Direct-source, consumer-permissioned VOI and VOE flows offer mortgage lenders more reliable data, higher conversion rates, and a better borrower experience—but only if you pick the right provider.

By now, you’re likely familiar with the value of direct-source data—especially when it comes to essential loan-origination processes like income and employment verifications.

By enabling borrowers to connect you to their payroll accounts and share verified income and employment data in real time, direct-source verification solutions deliver up to 80% lower verification costs, 50%+ conversion rates, and ongoing access to key borrower documents like paystubs and W-2s.

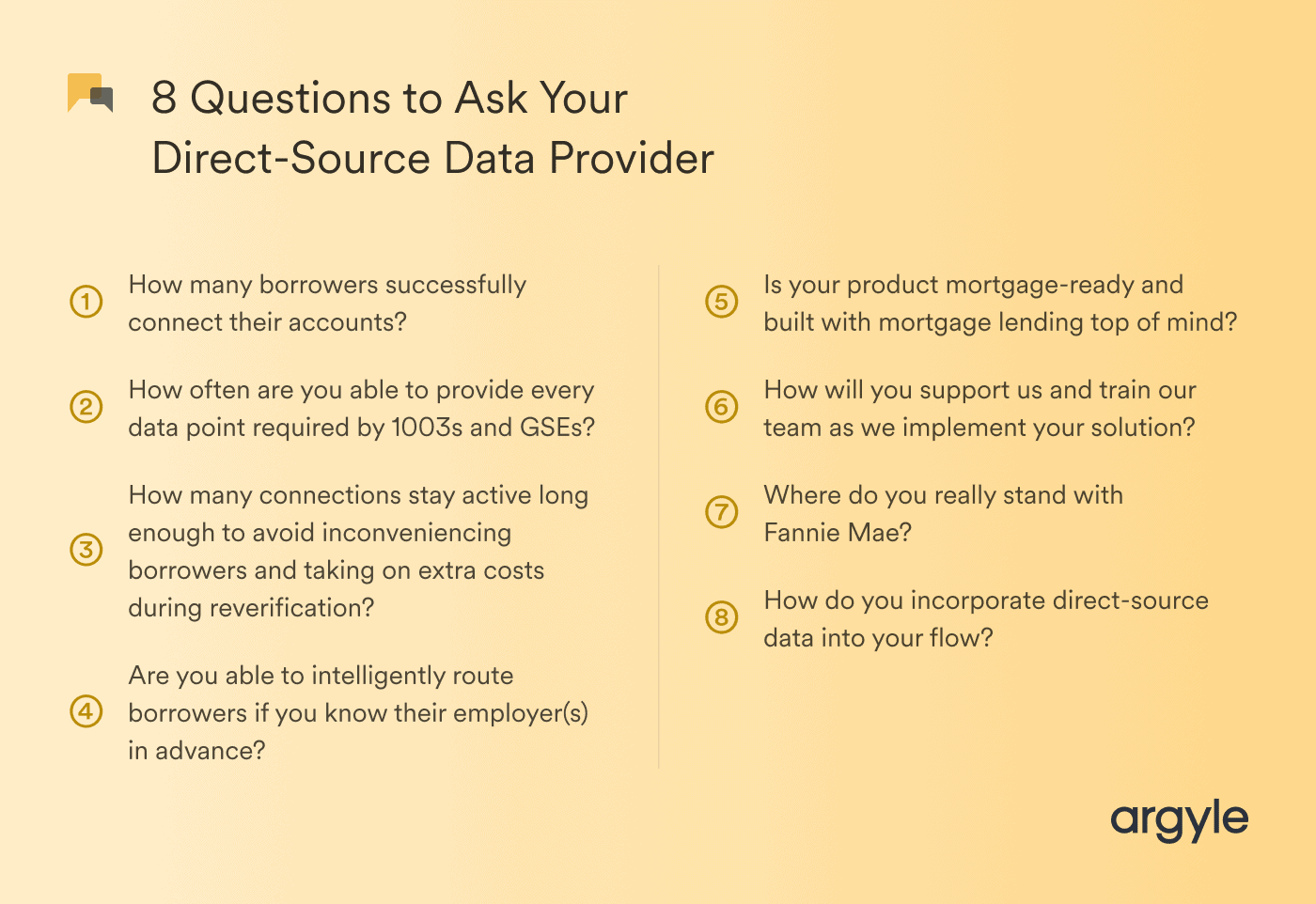

But even a fully consumer-permissioned, direct-source VOI and VOE flow is only as good as the platform behind it. Below, we list eight questions you can (and should) ask your direct-source verifications provider to ensure you’re partnering with a solution that sets you and borrowers up for success.

1. “How many borrowers successfully connect their accounts?”

Of course, exceptional connectivity means nothing if conversion rates are low. If borrowers can’t find and connect to their employer or payroll provider—or if you’re unable to modify the VOI/VOE experience and optimize its position in your loan origination workflow—borrowers may drop off before you even get to the verification stage.

The best direct-source VOI and VOE providers are constantly investing in new integrations and flexible product features, so they can extend their verified coverage while allowing you to tailor verification flows to your needs.

Argyle leads the industry in these areas. Not only does our data network cover over 210 million U.S. consumers and 99% of the Fortune 1000, we update tools like Argyle Link and Argyle Console regularly to expand customization options, enhance borrower experience, and maximize conversions.

