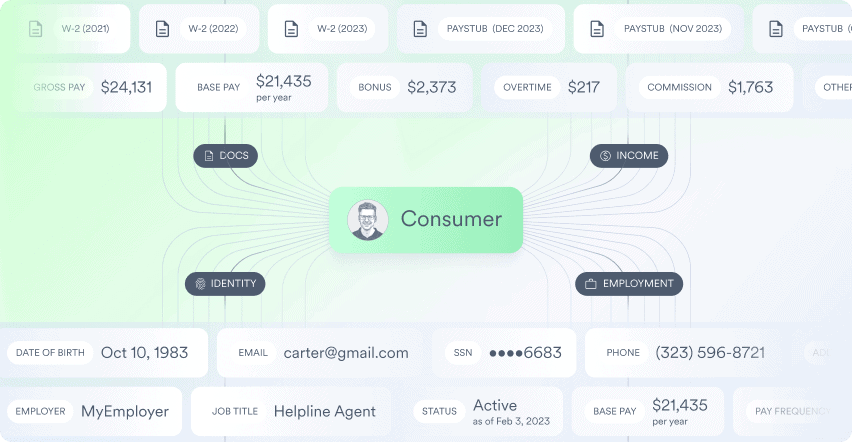

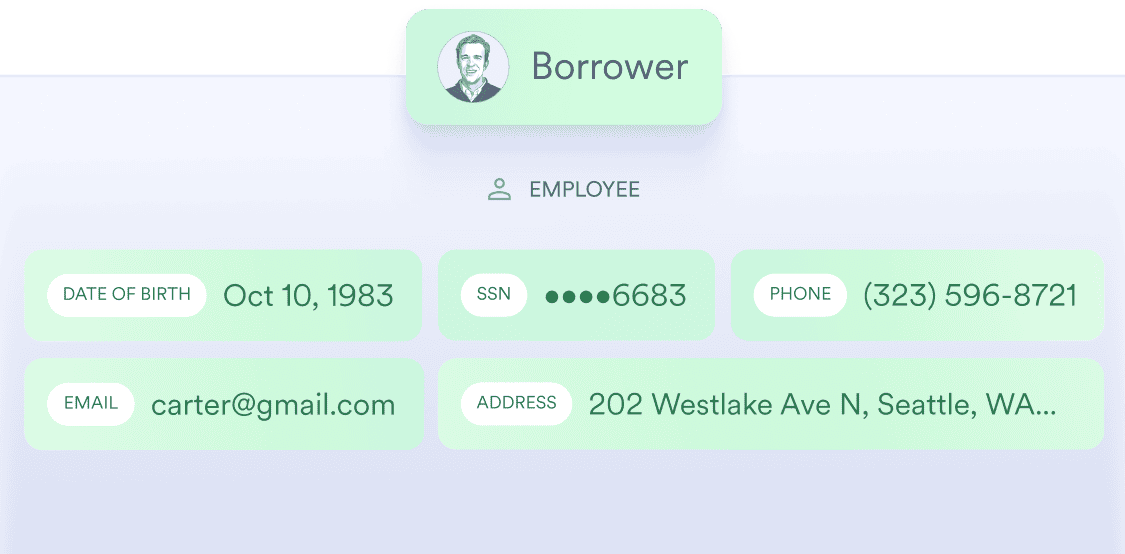

Argyle unlocks real-time income and employment data through consumer-permissioned payroll connections, enabling greater automation, efficiency, and visibility.

Request demo

The consumer-powered

verification platform

Verify income and employment more efficiently with direct-source, real time data.

our customers

Trusted by leading companies

from fintechs to the Fortune 500

our platform

Transform your business with

direct-source data

Automate expensive manual tasks, and only pay for the data you need when you need it.

Replace high-friction processes with seamless workflows for a better customer experience.

Stay compliant and make more informed decisions with unmatched visibility and data quality.

Process higher volumes and bring sophisticated products to market faster and with fewer resources.

