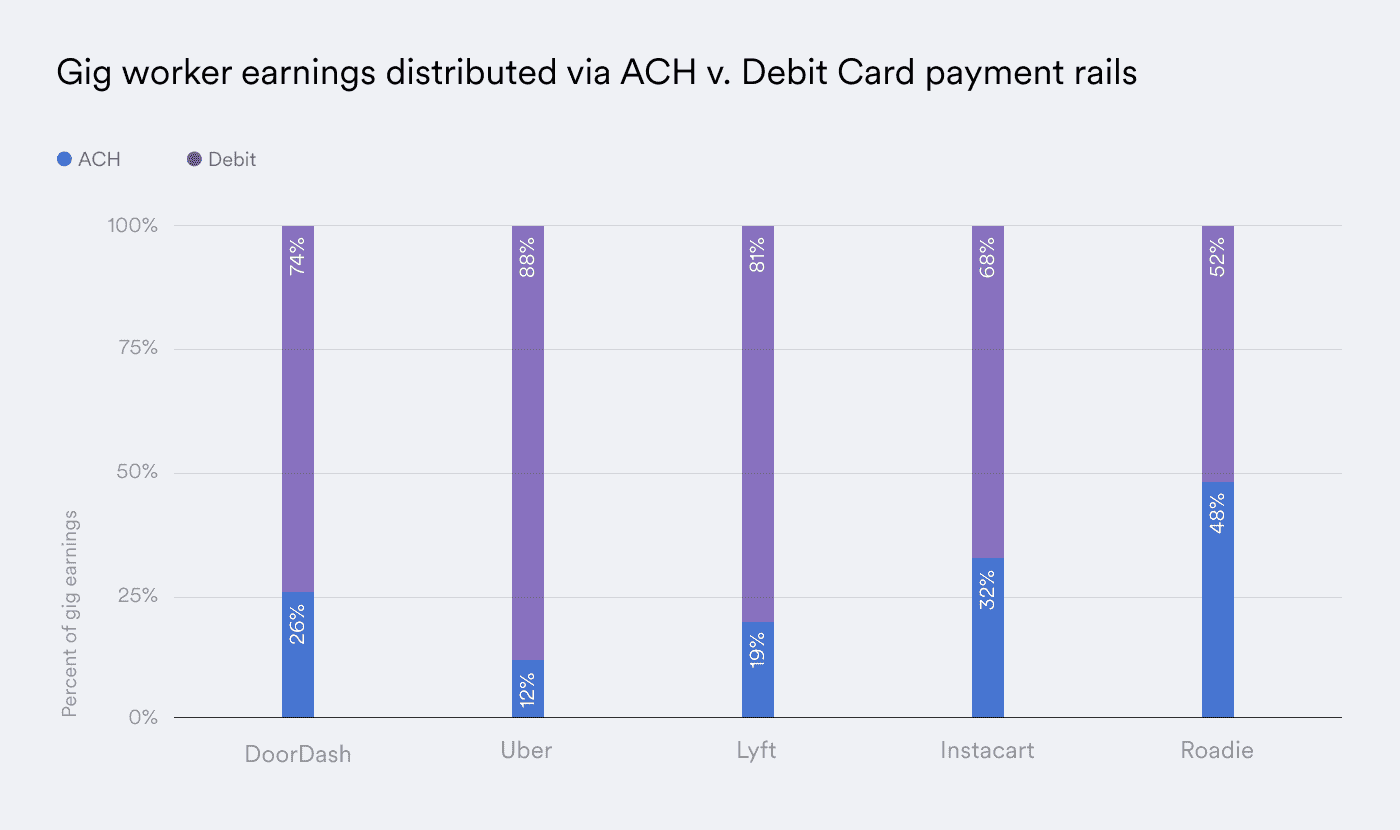

75% of Gig Workers Receive Payouts on Debit Cards Rails

75% of gig workers are paid out on debit cards instead of ACH deposits. Why? Because debit cards offer nearly instant payouts while traditional ACH can take up to 3-5 days to transfer funds. With Argyle’s integrations, your consumers can now seamlessly switch their debit card payouts to any debit card they choose, drastically reducing a conversion hurdle.*No affiliation, sponsorship, or endorsement is implied by the identification of the entities listed above. All rights in the trademarks and logos of such third parties remain solely and exclusively with their respective owners. For further legal details, click here.

Increase conversion by aligning your features with modern workforce needs

If 20% of your current consumers are gig workers—and 75% of those workers receive payouts via debit card—you could see an 18% increase in direct deposits when adding Argyle’s direct deposit and debit card payout features.Argyle effortlessly helps consumer switch their deposit information in two ways:1. ACH update by entering a new bank account number2. Debit card payout by updating the debit card number (including any non-gig or non-platform issuer card)No other player in the field offers seamless debit card payout switching—all without ever leaving your application.

The gig economy is growing

Highlighting this trend, the October jobs report shows that year-over-year, 6% more Americans have taken on part-time work in addition to their full-time jobs. This is reflected in the creator, shift, and gig work trends we’ve seen over the last several years, which indicate that 50% of the US workforce will participate in the gig economy by 2027.Learn more about gig economy trends in our Survey: Who Financial Institutions Are Leaving Behind.Ready to increase direct deposits by adding debit card payout switching to your product offerings? Contact [email protected] to see how we can help accelerate the growth and success of your organization. You can also sign up for a free account.