Take the back-and-forth and data blindspots out of account funding to drive assets under management

Direct deposit switching can be a complicated interaction for everyone involved. For the user, they need to collect all this account information that often isn’t located in one place to submit a request that may take multiple pay periods to complete, with no transparency into the process or timeline.

For financial institutions, this user request is just the beginning. Assuming you have all the right pieces from the user, it is now your team’s job to file paperwork and contact payroll providers to get the correct direct deposit information in place. With financial institutions moving to more digital solutions for their users, shouldn’t the infrastructure for providing these services find more efficient solutions as well?

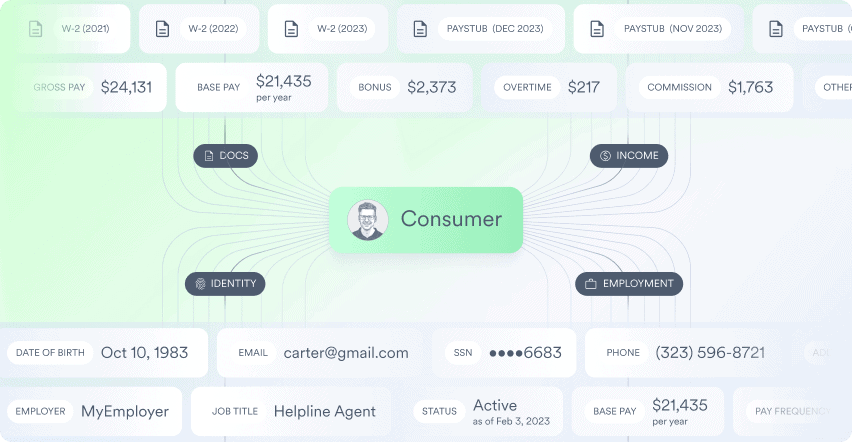

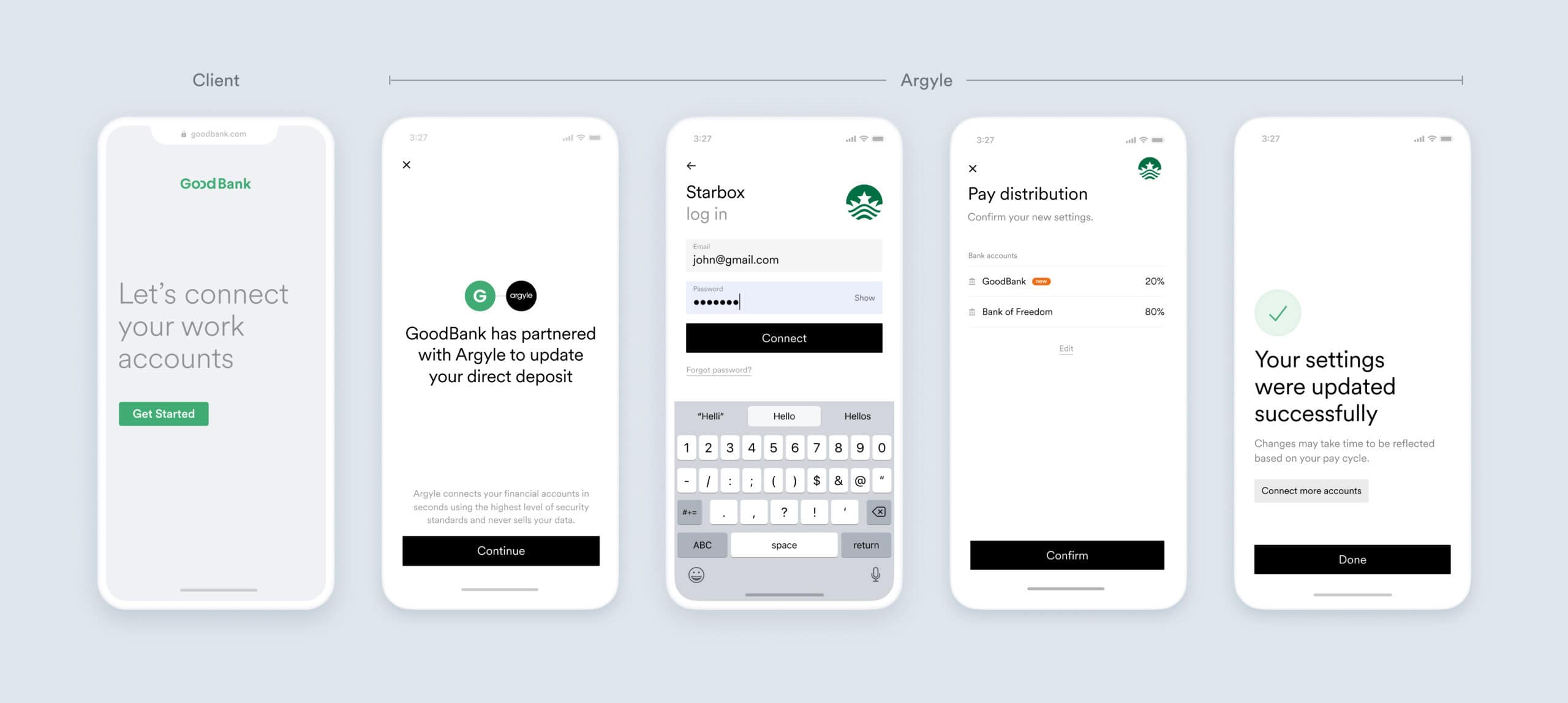

Enable your users to authorize a direct deposit switch instantly. Argyle automates account switching so that there’s no work on your end. For your users, it’s practically as simple. With just a few clicks and without leaving your platform, they can authorize a change in their direct deposit or allocate a part of their wages to you.

What is the value of offering a simple direct deposit switching solution?

Becoming your user’s primary account means a significant uptick in user activity, ultimately leading to an increase in managed assets, product adoption, and revenue. But what are the projected returns from just simply being the bank your user sends the majority of their funds to?

Expected returns: $10/month per account

Based on industry data and client results, neobanks can expect up to $10 a month in interchange revenue from active users who have set up a direct deposit, depending on size of deposits. Adding more assets under management also unlocks the possibility of offering additional solutions for users, and this can be validating in a crowded market.

Cost savings of an efficient and time saving solution