INDUSTRY SOLUTIONS

We empower businesses like yours

Learn how direct-source income and employment data enables incredible efficiencies across a range of industries.

Request demoEASY IMPLEMENTATION

Innovate without constraints

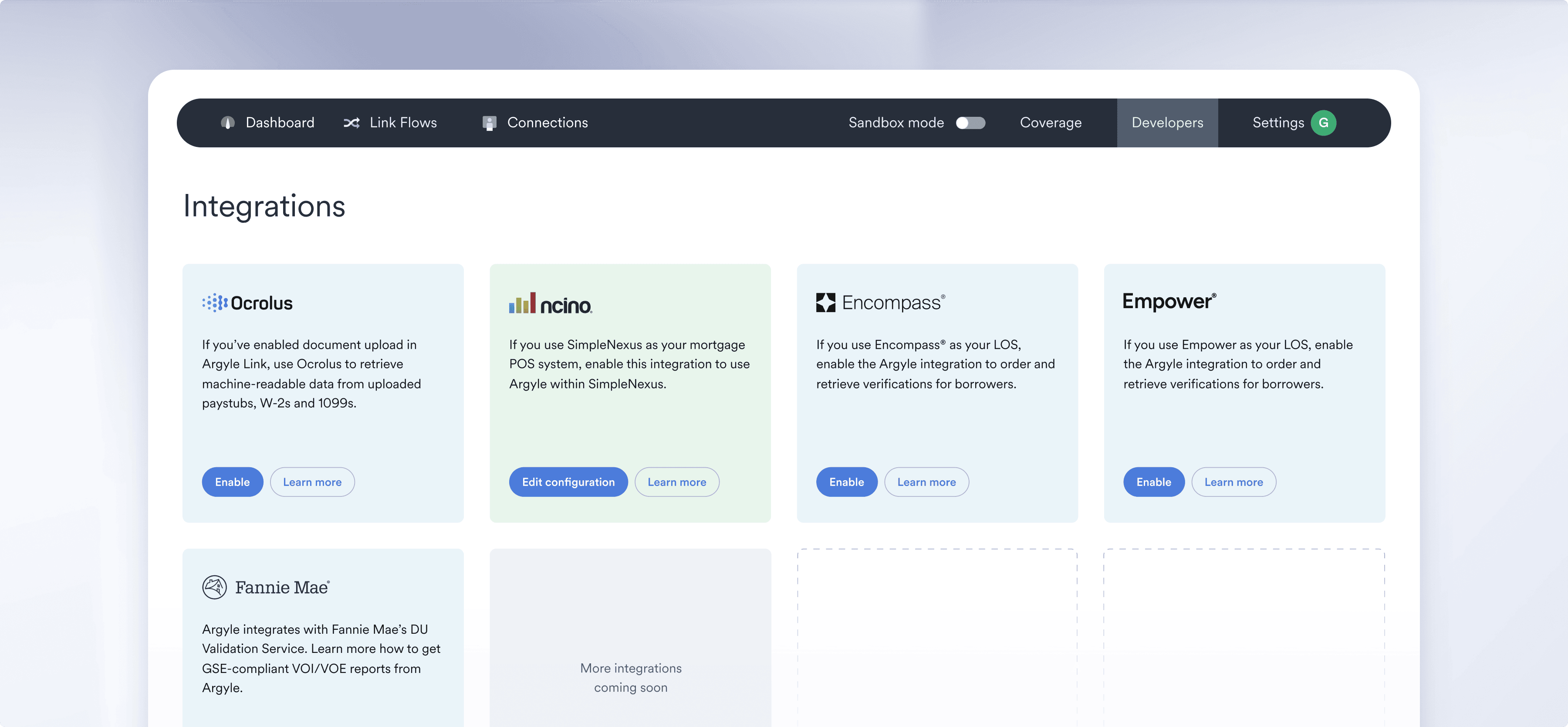

Our turnkey integrations, customizable consumer interfaces, and dynamic partnerships make it easy to implement Argyle alongside your existing front- and back-office systems.