Ultimately, at least five out of every ten borrowers are able to successfully connect their payroll accounts through Argyle, amounting to the best digital verification conversion rate on the market.

2. “How often are you able to provide every data point required by 1003s and GSEs?”

Another factor to consider is the depth or completeness of a provider’s dataset.

With a direct-source data model, accuracy is already baked in—after all, it’s a one-to-one, real-time reproduction of the information in a borrower’s payroll account. But not every direct-source data provider captures all of the attributes required by 1003 forms and government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. That depends on the number of endpoints and the quality of the data mapping a provider builds into their API.

A top-notch direct-source data provider gets granular with their output, looking beyond net income to gross-pay details like base pay, bonuses, tax withholdings, and commission rates.

As a benchmark, consider that Argyle offers over 170 data fields and consistently returns 95%+ of the data attributes and documents requested by GSEs. We also categorize income and employment data in a simple, standardized format that’s been assessed and approved by Fannie Mae.

3. “How many connections stay active long enough to avoid inconveniencing borrowers and taking on extra costs during reverification?”

Reverifying borrowers prior to closing is a critical part of mortgage lending, but this often happens weeks or even months after loan origination. By that time, a borrower’s financial data has likely grown stale.

That means, you either have to reach out to borrowers to collect and review their details and documents again—adding more time and friction to the process—or purchase an updated VOI or VOE report from a database like The Work Number (TWN) as an added expense.

A direct-source data provider worth its weight should help you avoid both scenarios by automatically refreshing a borrower’s information and affording you continuous access.

With Argyle, 65% to 70% of payroll connections are still active at 60 days, meaning you can easily access a borrower’s data and documentation at any time, at no additional cost.

4. “Are you able to intelligently route borrowers if you know their employer(s) in advance?”

In today’s hyper-digital world, borrower experience is paramount. Generally, the fewer hurdles your borrowers need to clear to accomplish their goal, the better.

One industry study found that each additional onboarding step in a digital app increases churn rates by 20%. In the post-2020 finance world, 63% of customers abandon the onboarding process when opening a new account—up from 40% in 2016—with the main culprit being lengthy, overly complex application flows.

The right direct-source data partner will offer frictionless service from end to end. That includes using smarter data collection practices to streamline a borrower’s journey based on information they’ve already provided.

Argyle allows you to customize your VOI/VOE flow to keep it short and simple. If you know a borrower is a gig worker, you can present them with a pre-selected menu of popular gig platforms, so they don’t need to manually search for their source(s) of income. Better still, if you know they work for Lyft, you can send them directly to the Lyft login screen—a process known as “deep linking,” which can increase conversion rates by 5 percentage points.

5. “Is your product mortgage-ready and built with mortgage lending top of mind?”

Mortgage lending is a high-stakes industry, and social proof and trust are key. You want to be sure not only that your direct-source verifications provider has a demonstrated history of success, but also that they have knowledgeable specialists and experienced advisors guiding their internal team.

Ask to see evidence of a potential verification partner’s skills and capabilities, whether in the form of case studies, partnership announcements, or industry recognition.

For example, Argyle has been vetted by 40+ mortgage lenders, including seven in the top 100, and we share their stories whenever possible. We’re also proud to have a team of award-winning subject matter experts, seasoned advisors, and powerful partners driving our mortgage product forward.

6. “How will you support us and train our team as we implement your solution?”

Incorporating new technology into your mortgage flow can be tricky or downright stressful, especially if you have team members who are unaccustomed to working with digital solutions.

Any direct-source verifications provider worth their salt will be able to put you at ease. At minimum, they should offer clear documentation and a dedicated customer success team to walk you through the implementation process and lead hands-on training sessions.

Providers who go above and beyond will also offer resources like quick-start guides to get you up and running fast, a transparent view into data standards like sync times and error handling, and an easy way to track metrics like your connection status and performance.

7. “Where do you really stand with Fannie Mae?”

One of the most common questions we field from mortgage lenders is whether or not we support Day 1 Certainty® and integrate with Fannie Mae’s Desktop Underwriter® (DU®) validation service.

It’s an important distinction. In today’s mortgage landscape, Day 1 Certainty has become all but synonymous with efficient verification processes, faster close times, and a better borrower experience. Not only that, it frees mortgage lenders from the burden of representations and warranties.

Currently, Argyle is the only consumer-permissioned income and employment verifications provider authorized to supply reports for DU.

8. “How do you incorporate direct-source data into your flow?”

Mortgage lenders rely on many different methods to collect and process borrowers’ income and employment data—from third-party, digital point-of-sale (PoS) and loan origination systems (LOS) to proprietary in-house processes.

Whatever method you use, you want to be sure that a direct-source verifications provider can work with your existing flow, and that it won’t be too much of a technical lift to incorporate their solution.

The right direct-source verifications provider will offer a range of flexible tools that allow you to connect to borrowers’ data in different ways and try out different approaches over time, as your services evolve.

For instance, Argyle offers both a direct API that integrates with most PoS and LOS platforms and a simple no-code solution that enables you to launch email- or text-based verification requests in less than a day and with zero development work.

Get the right answers.

Choosing the right direct-source data provider can mean the difference between a costly, friction-filled loan origination process and an efficient, effective flow that converts.

If you want to learn more about the qualities of a best-in-class direct-source data provider—or discover what an industry-leading verification solution like Argyle can do—get in touch with our team to book a demo. You can also register for a free account through Argyle Console to start testing our products out live.