More than the added assets under management, financial institutions can save both time and money by making the direct deposit switching process more streamlined. With fewer manual processes, employee time is saved and they can focus on services that benefit from a human touch. Improved productivity can keep margins low when every operating cost adds up.

The steps to implementing direct deposit account switching with Argyle

Now that you know the value of offering a clean direct deposit solution, you might be wondering if it is difficult to modernize your solution. With Argyle, we are there for you every step of the way.

The Argyle API lives within your banking app, so once it is up and running your users won’t ever leave your app to request a direct deposit switch that takes effect instantly. Everything is user-permissioned, so your users can be confident that they are sharing only the information they would want to share.

Sounds too easy? Don’t just take our word for it. We asked Matt Spokes, CEO and Founder of Moves Financial if he would share his thoughts on the Argyle Direct Deposit solution:

“With Argyle, we enable direct deposit switching with a one-click feature within the app,” said Spoke. “It’s all automated, so users don’t have to go through multiple sources and manually transfer the information.”

How long does it take for a direct deposit switch to be finalized?

Here’s the beauty of a fully digital solution. Once a user taps “confirm”, their payroll system is updated to reflect their request. No business days, paper checks, or wondering if the change will take place by payday involved. It is fully a self-service solution for the user. They designate the bank account they want their funds to head to and either select the dollar value or percentage they want sent there.

Getting started with Argyle

Curious to learn more? Sign up at argyle.com. We have a sandbox of data that you can play with and get a feel for the solution. Or if you want to try it out with your real user data, click “Get started” in the Argyle Console to begin your trial and connect up to five free accounts.