Request demo

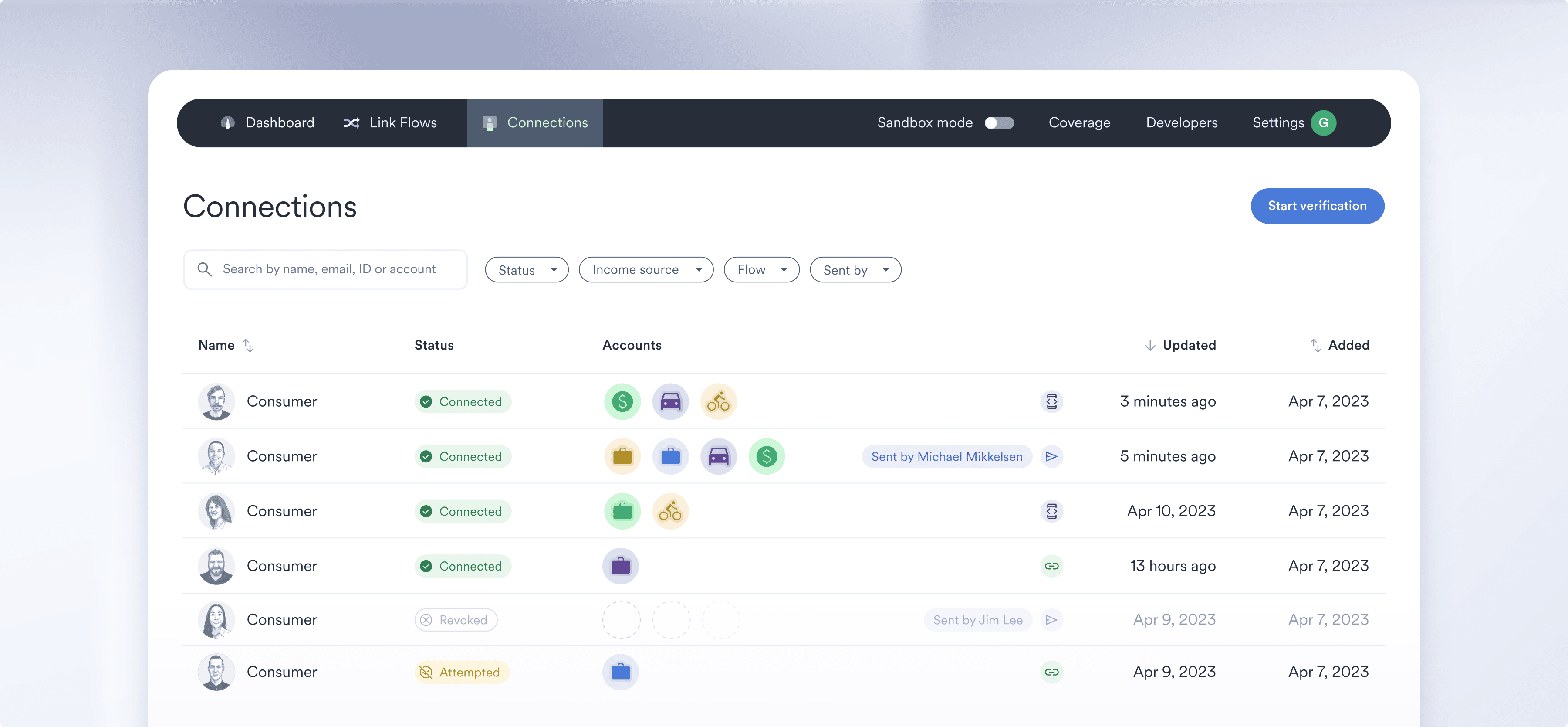

Get up and running without dev resources using our enterprise-grade, web-based solution.

