The friction of switching their direct deposit prevents your customers from fully funding their account and using your services to their potential.

Trusted by

problem

The challenges you’re facing

Painful deposit switch process Inability to cross-sell products (e.g. credit cards or loans)

When you attract customers, friction-filled workflows stand in the way of account funding.

Poor visibility into customers’ finances compromise your ability to present them with personalized credit offers.

BENEFIT

The Argyle solution

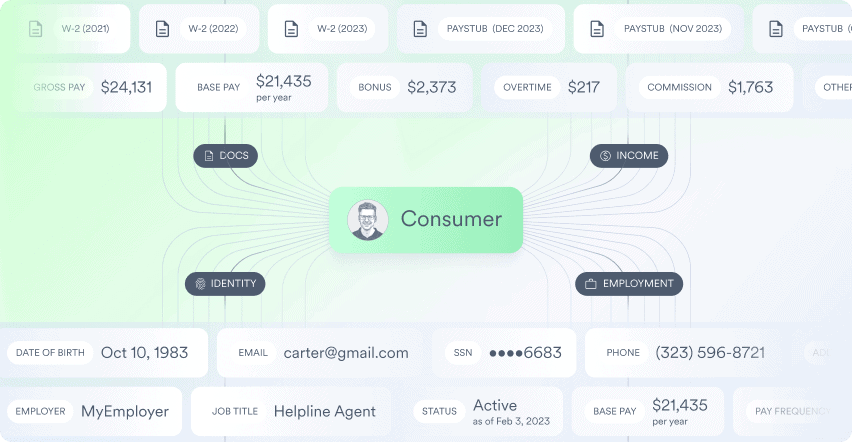

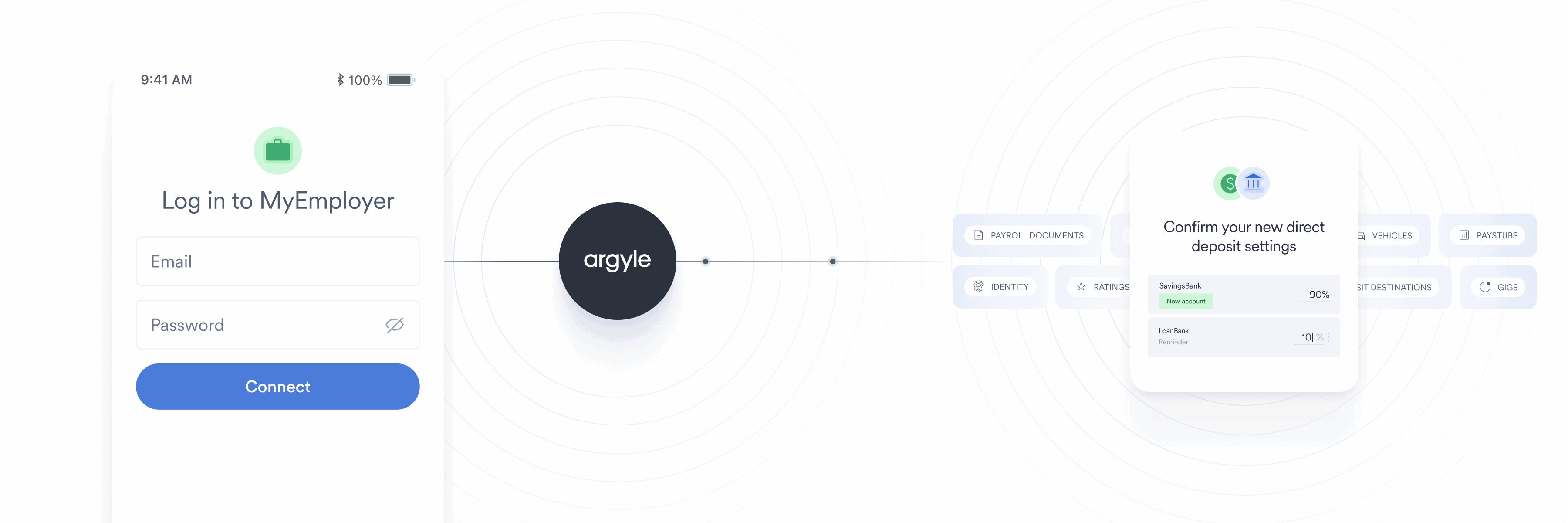

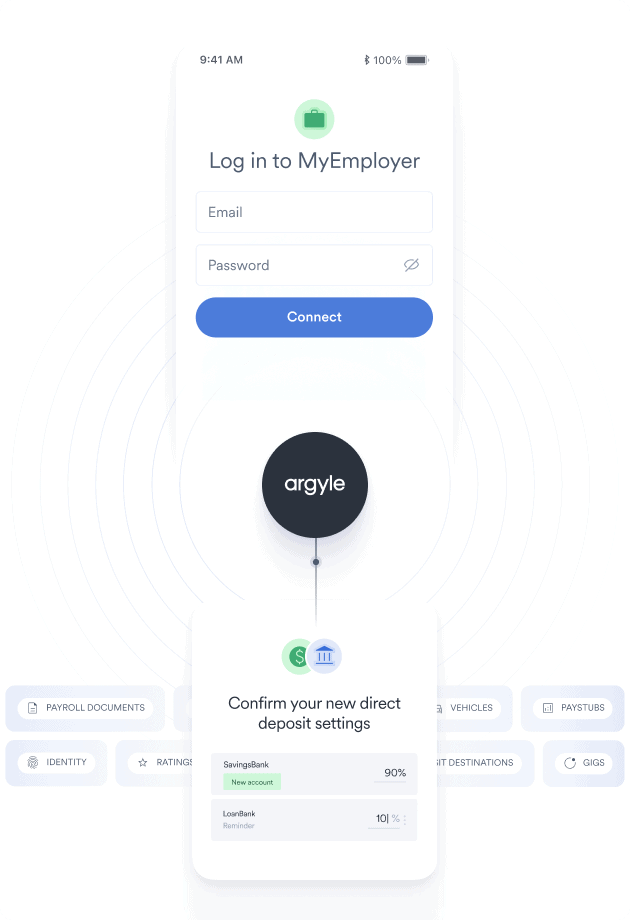

With Argyle, your customers can easily and instantly switch their direct deposit. Plus, you get access to data that makes sticky services like earned wage access a low-risk reality.

Your customers can authorize deposit switches in seconds without leaving your website or app.

Less friction for your customers leads to a higher volume of direct deposits and more AUM.

Your customers can set up multiple allocations, funding both checking and savings accounts in one quick and easy workflow.

Easily offer innovative banking services, like earned wage access, that foster customer loyalty.

Better digital experiences that drive performance across the customer journey

With Argyle, your customers connect your platform directly to their payroll accounts, enabling a host of solutions like Deposit Switching, and Income & Employment Verification.

KEY FEATURES

Why banks love Argyle

More direct deposits

Higher retention rates

More revenue

White-glove service and support

why Argyle

Find out why banks trust Argyle to power their digital experiences

Broader coverage

Higher conversion rate

Better quality

Blog

Learn more about Argyle

Ready to see what Argyle can do for you?

Get in touch to learn more about our verification solutions for the mortgage, personal lending, background check, and tenant screening industries, and more.

Contact sales