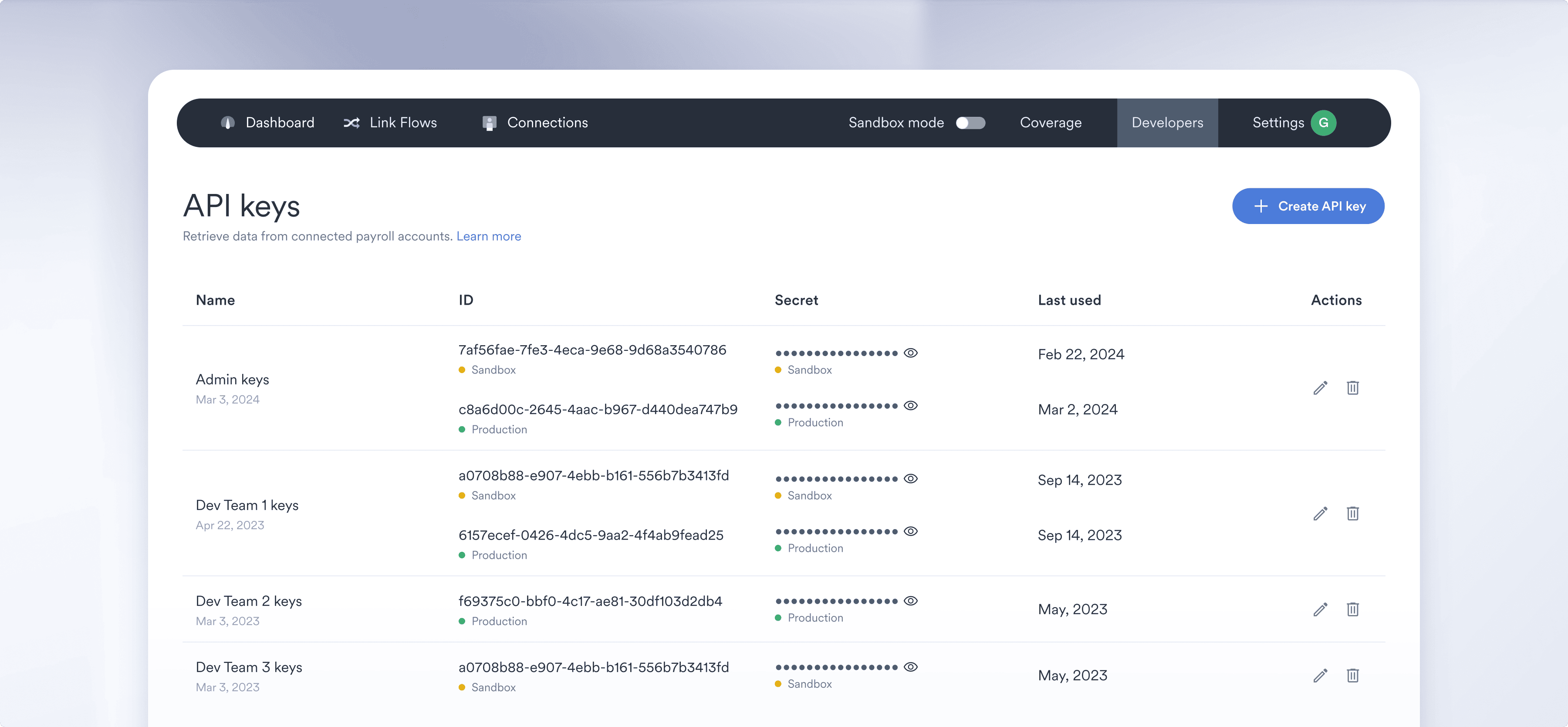

Explore Argyle ConsoleWith a little coding, your customers can share their income and employment data directly in your app.

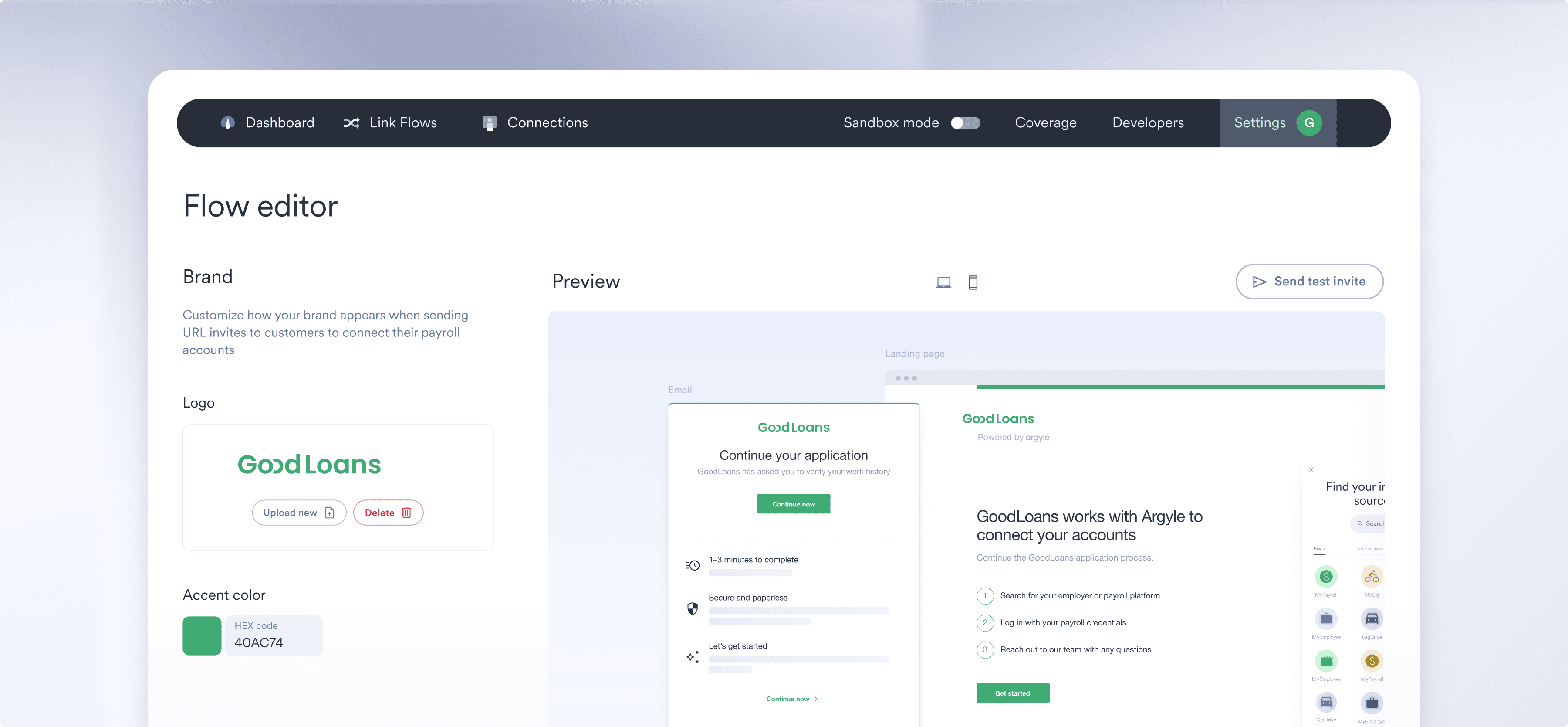

Check out our APIEdit the look and feel of your onboarding flow for on-brand experiences that convert.

Discover Argyle LinkWe work with best-in-class partners, so you get more innovation in one integration.

Discover LOS Integrationswhy Argyle

Argyle leads the market in

performance and data quality

We built Argyle on four principles: reliability, scalability, security, and ease of use. The results of our commitment speak for themselves:

Broader coverage

Higher verification rate

Better outcomes

Greater savings

Reliably scalable

RESOURCES

Find out more

Learn how automating income and employment verifications using direct-source data can help your business thrive.

Ready to see what Argyle can do for you?

Get in touch to learn more about our verification solutions for the mortgage, personal lending, and background check industries, and more.

Contact sales